Canada Renewable Energy Tax Credit The Canadian government has proposed five new refundable investment tax credits ITCs designed to grow Canada s clean economy and allow Canada to remain

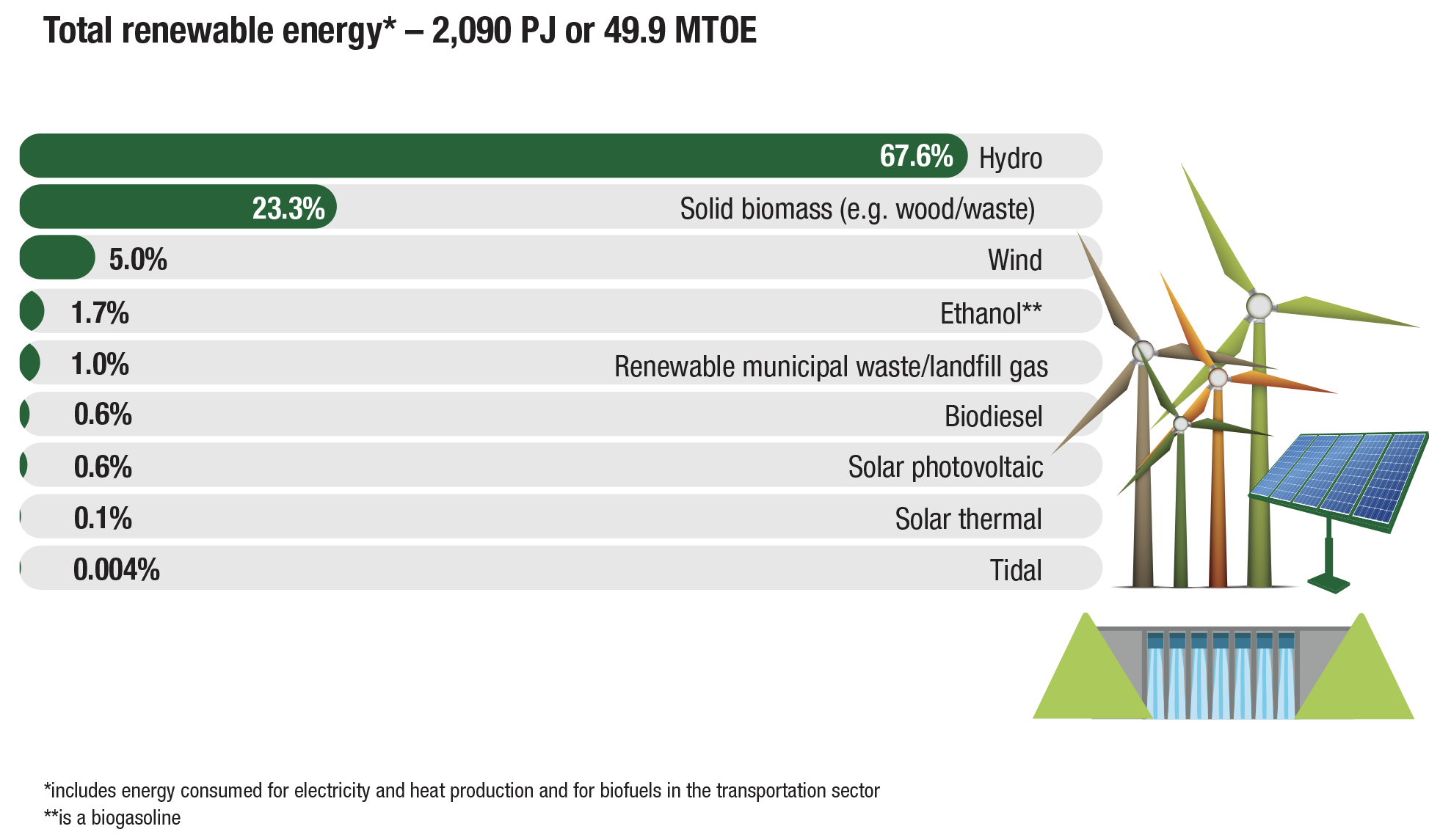

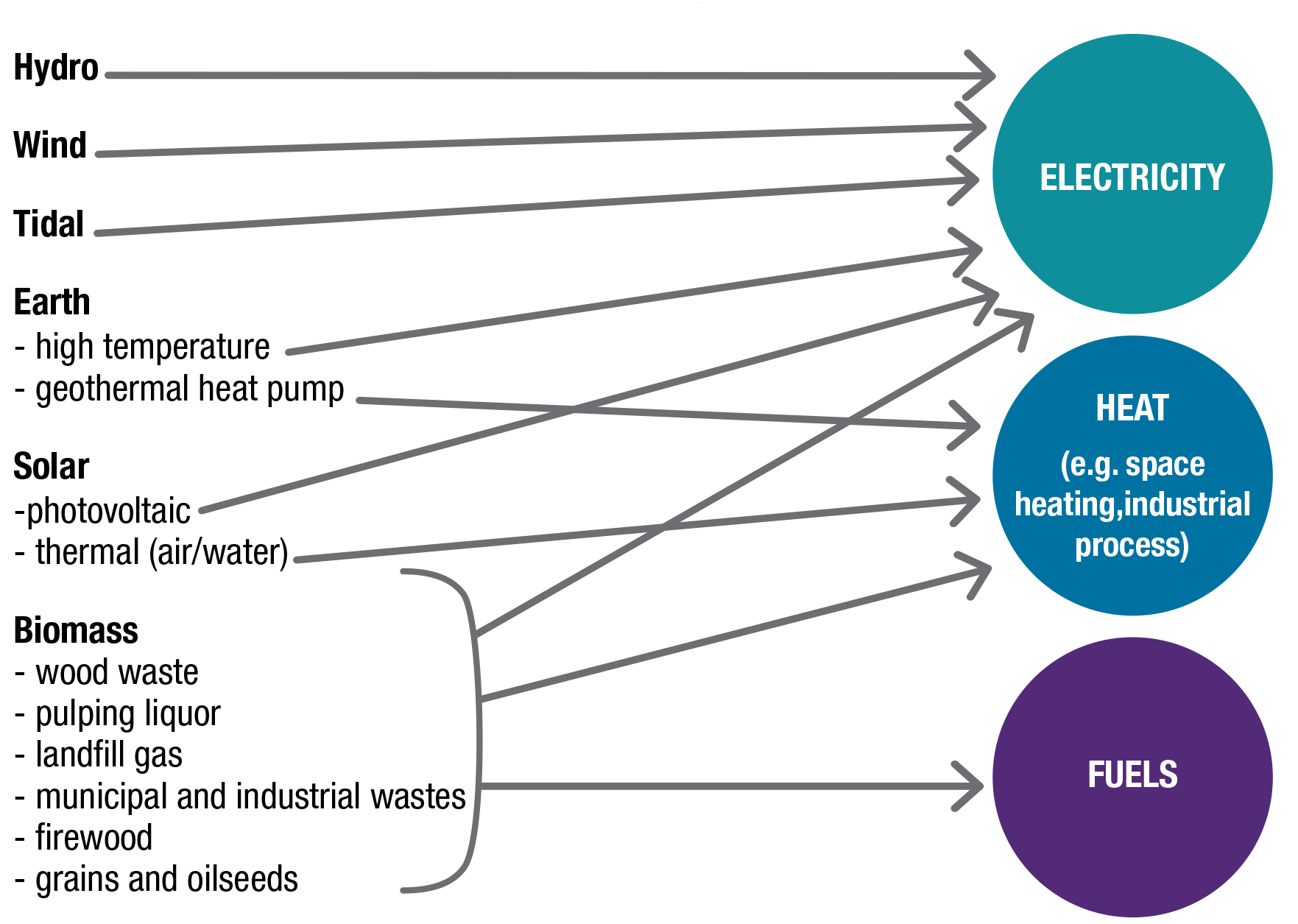

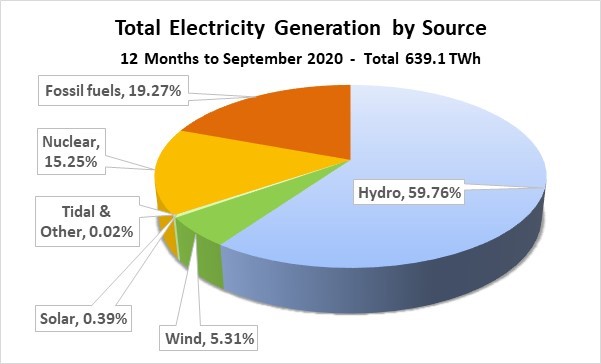

The Clean Electricity ITC would provide a 15 refundable tax credit for eligible investments in non emitting electricity generation systems wind concentrated solar solar photo voltaic hydro wave tidal and nuclear As a business you may be eligible for tax credits for investments in Canada that support the transition to net zero emissions Carbon Capture Utilization and Storage CCUS

