Can You Get A Tax Return If Your On Social Security Technically there s a spot for every taxpayer to include their total Social Security benefits on their tax returns On the 1040 form Line 5a is where all benefits go Image source

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay In addition those who only receive payment from Social Security benefits may not be required to file a tax return at all To figure out how much you may owe you ll need your filing

Can You Get A Tax Return If Your On Social Security

Can You Get A Tax Return If Your On Social Security

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-15000-on-tax-return-canada.jpg

How To File A Tax Extension ZenLedger

https://uploads-ssl.webflow.com/5f9a1900790900e2b7f25ba1/62547502a2486c6ddefbf6e3_personalTaxExtension.png

Where s My Refund Bill Brooks CPA

https://www.billbrookscpa.com/wp-content/uploads/2019/03/tax-return.jpg

IRS reminds taxpayers their Social Security benefits may be taxable Internal Revenue Service IRS Tax Tip 2022 22 February 9 2022 A new tax season has arrived The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

Generally if Social Security benefits were your only income your benefits are not taxable and you probably do not need to file a federal income tax return If you received Social Security benefits plus other income the answer to how much if any is taxable can be found in the worksheet in the Form 1040 instruction book Do I have to pay taxes on my social security benefits Are social security survivor benefits for children considered taxable income I received social security benefits this year that were back benefits for prior years Do I amend my returns for those prior years Are the back benefits paid in this year for past years taxable this year

Download Can You Get A Tax Return If Your On Social Security

More picture related to Can You Get A Tax Return If Your On Social Security

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

https://1044form.com/wp-content/uploads/2020/08/completing-form-1040-the-face-of-your-tax-return-us-2-2048x1199.png

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/05/IRS-Tax-Refund-check-shutterstock_1640116444.jpg

How To Fill Out Your Tax Return Like A Pro The New York Times

https://static01.nyt.com/images/2017/02/16/business/yourtaxes/oakImage-1487256985790/oakImage-1487256985790-videoSixteenByNineJumbo1600.png?year=2017&h=555&w=986&s=51679f6356e6d10e1ea3c9bada2e8fdcb0325027fff28841dd4201359b31784a&k=ZQJBKqZ0VN&tw=1

1 Income matters age doesn t Contrary to another common misperception you don t stop paying taxes on your Social Security when you reach a certain age Income and income alone dictates whether you owe federal taxes on You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay income tax on up to 50 of your benefits More than 34 000 up to 85 of your benefits may be taxable

Whether or not your Social Security income is taxable depends on your total income including your Social Security plus any other income Generally speaking if your only income is Social Security you probably don t make enough money to be required to file a federal tax return Get tax form 1099 1042S Download a copy of your 1099 or 1042S tax form so you can report your Social Security income on your tax return Your 2023 tax form will be available online on February 1 2024 Most people get a copy in the mail

Can Credit Card Companies Sue You If Your On Social Security Leia Aqui

https://images.ctfassets.net/90p5z8n8rnuv/4hmb9pp6S6nj3WVCYutqZZ/77901d6c696eddd3215cce4e1d9a9bc3/Can_Credit_Card_Companies_Garnish_Your_Wages_Asset_-_01.jpeg

Tax Return Free Of Charge Creative Commons Clipboard Image

http://www.picpedia.org/clipboard/images/tax-return.jpg

https://www.fool.com/retirement/2019/12/23/does-my...

Technically there s a spot for every taxpayer to include their total Social Security benefits on their tax returns On the 1040 form Line 5a is where all benefits go Image source

https://www-origin.ssa.gov/benefits/retirement/planner/taxes.html#!

