Can You Get Reimbursed For Gas And Mileage For 2020 the federal mileage rate is 0 575 cents per mile Reimbursements based on the federal mileage rate aren t considered income making

Employers who reimburse mileage should not also reimburse for gas or for oil changes Mileage reimbursement should cover all of those expenses Of course an employer can Yes some employers may choose to reimburse employees for both mileage and gas expenses Mileage reimbursement typically covers a broader range of

Can You Get Reimbursed For Gas And Mileage

Can You Get Reimbursed For Gas And Mileage

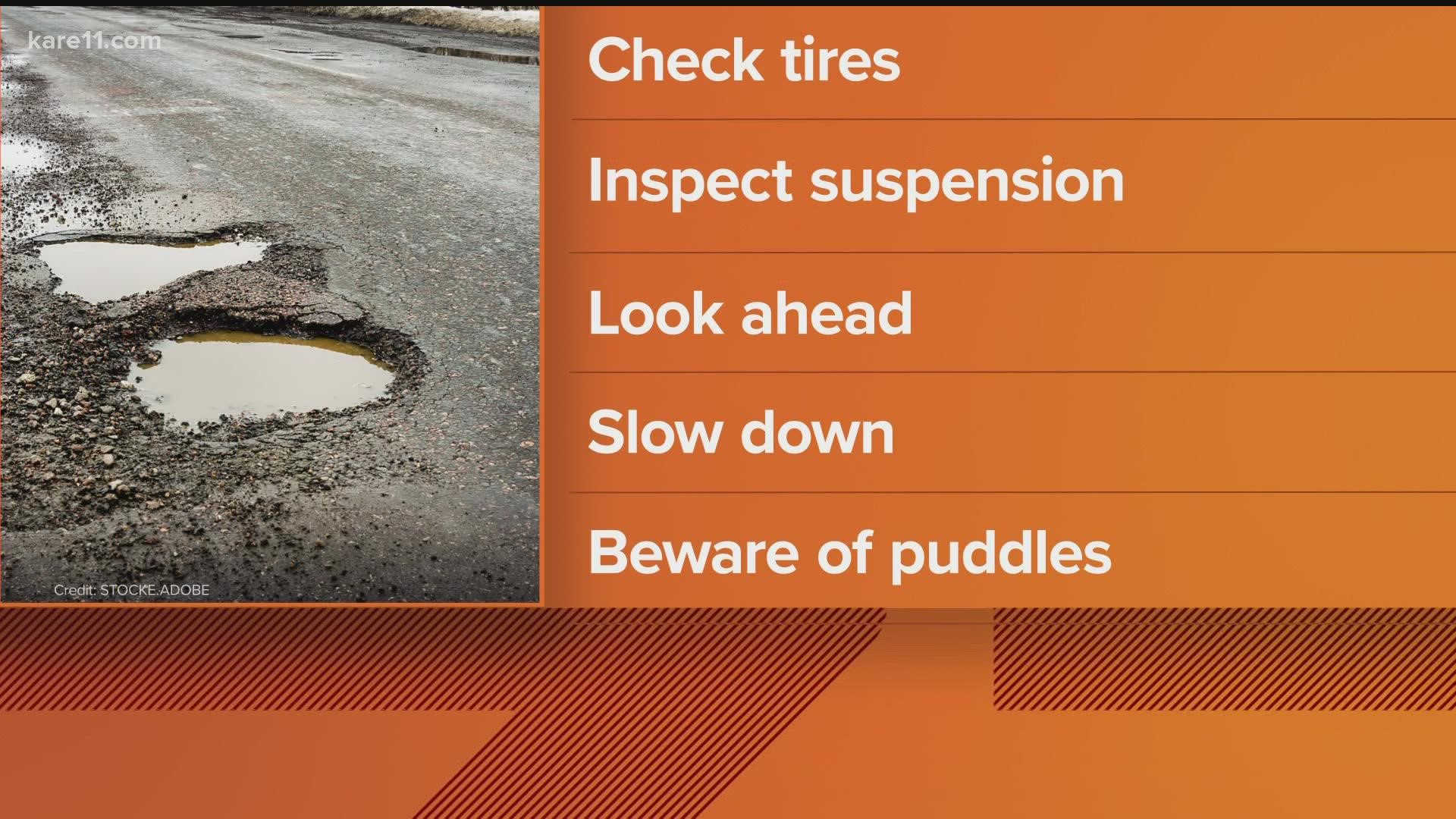

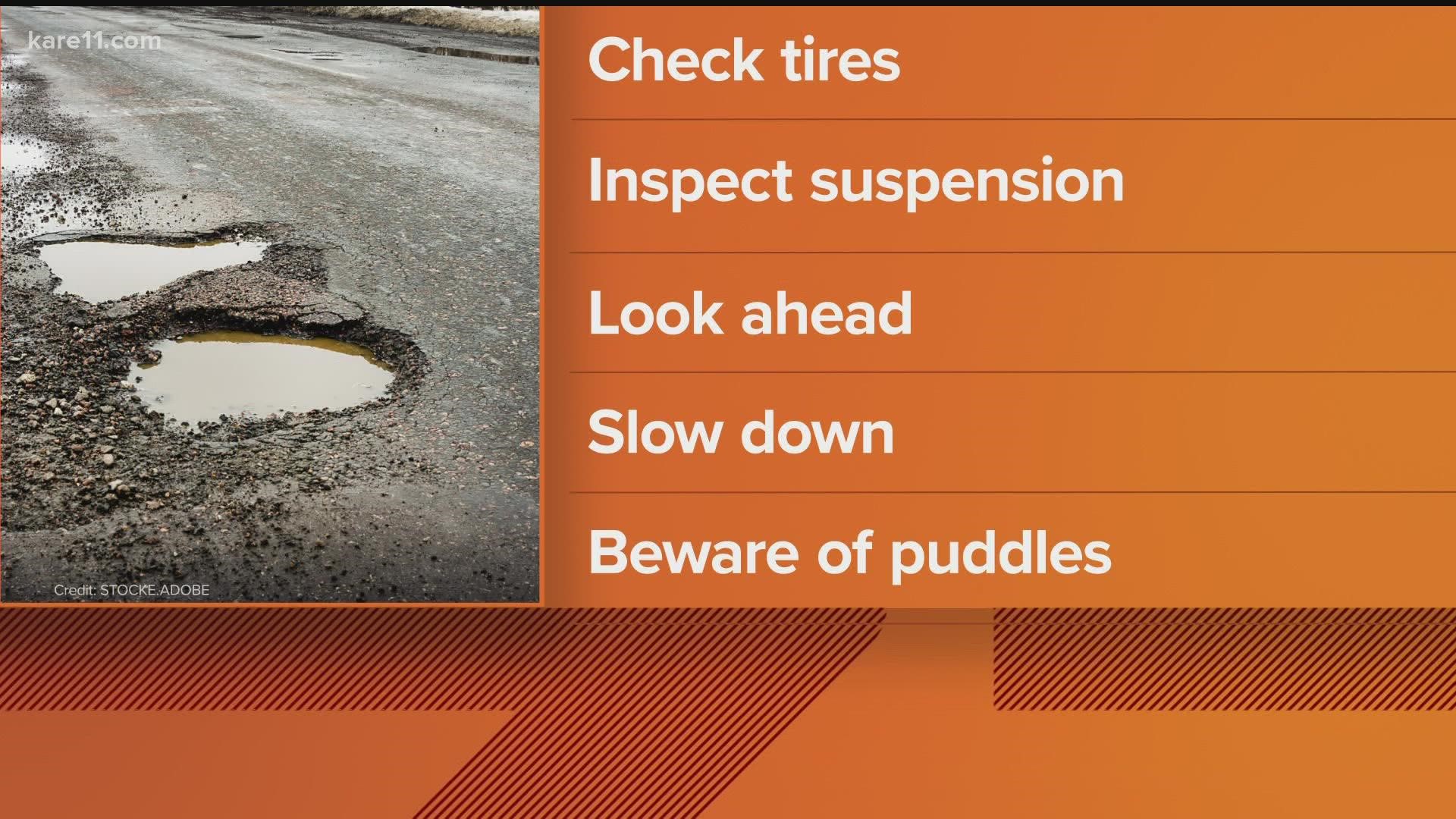

https://media.kare11.com/assets/KARE/images/c3a5f788-883e-4ad8-baf1-4c465b8c8e6d/c3a5f788-883e-4ad8-baf1-4c465b8c8e6d_1920x1080.jpg

