Can You Write Off A Vehicle Over 6000 Pounds In Canada Is it same in Canada to write off full vehicle if it s over 6000lbs Taxes In the USA they are allowed to write off up to I believe 65k on a vehicle if it s a work vehicle and is over

Can I get a tax write off for vehicle over 6 000 lbs Yes you can get a tax write off for a vehicle over 6 000 lbs if you use it for business purposes The tax write off News release December 23 2021 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax

Can You Write Off A Vehicle Over 6000 Pounds In Canada

Can You Write Off A Vehicle Over 6000 Pounds In Canada

https://mindthetax.com/wp-content/uploads/2022/03/vehicle-write-off-for-business-scaled.jpg

How To Get 100 Auto Tax Deduction Over 6000 Lb GVWR IRS Vehicle

https://i.ytimg.com/vi/Ce-xd007kkc/maxresdefault.jpg

What You Need To Know In 2019 To Write Off 6 000 Pound GVWR Vehicles

http://static1.squarespace.com/static/58d31e84d2b857698e85d3a9/5925f97a725e25c61b4b9f38/5df93ffec5bb6c13c5fbf94e/1576616742795/InkedIMG_9936_LI.jpg?format=1500w

101 rowsEligible vehicles for the Section 179 tax write off include Heavy SUVs pickups and vans over 6 000 lbs GVWR more than 50 business use Obvious In addition to having a higher depreciation limit which reflects the generally higher cost for these vehicles zero emission passenger vehicles purchased after

Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business AND you buy it brand new from the dealer no private party used vehicle It has to be December 19 2023 5 min read Claiming Vehicle Expenses from the CRA as Self Employed In this article General rules for self employed mileage deductions in

Download Can You Write Off A Vehicle Over 6000 Pounds In Canada

More picture related to Can You Write Off A Vehicle Over 6000 Pounds In Canada

How To Write Off Your Vehicle Exclusively For Your Business Tax

https://i.ytimg.com/vi/2X-rwh1xFmM/maxresdefault.jpg

2018 Tax Deductions For 6 000 LB GVWR Vehicles

http://static1.squarespace.com/static/58d31e84d2b857698e85d3a9/5925f97a725e25c61b4b9f38/5c2519ef575d1fcf2a45ea26/1576612868310/em-2017-tahoe-specialedition-07.jpg?format=1500w

Should You Claim Tax Deductions For Company s Vehicle Wraps Wraps

https://www.wrapsdirect.com/wp-content/uploads/2023/04/IMG_5900-scaled.jpeg

You may qualify to deduct some of your vehicle related expenses if you use your car for business purposes The IRS defines a car as any four wheeled vehicle including a truck or van intended for use Guidelines Concerning Vehicles That Weight More Than 6 000lbs Since a vehicle that weighs over 6 000 pounds can certainly be considered a business asset it

How do I write off a 6 000 pound car If your vehicle still weighs less than 14 000 pounds you could receive a maximum first year deduction of up to 27 000 for Do Vehicles Under 6000 lbs Qualify Conclusion List of New Qualifying Vehicles in 2023 Can You Fully Write Off a 6000 Pound Car The prospect of a full

How To Write Off Credit Card Fees Individual Vs Business Tax

https://www.mycreditcardclub.com/wp-content/uploads/2022/06/How-to-Write-Off-Credit-Card-Fees-Individual-vs.-Business-Tax-Deductions-1536x1428.png

11 Cars That Weigh Around 6000 Lbs Pounds Weight Of Stuff

https://weightofstuff.com/wp-content/uploads/2021/05/Mercedes-Benz-G500-Cabriolet-6000-lbs.jpg

https://www.reddit.com/r/PersonalFinanceCanada/...

Is it same in Canada to write off full vehicle if it s over 6000lbs Taxes In the USA they are allowed to write off up to I believe 65k on a vehicle if it s a work vehicle and is over

https://www.taxfyle.com/blog/list-of-vehicles-over-6000-lbs

Can I get a tax write off for vehicle over 6 000 lbs Yes you can get a tax write off for a vehicle over 6 000 lbs if you use it for business purposes The tax write off

