Can You Include Hmrc In Iva All debts owed to the HM Revenue and Customs HMRC can be included in an IVA Income tax arrears If you are self employed and have accumulated tax arrears through previous years of trading then your IVA will enable you to wipe the slate clean with the taxman

Are you allowed to put HMRC debt in an IVA If you are struggling with HMRC debt an IVA can help Personal outstanding tax such as self assessment arrears can be included Personal tax debts can be put into the Arrangement in exactly the same way as any other unsecured debts you owe If HMRC debts are only a small part of what you owe you should still be able to include them in an IVA If you owe money for your rent mortgage or secured loans You can t usually include secured loans mortgages or rent in an IVA

Can You Include Hmrc In Iva

Can You Include Hmrc In Iva

https://www.bleepstatic.com/content/hl-images/2020/11/07/hmrc.png

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

Does Hmrc Check Whether Someone Is A Director Who Is My Filipino Vrogue

https://media.thebestof.co.uk/v2/rule/blog_gallery/resource_page/3/59/70/5970c497c6a71175580024a2_1520957248/HMRC-logo-1.png

A person suitable for a protocol consumer IVA is likely to be in receipt of a regular sustainable income for example but not limited to from employment or a regular pension have several Part 11 HMRC HM Revenue Customs HMRC claims HMRC s provisional claim in the arrangement will include any tax credit overpayment

One of the advantages of an IVA compared to a Debt Management Plan is that HMRC debts such as income tax and VAT can be included in the agreement This can make an IVA a very appropriate solution for people who run their own business and have become personally liable for unpaid income tax PAYE or VAT Which Debts You Can Include in an IVA An IVA would cover most of your unsecured debts Debts covered by IVA include Overdrafts Personal loans and catalogue debts Council Tax arrears Hire purchase debts shortfalls Credit and store cards Mortgage shortfalls The money you owe to HMRC e g income tax unless deemed fraudulent

Download Can You Include Hmrc In Iva

More picture related to Can You Include Hmrc In Iva

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled.jpeg

HMRC Exchange Rates East Lancashire Chamber Of Commerce

https://www.chamberelancs.co.uk/wp-content/uploads/2021/07/1200px-HM_Revenue__Customs.svg.png

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/63c193408afaa48faaf4a82a_P60_Document_2023_02.jpg

You can use an IVA to help pay off many common debts including but not exclusively overdrafts personal loans catalogue debts Council Tax arrears hire purchase debts mortgage shortfalls credit and store cards money you owe to HMRC such as Income Tax or National Insurance contributions This guide tells you how an individual voluntary arrangement IVA can be used to deal with your debts Use this guide to find out what an IVA is find out if you may be eligible to apply for an IVA to help you deal with your debts see when we can help you to apply for an IVA understand how an IVA is set up and

An individual voluntary arrangement IVA is an affordable legally binding way to pay off debts Most debts are included in an IVA but not all Any leftover balances are usually written off when the IVA ends There is no limit to how much debt can be included in an IVA Is HMRC debt included in a self employed IVA Can you use credit facilities in a self employed IVA What happens if your vehicle is on finance Do you have to tell your customers that you have an IVA Want help to start an IVA Give us a call 0800 011 4712 or complete the form below to speak to one of our experts