Canada Renewable Energy Tax Credit

Canada Renewable Energy Tax Credit

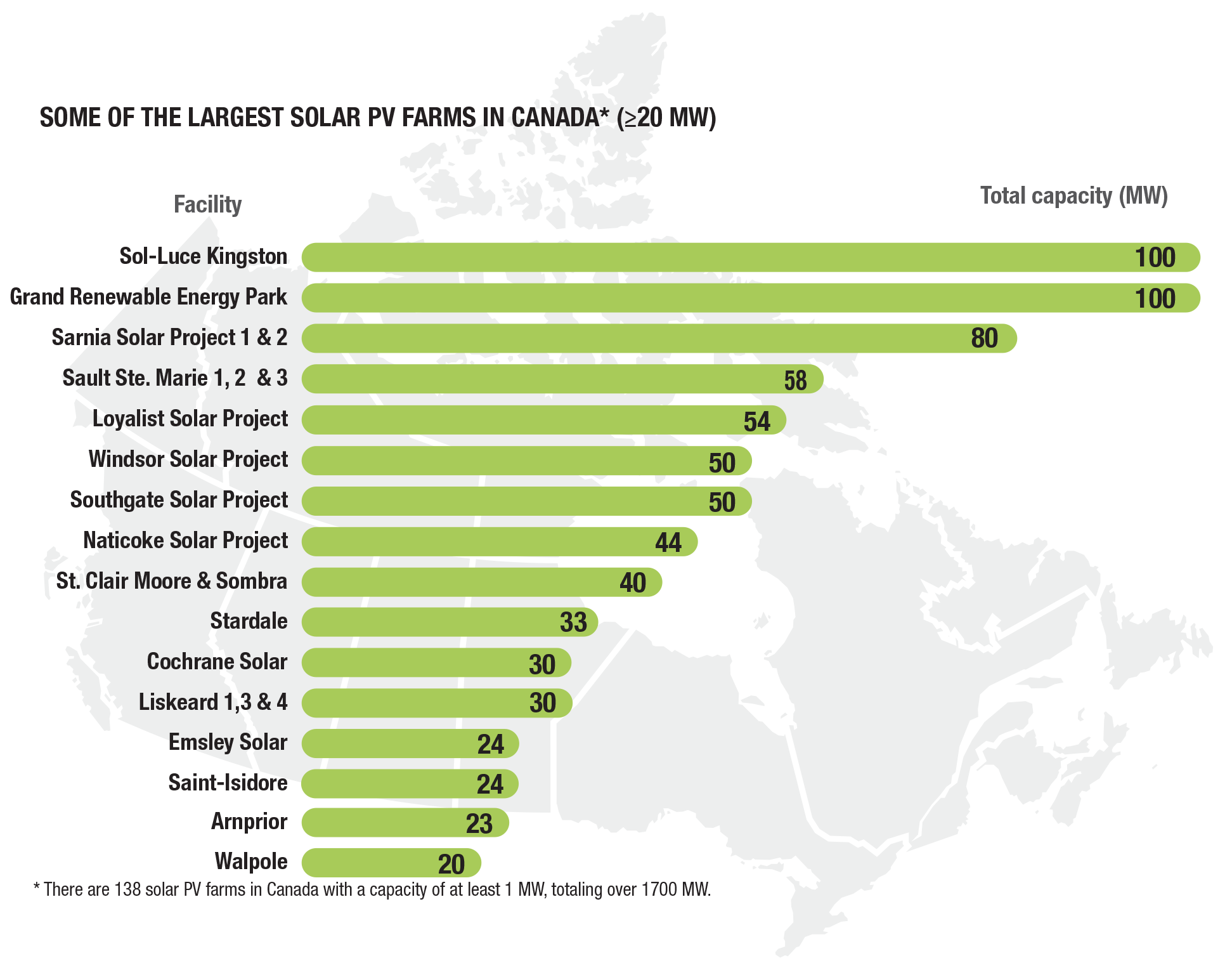

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/energy_fact/some-of-largest-solar-pv-farms-in-canada-2018.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Renewable Energy Facts Natural Resources Canada

