Can You Get A Tax Credit For Home Improvements Use these steps for claiming an energy efficient home improvement tax credit for residential energy property Make sure the property on or in connection which you are

A2 The credit is a nonrefundable personal tax credit A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability A taxpayer will not The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy Credit

Can You Get A Tax Credit For Home Improvements

Can You Get A Tax Credit For Home Improvements

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

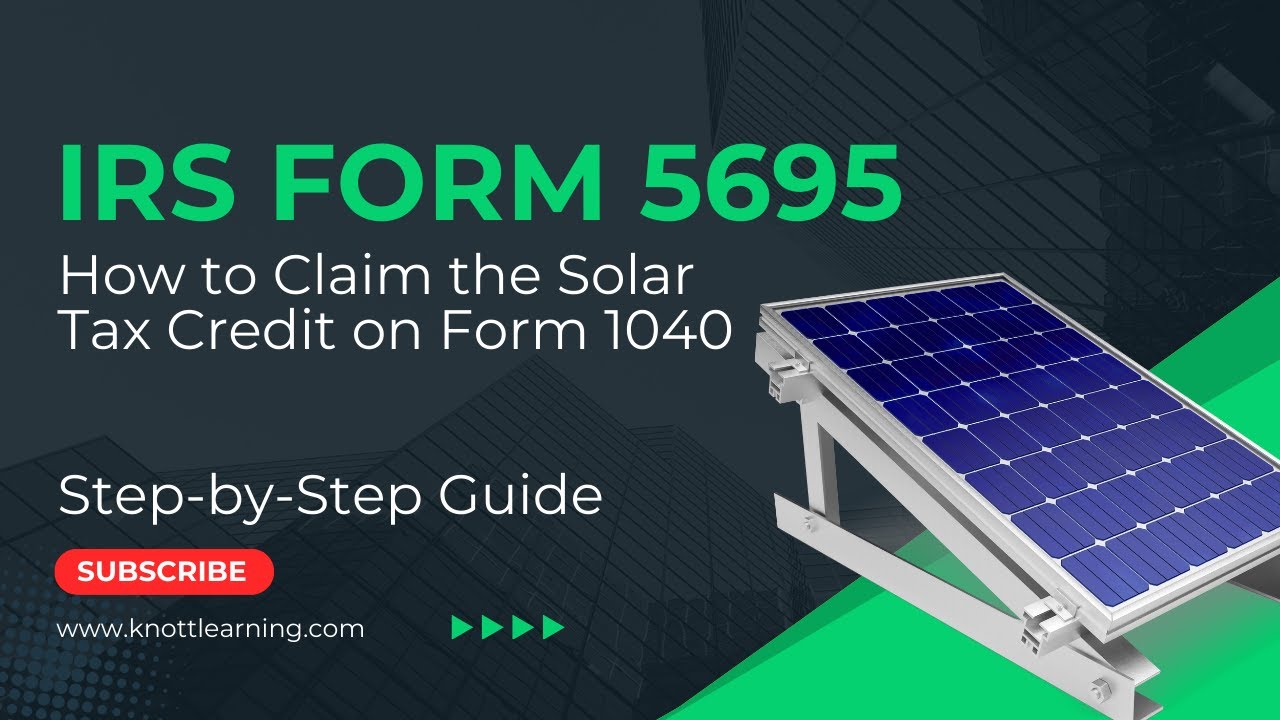

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/19/10/07/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-5583828754740272087-1600x1200.jpeg

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed A More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals building contractors and others See

Can I get tax credits for home improvements If you made energy saving improvements to your primary home during the tax year you could qualify for the residential renewable energy tax credit The system can The Energy Efficient Home Improvement Credit allows you to claim up to 30 of the cost of eligible expenses with a total annual cap of 3 200 The following home improvements qualify for this tax credit Biomass

Download Can You Get A Tax Credit For Home Improvements

More picture related to Can You Get A Tax Credit For Home Improvements

How To Save Money On Home Improvements With Energy Efficiency Tax

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:auto/h:auto/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/12/How-to-Save-Money-on-Home-Improvements-with-Energy-Efficiency-Tax-Credits-Rebates.jpg

How Do You Get A Tax ID Number For A Business

https://businessfirstfamily.com/wp-content/uploads/2019/10/How-Do-You-Get-A-Tax-ID-Number.jpg

Where Can I See What Health Insurance Plans Are Available To Me Will I

https://i.ytimg.com/vi/lJ2ePwuXEag/maxresdefault.jpg

For 2024 you can receive a tax credit equal to 30 of the cost of eligible improvements like installing solar panels energy efficient windows and doors insulation certain energy efficient Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act

Do You Get A Tax Form For Paid Online Surveys YouTube

https://i.ytimg.com/vi/coQMiaCVAZs/maxresdefault.jpg

R D Tax Credit Criteria For The Concrete Contractor For Construction Pros

https://img.forconstructionpros.com/files/base/acbm/fcp/image/2023/03/AdobeStock_221936352.64066812dbc11.png?auto=format%2Ccompress&fit=max&q=70&w=1200

https://www.irs.gov › credits-deductions › how-to...

Use these steps for claiming an energy efficient home improvement tax credit for residential energy property Make sure the property on or in connection which you are

https://www.irs.gov › credits-deductions › frequently...

A2 The credit is a nonrefundable personal tax credit A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability A taxpayer will not

Is There A Tax Credit For Home Improvements Credit Walls

Do You Get A Tax Form For Paid Online Surveys YouTube

Income Tax Credit For Home schooling Families Libertas Institute

The Tax Credit For Home Insulation Windows And Doors In 2022

Small Businesses Get Tax Credits For Paid Leave For Covid Vaccinations

What Is The Tax Credit For Home Improvements TAXP

What Is The Tax Credit For Home Improvements TAXP

Does A New Roof Qualify For A 30 Tax Credit Roofing Optimum

What Is The Tax Credit For Purchasing A Home

Retirement Savings Contribution Credit Get A Tax Credit For Saving

Can You Get A Tax Credit For Home Improvements - According to the Internal Revenue Service in 2024 more than 2 billion in credits were claimed for these improvements by 2 3 million families averaging 880 per family With