Can You Write Off Rent On Taxes Rent is generally not tax deductible for most people but if you re self employed you can deduct rent as a business expense The home office deduction allows you to write off a portion of your rent if

Learn why you cannot deduct rent payments on your tax return and when you may be able to deduct a portion of the rent for your business use Find out the requirements and Landlords can deduct most ordinary and necessary expenses related to the renting of residential property This includes rental property tax deductions for use of a car cleaning costs mortgage

Can You Write Off Rent On Taxes

Can You Write Off Rent On Taxes

http://blog.turbotax.intuit.com/wp-content/uploads/2010/12/writeoff.png

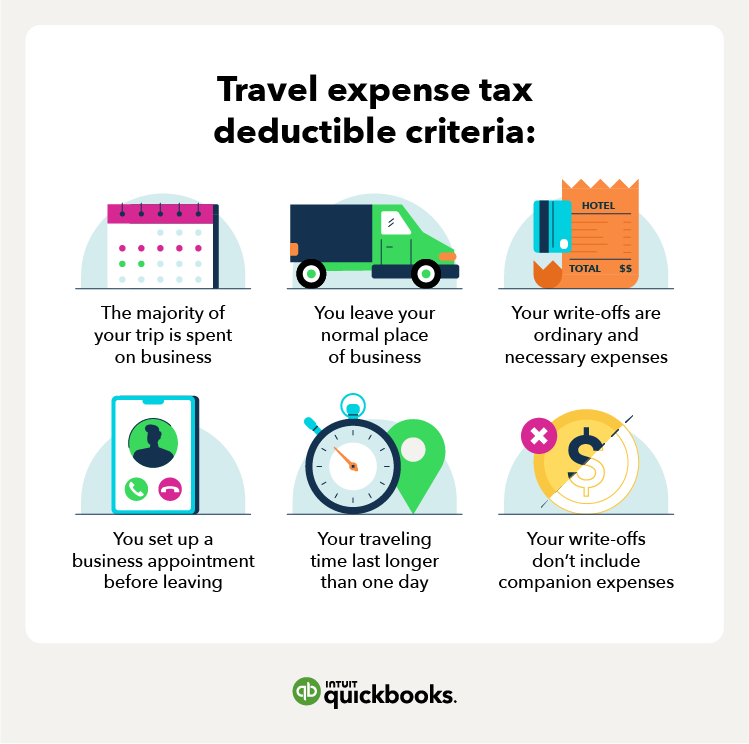

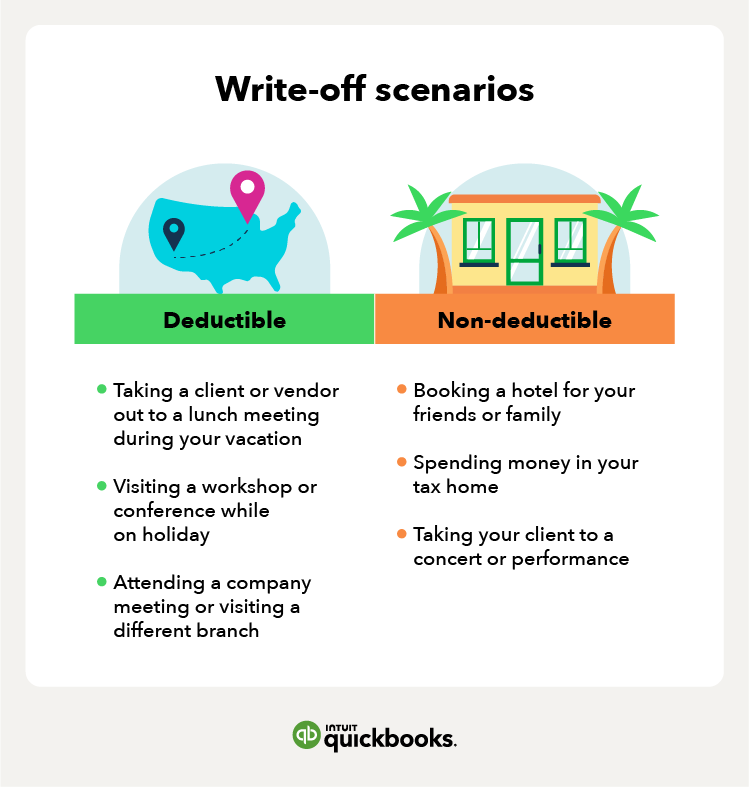

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/tax-deduction-criteria.png

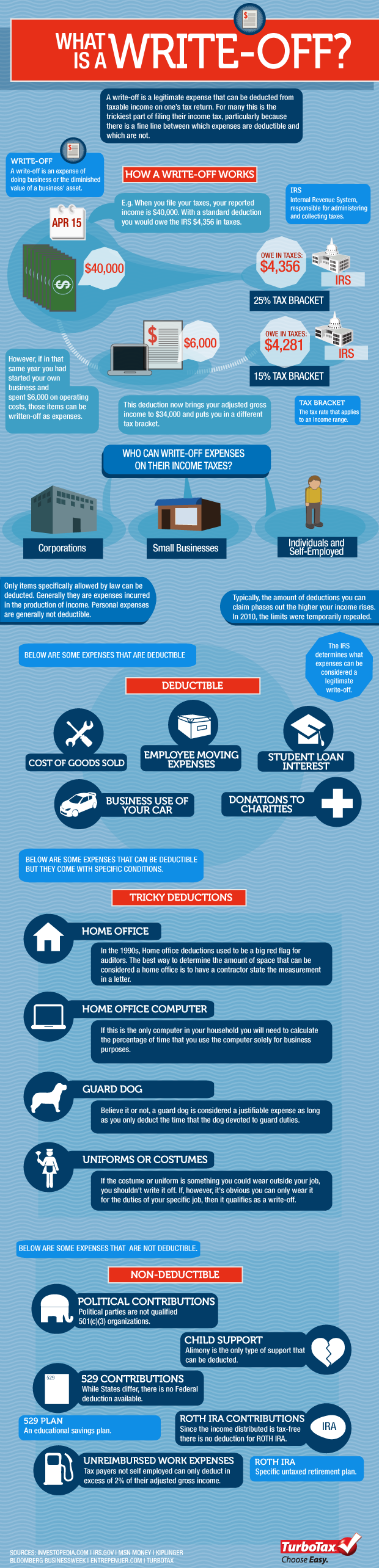

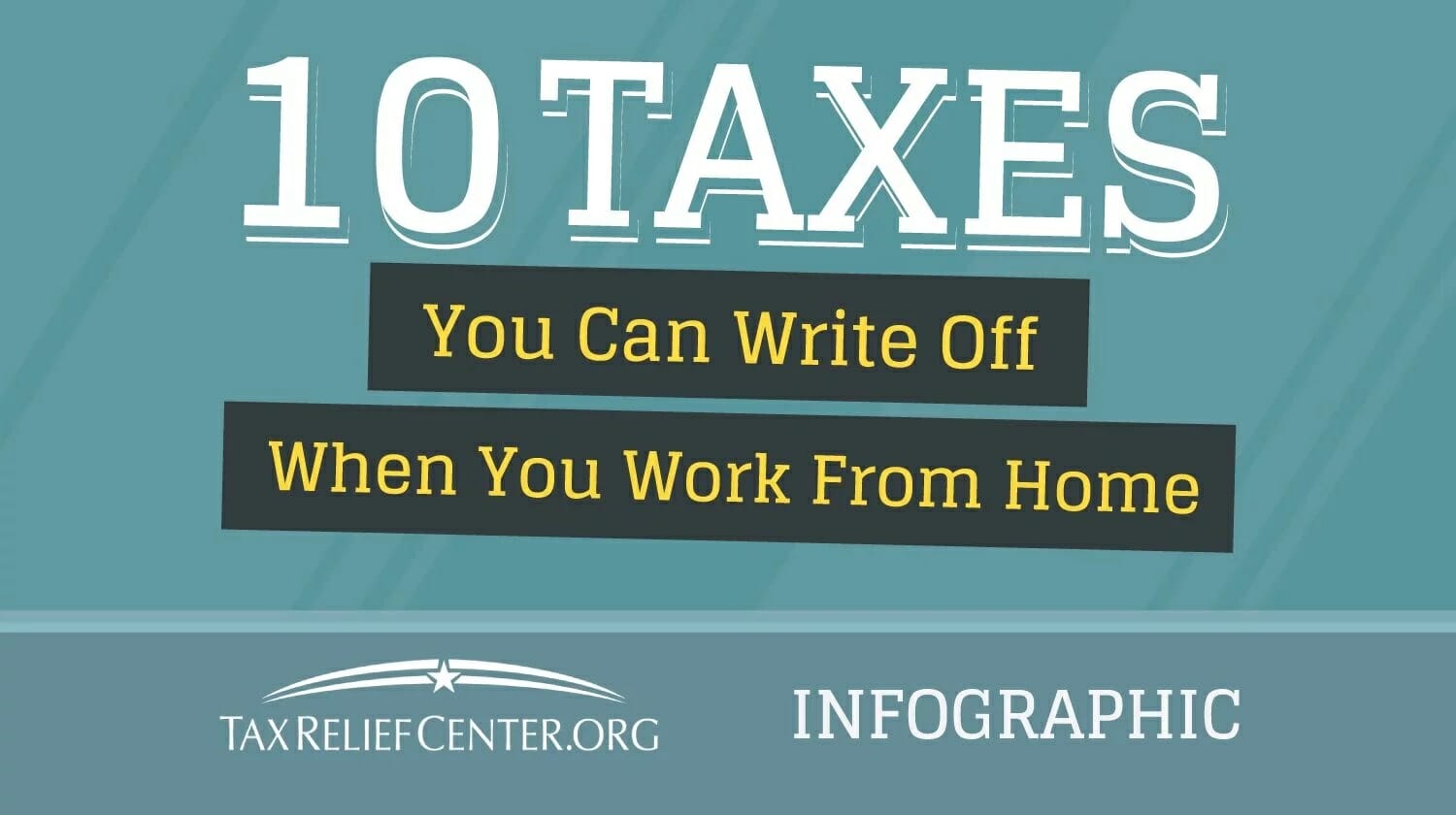

What Can You Write Off On Your Taxes INFOGRAPHIC Tax Relief Center

https://help.taxreliefcenter.org/wp-content/uploads/2018/01/Feature-Image-TRC-5-Things-You-Can-Write-Off-From-Your-Taxes.jpg

Rent itself can t be deducted from your taxable income but there are other tax breaks you can claim to lower your liability when you don t own a home See if you qualify Learn how to deduct rental expenses as a business expense when the rent is for property used for the business Find out the rules for lease or purchase

Can I claim rent as a deduction on taxes According to Adams you cannot claim rent as a deduction if the rent is for a place serving as your primary residence You can deduct the rent you pay for property that you use for rental purposes If you buy a leasehold for rental purposes you can deduct an equal part of the cost each year over the term of the lease

