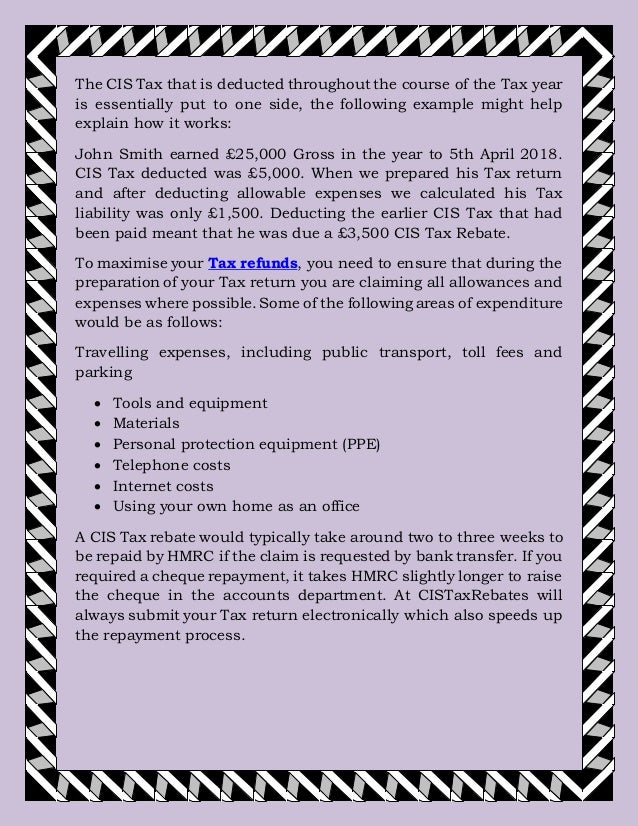

Cis Tax Rebate Form Web 20 juil 2017 nbsp 0183 32 Guidance Claim a refund of Construction Industry Scheme deductions if you re a limited company or an agent Get a refund of your Construction Industry Scheme

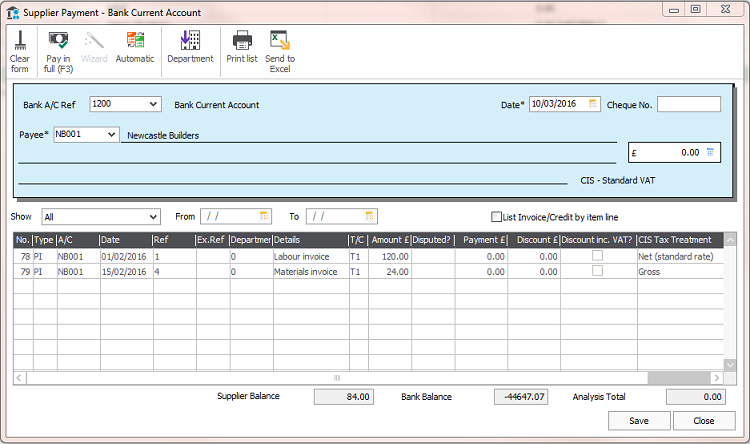

Web 6 avr 2023 nbsp 0183 32 Registered CIS workers receive their payments net of 20 tax If a subcontractor is unregistered they will receive their payment net of 30 tax It is also Web 21 nov 2014 nbsp 0183 32 Guidance Record of amounts set off Repayment of sub contractor deductions Sub contractor registrations This collection brings together forms and