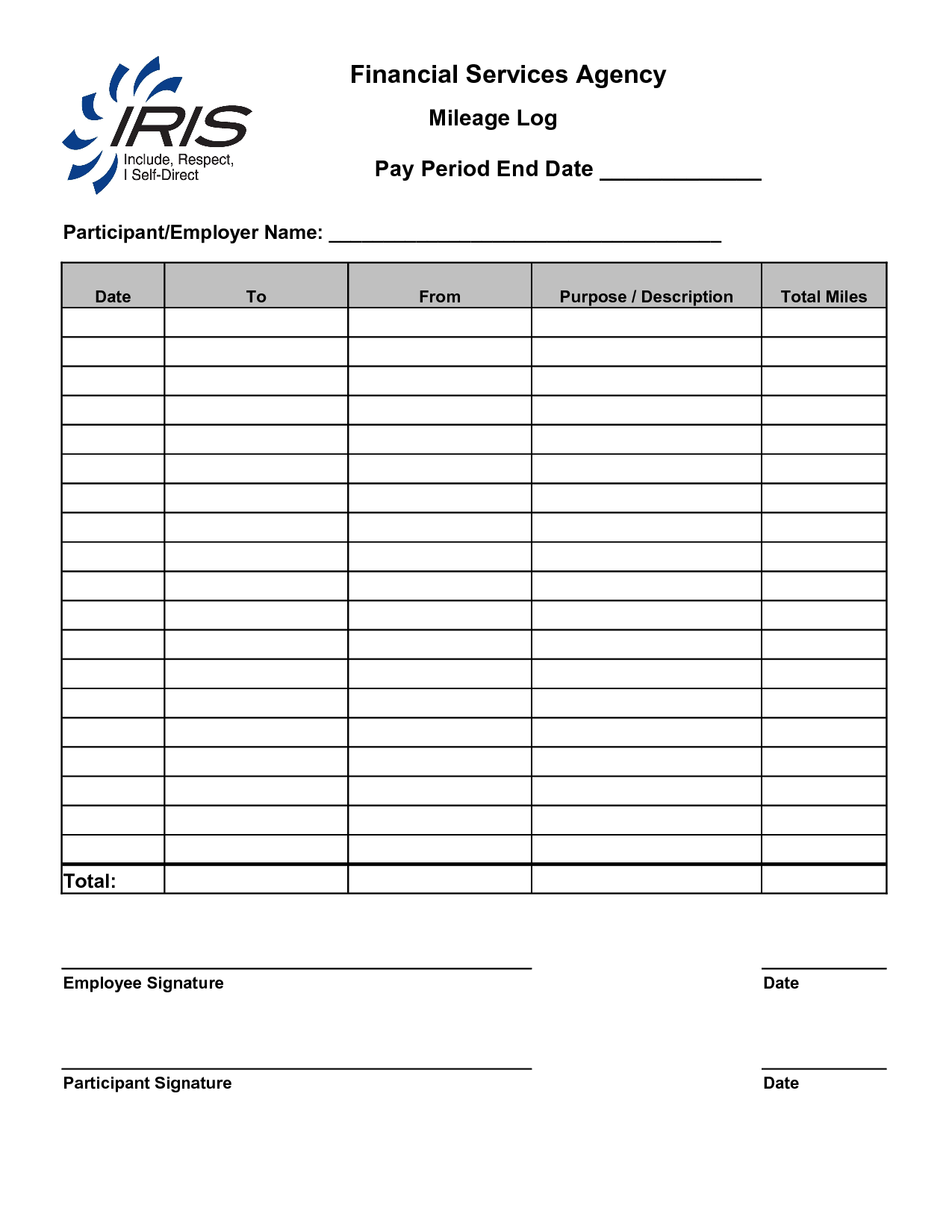

What Employers Need To Know About Expense Reimbursement Sentric

https://sentrichr.com/wp-content/uploads/2021/03/Common-Business-Expenses-Reimbursed.png

Problem Solved Drivers Reimbursed By RaceTrac After Discovering Water

https://media.nbcdfw.com/2019/09/Water-in-Gas-1.jpg?resize=1200%2C675

If you are reimbursed for mileage you can reduce the amount of income taxes you owe on your salary Reimbursement for company mileage is an often misunderstood tax deduction Whether you are a business owner Mileage reimbursement is employer set compensation for work related use of your personal vehicle Some companies pay monthly car allowances while others might require you to track mileage for specific

The mileage reimbursement covers the cost of operating a personal vehicle for business reasons This includes the cost of things like gasoline oil maintenance and wear and For 2021 the standard mileage rate for the use of a car as well as vans pickups or panel trucks is 56 cents per mile a decrease of 1 5 cents from the rate for 2020 The IRS didn t explain why the