Download Can You Write Off Rent On Taxes

More picture related to Can You Write Off Rent On Taxes

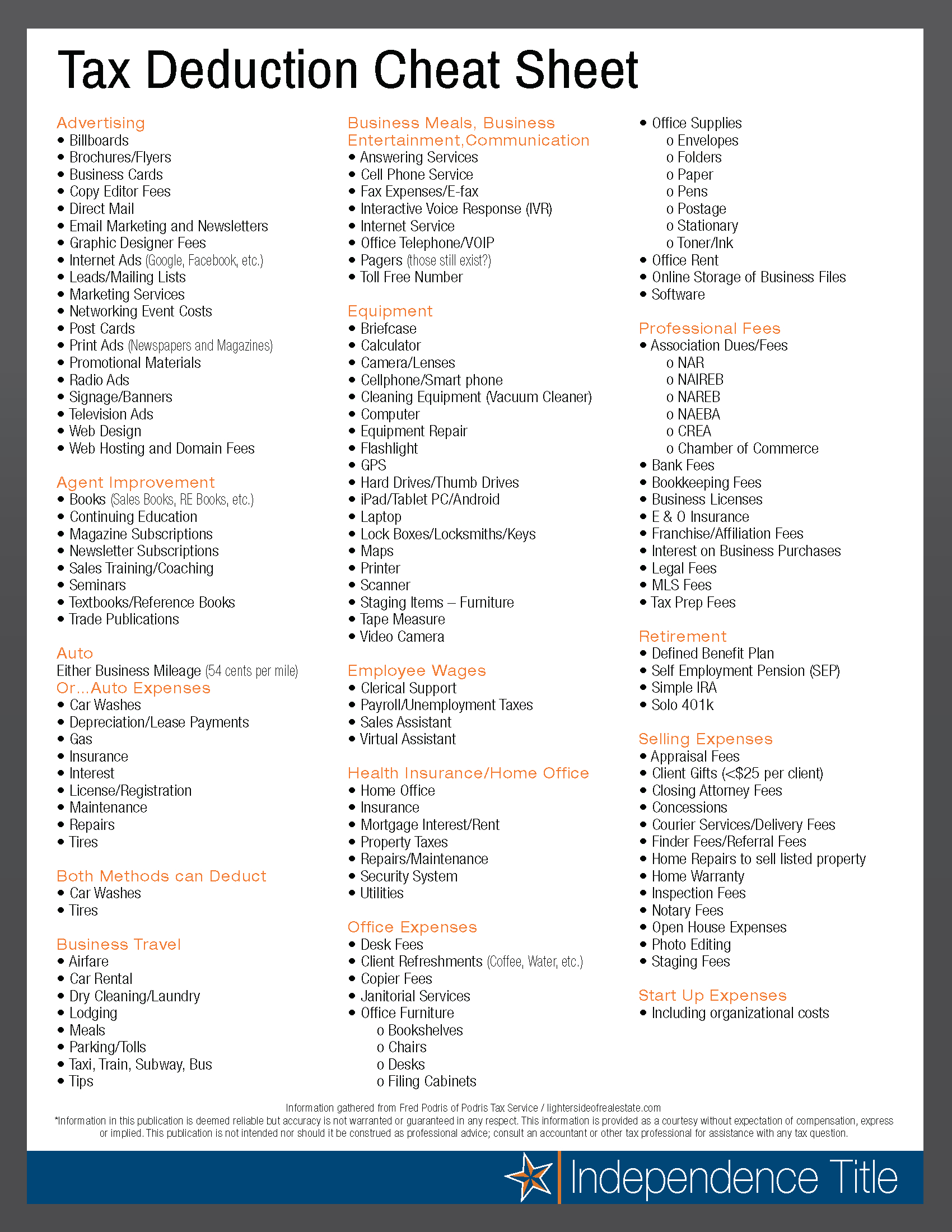

Tax Deductions Artofit

https://i.pinimg.com/originals/cf/49/dd/cf49dd5c5ecb1e55b3c98f8cd9ff1acb.png

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-1.png

What Can You Write Off On Your Taxes INFOGRAPHIC Tax Relief Center

https://i.pinimg.com/736x/6e/f1/74/6ef174dc57f9ba0101d63af337acbd3b.jpg

Tax deductions for rental property Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say Learn about contributions you can write off on your taxes and about the difference between the standard deduction and itemized deductions

Whether you are self employed or operate a business it is possible to write off rent as a business expense if you meet certain eligibility requirements and follow the correct You can only claim a depreciation deduction for residential rental property if you own the property you use the property to produce income i e rental income

A Woman Working On Her Laptop With The Title How To Write Off Taxes For

https://i.pinimg.com/736x/44/de/5d/44de5d6dbbba4266df9717f02a9664c6.jpg

Can You Claim Rent On Your Taxes In Bc Defiancedesigns

https://lh6.googleusercontent.com/proxy/NSzRFEH79eRzI7SxTgaR1rFl8M5S2Ar5cSjxM_mMEU4HgL0unHdKh-jrxmTao-fClu_8ln5XFZ4Fvz2muJAoy5aKv_xBObDGZDOHqh4=w1200-h630-p-k-no-nu

https://www.keepertax.com/posts/rent-a…

Rent is generally not tax deductible for most people but if you re self employed you can deduct rent as a business expense The home office deduction allows you to write off a portion of your rent if

https://www.hrblock.com/.../deducting-rent-on-taxes

Learn why you cannot deduct rent payments on your tax return and when you may be able to deduct a portion of the rent for your business use Find out the requirements and