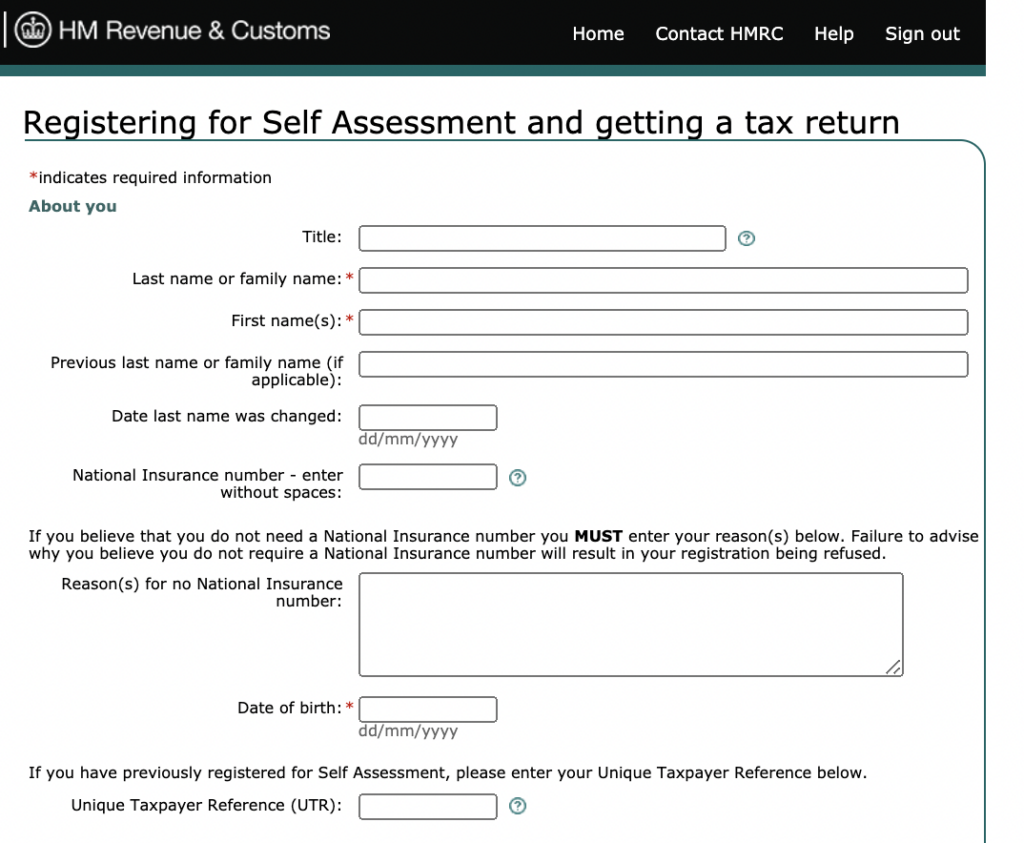

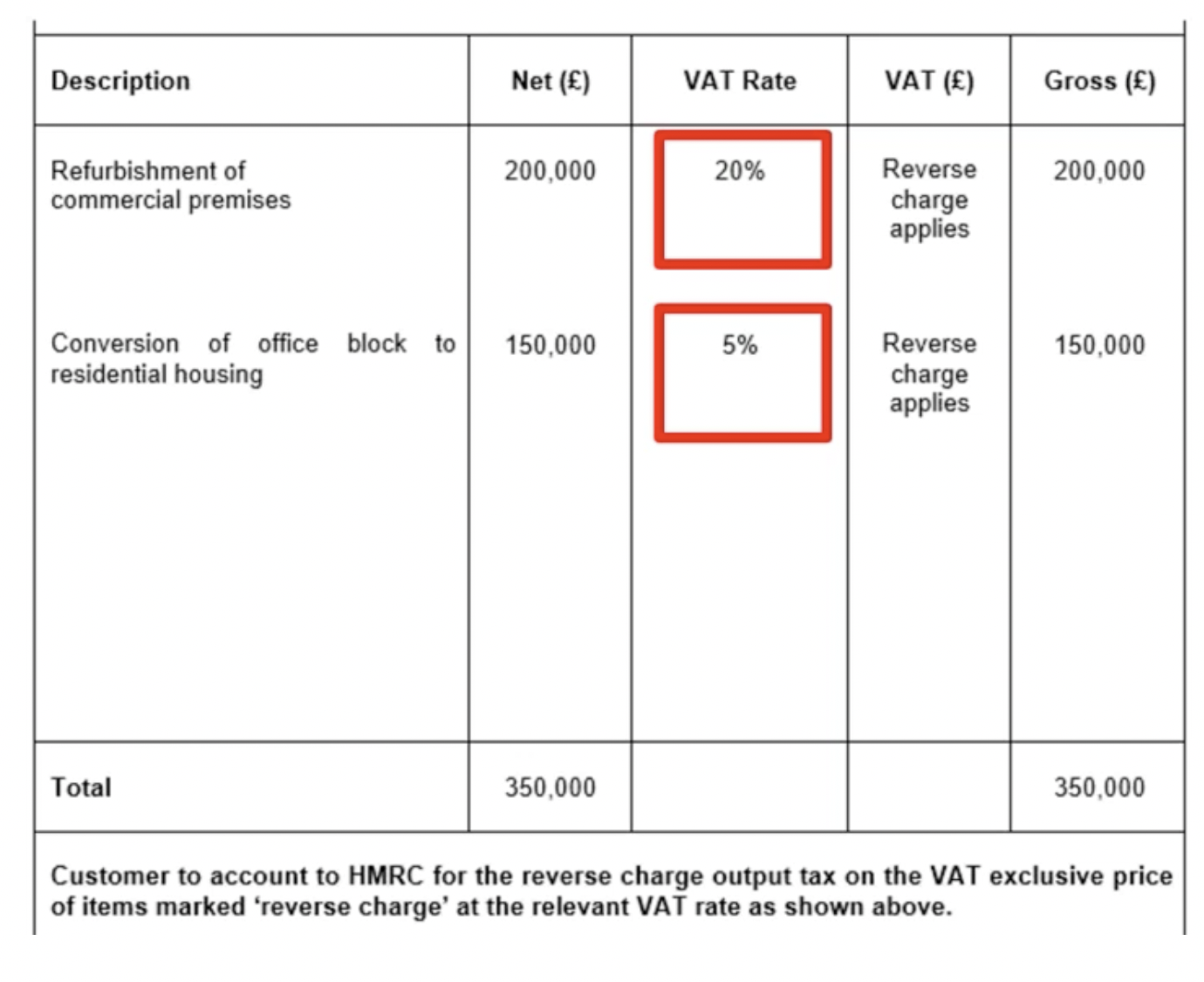

What Is An SA1 Form Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2021/11/sa1-form-hmrc-1024x843.png

HMRC To Sell Taxpayers Financial Data To Private Companies HuffPost UK

http://i.huffpost.com/gen/1748097/images/o-HM-REVENUE-AND-CUSTOMS-facebook.jpg

https://www.iva.org/unpaid-inland-revenue-tax-bill

All debts owed to the HM Revenue and Customs HMRC can be included in an IVA Income tax arrears If you are self employed and have accumulated tax arrears through previous years of trading then your IVA will enable you to wipe the slate clean with the taxman

https://ivainformation.com/articles/hmrc-debt-can-it-go-in-an-iva

Are you allowed to put HMRC debt in an IVA If you are struggling with HMRC debt an IVA can help Personal outstanding tax such as self assessment arrears can be included Personal tax debts can be put into the Arrangement in exactly the same way as any other unsecured debts you owe