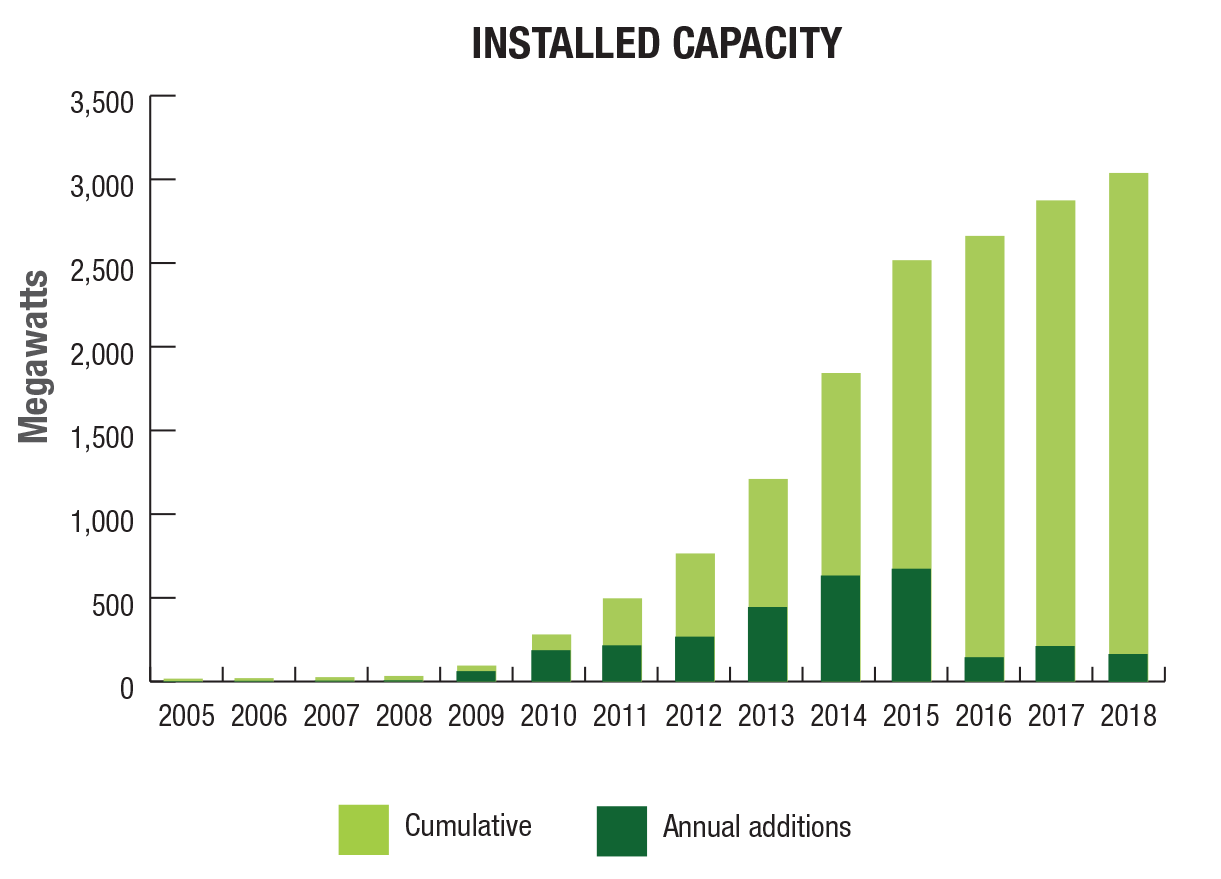

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/solar-pv-installed-capacity-2019.png

This generally aligns with the activities that qualify for Canadian renewable and conservation expenses CRCE according to the Natural Resources Canada Canmet Energy Technical Guide 2012 Regardless of whether your organization plans to or has already started investing in clean energy or simply plans to see if it may be eligible it s critical to understand the tax credits that may be available the project

