2024 Nj Homestead Rebate New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

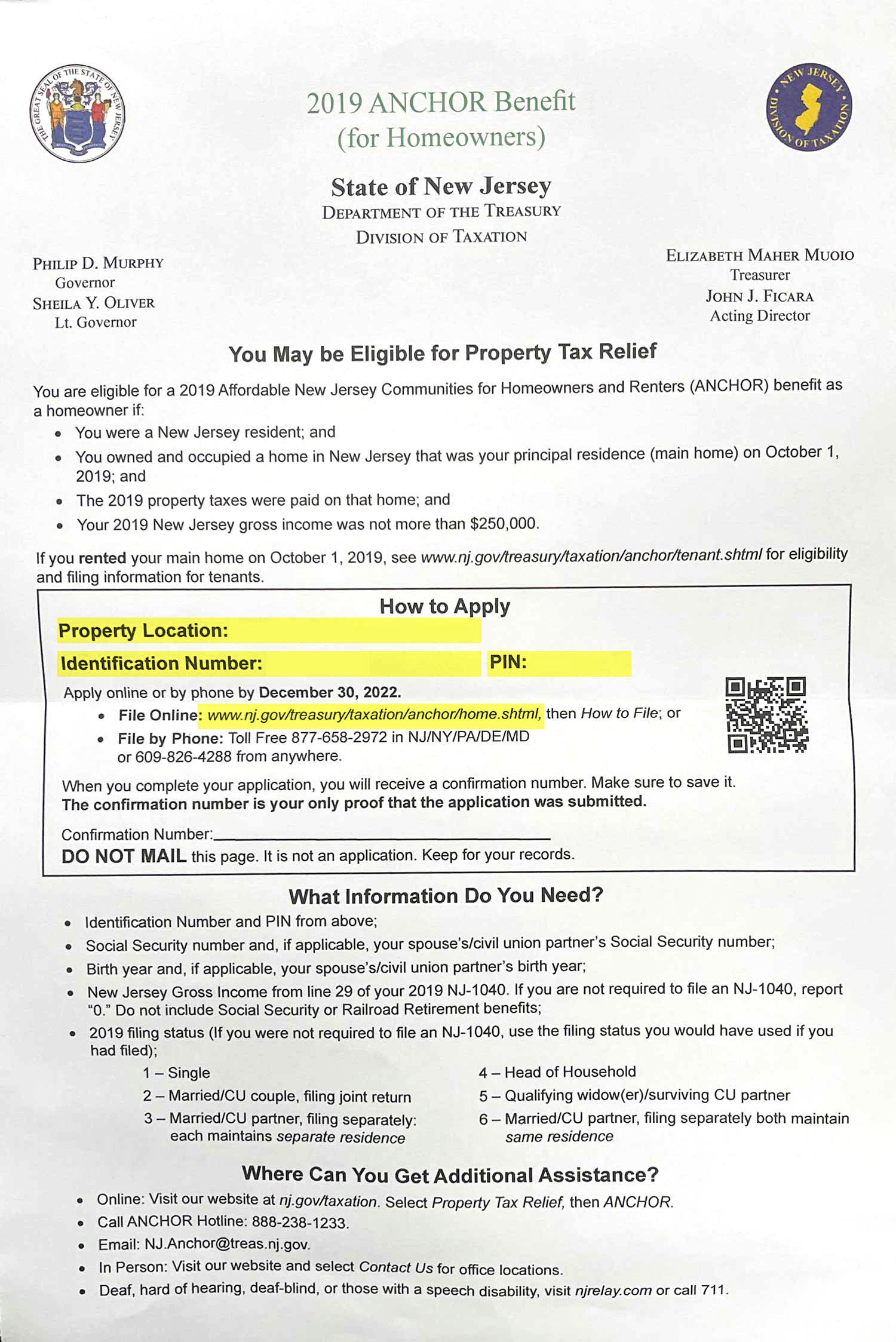

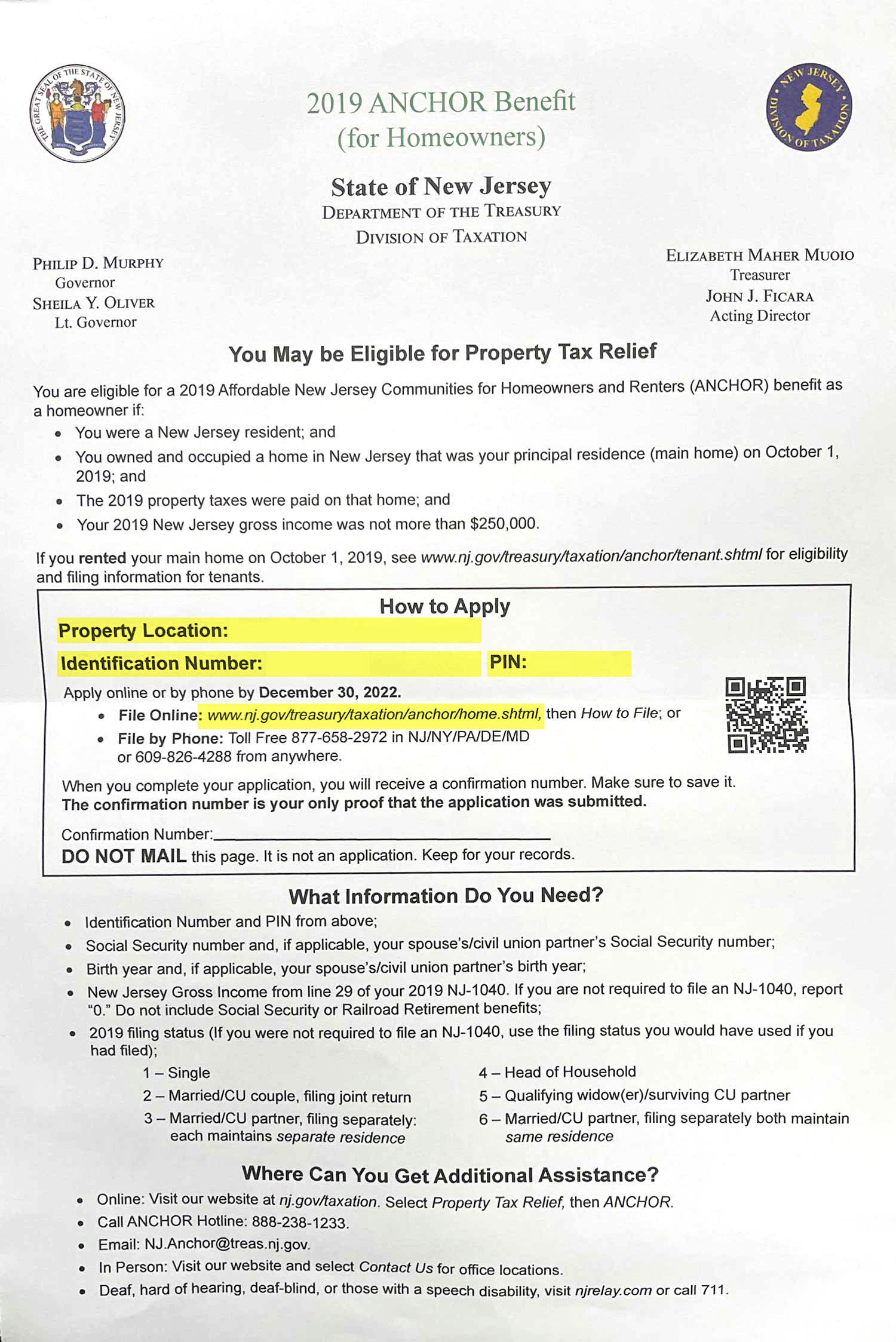

Your 2020 New Jersey gross income was not more than 250 000 Filing Deadline The filing deadline was December 29 2023 All property tax relief program information provided here is based on current law and is subject to change Gross Income Deceased Homeowners Ineligible Properties Condominiums and Co ops Continuing Care Communities If you own a home primary residence but were a temporary resident of an Assisted Living Facility ALF and did not change your primary domicile you are eligible to apply for the benefit on the home you owned on October 1 2020 as long as you meet all other program requirements

