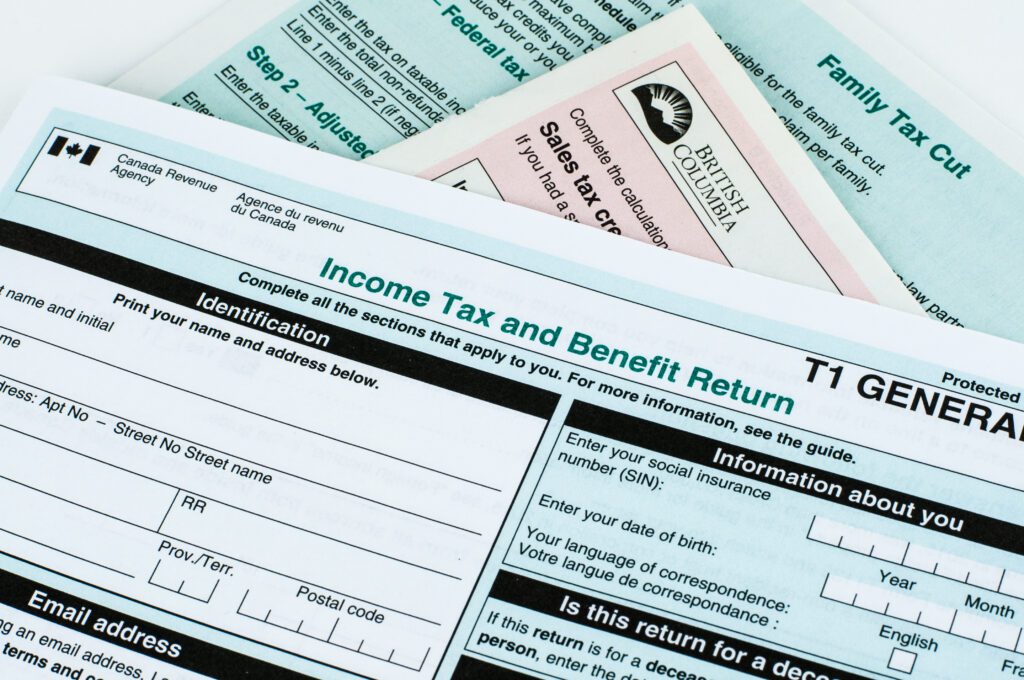

Canada Income Tax Return Medical Expenses The medical expense tax credit is a non refundable tax credit that you can use to reduce the tax that you paid or may have to pay If you paid for healthcare expenses you may be able to

Medical expenses not covered by provincial or private health care plans may save you money on your tax return If you file your taxes jointly with a spouse or partner it s usually TaxTips ca Eligible medical expenses including eyeglasses private health services plan premiums out of country medical coverage transportation costs tutoring services gluten free food costs for those with Celiac disease

Canada Income Tax Return Medical Expenses

Canada Income Tax Return Medical Expenses

https://www.weandgst.in/wp-content/uploads/2019/04/1200px-Income_Tax_Department_May_2018.jpg.png

How To File Income Tax Return For The Deceased Person By Legal Heir

https://wealth4india.com/blogs/wp-content/uploads/2022/07/income-tax-return-for-the-deceased-person-2048x1152.png

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

https://www.olympiabenefits.com/hubfs/Who should claim medical expenses on taxes Canada-1.png

Most Canadians know that they can claim some of their medical expenses but many are unsure of what and how much they can claim In this article we ll go over what medical expenses are tax deductible common The good news is that many medical expenses and costs can be deducted on your tax return Here s what you need to know about how these credits work and how they can help lower your tax bill during tax time

Maximize your Canadian income tax return by claiming medical expenses as a non refundable tax credit Learn how to track and deduct healthcare costs Some people don t see the need to claim medical expenses Eligible medical expenses can be claimed as a non refundable tax credit Medical Expense Tax Credit in Canada at the federal and provincial territorial levels Your medical expenses must exceed a minimum

Download Canada Income Tax Return Medical Expenses

More picture related to Canada Income Tax Return Medical Expenses

Income Tax BCIT

https://www.bcit.ca/wp-content/uploads/2022/03/Income-Tax-1024x680.jpeg

As An American Living In Canada Do I Need To File Tax Returns In Both

https://help.truenorthaccounting.com/hubfs/image-png-Sep-29-2020-07-50-36-75-PM.png

Income Tax Return Consultancy Services At Rs 1000 return In Surat ID

https://5.imimg.com/data5/SELLER/Default/2022/6/VY/UZ/HR/130388980/income-tax-return-consultancy-services-1000x1000.jpg

If you paid for hospital services paid to live in a nursing home or bought medical supplies such as pacemakers vaccines or walking aids you may be able to claim a non refundable tax There is an income limit that applies for claiming medical expenses Your 2021 expenses need to exceed the lesser of your net income on line 23600 of your tax return or 2 241 The

Below I ll dive into the specifics and outline several ways that you can maximize your return and get credit for out of pocket medical expenses tax deductions Tax Day is the deadline that all income tax returns must be filed in Canada s Medical Expense Tax Credit METC is a non refundable tax credit The list of eligible and excluded medical expenses published by the Canada Revenue Agency

Canadian Final Income Tax Return US Canadian Cross Border Tax

https://cbfinpc.com/wp-content/uploads/2020/04/Canadian-Income-Tax-Return-Preparation-cbfinpc.com_-scaled.jpg

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-15000-on-tax-return-canada.jpg

https://www.canada.ca › en › revenue-agency › services...

The medical expense tax credit is a non refundable tax credit that you can use to reduce the tax that you paid or may have to pay If you paid for healthcare expenses you may be able to

https://turbotax.intuit.ca › tips

Medical expenses not covered by provincial or private health care plans may save you money on your tax return If you file your taxes jointly with a spouse or partner it s usually

Latest ITR Forms Archives Certicom

Canadian Final Income Tax Return US Canadian Cross Border Tax

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

The Importance Of Filing Your Income Tax Return On Time Techuck

Salary Income Tax Return Service At Best Price In Bengaluru ID

Salary Income Tax Return Service At Best Price In Bengaluru ID

Is Your Income Tax Return Ready Monitor

Qualified Business Income Deduction And The Self Employed The CPA Journal

Income Tax Rule

Canada Income Tax Return Medical Expenses - Eligible medical expenses can be claimed as a non refundable tax credit Medical Expense Tax Credit in Canada at the federal and provincial territorial levels Your medical expenses must exceed a minimum