Download Can You Get Reimbursed For Gas And Mileage

More picture related to Can You Get Reimbursed For Gas And Mileage

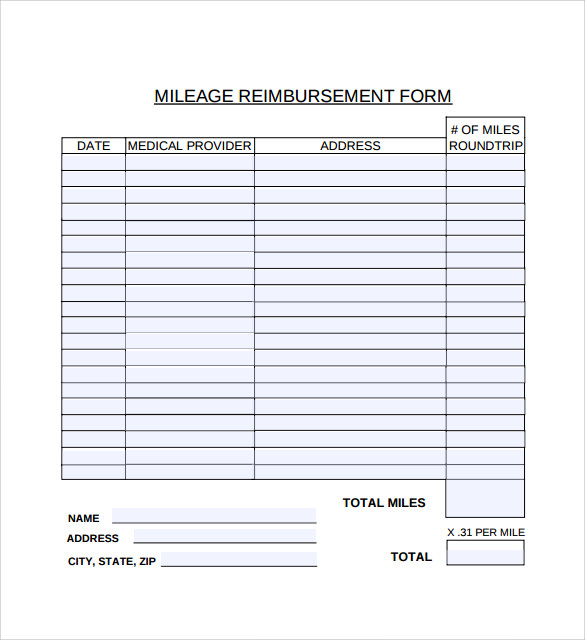

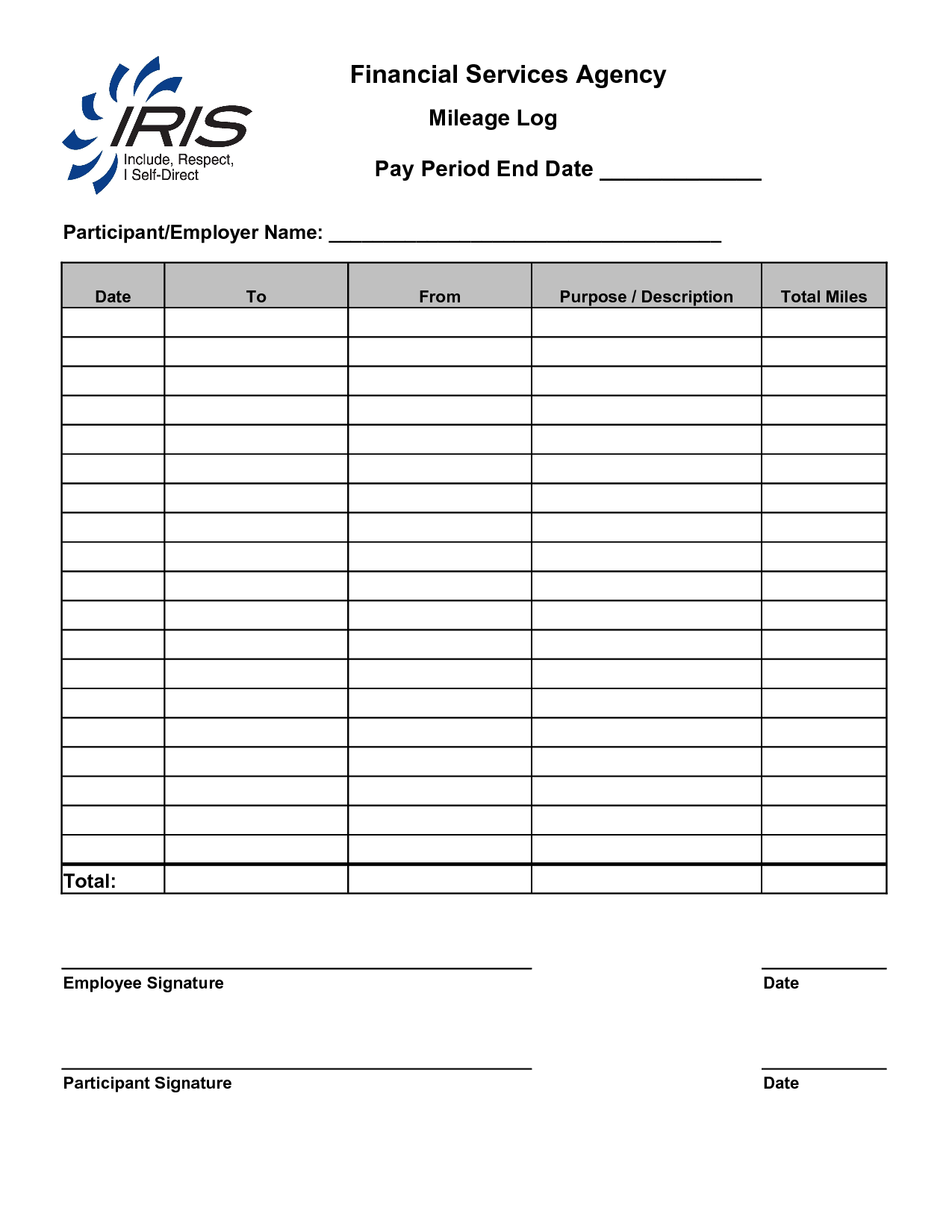

Mileage Reimbursement Form 8 Download Free Documents In PDF Word

http://images.sampletemplates.com/wp-content/uploads/2016/02/24130455/Mileage-Reimbursement-Form.jpg

How To Get Reimbursed For At home COVID Tests KTLA

https://ktla.com/wp-content/uploads/sites/4/2022/01/AP21320699175505.jpg?w=1920&h=1080&crop=1

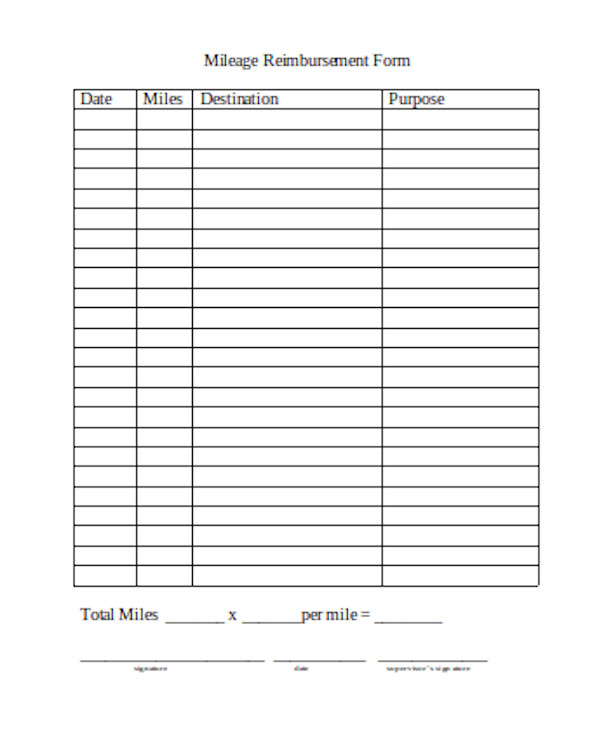

Mileage Reimbursement Form Excel Excel Templates

https://images.sampleforms.com/wp-content/uploads/2016/08/Basic-Mileage-Reimbursement-Form.jpg

The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like Federal tax law allows you to claim a deduction for the business mileage if you re not reimbursed for the expense File 100 FREE with expert help 37 of filers

Fuel costs Vehicle maintenance The automation saves time on the administrative end and typically means employees can get reimbursed sooner When reimbursing employees for mileage you can use IRS gas mileage reimbursement rate There is no standard reimbursement rate as companies can set their own rate Some companies will even offer various ways to pay