Cis Tax Rebate Form

Cis Tax Rebate Form

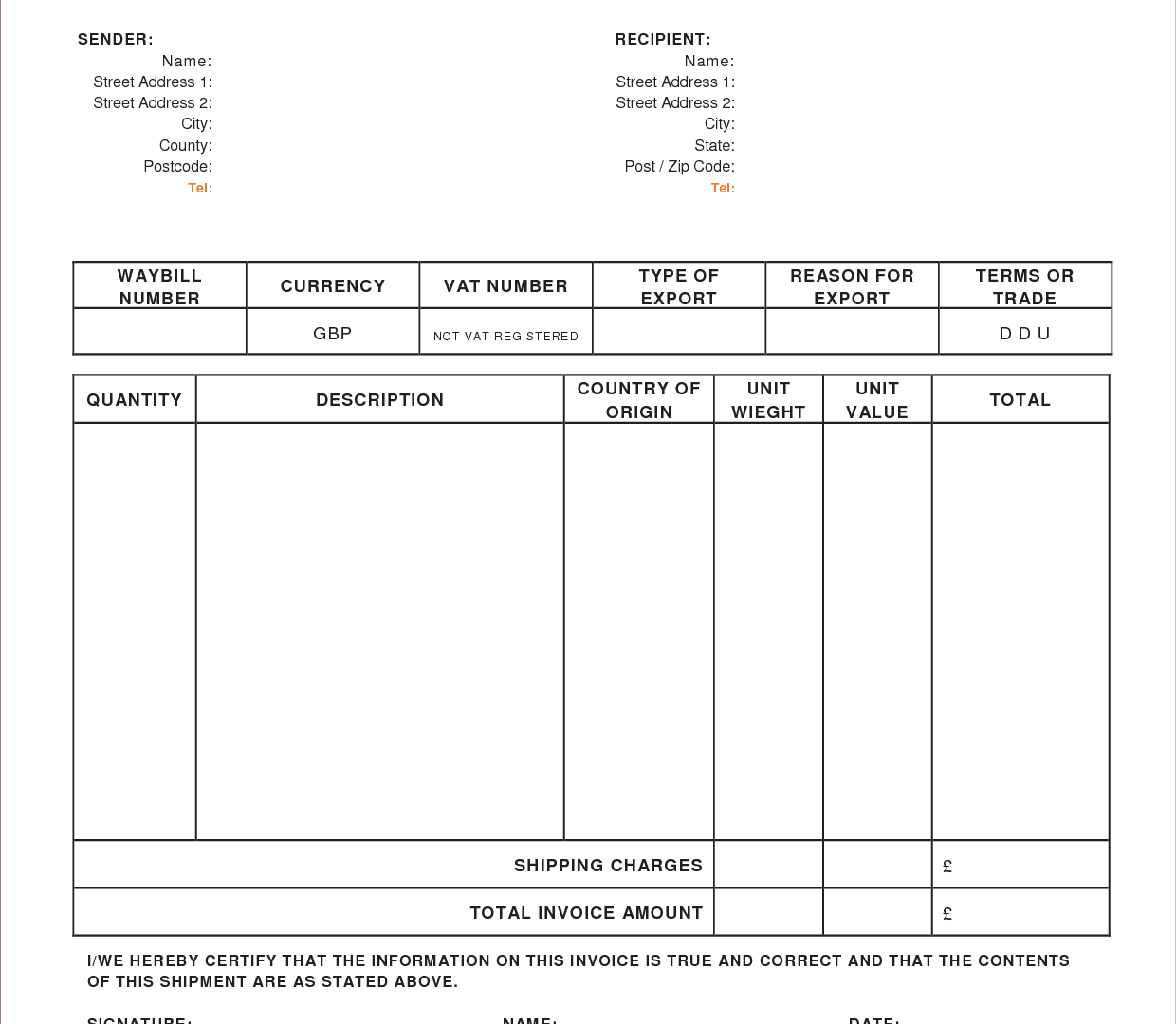

https://legaldbol.com/wp-content/uploads/2019/03/95-Free-Printable-Invoice-Template-With-Vat-And-Cis-Deduction-Layouts-by-Invoice-Template-With-Vat-And-Cis-Deduction.jpg

