Can You Get Tax Refund From Previous Years The latest date by law you can claim a credit or federal income tax refund for a specific tax year is generally the later of these 2 dates 3 years from the date you filed your federal income tax return or 2 years from the date you paid the tax

If you re due a tax refund for a prior year claim it by filing your tax return for that year You only have three years from the original tax return due date to claim old tax Filing taxes for previous years can help reduce any penalties or interest you may owe if you were required to file taxes in previous years but did not If you are eligible for tax credits in the future and don t owe taxes you

Can You Get Tax Refund From Previous Years

Can You Get Tax Refund From Previous Years

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs

https://i.pinimg.com/736x/25/84/14/258414a9ba63687de99d431af3bce628.jpg

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

In order to find out the status of your refund or tax return for prior year returns you will need to contact the IRS by phone at 1 800 829 1040 However for your current year return you will be able to use the Where s You can use the IRS Where s My Refund tool or call the IRS at 800 829 1954 to check the status of a refund if you previously filed a return as far back as the 2021 tax year To use the tool you ll need to know the tax year of the return your Social Security number filing status and the refund amount

You cannot claim a refund using this tool If you ve already claimed a tax refund check when you can expect a reply This service is also available in Welsh Cymraeg By law they only have a three year window from the original due date normally the April deadline to claim their refunds Some people may choose not to file a tax return because they didn t earn enough money to be required to file Generally they won t receive a penalty if they are owed a refund But they may miss out on receiving a refund

Download Can You Get Tax Refund From Previous Years

More picture related to Can You Get Tax Refund From Previous Years

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

https://www.abccolumbia.com/content/uploads/2020/01/tax_refund_2_.58ad2540b4575.5e306c8f8554a.png

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

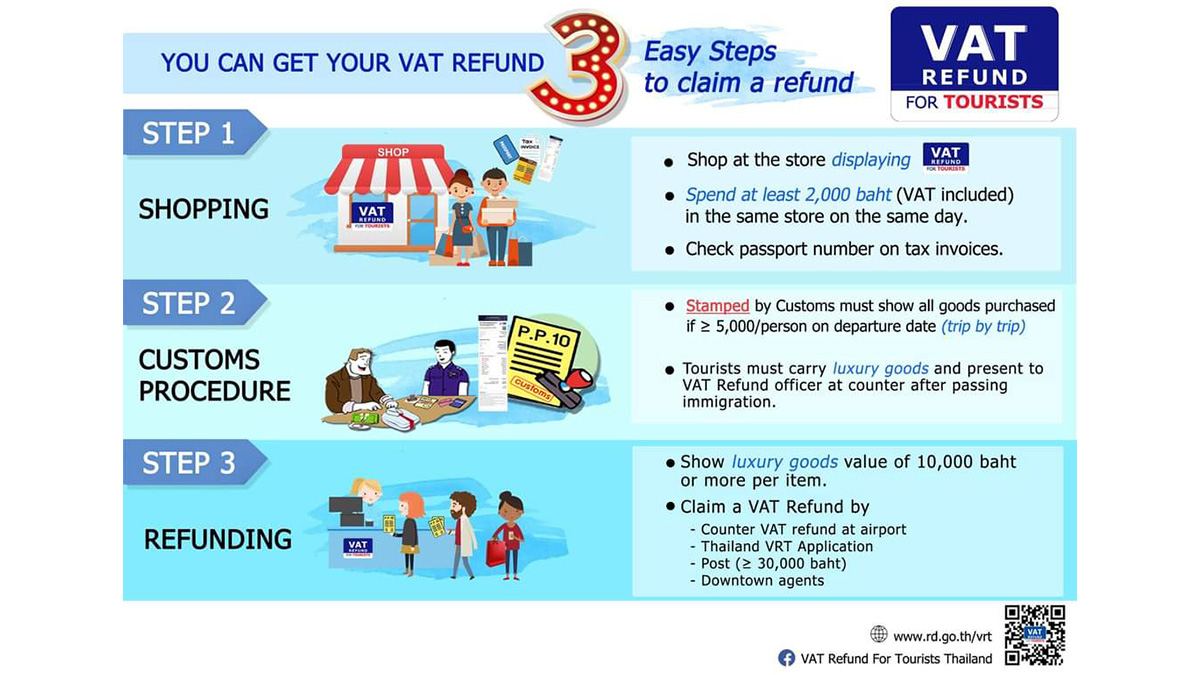

Thailand Offers VAT Refund For Tourists TAT Newsroom

https://www.tatnews.org/wp-content/uploads/2022/12/3-steps-to-claim-VAT-refund.jpg

If your refund exceeds your total balance due on all outstanding tax liabilities including accruals you ll receive a refund of the excess unless you owe certain other past due amounts such as state income tax child support a student loan or other federal nontax obligations which are offset against any refund If you are eligible for a refund there is generally no IRS late filing penalty for filing your return late after the IRS tax due date Let s file your return and get your refund before it expires Use the FREE eFile tax calculator and estimate your tax refund Download and complete prior year tax return forms

You have unfiled or missing tax returns for prior tax years If your election to apply the refund to next year s estimated tax liability was a mistake estimated tax payments aren t needed or required call the IRS toll free at 1 800 829 1040 TTY TDD 1 800 829 4059 for help The answer is yes in most cases But if you didn t meet the filing requirements you don t need to file a prior year s tax return Other reasons you d need to file a previous year tax return Other tax situations might require you to file prior year taxes especially if you owe any special taxes like these

Check IRS Where s My Refund IRS Refund Status 2023

https://nufo.org/wp-content/uploads/2022/04/Where-Is-My-Tax-Refund-1-768x627.png

Your Tax Refund Is The Key To Homeownership

https://files.mykcm.com/2019/03/25075643/20190325-MEM-ENG.jpeg

https://www.irs.gov/filing/time-you-can-claim-a-credit-or-refund

The latest date by law you can claim a credit or federal income tax refund for a specific tax year is generally the later of these 2 dates 3 years from the date you filed your federal income tax return or 2 years from the date you paid the tax

https://www.nerdwallet.com/article/taxes/back-taxes-past-due-returns

If you re due a tax refund for a prior year claim it by filing your tax return for that year You only have three years from the original tax return due date to claim old tax

Here s The No 1 Thing Americans Do With Their Tax Refund GOBankingRates

Check IRS Where s My Refund IRS Refund Status 2023

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Tax Refund Schedule 2023 How Long It Takes To Get Your Tax Refund

TaxFree4U You Get Tax refund From Purchases And Bonus gifts In One

Why Is My Federal Refund Lower Than Last Year The Daily CPA

Why Is My Federal Refund Lower Than Last Year The Daily CPA

Where Is My 2011 State And Federal Refund Using Online Tool

Why Do You Get A Tax Refund YouTube

How To Write A Refund Letter For Overpayment Allardyce Pen

Can You Get Tax Refund From Previous Years - In order to find out the status of your refund or tax return for prior year returns you will need to contact the IRS by phone at 1 800 829 1040 However for your current year return you will be able to use the Where s