Can You Write Off Hot Water Heater On Taxes Heat Pump Water Heaters Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits For the tax years 2017 through 2019 you can claim 30 percent of the cost of your solar water heater system which includes the cost of installation For the tax year 2020 the credit drops to 26 percent and for the tax

Can You Write Off Hot Water Heater On Taxes

Can You Write Off Hot Water Heater On Taxes

https://www.thinhairgrowth.com/wp-content/uploads/2015/03/closetabs.jpg

What Can You Write Off On Your Taxes SoundOracle Sound Kits

https://cdn.shopify.com/s/files/1/1042/7832/t/95/assets/tax-write-offs-1641387329585.jpg?v=1641387334

Turn Off Hot Water Heater To Save Money Help The Environment

https://sweethomeadvisor.com/wp-content/uploads/2021/11/Turn-Off-Your-Hot-Water-Heater-to-Save-Money-1-768x432.png

You can elect to deduct state and local general sales taxes instead of state and local income taxes as an itemized deduction on Schedule A Form 1040 If you make that choice you cannot include those sales taxes as part of your cost basis Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar panel systems or other qualifying renewable energy sources

These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work General overview of the Energy Efficient Home Improvement Credit How much of a credit can I claim on my tax return for a new solar hot water heater You could be eligible for an energy efficient home improvement tax credit on as much as 30 of the cost including installation with no upper limit

Download Can You Write Off Hot Water Heater On Taxes

More picture related to Can You Write Off Hot Water Heater On Taxes

Should I Turn Off Water Heater If Water Is Off Electric Gas SMD

https://sustainabilitymattersdaily.com/wp-content/uploads/2020/02/water-heater-off-pin-683x1024.jpg

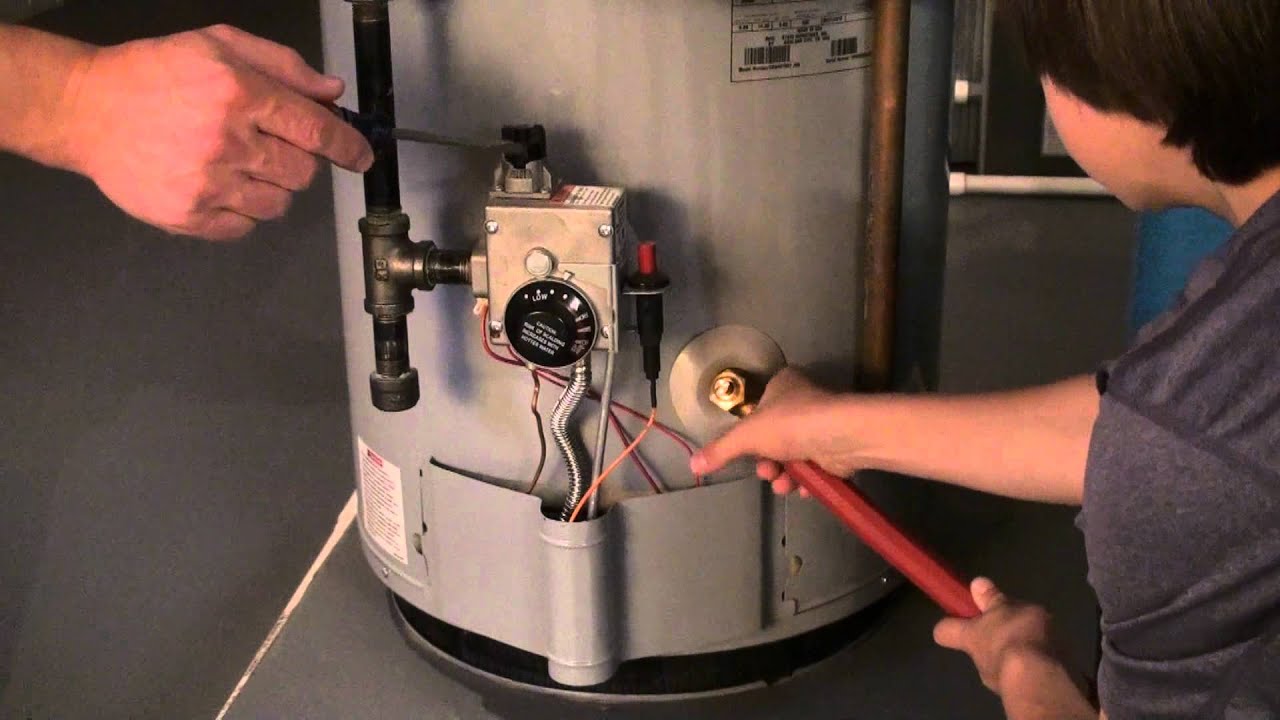

Easy Water Heater Shutdown Video By DRF Trusted Property Solutions

https://i.ytimg.com/vi/WESbtmygsOs/maxresdefault.jpg

Hot Water Heater Not Working 2001 Jayco Eagle 232U Where Do I Check

https://f01.justanswer.com/si13KK8b/b6a5f417-06be-402e-a3e6-6354676c66a1.jpeg

When you file your taxes there will be a section that asks you about any upgrades you made to your home Form 5695 Residential Energy Credits or business Form 3468 Investment Credit There you will be able to enter the details for your new water heater or boiler and submit a copy of the receipt The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022

According to the IRS expenses that may result in a betterment to your property include expenses for fixing a pre existing defect or condition enlarging or expanding your property or increasing the capacity strength or quality of your property are considered expenses that must be capitalized There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to newer more efficient models

The 9 Best Aqua Hot Rv Water Heater Home Creation

https://images-na.ssl-images-amazon.com/images/I/71PCd%2Bz1n5L._AC_SL1500_.jpg

Whirlpool Energy Smart Hot Water Heater Problems AdinaPorter

https://www.adinaporter.com/wp-content/uploads/2019/02/whirlpool-energy-smart-hot-water-heater-problems-how-to-troubleshoot-electric-hot-water-heater-problems-of-whirlpool-energy-smart-hot-water-heater-problems.jpg

https://www.energystar.gov/.../heat-pump-water-heaters

Heat Pump Water Heaters Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits

Comparing Centralized Decentralized Water Heating Systems Plumber

The 9 Best Aqua Hot Rv Water Heater Home Creation

Gas Water Heater With Gas Shut Off Valve Inspection Gallery InterNACHI

Should You Turn Off Hot Water Heater On Vacation An In Depth

GE 60 Gal 12 Year 50 000 BTU Natural Gas Water Heater The Home Depot

New Hot Water Heater From Rheem Reduces Energy Use By 73 Builder

New Hot Water Heater From Rheem Reduces Energy Use By 73 Builder

How To Turn Off Hot Water Heater If Leaking

110 220V 3 8KW Electric Tankless Instant Hot Water Heater For Bathroom

Tankless Water Heater Hot Tub Benefits And Considerations Home

Can You Write Off Hot Water Heater On Taxes - If you re replacing an existing appliance with a new one that s disposing of one capital asset and putting in service another You depreciate the new one and you dispose of the old one if not fully depreciated talk to your tax adviser how to handle the remaining value