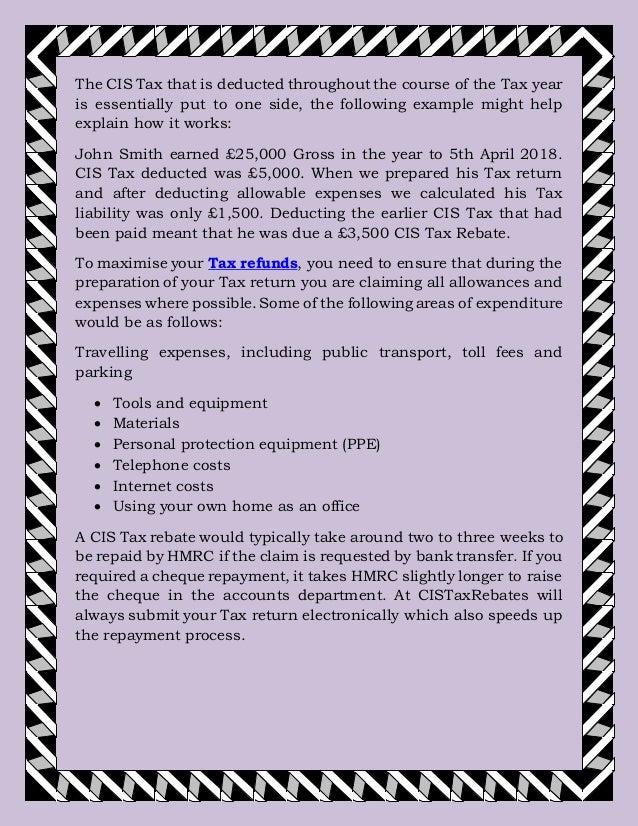

Cis Tax Rebates

https://image.slidesharecdn.com/cistaxrebates-190325141611/95/cis-tax-rebates-2-638.jpg?cb=1553523394

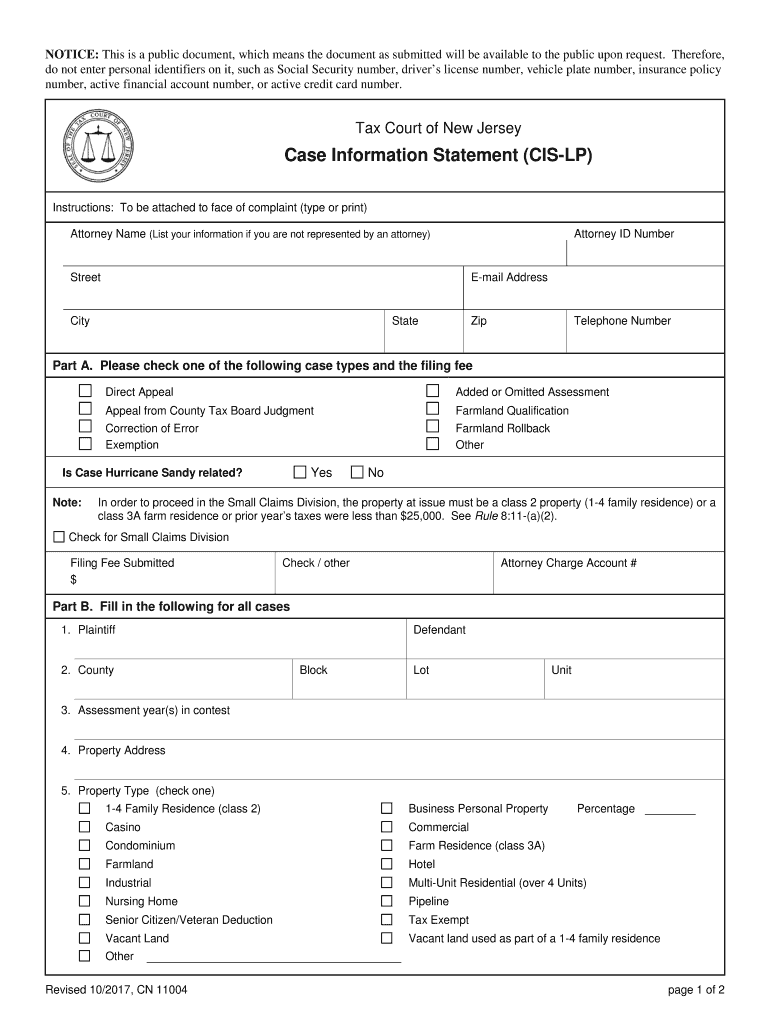

NJ CN 11004 CIS LP 2017 Complete Legal Document Online US Legal Forms

https://www.pdffiller.com/preview/458/243/458243323/large.png

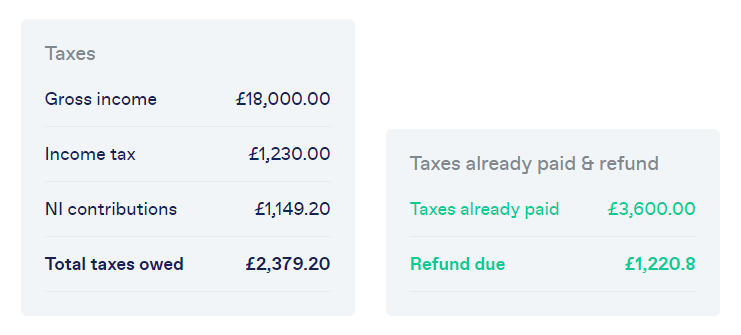

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The Web 9 mars 2023 nbsp 0183 32 The average tax rebate for CIS workers in the UK is 163 1453 so it s worth finding out what you re owed We will help you claim your CIS tax rebate as well as relief

