Tax Rebate Under Education Loan Web To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web 16 f 233 vr 2021 nbsp 0183 32 The documents required to claim tax deduction under Section 80E are Certificate from the financial institution or authorized charitable trust who granted the

Tax Rebate Under Education Loan

Tax Rebate Under Education Loan

https://financegradeup.com/wp-content/uploads/2020/03/Education-Loan-Tax-Deduction.jpg

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

Web The easiest and the quickest way to calculate your education loan income tax benefits as per the latest budget FY 20 21 How long is your course in months Total Loan Amount Rate of interest for the loan in Will you Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Web Total tax rebate The amount of Income Tax an individual can save by availing of iSMART Education Loan from ICICI Bank The amount of rebate will vary for different tax slabs Web An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in

Download Tax Rebate Under Education Loan

More picture related to Tax Rebate Under Education Loan

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

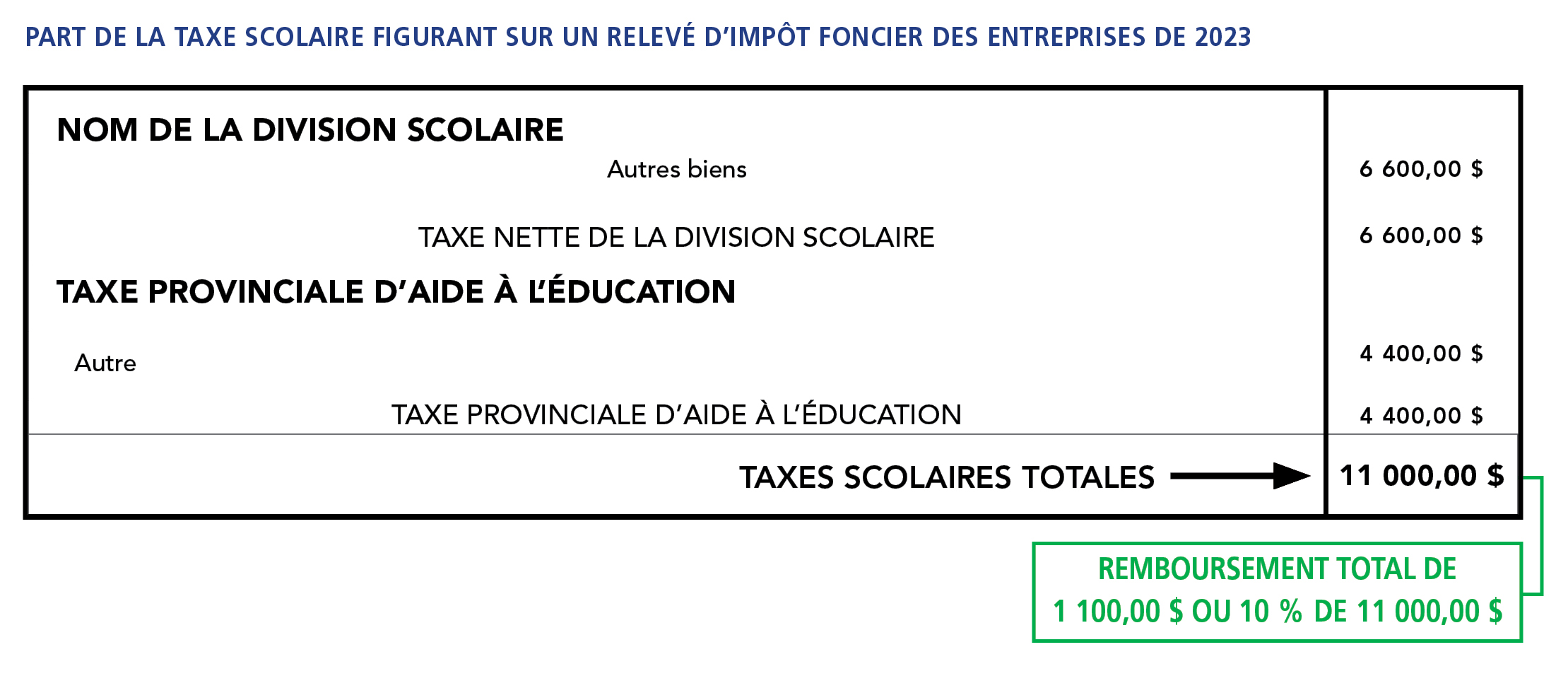

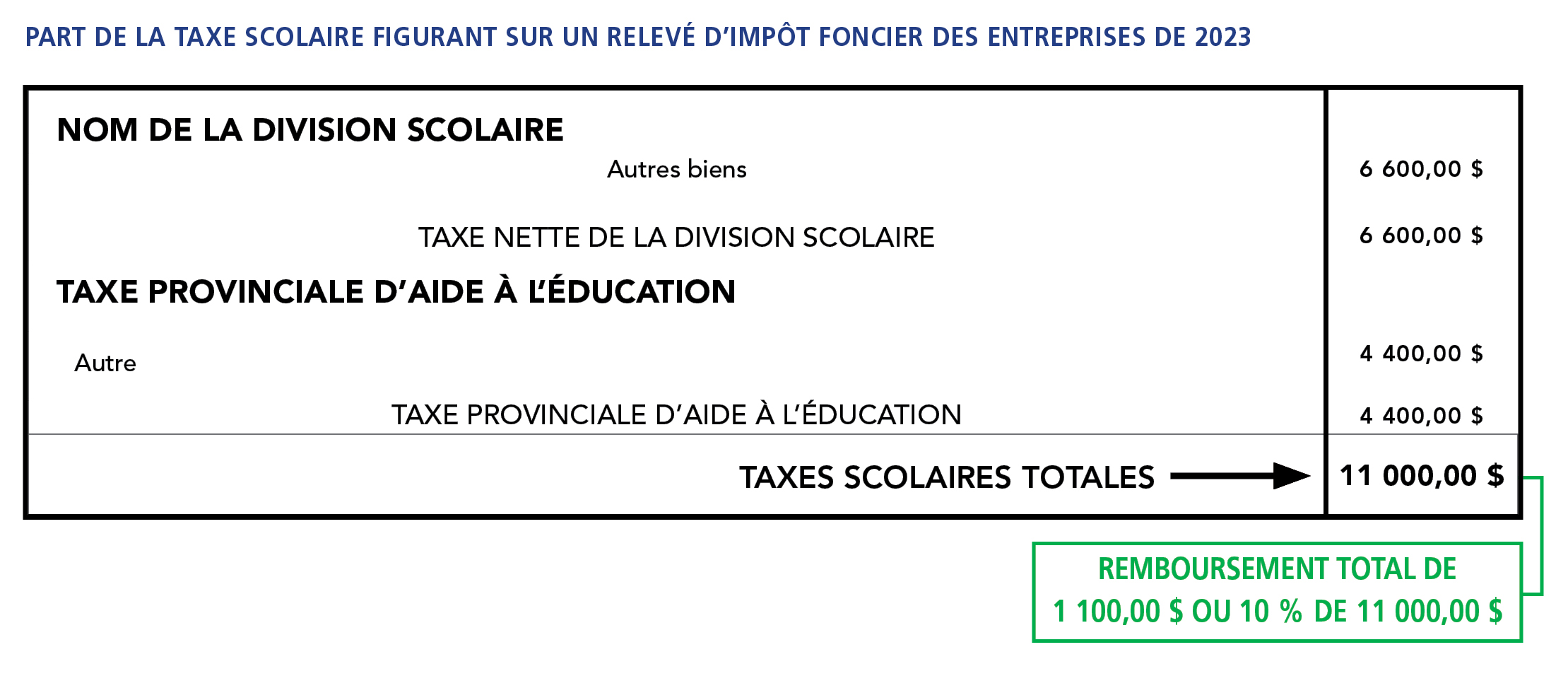

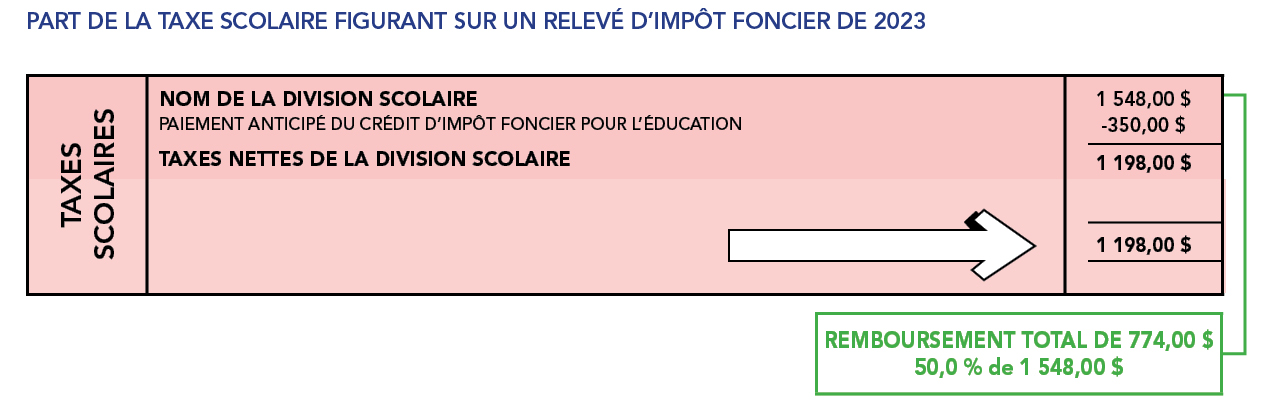

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web If you pay qualified education expenses in both 2022 and 2023 for an academic period that begins in the first 3 months of 2023 and you receive tax free educational assistance or a refund as described above you Web 5 juil 2023 nbsp 0183 32 Dans le formulaire de d 233 claration de revenus 224 remplir en ligne les frais de scolarit 233 sont 224 indiquer dans la partie R 233 ductions d imp 244 t Cr 233 dits d imp 244 t au sein

Web Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan There are other benefits to an education loan and they can be Web 31 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Province Du Manitoba Imp t Foncier Pour L ducation

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.fr.jpg

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

https://gstguntur.com/wp-content/uploads/2021/07/Section-87A-Rebate-Income-Tax-Act-768x432.png

https://www.etmoney.com/blog/education-loa…

Web To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education

https://www.charteredclub.com/section-80e-education-loan

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Province Du Manitoba Imp t Foncier Pour L ducation

Education Rebate Income Tested

Province Du Manitoba Imp t Foncier Pour L ducation

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Tax Tables Weekly Ato Review Home Decor

Tax Tables Weekly Ato Review Home Decor

Manufacturer Rebate Under Chain To Chain Competition

Sbi Education Loan Form Filling Sample Pdf Fill Online Printable

E Books MATRIXFREEDOM By Iain Clifford Learn To Discharge Your

Tax Rebate Under Education Loan - Web An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in