Budget 2024 announces further details on and in certain cases expands previously announced investment tax credits ITCs to support the adoption of clean energy technology and Canada s net zero commitments Power purchase agreements PPAs PPAs for renewable energy purchased for operating a clean hydrogen project are eligible for the CI calculation in place of using the grid s CI if the PPA will be in place for the first

Download Canada Renewable Energy Tax Credit

More picture related to Canada Renewable Energy Tax Credit

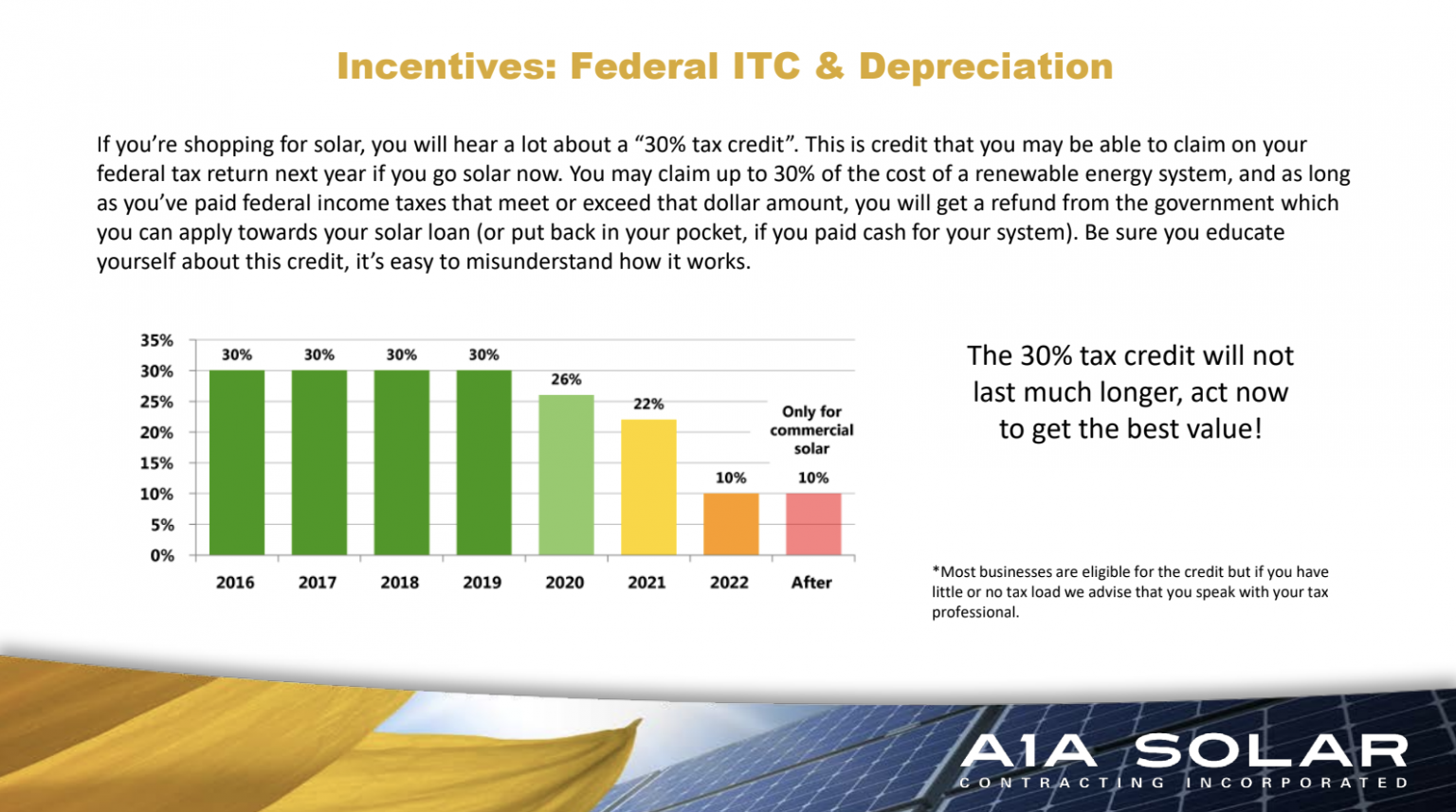

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

https://a1asolar.com/wp-content/uploads/2018/10/tax-credit-chart-1536x857.png

Renewable Energy Facts Natural Resources Canada

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/energy_fact/total-renewable-energy-production-2020.png