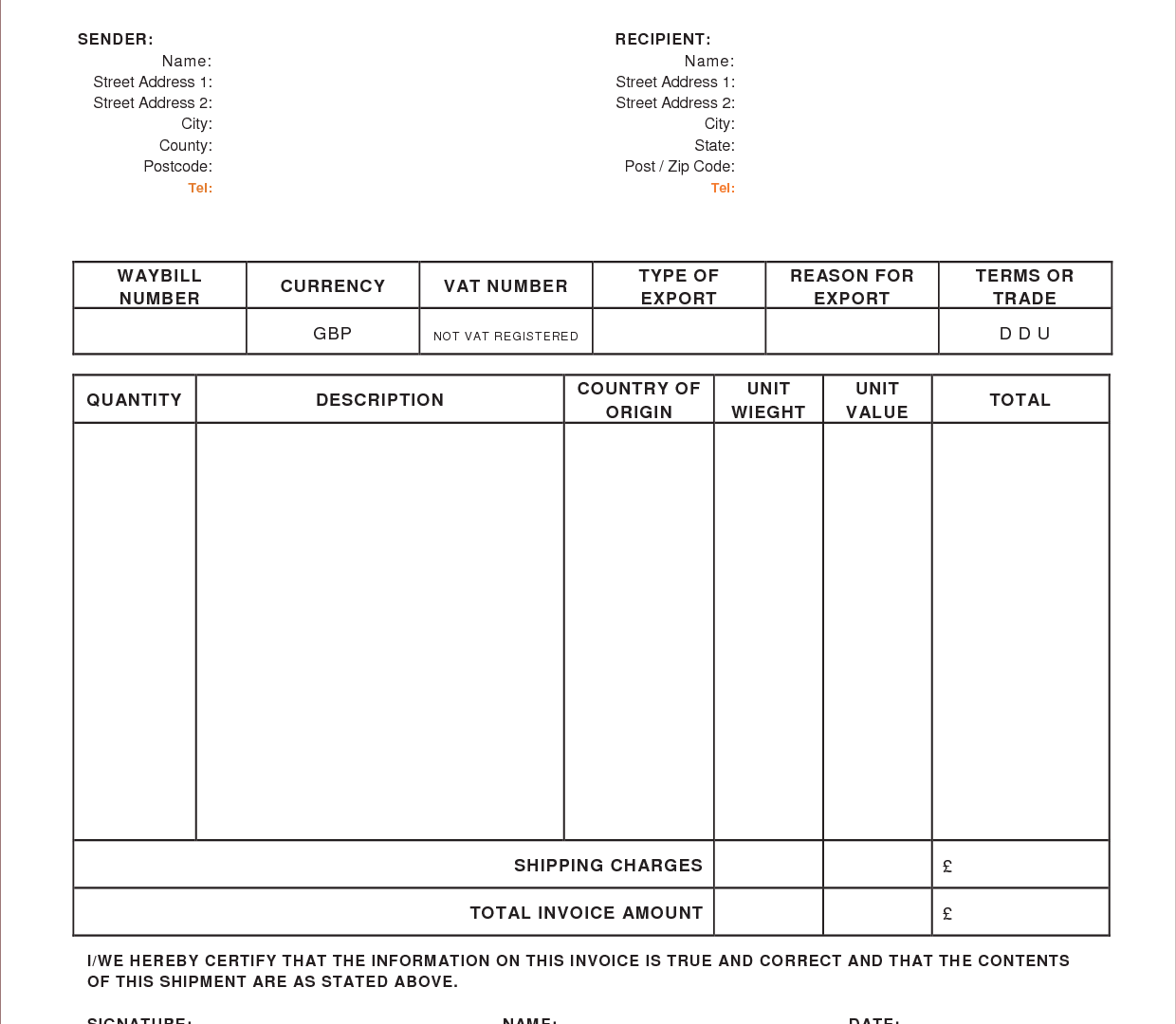

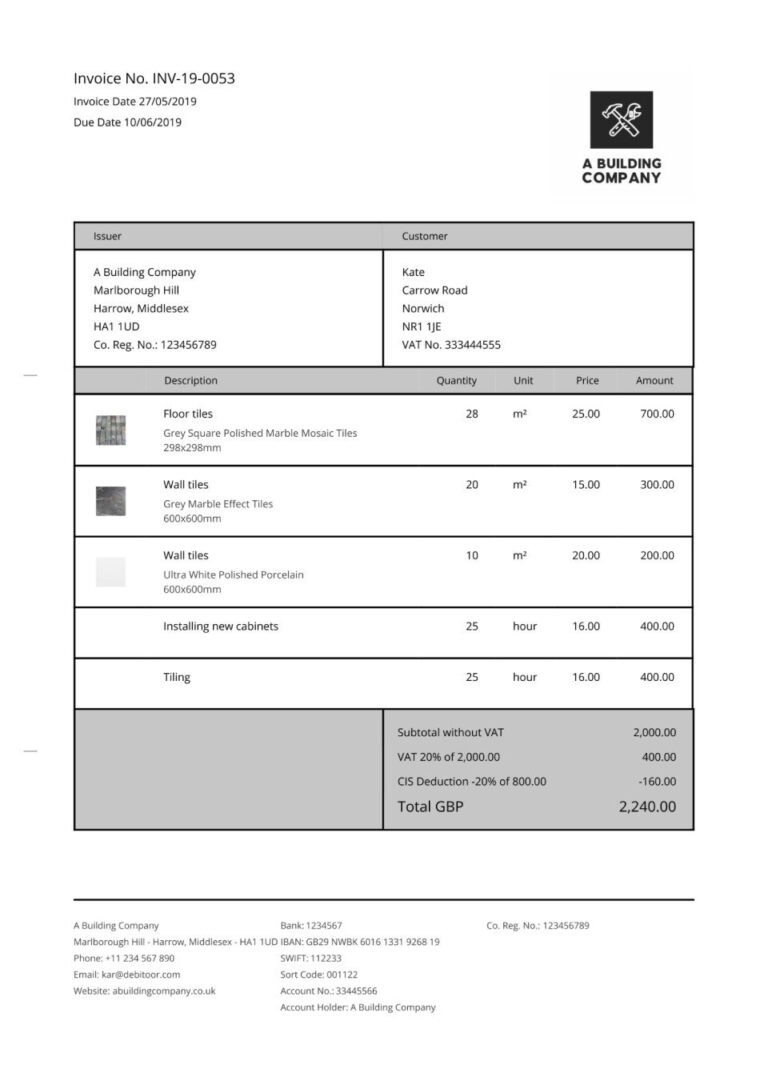

Web Totalpayment exclusive of VAT 600 Lesscost of materials exclusive of VAT 200 Amountliable to deduction 400 Amountdeducted at 20 80 Netpayment to Web Home Tax Returns CIS CIS Tax Returns If you are working via the Construction Industry Scheme CIS you ll be required to file a self assessment tax return after your first year

Download Cis Tax Rebate Form

More picture related to Cis Tax Rebate Form

Original Cis Receipt Template Beautiful Receipt Templates

https://i.pinimg.com/736x/de/b8/6f/deb86f55e49cc298766a27746771d737.jpg

Cis Invoice Template Subcontractor

https://lh3.googleusercontent.com/proxy/qNL-bp75asz2SfB9o4ogJbRyGYKQ97bqCr4sA5AHNdq18qgrml8YuDFPkRHzLLuil9L6zU5MkhwsjEKenSz3cp7762NcEaIWeNQbp4xR1uObXjMB-2N5vgmbizvYt8YqaF0EK2GgcnWNb5Cklt1-b02JHiRfVv6dJnR9O9eMSS9hERlq8jh4IAviy613lwwz6mygXcztR7RViZJ5p3gh2lEsvakQLg94ItWfFyhbt4xwSXAzC-k9bly0hnN7LPhmr-LMkFTU6YtkqszuETXzSEFnfaUHX3T1msZS3j4RqPNo05EItQqgyBQFCID49Yikw0b3Oj2kel1Xm0O7CRzrJn6R-flSFN0=s0-d