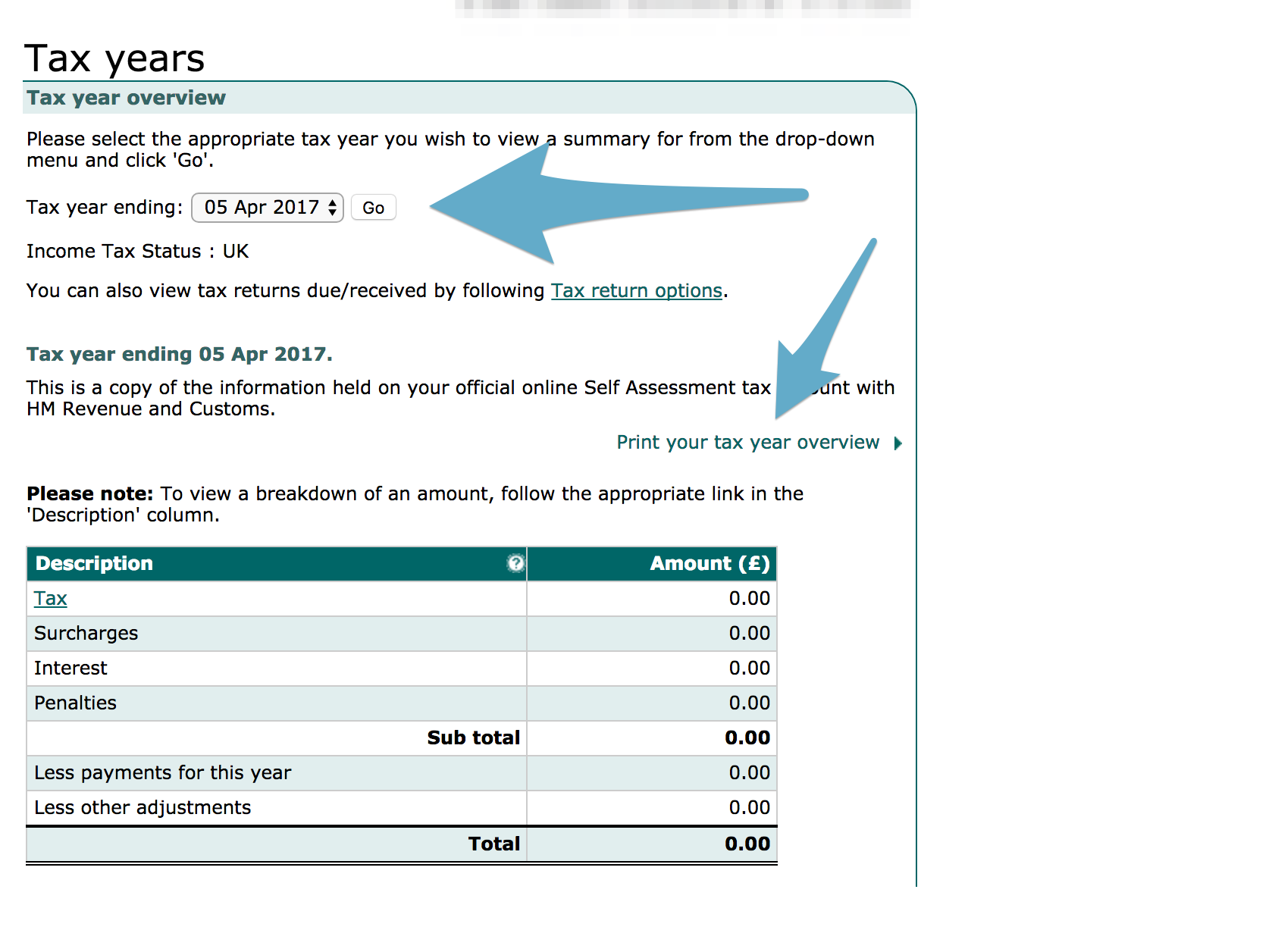

What Does Your Receipt Or Purchase VAT Invoice Need To Contain To Keep

What Is An SA1 Form Goselfemployed co

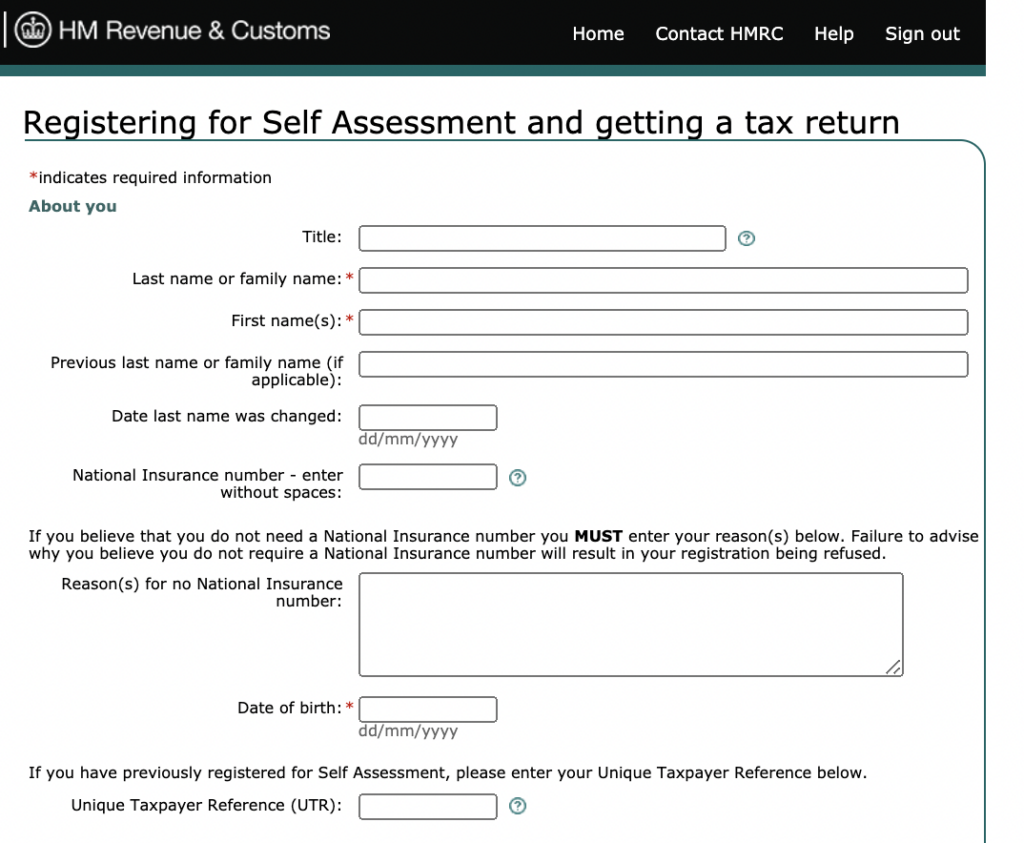

How To Print Your SA302 Or Tax Year Overview From HMRC Love

Cis And Vat Reversal Invoice Template SexiezPicz Web Porn

Non Discrimination Policy Template

2017 Form UK HMRC APSS255 Fill Online Printable Fillable Blank

2017 Form UK HMRC APSS255 Fill Online Printable Fillable Blank

HMRC Mileage Rates UK 2021 2022 Goselfemployed co

Zimra Vat 7 Return Form Atlantacaqwe

Esempio Fattura Reverse Charge Impianti Elettrici Hot Sex Picture

Can You Include Hmrc In Iva - One of the advantages of an IVA compared to a Debt Management Plan is that HMRC debts such as income tax and VAT can be included in the agreement This can make an IVA a very appropriate solution for people who run their own business and have become personally liable for unpaid income tax PAYE or VAT