Renewable Energy Facts Natural Resources Canada

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/energy_fact/main-sources-uses-canada.png

Clean Technology Investment Tax Credit A refundable 30 tax credit on capital cost of investments made by taxable entities in wind solar PV and energy storage technologies This Credit will be available to all project The new 15 refundable tax credit is intended to support clean electricity technologies and proponents to expand the capacity of Canada s clean electricity grid to

Canada has introduced six clean economy investment tax credits intended to incentivize environmentally friendly activity in sectors such as manufacturing mineral extraction and New refundable investment tax credits aim to incentivize the development and adoption of clean technologies and energy helping Canada meet its greenhouse gas emissions reduction

Energy Secretary Says Time Is Right For Clean Energy Tax Credits

https://dailyenergyinsider.com/wp-content/uploads/2022/06/FV26YCZWQAEgcTH.jpeg

Infographic Renewable Energy In Canada Environment Business In

https://biv.com/sites/default/files/2017-12/infographic_-_renewable_energy_in_canada.jpg

https://www.fas…

The Canadian government has proposed five new refundable investment tax credits ITCs designed to grow Canada s clean economy and allow Canada to remain

https://www.fasken.com › en › knowledge › …

The Clean Electricity ITC would provide a 15 refundable tax credit for eligible investments in non emitting electricity generation systems wind concentrated solar solar photo voltaic hydro wave tidal and nuclear