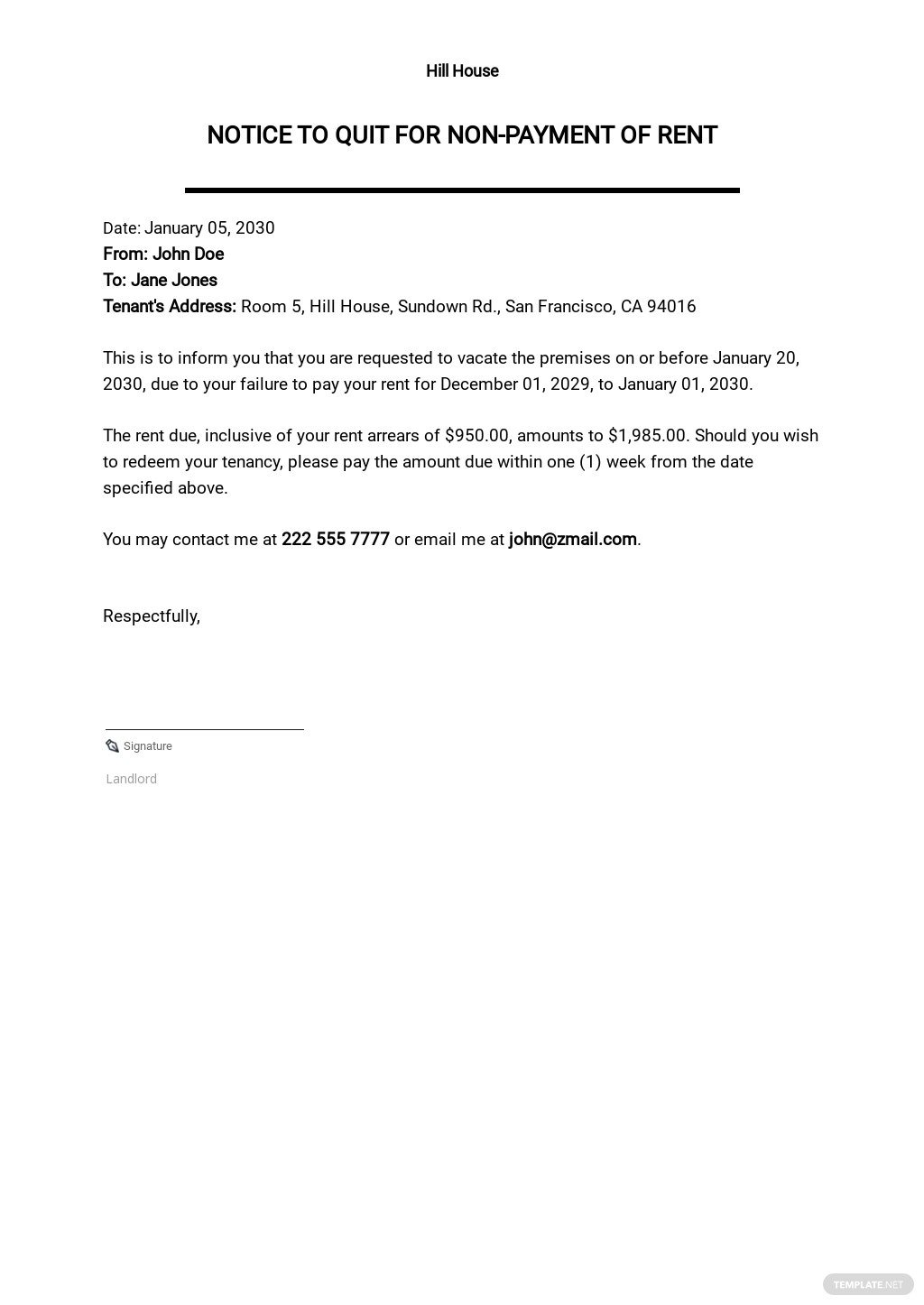

50 Notice Samples Format Examples 2023

A Woman Working On Her Laptop With The Title How To Write Off Taxes For

Rent Receipt Template

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

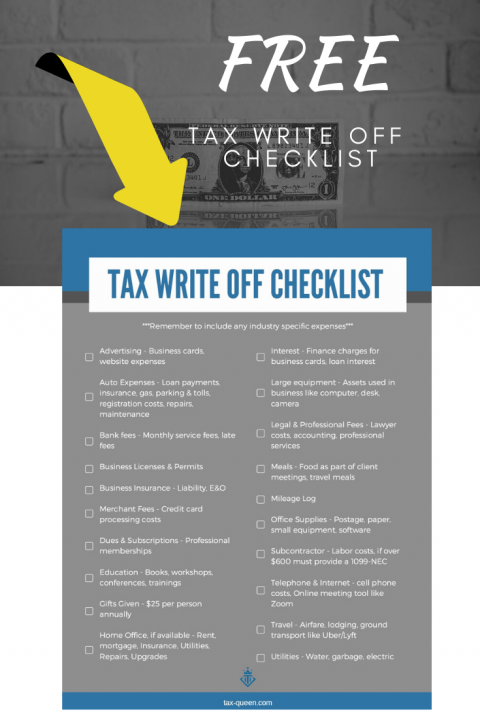

Small Business Tax Write Off Checklist Tax Queen

CPA Answers Can You Write Off Rent YouTube

CPA Answers Can You Write Off Rent YouTube

Can I Write Off Rent As A Business Expense Shared Economy Tax

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

Payment Request Template

Can You Write Off Rent On Taxes - You can deduct the rent you pay for property that you use for rental purposes If you buy a leasehold for rental purposes you can deduct an equal part of the cost each year over the term of the lease