Can You Use Medical Bills As A Tax Write Off The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement directly or payment

If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there are Fortunately if you have medical bills that aren t fully covered by your insurance you may be able to take a deduction for those to reduce your tax bill

Can You Use Medical Bills As A Tax Write Off

Can You Use Medical Bills As A Tax Write Off

https://nickponte.com/wp-content/uploads/2022/12/Tax-Return-Maui-Sunrise-Photo-2048x1365.jpg

Can I File Bankruptcy On Medical Bills Schmidt Whitten Whitten

https://kmslawoffice.net/wp-content/uploads/2023/05/AdobeStock_118985864.jpg

Is Popular Streaming Content Being Purged For Tax Write Offs Kiplinger

https://cdn.mos.cms.futurecdn.net/i7PsPR3evfUe3o8yMUNF35.jpg

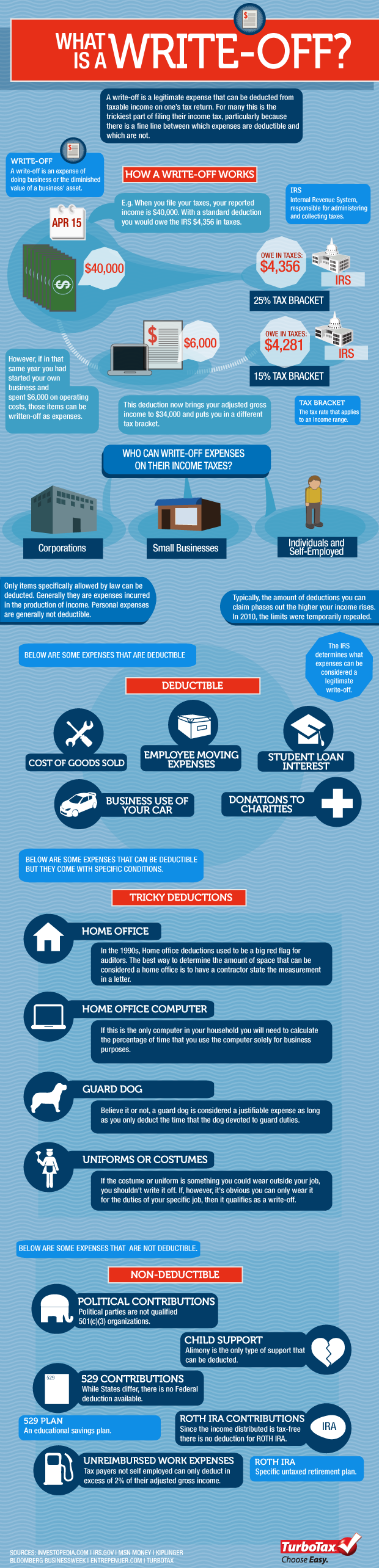

Can You Deduct Medical Expenses From Your Taxes Yes you can claim medical expenses on taxes For tax year 2023 the IRS permits you to deduct the portion Medical Expenses Medical and dental expenses qualify for a tax deduction though you can deduct only the costs that exceed 7 5 of your AGI To claim medical

Most forms of medical spending from insurance premiums to treatment are tax deductible if you meet the IRS requirements To claim this deduction you must take But there s an even better way to deduct your medical costs You can write off out of pocket medical expenses as a business deduction if you own a small business or are

Download Can You Use Medical Bills As A Tax Write Off

More picture related to Can You Use Medical Bills As A Tax Write Off

What s A Tax Write Off YouTube

https://i.ytimg.com/vi/gOrXmwYPmZ4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgWShHMA8=&rs=AOn4CLCZtlyvxa_o0hiYbwuStIXSPFY-fA

What Is A Tax Write Off Definition And Examples BooksTime

https://www.bookstime.com/wp-content/uploads/2022/07/what-is-a-tax-write-off-definition-and-examples-scaled-1.webp

What Is A Tax Write Off

https://www.deskera.com/blog/content/images/size/w2000/2023/01/2-4.png

You can deduct medical expenses that exceed 7 5 of your income Learn more about the medical expense deduction and how to save money at tax time Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply

You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings If you re new to filing taxes as a 1099 worker you have a lot of options when it comes to saving on health insurance and medical expenses The primary ways of

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Are Your Invention Expenses A Tax Write Off Should You Incorporate

https://i.ytimg.com/vi/3oouQK_PePU/maxresdefault.jpg

https://www.irs.gov/taxtopics/tc502

The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement directly or payment

https://www.forbes.com/advisor/taxes/claim-medical-expenses-on-taxes

If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there are

Need A Tax Write Off Donate To These Awesome Idaho Nonprofits

The Deductions You Can Claim Hra Tax Vrogue

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)

What Are Tax Write Offs

A Medical Bill You Can Actually Understand MetroHealth Part Of Federal

.png)

Did You Miss Any Of These Small Business Tax Deductions

.png)

Did You Miss Any Of These Small Business Tax Deductions

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Can You Write Off Pet Medical Bills Leia Aqui What Pet Expenses Are

Hairstylist Tax Write Offs Checklist For 2024 Zolmi

Can You Use Medical Bills As A Tax Write Off - If you choose to itemize deductions on your personal return you can write off qualified unreimbursed medical expenses on Schedule A of the Form 1040 tax form