Can You Deduct Interest On A Car Loan Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

Types of interest not deductible include personal interest such as Interest paid on a loan to purchase a car for personal use Credit card and installment interest incurred for personal expenses You cannot deduct a personal car loan or it s interest While typically deducting car loan interest is not allowed there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

Can You Deduct Interest On A Car Loan

Can You Deduct Interest On A Car Loan

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

Can You Deduct Property Taxes With A Standard Deduction

https://www.realized1031.com/hubfs/propertytaxes-1295797018.jpg#keepProtocol

Can You Deduct Mortgage Interest When Your Name Is Not On Title

https://static.twentyoverten.com/58aa3fbed783f674a683c47e/2fR3PfBnbt/pexels-winrood-lee-2362030.jpg

Specifically the IRS does not allow you to deduct personal interest such as The interest you pay on a loan to buy a car for personal use Credit card and installment loan interest You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest may be tax deductible The amount you can deduct will depend on how many miles you drive for business vs personal use

Interest paid on personal loans car loans and credit cards is generally not tax deductible However you may be able to claim interest you ve paid when you file your taxes if you take If 60 of your driving time is used for pie delivery and 40 is for personal tasks you can deduct 60 of your auto loan interest The costs you can deduct with the actual expenses method include gas repairs insurance oil changes all your vehicle operating costs plus your car s depreciation

Download Can You Deduct Interest On A Car Loan

More picture related to Can You Deduct Interest On A Car Loan

In California Can You Deduct Interest On A Second Mortgage

https://s.hdnux.com/photos/01/26/17/30/22607361/10/1200x0.jpg

Can You Deduct Mortgage Interest On Investment Property Commercial

https://aurumsharpe.com/wp-content/uploads/2022/09/hh.jpg

Can You Deduct Interest On Loans FBLG Certified Public Accountants

https://fbl.cpa/assets/images/uploads/FBLG_WebCTAs_TaxServices.jpg

Can you deduct car loan interest You may deduct interest on a loan for a car you use in your business Taxpayers can even deduct the interest if you take out a home equity loan to buy a business vehicle You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your taxes But writing off car loan interest as a business expense isn t as easy as just deciding you want to start itemizing your tax return when you file

Deducting car loan interest on your tax returns can be a valuable write off if you re a small business owner or you re self employed But before you claim this deduction be sure you If you use your car for business you can deduct the interest you pay on your car loan as an interest expense You can take this deduction whether you deduct your car expenses using the actual expense method or the standard mileage rate because the standard mileage rate was not intended to encompass interest on a car loan

Can You Deduct Home Equity Loan Interest Extravigator

http://extravigator.com/wp-content/uploads/2020/06/frankie-valentine-WWS9i5_Q8vE-unsplash.jpg

How To Deduct Full Mortgage Interest When Turning Your Home Into A

https://i.pinimg.com/originals/6a/c2/66/6ac266b57239328a0bba6c1c238bd489.jpg

https://www.hrblock.com/tax-center/filing/...

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

https://www.irs.gov/taxtopics/tc505

Types of interest not deductible include personal interest such as Interest paid on a loan to purchase a car for personal use Credit card and installment interest incurred for personal expenses

You Can Deduct Interest On HELOCs Equity Mortgages Under New Tax Law

Can You Deduct Home Equity Loan Interest Extravigator

How To Deduct Your Car And Rent On Your Tax Return YouTube

How Much Mortgage Interest Can You Deduct On Your Taxes CBS News

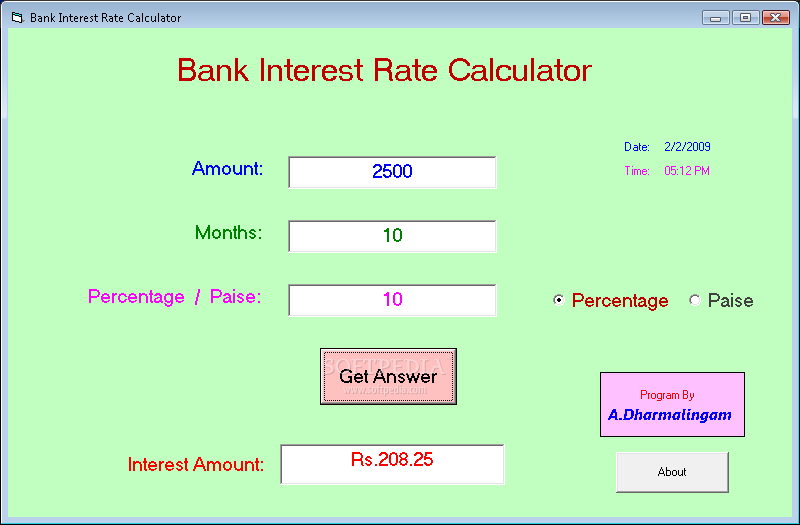

How To Calculate Interest Rate In Calculator Haiper

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

TaxAudit You Can Deduct Mortgage Interest Maybe Sweet Captcha

.png?format=1500w)

Can You Deduct Mortgage Interest On A Second Home Sand Hill

Can You Deduct Interest On A Rv Loan Loan Walls

Can You Deduct Interest On A Car Loan - Specifically the IRS does not allow you to deduct personal interest such as The interest you pay on a loan to buy a car for personal use Credit card and installment loan interest