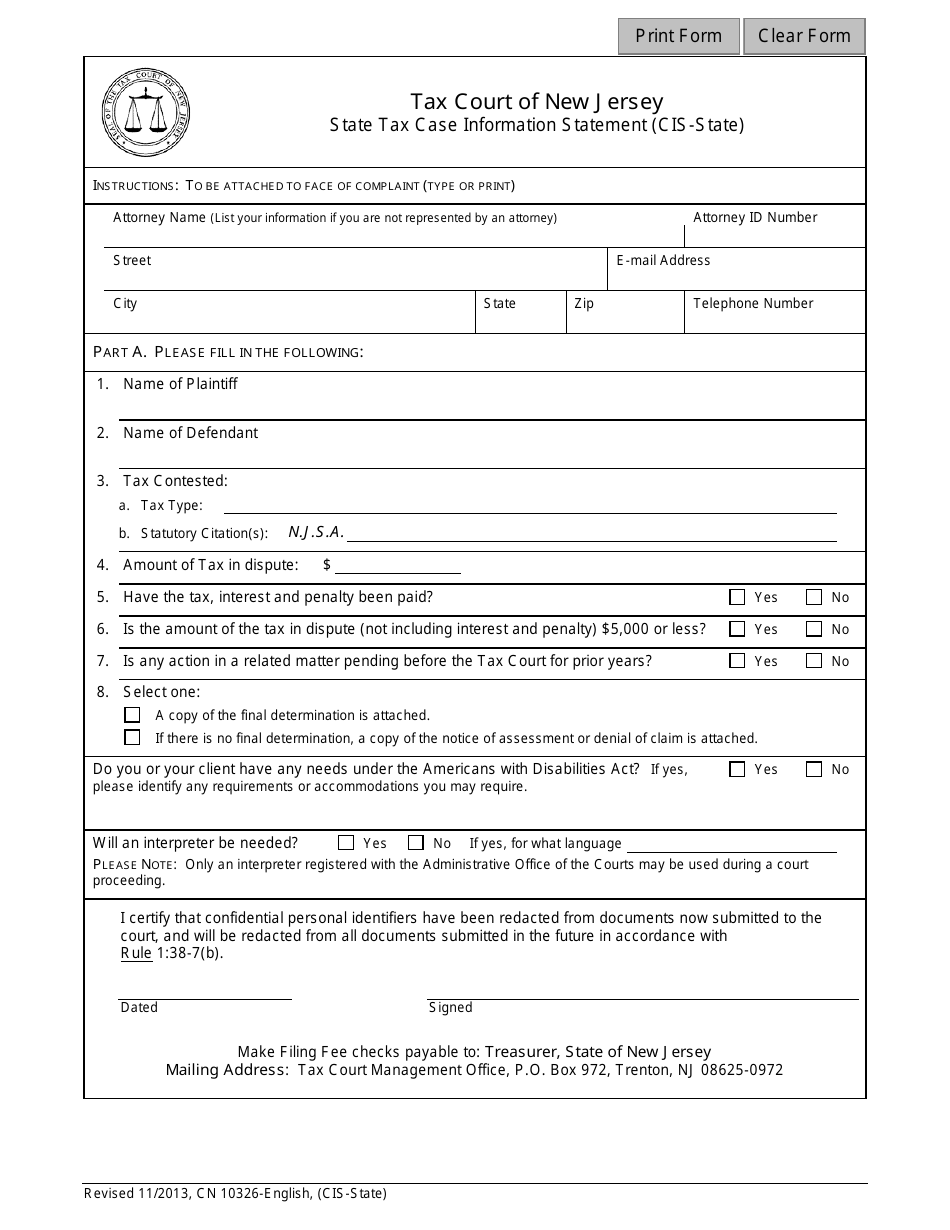

Cis Form Fillable Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1864/18641/1864161/form-cn10326-state-tax-case-information-statement-cis-state-new-jersey_print_big.png

Web Quickly calculate how big your CIS tax rebate is and what expenses you can claim Sometimes you can claim expenses even without receipts use this calculator to see if you qualify Tax year 2023 24 Web 25 mars 2022 nbsp 0183 32 25th Mar 2022 If any of your clients are self employed workers in the construction industry it s well worth brushing up your knowledge around the Construction

Web What is a CIS Tax Refund Form A CIS tax refund is claimed using your Self Assessment tax return form You will have to complete a tax return to be able to reclaim your CIS tax Web 17 janv 2023 nbsp 0183 32 The Process of Claiming Back Deducted CIS Tax A limited company in the UK can claim back CIS Construction Industry Scheme tax that has been deducted from