2024 Nj Homestead Rebate

2024 Nj Homestead Rebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

Do I Qualify For The Homestead Rebate Or The Senior Freeze NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2020/04/houston-3267075_1920-1024x683.jpg

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2019/03/Homestead-968x643.jpg

The program gives rebates of up to 1 500 for homeowners with a household income of less than 150 000 Homeowners with a household income between 150 000 and 250 000 can receive 1 000 and The administration says it can reach more residents in 2024 New Jersey residents are just beginning to receive the first payments under the state s new Anchor property tax relief program but attention is already shifting to finding ways to improve the program in year two

The online portal to apply for the state s newest property tax savings program is open The program called ANCHOR short for the Affordable New Jersey Communities for Homeowners and Renters The Department of the Treasury confirmed that 2024 ANCHOR benefits would be based on tax year 2020 income and residency if legislators approve the renewal of the 2 billion program included in

Download 2024 Nj Homestead Rebate

More picture related to 2024 Nj Homestead Rebate

What Happens To The Homestead Rebate After A Move Nj

https://www.nj.com/resizer/sBo-4_lkRhrOYJI-ucvPmOA_ofU=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/4K2FXGBYXBBBLKOPD6EDVE6DJY.jpg

Is The Homestead Rebate For Homeowners Running Late Nj

https://www.nj.com/resizer/Z-Lasop-fy7Cz2Lo9wlvlTFVzPw=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RW7W4DUDE5BIHBJBZMV2YOV254.jpg

Who Qualifies For NJ Homestead Rebate 2022 YouTube

https://i.ytimg.com/vi/vklEBvf_5vE/maxresdefault.jpg

This year s ANCHOR rebates will be based on tax returns filed in 2020 and for New Jersey seniors the payout will be 250 higher This increase is being billed by lawmakers as part of the StayNJ plan a property tax credit for those 65 and older that will not go into effect until 2026 ANCHOR replaced the Homestead Benefit A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits

Electronic Services The inquiry system will tell you if your application is in processing we have no record of processing your application the date we issued a benefit including if it was applied to your property tax bill for tax year 2018 To use this service you will need your valid Social Security Number SSN Individual Taxpayer For example under Murphy s proposal senior and disabled homeowners making less than 100 000 annually would get the largest relief benefits totaling on average more than 850 according to Treasury The next highest average benefits totaling 787 would go to senior and disabled homeowners making between 100 000 and 150 000 annually

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

https://www.msn.com/en-us/money/realestate/this-is-who-can-qualify-for-nj-anchor-rebates-in-2024/ar-AA1emGXe

New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

https://nj.gov/treasury/taxation/anchor/home.shtml

Your 2020 New Jersey gross income was not more than 250 000 Filing Deadline The filing deadline was December 29 2023 All property tax relief program information provided here is based on current law and is subject to change Gross Income Deceased Homeowners Ineligible Properties Condominiums and Co ops Continuing Care Communities

When Can I Apply For The Homestead Rebate Nj

Homeowner Renters District 16 Democrats

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

What Happened To My Homestead Rebate Nj

Is This Estate Eligible For The Homestead Rebate NJMoneyHelp

Mass Save Rebate Form 2021 PrintableRebateForm

Mass Save Rebate Form 2021 PrintableRebateForm

When Will I Be Eligible For The Homestead Rebate Nj

Do I Have To Report The Homestead Rebate On My Federal Taxes NJMoneyHelp

Can I Submit A Paper Application For The Homestead Rebate Nj

2024 Nj Homestead Rebate - The second New Jersey Anchor tax rebate payment is expected to be sent by November 1 i e six months after the first one Interestingly the rebate payment date is a week before Election Day