Energy Resource Guide Canada Renewable Energy

Energy Secretary Says Time Is Right For Clean Energy Tax Credits

2023 Residential Clean Energy Credit Guide ReVision Energy

Renewable Electricity Tax Credit Equalization Act Introduced In House

Residential Energy Tax Credit Use Eye On Housing

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

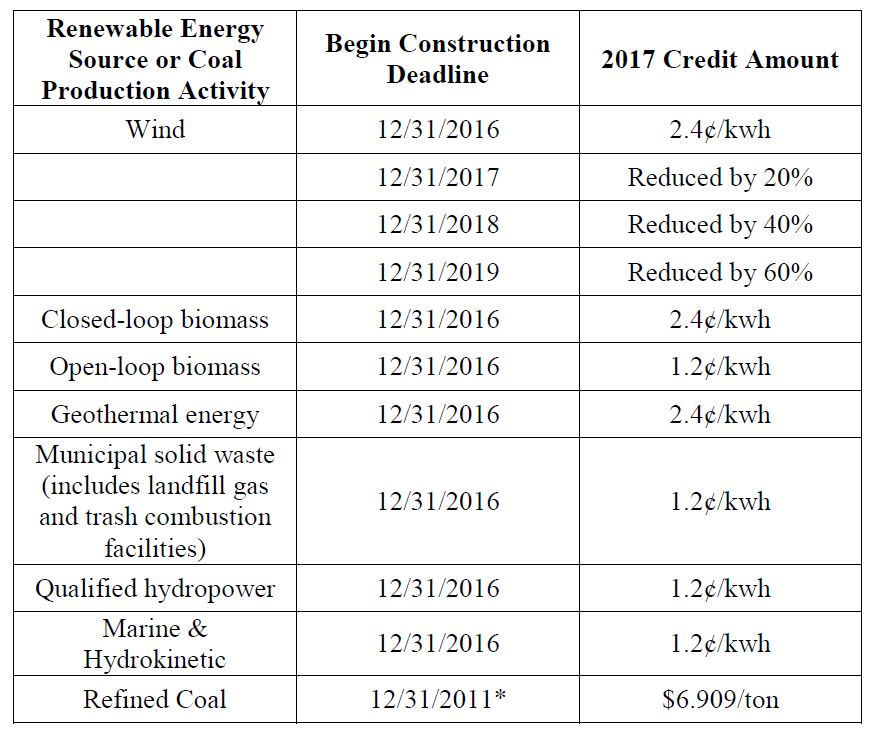

Renewable Energy Law Alert IRS Releases 2017 Annual Inflation Factor

Environmental Conservation And Clean Energy Organizations Rally For

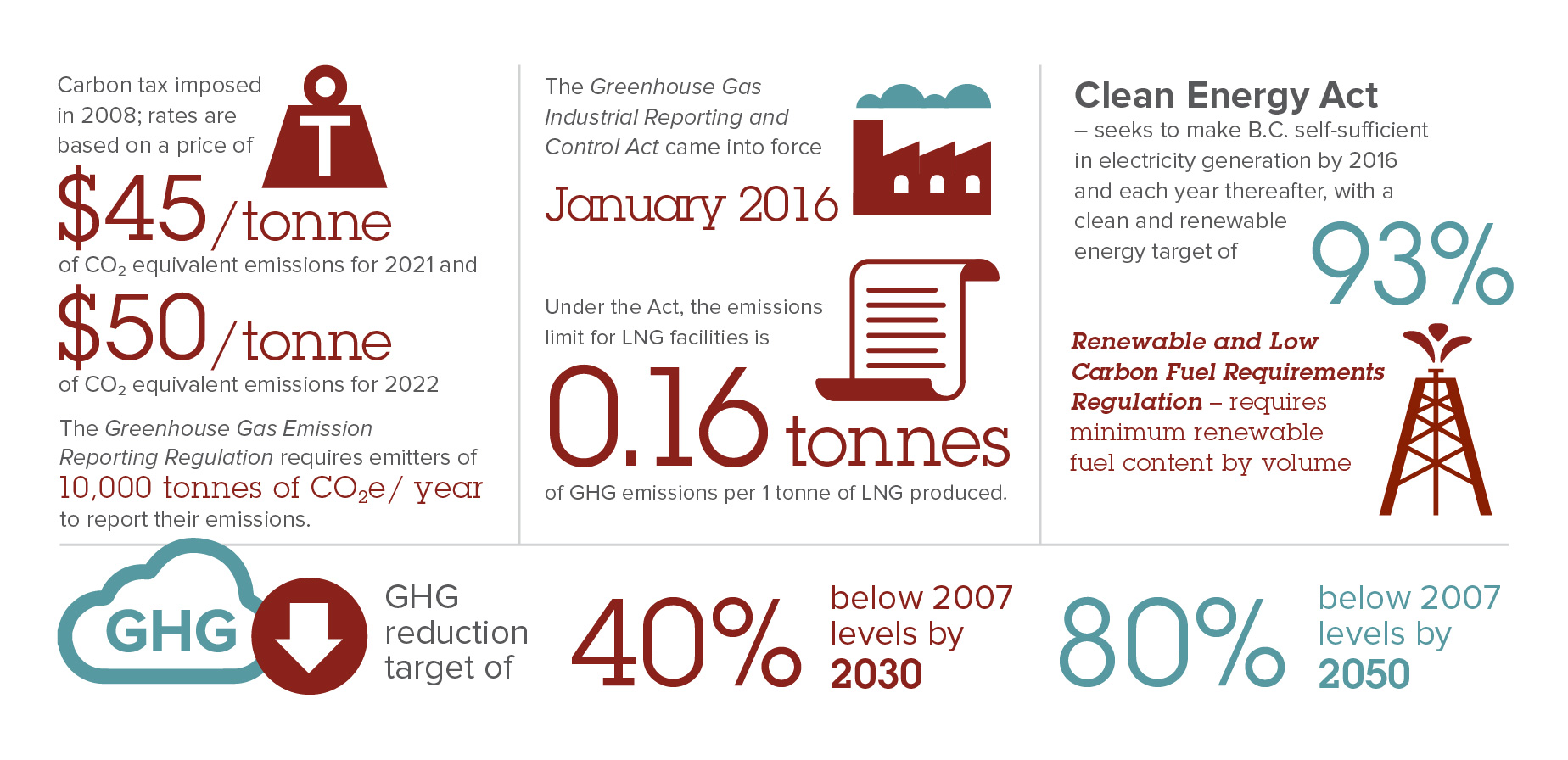

B C s Carbon And Greenhouse Gas Legislation

Canada Renewable Energy Tax Credit - For Canadian businesses with the goal to improve their sustainability as well as that of the country the government has instituted five new types of tax credit available over the next ten