Can You Claim Vat On Donations Paid Input tax and donations The VAT rules only permit your business to reclaim input tax VAT paid on purchases where the expenditure is linked to VATable supplies sales it makes In other words your business must be VAT registered and the purchase on which you paid VAT must have a clear connection with the business activity

21 June 2022 Share this article What conditions need to be met to ensure that a donation will not be subject to VAT Key Points What is the issue Income earned by a charity or other organisation is outside the scope of VAT if it relates to a genuine donation It is also ignored as far as the VAT registration threshold is concerned In general should VAT be levied on donations Answer The VAT Act Section 7 1 a of the VAT Act imposes VAT on the supply of goods or services made by a vendor in the course or furtherance of the VAT enterprise carried on by the vendor

Can You Claim Vat On Donations Paid

Can You Claim Vat On Donations Paid

https://westwon.co.uk/wp-content/uploads/2021/07/VAT--scaled.jpg

Can I Claim Back VAT On A Hire Purchase Car

https://www.carmoola.co.uk/hs-fs/hubfs/Can You Claim VAT on a Hire Purchase Deal.jpg?width=2280&height=1622&name=Can You Claim VAT on a Hire Purchase Deal.jpg

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

1 Overview 2 Charities 3 Implications of VAT for charities 4 Deciding whether your activities are business or non business 5 VAT treatment of income received by charities 6 VAT Output VAT charged by a charity can be reclaimed as input tax if the receiver is registered for VAT and incurs it for business purposes If supplies are made to non VAT registered businesses or members of the public the supplies will carry an additional and irrecoverable cost to the recipients

The key risk is that if donation money cannot be clearly distinguished from sponsorship income it will become taxable and the charity will be liable to VAT on the entire amount For example a donation given free of charge to a charity is outside the scope of where nothing is given in return but a donation given in return for example advertising may be considered a taxable activity and may lead to VAT obligations Obligations to account for VAT

Download Can You Claim Vat On Donations Paid

More picture related to Can You Claim Vat On Donations Paid

Can You Claim Vat On Staff Welfare South Africa Greater Good SA

https://gg.myggsa.co.za/can-you-claim-vat-on-staff-welfare-south-africa-.jpg

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

If a monetary donation is freely given it is not consideration for any supply and so is outside the scope of VAT In this situation the donation has to be unconditional and the following points VAT on sponsorship will be claimed for the money spent on providing products for such events Moreover such events at clubs make VATable supply to the offered services or products by your business They can t charge VAT until they are VAT registered

HMRC replaces its VAT guidance 28 02 2018 One of the more complex tax issues charities face is working out whether the funding they receive be it from a grant making foundation or a public authority is a grant or a payment for services for which they need to charge VAT Getting it wrong either one way or the other can be expensive Is VAT applicable on payments received as donations grants or sponsorships VAT treatment upon receiving donations grants or sponsorships will depend upon whether the donor grantor or sponsor is receiving any benefit in exchange for making that payment or not

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

Reclaiming VAT On Donations And Sponsorship Mad About Bookkeeping Ltd

https://www.madaboutbookkeeping.co.uk/wp-content/uploads/2022/05/shutterstock_1862633668-1-1200x720-1-768x461.jpg

https://www.madaboutbookkeeping.co.uk/reclaiming...

Input tax and donations The VAT rules only permit your business to reclaim input tax VAT paid on purchases where the expenditure is linked to VATable supplies sales it makes In other words your business must be VAT registered and the purchase on which you paid VAT must have a clear connection with the business activity

https://www.taxadvisermagazine.com/article/...

21 June 2022 Share this article What conditions need to be met to ensure that a donation will not be subject to VAT Key Points What is the issue Income earned by a charity or other organisation is outside the scope of VAT if it relates to a genuine donation It is also ignored as far as the VAT registration threshold is concerned