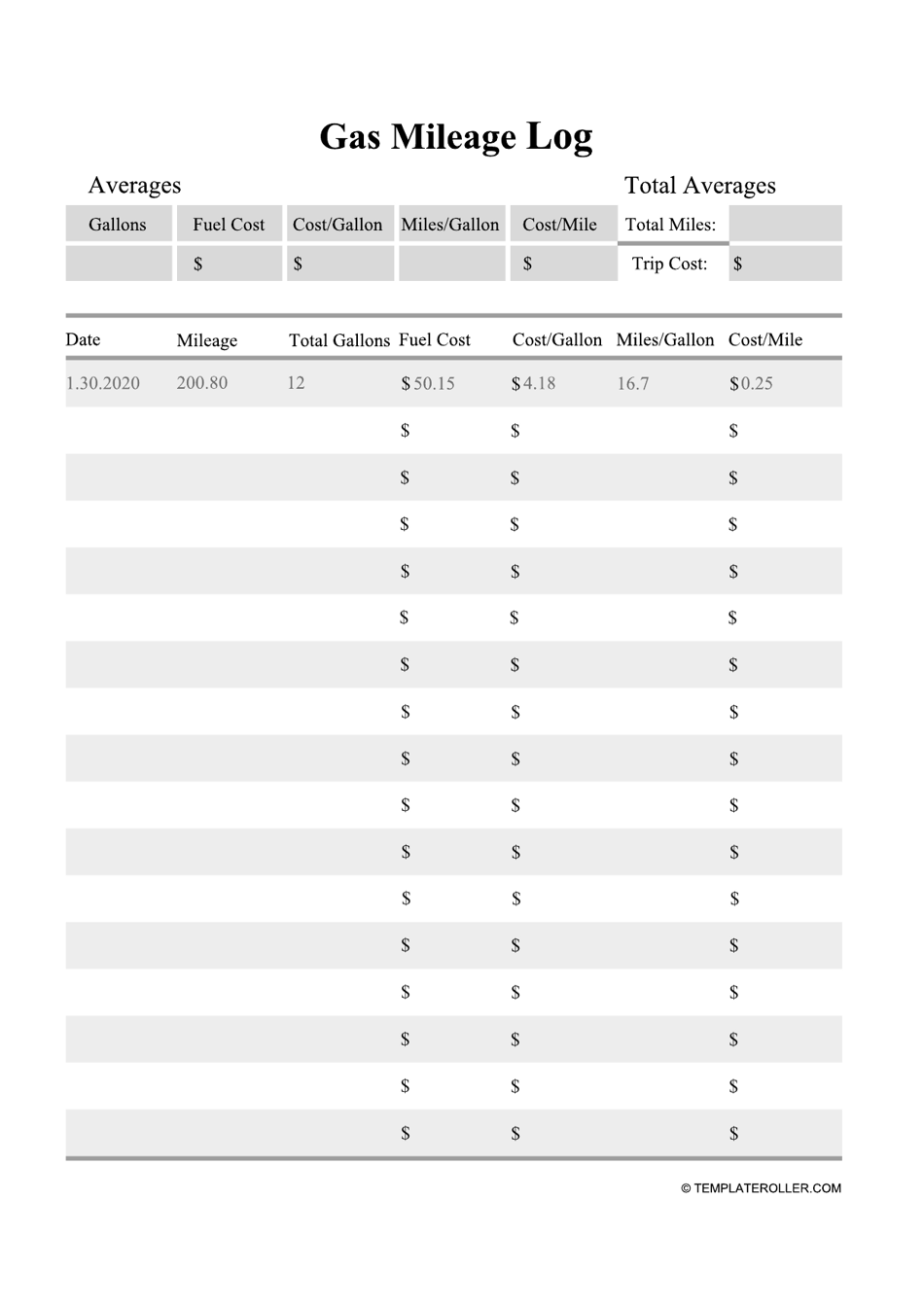

Gas Mileage Log Sheet Printable

https://www.worksheeto.com/postpic/2013/05/gas-mileage-log-sheet-printable_557927.png

Free Printable Gas Mileage Logs Printable Templates

https://data.templateroller.com/pdf_docs_html/2049/20499/2049985/gas-mileage-log-template_print_big.png

https://www.fool.com/the-ascent/small-business/...

For 2020 the federal mileage rate is 0 575 cents per mile Reimbursements based on the federal mileage rate aren t considered income making

https://blog.timesheets.com/2014/03/gas-costs...

Employers who reimburse mileage should not also reimburse for gas or for oil changes Mileage reimbursement should cover all of those expenses Of course an employer can

Mileage And Travel Expenses Can Be Reimbursed Under Workers Comp This

Gas Mileage Log Sheet Printable

If You Have A Reliable Car And Have Had Your License For At Least 2

:max_bytes(150000):strip_icc()/final4-5a5f2a2922bb4ca1a244d4a16e550de6.jpg)

Does Credited Mean Refund Leia Aqui What Is The Difference Between

How To Get Reimbursed For Your Time And Expenses When Caring For Aging

Reimbursement Meaning Types Examples How It Works

Reimbursement Meaning Types Examples How It Works

Aaa Service Reimbursement Form Fill Out Printable PDF Forms Online

The Benefits Of Automating Mileage Capture

Can You Get Reimbursed For Your Compounded Medications The Healthy

Can You Get Reimbursed For Gas And Mileage - The mileage reimbursement covers the cost of operating a personal vehicle for business reasons This includes the cost of things like gasoline oil maintenance and wear and