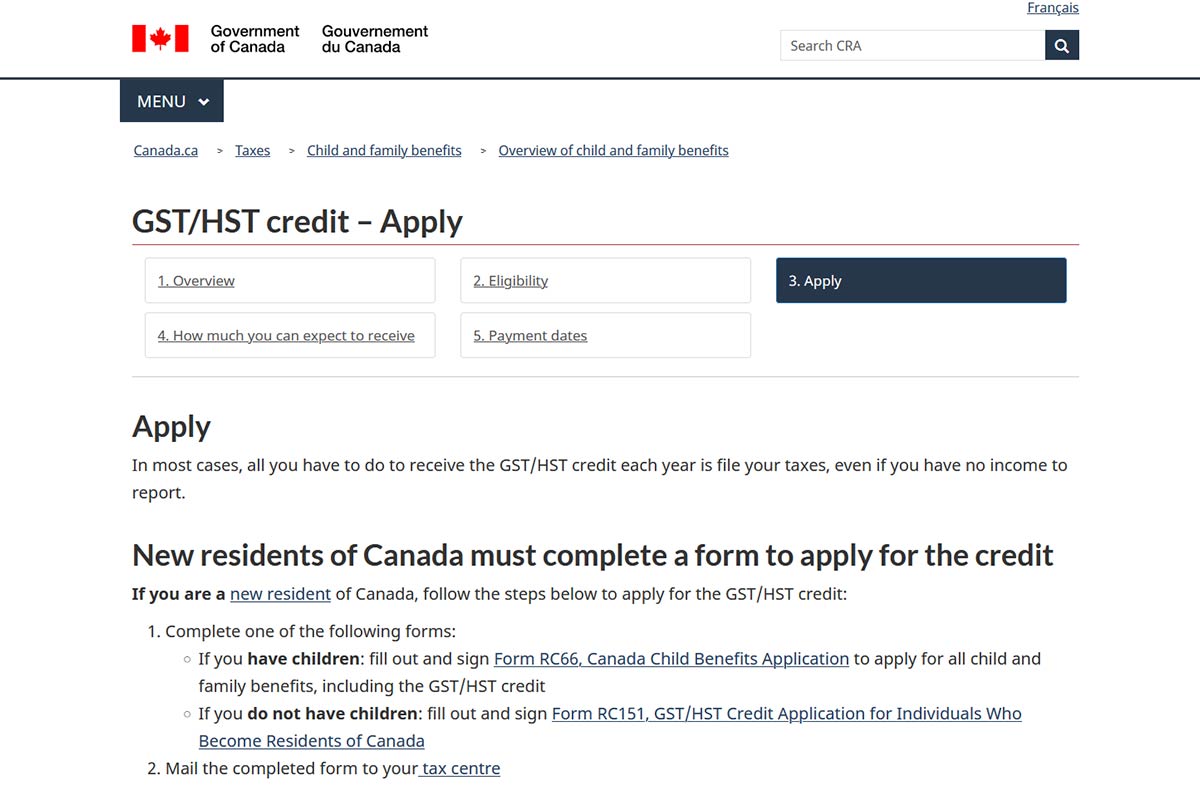

Canada Gst Credit Amount Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates The goods and services tax harmonized sales tax GST HST credit is a tax free