Can You Claim VAT Back On Fuel YouTube

Can You Claim Back VAT Without Receipt Accountant s Answer

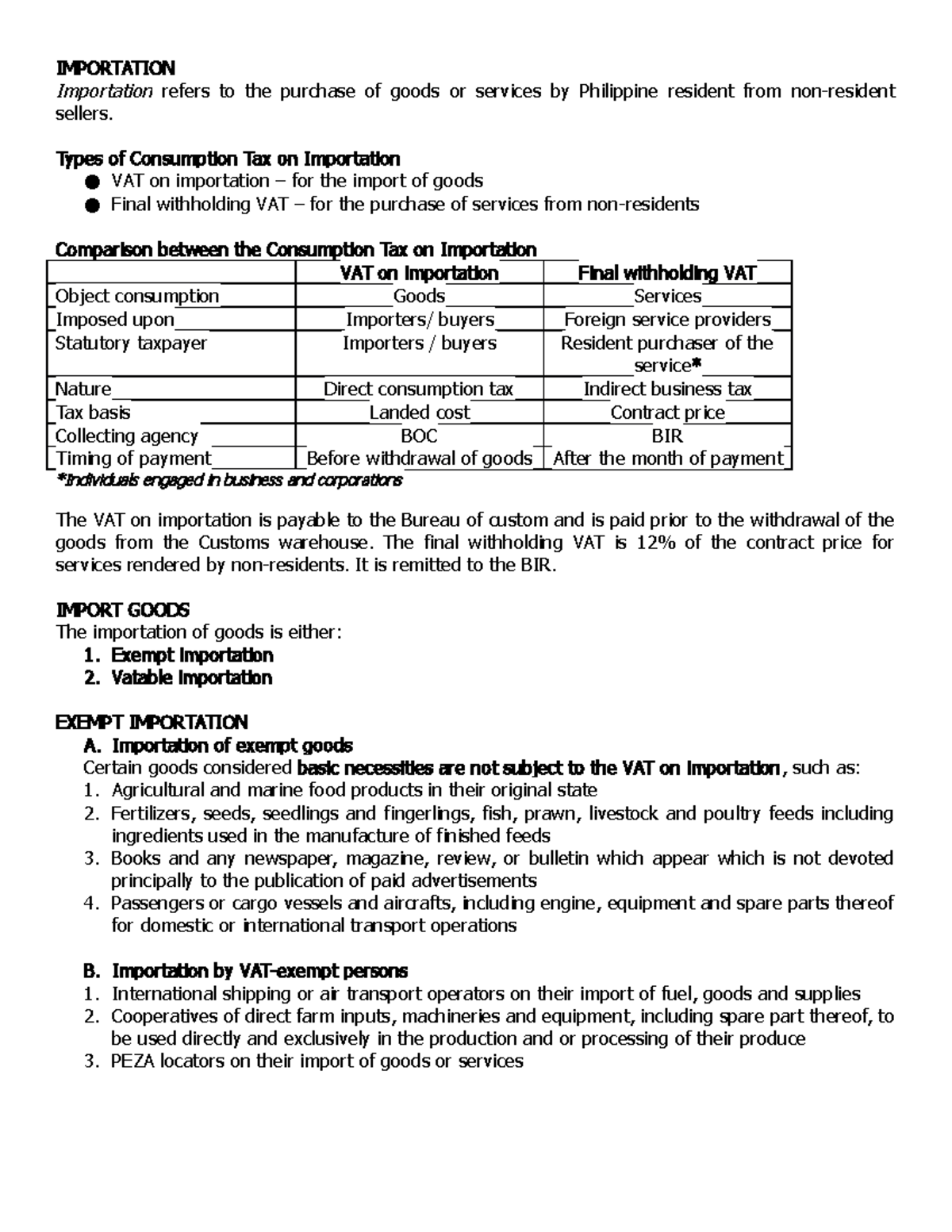

TAX 02 VAT ON Importation IMPORTATION Importation Refers To The

Can You Claim VAT On Food For Staff Exploring South Africa s VAT

Can You Claim VAT On Commission Paid

Can You Claim VAT On Entertaining Clients Employees YouTube

Can You Claim VAT On Entertaining Clients Employees YouTube

How Far Back Can You Claim VAT On Expenses In UK Intertax Tax

How Far Back Can You Claim VAT On Invoices

Can You Claim VAT On Staff Medical Expenses

Can You Claim Vat On Donations Paid - The key risk is that if donation money cannot be clearly distinguished from sponsorship income it will become taxable and the charity will be liable to VAT on the entire amount