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay

What Is A Direct Tax with Pictures

Can Credit Card Companies Sue You If Your On Social Security Leia Aqui

Free Online Tax Forms Printable Printable Templates

States That Tax Social Security Benefits Tax Foundation

Social Security Taken Out Of Paycheck JubranShuman

What Is Line 10100 On Tax Return formerly 101 Notice Of Assessment

What Is Line 10100 On Tax Return formerly 101 Notice Of Assessment

Who Should File Income Tax Return A Y 2023 24

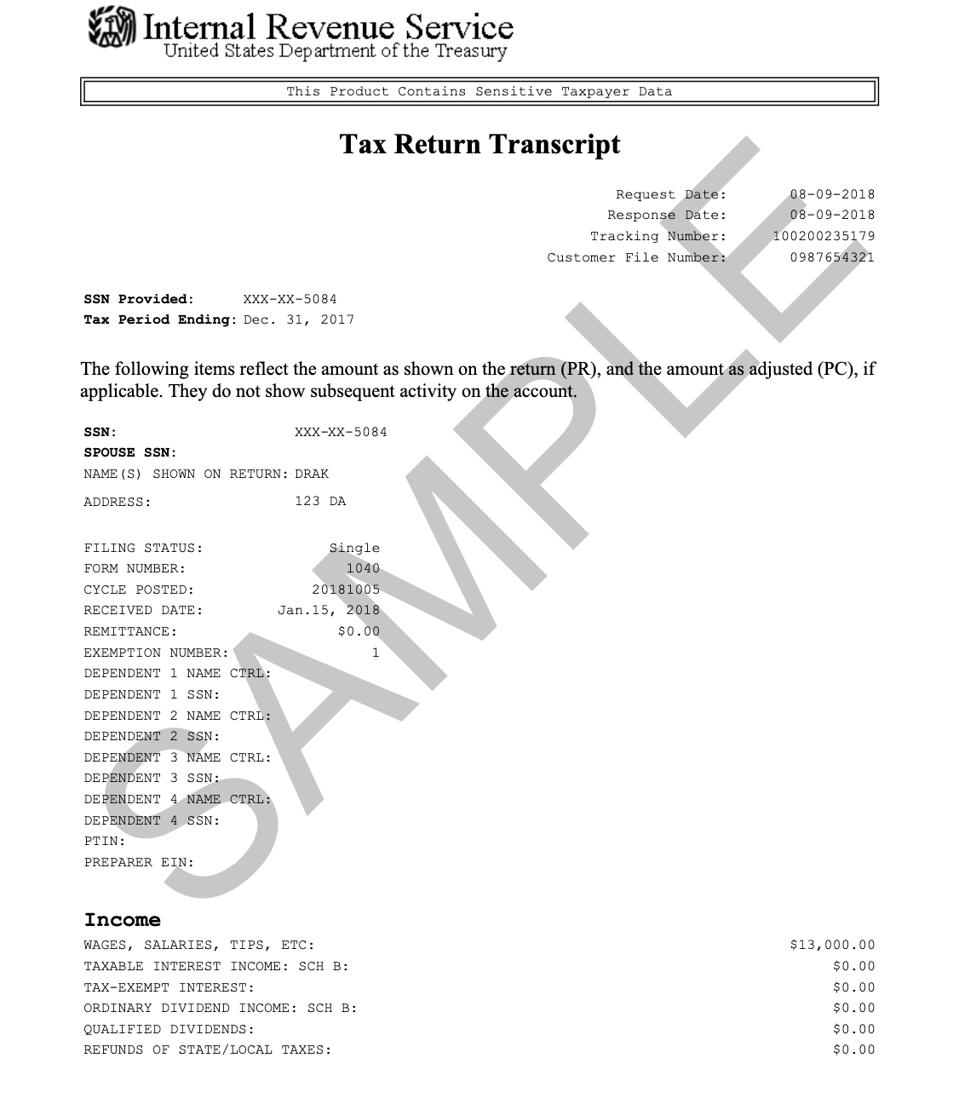

Your Tax Transcript May Look Different As IRS Moves To Protect Privacy

4 Ways To Get A Tax ID Number WikiHow

Can You Get A Tax Return If Your On Social Security - If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits