Canada Revenue Check Dates We ve compiled a complete list of the major government program payment dates This includes dates for CPP OAS GST HST CCB CAIP and more

With the tax season in full swing individuals had to file April 30 and self employed have until June 15 you might be wondering about the processing time for tax Use our 2024 ultimate Government of Canada benefit payment dates guide to understand what benefits might be available to you how much money you could get

Canada Revenue Check Dates

Canada Revenue Check Dates

https://nehruinc.ca/wp-content/uploads/2022/01/Canada-Revenue-Agency-2022-Tax-Fact-Sheet-and-Important-Dates-1-940x675.jpg

Canada Revenue Agency Jobs 1000 Available Positions With Salaries

https://canadianjobbank.org/wp-content/uploads/2022/02/canada-revenue-agency.jpg

Canada Revenue Agency 2022 Important Tax Dates Nehru Accounting

https://nehruinc.ca/wp-content/uploads/2022/01/Canada-Revenue-Agency-2022-Tax-Fact-Sheet-and-Important-Dates-2-940x675.jpg

You may know that your income tax return is due on April 30 2024 but that is not the only date to know about Find out when you can download your T4s your last Updated for 2024 and 2025 Click the relevant category below to see your tax and payment deadlines We ve also included some guidance and examples where

The CRA will start paying refund interest on the latest of the following 3 dates the date of the overpayment the 120th day after the end of the tax year if the The change goes into effect on September 1 The bulk of Costco s profits come from annual fees It reported last year that it earned 4 6 billion in revenue from

Download Canada Revenue Check Dates

More picture related to Canada Revenue Check Dates

Canada DeFi Taxes The Ultimate Guide Koinly

https://images.prismic.io/koinly-marketing/1ee2e9b0-39fc-4f77-93c9-babfd5fd3ef3_Canada+DeFi+tax+guide.png?auto=compress,format

/GSTwithcoinsgetty-5bb9136b46e0fb0026cbee5d.jpg)

What Is The Canada Revenue Agency CRA Business Number

https://www.thebalancesmb.com/thmb/Qwm68sqpugEhBzs_u6MTgDJGFF0=/2121x1414/filters:fill(auto,1)/GSTwithcoinsgetty-5bb9136b46e0fb0026cbee5d.jpg

CANADA REVENUE OL1 USED EBay

https://i.ebayimg.com/images/g/ZY8AAOSwdW9aAhyW/s-l1600.jpg

CCB is administered by the Canada Revenue Agency CRA It is a tax free monthly payment made to eligible families to help with the cost of raising children under In its fiscal 2024 fourth quarter ended June 30 Supermicro reported record revenue of 5 31 billion up 143 year over year and 38 sequentially This drove

Generally the due date to file your income tax return is April 30 However if this date falls on a weekend or a public holiday the Canada Revenue Agency CRA allows the return On May 27 2024 the settlement period for trading GoC bonds in the secondary market in Canada moved from two days to one This shortened time for

Canada Revenue Agency Jobs Casewes

https://mystartupevents.com/wp-content/uploads/2021/11/22916_image.jpg

Canada Revenue Agency AtekaAurimas

https://blogapp.bitdefender.com/hotforsecurity/content/images/size/w1000/wordpress/2020/08/Canada-Revenue-Agency-Discloses-Credential-Stuffing-Attack-on-5500-Service-Accounts.jpg

https://moneygenius.ca/blog/benefit-payment-dates

We ve compiled a complete list of the major government program payment dates This includes dates for CPP OAS GST HST CCB CAIP and more

https://www.moneysense.ca/columns/moneyflex/how...

With the tax season in full swing individuals had to file April 30 and self employed have until June 15 you might be wondering about the processing time for tax

Revenue Free Of Charge Creative Commons Lever Arch File Image

Canada Revenue Agency Jobs Casewes

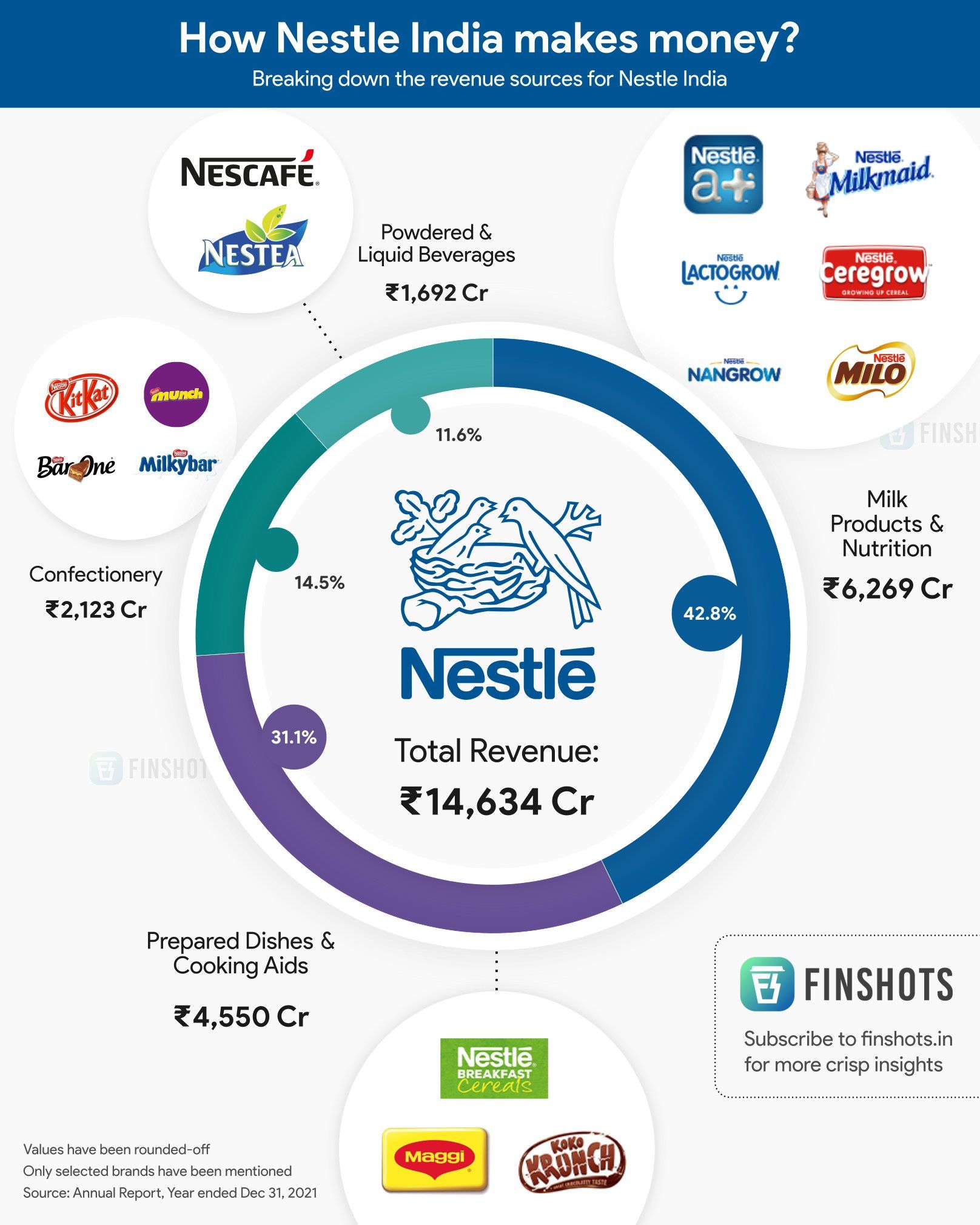

Nestle India Revenue Breakdown

Income Statement Business Insider Australia

Canada Revenue Agency reviewing Taxpayers Wrongfully Declared Dead

NetSuite Streamlines Revenue Accounting IBT

NetSuite Streamlines Revenue Accounting IBT

Revenue Pro Tips Helping You Generate Revenue Is What We Live For

Canada Provincial Revenue SL4 Used Partially Reconstructed Sheet

Revenue Bridge Chart Template Mosaic

Canada Revenue Check Dates - You may know that your income tax return is due on April 30 2024 but that is not the only date to know about Find out when you can download your T4s your last