Can You Deduct Rental Property Interest What Deductions Can I Take as an Owner of Rental Property If you receive rental income from the rental of a dwelling unit there are certain rental expenses you

You can deduct 20 000 in interest from your rental income reducing your taxable rental income to 40 000 Your lender will provide you with Form 1098 annually Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies

Can You Deduct Rental Property Interest

Can You Deduct Rental Property Interest

https://i0.wp.com/learn.roofstock.com/hubfs/iStock-1191634510.jpg#keepProtocol

Hecht Group Can You Deduct Employee Wages For Working On Rental Property

https://img.hechtgroup.com/1663815977999.a80ddf7e236158c3db9a35affdb4d746

3 Tax Questions Every Landlord Needs To Consider TechPlanet

https://techplanet.today/storage/posts/2022/11/11/34/a5BwrxeHDklEV8MB5BtxiHeRM7QuBrQ6Wx67CRZQ.jpg

Expenses you can deduct The expenses you can deduct from your rental income are the cost of insuring your rental property the rates for the property payments to agents who Can you deduct mortgage interest on a rental property Yes if you receive rental income from a property you are entitled to deduct certain expenses including

Broadly you can deduct qualified rental expenses e g mortgage interest property taxes interest and utilities operating expenses and repair costs You can If you borrowed funds on or after 27 March 2021 for your property interest deductions cannot be claimed between 1 October 2021 and the end of the 2023 24 tax year

Download Can You Deduct Rental Property Interest

More picture related to Can You Deduct Rental Property Interest

Can You Deduct Rental Expenses When A Property Is Vacant

https://huddlestontaxcpas.com/wp-content/uploads/2020/03/Huddleston-Final-010-scaled.jpg

Can I Deduct Health Insurance Premiums If I m Self Employed The

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

Can You Deduct Property Taxes With A Standard Deduction

https://www.realized1031.com/hubfs/propertytaxes-1295797018.jpg#keepProtocol

Tax deductions for rental property Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of

You can usually deduct mortgage interest as a business expense for investment properties like a rental How to calculate rental mortgage interest Your mortgage There are 25 main rental property deductions that most real estate investors can take to reduce taxable net income Expenses may be deducted for items such as normal

Can I Deduct Rental Losses From Another State NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2020/12/workbook-1205044_1920-700x477.jpg

Can You Deduct Mortgage Interest On A Rental Property

https://www.realized1031.com/hubfs/Images/photo/abstract/coins-house-tan-IS-1019219898.jpg

https://www.irs.gov/businesses/small-businesses...

What Deductions Can I Take as an Owner of Rental Property If you receive rental income from the rental of a dwelling unit there are certain rental expenses you

https://www.baselane.com/resources/the-landlords...

You can deduct 20 000 in interest from your rental income reducing your taxable rental income to 40 000 Your lender will provide you with Form 1098 annually

How To Deduct Full Mortgage Interest When Turning Your Home Into A

Can I Deduct Rental Losses From Another State NJMoneyHelp

Can You Deduct Mortgage Interest On Investment Property Commercial

Can You Deduct Mortgage Interest When Your Name Is Not On Title

Can I Deduct Donations To My Church NJMoneyHelp

What Expenses Can You Deduct When Renovating A Rental Property

What Expenses Can You Deduct When Renovating A Rental Property

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Are Professional Conferences Tax Deductible

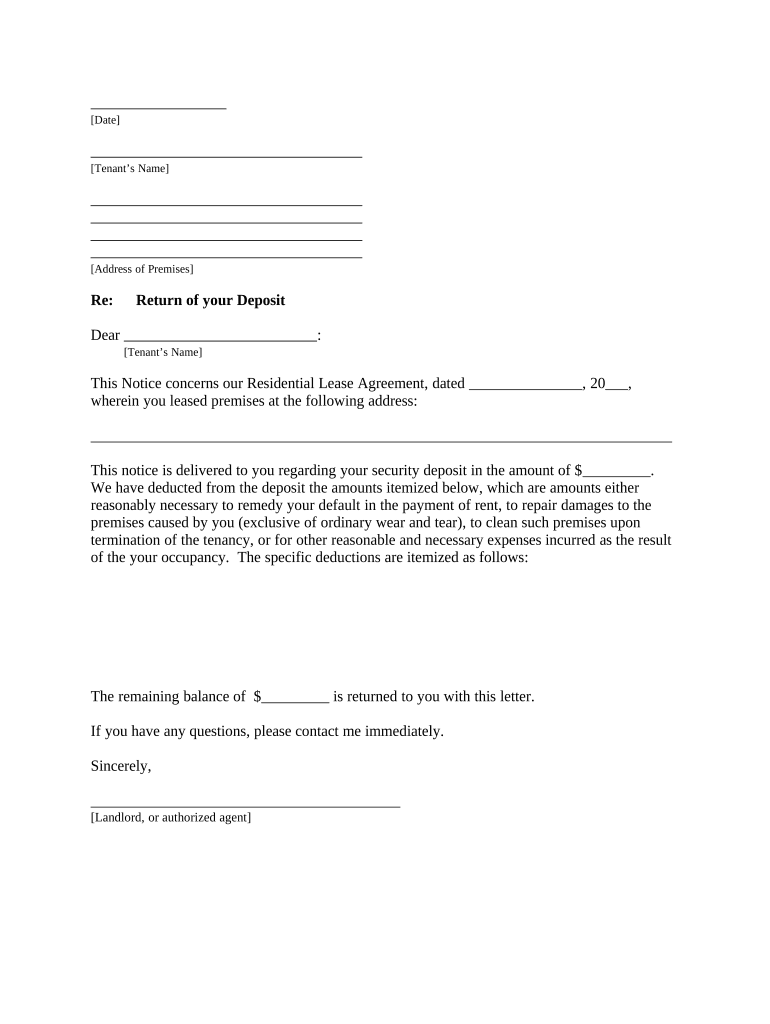

Letter From Landlord To Tenant Returning Security Deposit Less

Can You Deduct Rental Property Interest - As a rental property investor you can deduct the interest part of your mortgage payment but not the principal payments because those are used to reduce the mortgage loan