Which Suvs Weigh Over 6000 Pounds Sporty Logbook Photo Gallery

How To Write Off Credit Card Fees Individual Vs Business Tax

Part 2 Vehicle 100 Tax Deduction Auto Depreciation SUV Truck

9 Vehicles That Weigh Over 6000 Pounds Measuring Stuff

9 Vehicles That Weigh Over 6000 Pounds Measuring Stuff

Which Suvs Weigh Over 6000 Pounds Sporty Logbook Photo Gallery

Which Suvs Weigh Over 6000 Pounds Sporty Logbook Photo Gallery

Vehicles Over 6 000 Pounds US Can I Get A Tax Deduction 2024

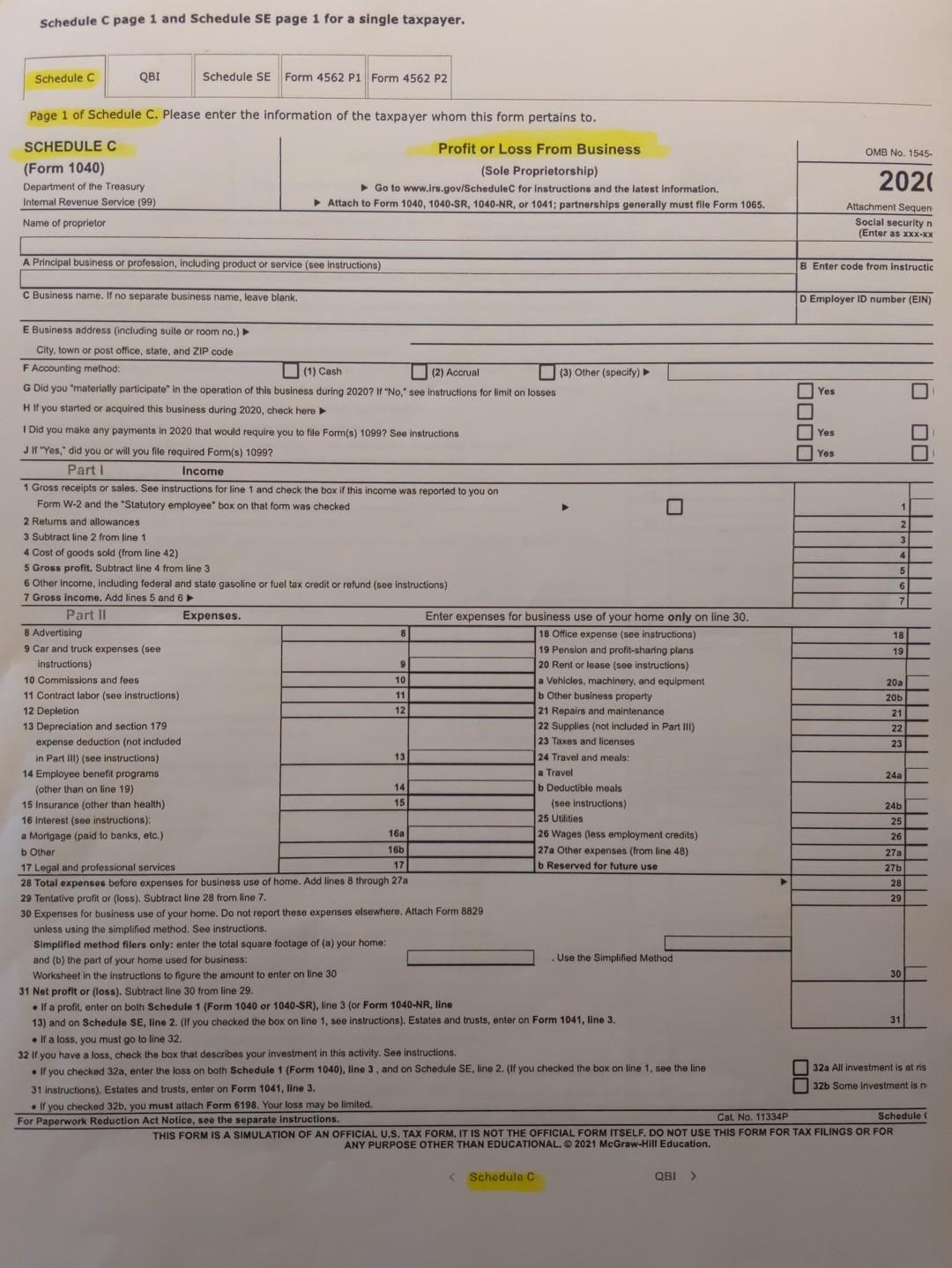

Solved Cassi SSN 412 34 5670 Has A Cash basis Home Chegg

6000 Pound Vehicle List Special IRS Depreciation Tax Benefit

Can You Write Off A Vehicle Over 6000 Pounds In Canada - In addition to having a higher depreciation limit which reflects the generally higher cost for these vehicles zero emission passenger vehicles purchased after