Child Relief Tax Rebate Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Web The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most Web As the maximum relief claim allowed for a child is 50 000 the amount of WMCR allowed will be 46 000 50 000 4 000 Type of relief Total amount of relief claimed on

Child Relief Tax Rebate

Child Relief Tax Rebate

https://2.bp.blogspot.com/-_pLNiXKLQqI/WsuZ3S3YQJI/AAAAAAAAYsE/E9ORc-9MkocQGM1lJApJ0ugHZXzRROWAgCLcBGAs/s1600/Child-Related%2BReliefs.JPG

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2016/04/table.jpg?fit=654%2C320&ssl=1

Web 20 d 233 c 2022 nbsp 0183 32 It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR on a

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and

Download Child Relief Tax Rebate

More picture related to Child Relief Tax Rebate

Note These Tax saving Tips Business News AsiaOne

http://www.asiaone.com/sites/default/files/inline/images/18110_1489974732.jpg

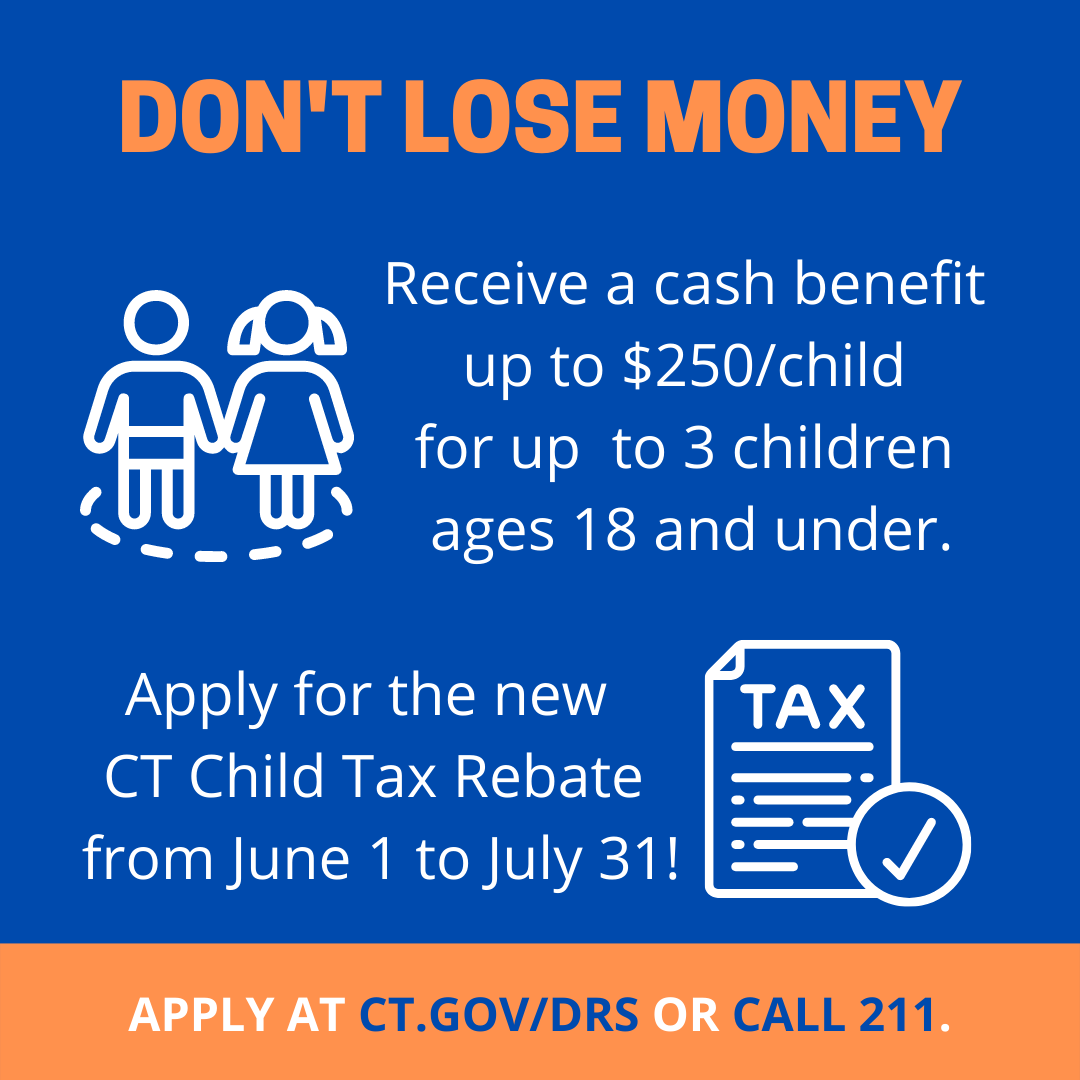

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Web 14 avr 2022 nbsp 0183 32 Parents can deduct 4 000 per child under the Qualifying Child Relief QCR during tax filing or 7 500 per child under the Handicapped Child Relief HCR Mums Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than

Web 28 mars 2023 nbsp 0183 32 You can claim the full amount of the 2021 Child Tax Credit if you re eligible even if you don t normally file a tax return To claim the full Child Tax Credit file a Web 13 janv 2022 nbsp 0183 32 To claim a person as a dependent on your tax return that person must be your qualifying child or qualifying relative A child is your qualifying child if the following

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/gKQ2psaELuOBCeaQ8VxbmEjmLAI=/800x450/smart/filters:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Depositphotos_97954768_L-1068x713.jpg

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

https://www.whitehouse.gov/child-tax-credit

Web The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most

MP Louis Ng Pushes For Government To Extend Tax Rebate And Child Relief

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

Child Tax Rebates

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

.png)

Giving Children A Debt free Future With SSPN The Edge Markets

.png)

Giving Children A Debt free Future With SSPN The Edge Markets

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

What To Know About California Middle Class Tax Refund Debit Cards

How To Apply For CT Child Tax Rebate Application Eligibility Requirements

Child Relief Tax Rebate - Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per