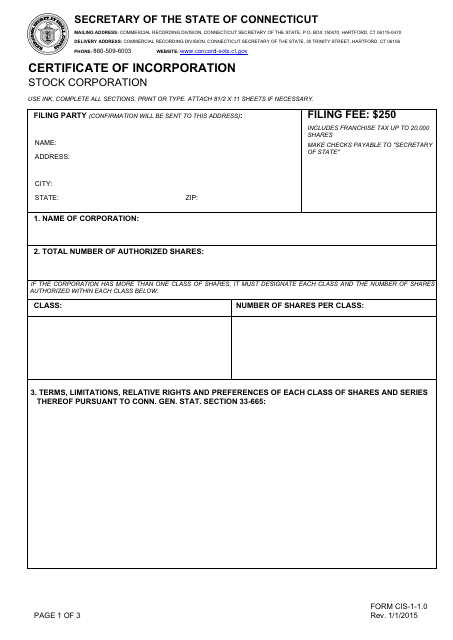

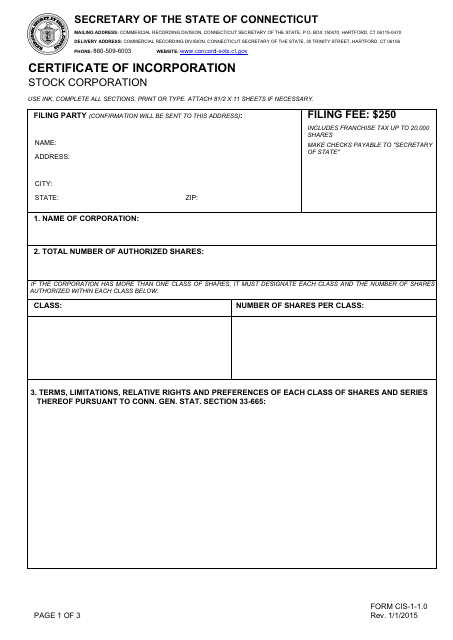

Form CIS 1 1 0 Download Fillable PDF Or Fill Online Certificate Of

https://data.templateroller.com/pdf_docs_html/1782/17828/1782831/form-cis-1-1-0-certificate-incorporation-stock-corporation-connecticut_big.png

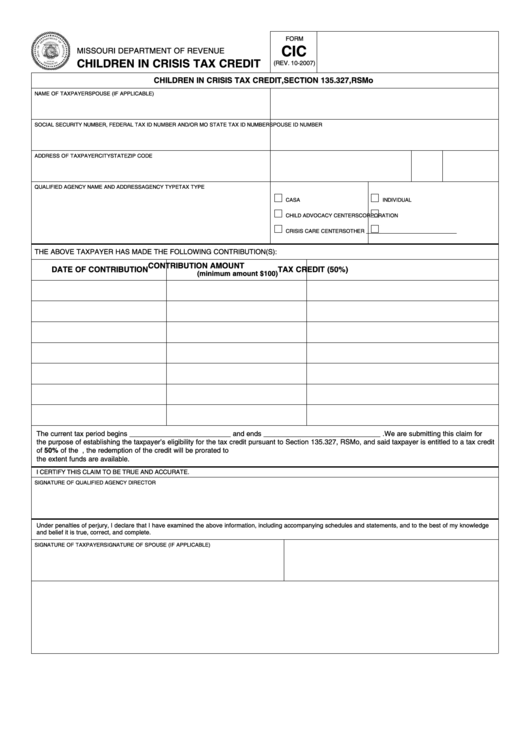

Fillable Form Cic Children In Crisis Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/232/2329/232991/page_1_thumb_big.png

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 Guidance Claim a refund of Construction Industry Scheme deductions if you re a limited company or an agent Get a refund of your Construction Industry Scheme

https://www.litrg.org.uk/tax-guides/tax-basics/how-do-i-claim-tax-back/...

Web 6 avr 2023 nbsp 0183 32 Registered CIS workers receive their payments net of 20 tax If a subcontractor is unregistered they will receive their payment net of 30 tax It is also

How Does The Construction Industry Scheme CIS Work TaxScouts

Form CIS 1 1 0 Download Fillable PDF Or Fill Online Certificate Of

Invoice Templates For Cis Subcontractors Debitoor With Regard To Hmrc

Cis Invoice Template Subcontractor

CIS Help And User Guide Sage 200 Sicon Ltd

CIS Contractor How To File CIS Return Online Accountant s Notes

CIS Contractor How To File CIS Return Online Accountant s Notes

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

CIS Help And User Guide Sage 200 Sicon Ltd

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained

Cis Tax Rebate Form - Web What is a CIS tax refund form A CIS tax refund is claimed using your Self Assessment tax return form You will have to complete a tax return to be able to reclaim your CIS tax