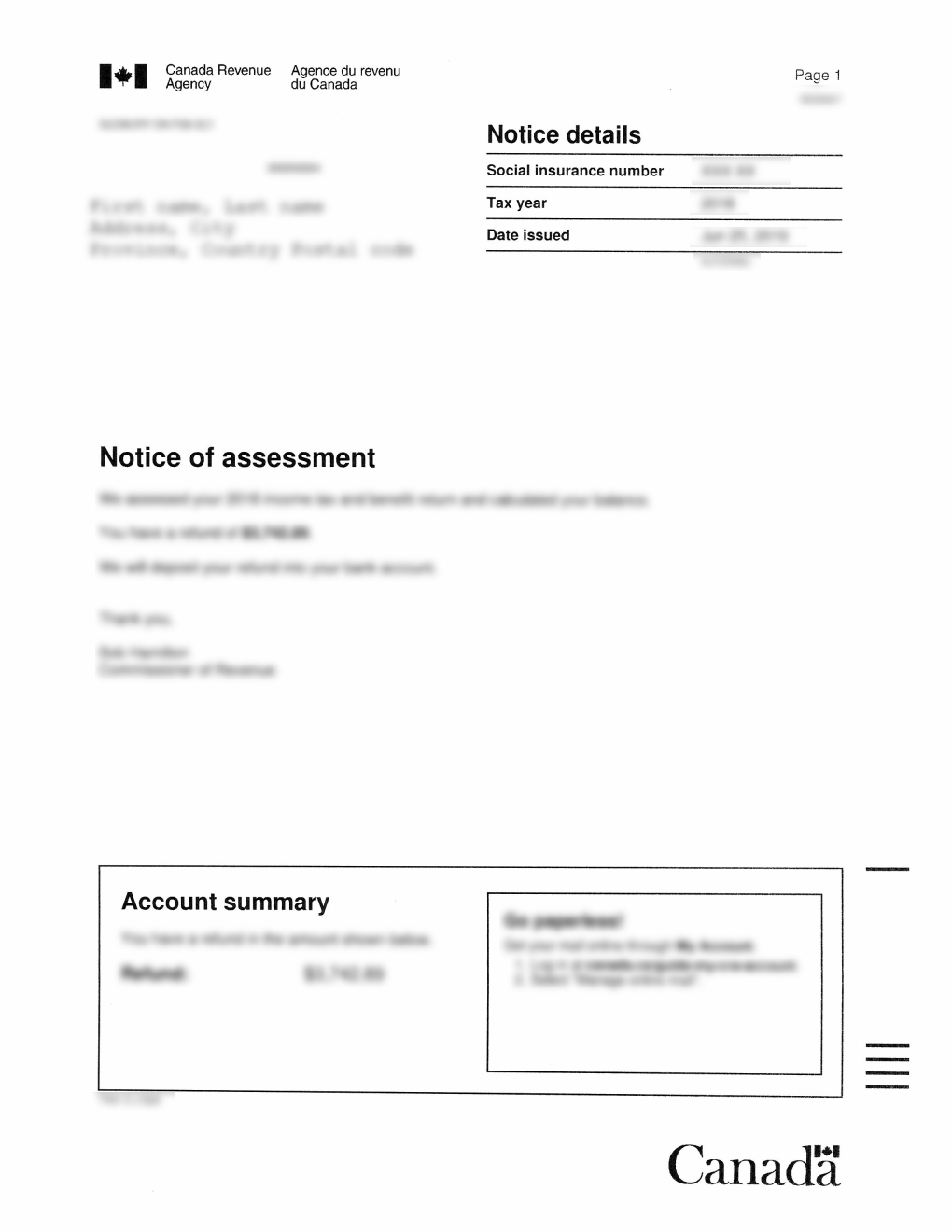

If the CRA determines that you are eligible for the GST HST credit based on your 2022 tax return and that you will receive payments you will receive a GST HST credit notice in This one time GST credit payment will be double the amount of the GST credit you would receive over a six month period The amount is calculated based on your family

Canada Gst Credit Amount

Canada Gst Credit Amount

https://images.dailyhive.com/20221019110130/Untitled-design-2022-10-19T140122.379.jpg

GST Calculator Tax Calculator

https://www.finology.in/Calculators/images/CalculatorImage/gst-calculator.png

Canada GST HST Credit Payment Dates 2024 Credit Amount

https://caknowledge.com/wp-content/uploads/2024/01/canada-gst-hst-credit-payment-dates.jpg

Calculation sheet for the additional one time GST credit payment November 4 2022 calculation sheet for the July 2022 to June 2023 payments 2021 News Canada Explainer Eligible Canadians will receive the GST HST credit today Here s how much you can expect The quarterly non taxable payment is meant

Goods and services tax harmonized sales tax GST HST credit payment amounts base year 2019 2022 base year July 2023 June 2024 Credit for eligible adult Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates You are generally eligible for the GST HST credit if you are At least 19 years old If you

Download Canada Gst Credit Amount

More picture related to Canada Gst Credit Amount

Our Canada Dream Diary GST HST Credit

https://2.bp.blogspot.com/-DlhmidEYDUY/WEphCMZUbcI/AAAAAAAAA0s/9OXVOKk9Vlo3QJNfKuw-ejSsTOvfruI5QCLcB/w1200-h630-p-k-no-nu/IMG_2623.JPG

Canada GST HST Credit Dates 2024 Eligibility Criteria Benefits

http://www.sarkariexam.com/wp-content/uploads/2024/01/CanadaGST_HSTCreditDates2024EligibilityCriteriaBenefitsAmountStatusHowToOnlineApply_.jpg

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

https://www.insurdinary.ca/wp-content/uploads/2021/11/gst-hst-credit-application.jpg

The maximum that can be received is reduced by 5 of net income in excess of the phase out threshold of 42 335 44 325 for Jul 2024 Jun 2025 The GST credit amounts HOW MUCH ARE THE PAYMENTS The amount of money you can receive also depends on your net family income as stated in your 2021 tax return as well as marital status and how many children you

To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2022 tax year ranges from 52 255 to 69 105 depending on your Key Takeaways Low to modest income Canadians can offset taxes on consumer goods services through the GST HST credit New residents of Canada must

3 Unmistakable Signs That The Canada GST Tax Could Be On The Rise

https://www.gatewaytax.ca/wp-content/uploads/2022/06/3-Reason-Why-The-Canada-GST-Tax-Could-Be-On-The-Rise-Featured-Image-1536x864.png

How To Apply Online GST Registration Nafisflahi Forum

https://www.nafisflahi.com/wp-content/uploads/2023/01/GST-registration-certificate.jpg

https://www. canada.ca /en/revenue-agency/services...

Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates The goods and services tax harmonized sales tax GST HST credit is a tax free

https://www. canada.ca /.../rc4210/gst-hst-credit.html

If the CRA determines that you are eligible for the GST HST credit based on your 2022 tax return and that you will receive payments you will receive a GST HST credit notice in

Comment Avoir Son Avis D imposition 2020 ZIOUKA Business News

3 Unmistakable Signs That The Canada GST Tax Could Be On The Rise

Group Calls For Expansion Of GST HST Credit From Canadian Government

Who Is Eligible For The GST Credit In Canada 2022 GST Payment Dates

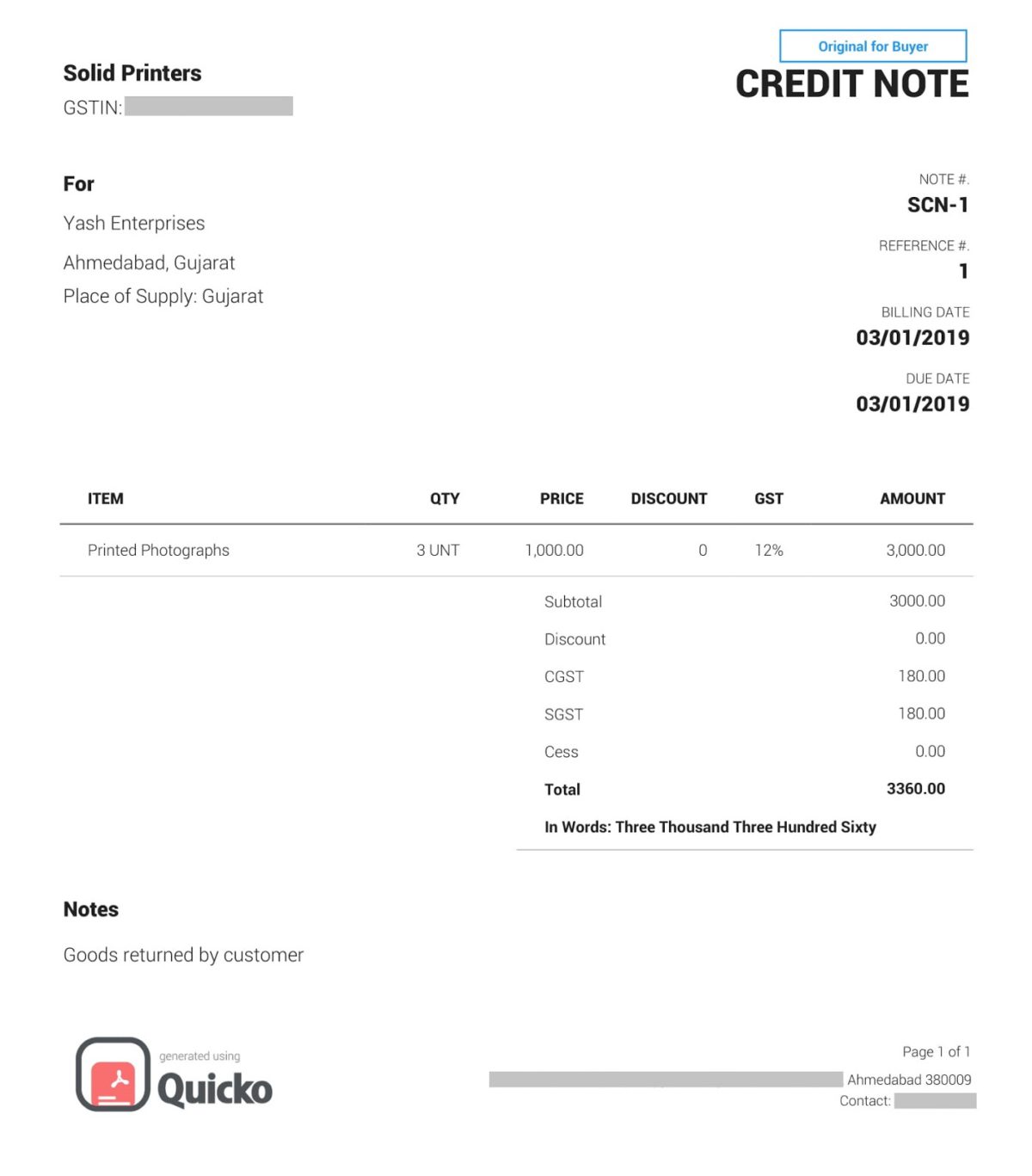

What Is A Credit Note Under GST Learn By Quicko

GST Revenue Neutral Rate

GST Revenue Neutral Rate

GST India GST HSN Code Tax Rate APK For Android Download

How To Complete A Canadian GST Return with Pictures WikiHow

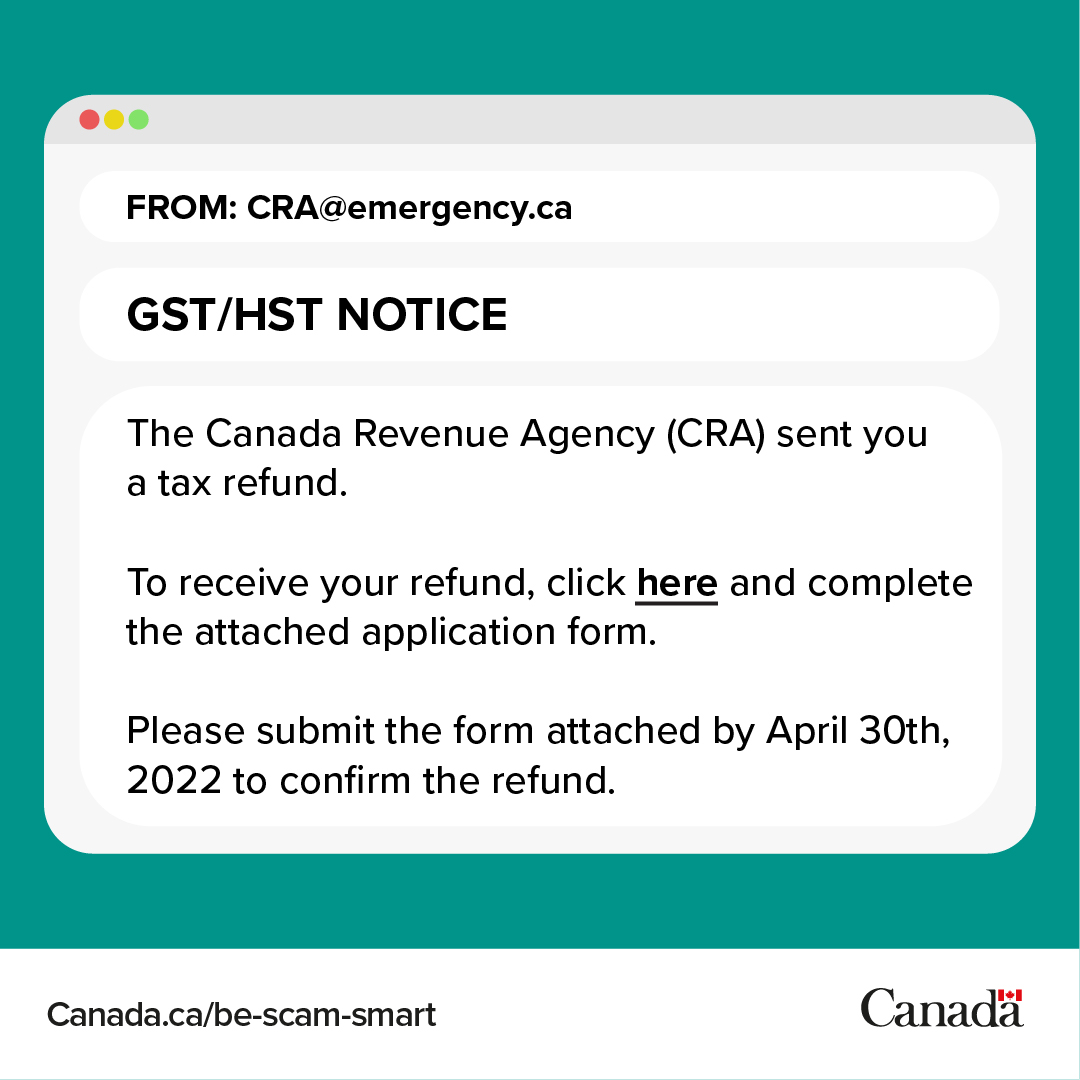

Canada Revenue Agency On Twitter If You Receive An Email Looking Like

Canada Gst Credit Amount - Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates You are generally eligible for the GST HST credit if you are At least 19 years old If you