Tax Credit On Student Loan Interest Verkko 26 lokak 2023 nbsp 0183 32 The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable

Verkko 12 jouluk 2023 nbsp 0183 32 The student loan interest tax deduction The tax benefits of your student loan don t end with the above credits A deduction is also available for the interest payments you make when you start repaying your loan As of 2023 the deduction is available to the following filers Single filers with MAGIs of 90 000 or less Verkko 21 marrask 2023 nbsp 0183 32 You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2022 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

Tax Credit On Student Loan Interest

Tax Credit On Student Loan Interest

https://www.wiztax.com/wp-content/uploads/2022/08/Student-Loans-Tax-Debt_m-scaled.jpeg

Student Loan Interest Rates Update Plan 1 2 Etc CIPP

https://www.cipp.org.uk/static/uploaded/e865dc5e-0558-4639-a954c8c314139d7b.jpg

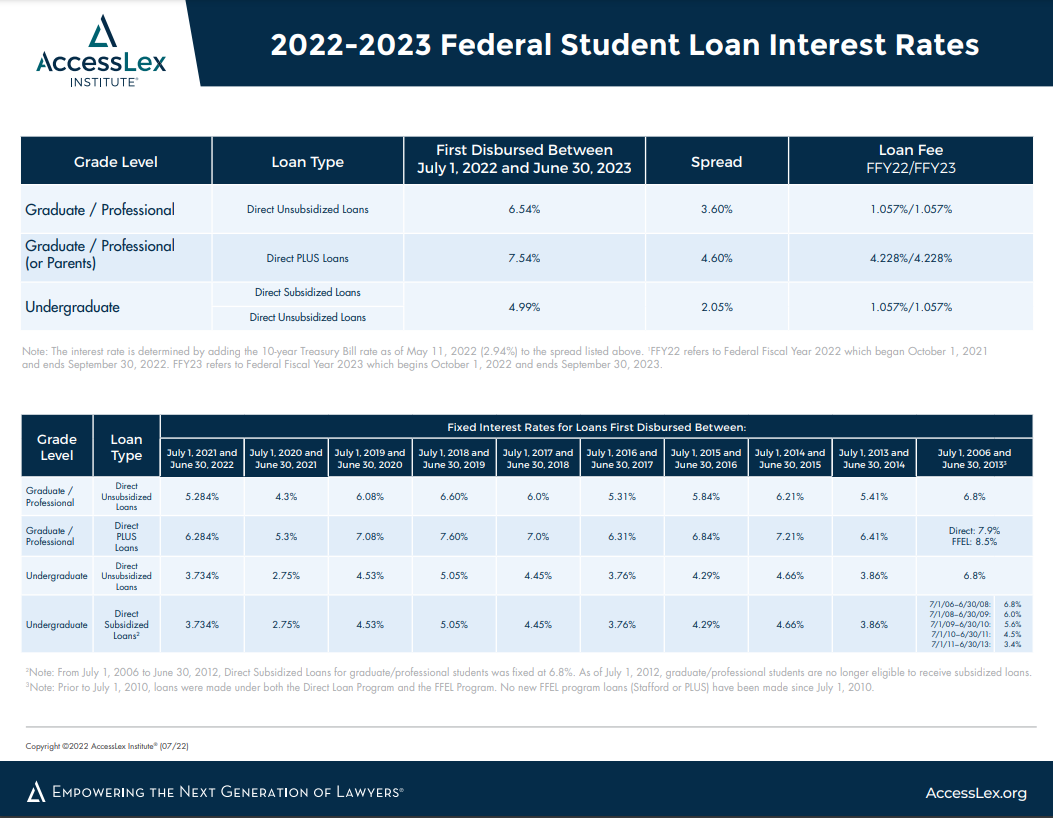

Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022 Verkko Student loan interest deduction For 2022 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 70 000 and 85 000 145 000 and 175 000 if you file a joint return You can t claim the deduction if your MAGI is 85 000 or more 175 000 or more if you file a joint return See chapter 4

Verkko 6 tuntia sitten nbsp 0183 32 How to claim the AOTC To claim the full credit you need to have spent at least 4 000 in qualifying expenses the credit amount is equal to 100 of the first 2 000 paid plus 25 of the next 2 000 Qualifying expenses for this credit are tuition required enrollment fees and required course materials not living expenses or Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes for interest on student loans Learn how it works and if you qualify The student loan interest deduction allows you to deduct up to 2 500 from your taxes for interest on student loans Learn how it works and if you qualify Skip to

Download Tax Credit On Student Loan Interest

More picture related to Tax Credit On Student Loan Interest

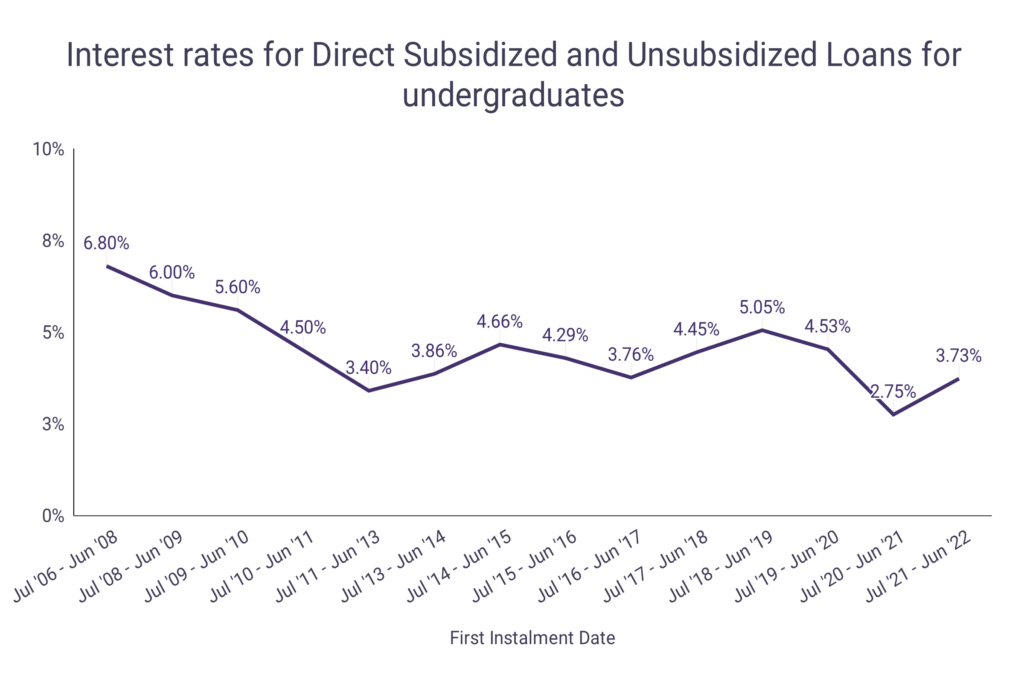

Student Loan Interest Rate And Limit Statistics WordsRated

https://wordsrated.com/wp-content/uploads/2023/03/1-Interest-rates-for-Direct-Subsidized-and-Unsubsidized-Loans-for-undergraduates-1024x683.png

Report 2 Million Missed Out On Student Loan Forgiveness Money

https://img.money.com/2021/03/News-2021-Student-Loan-Borrowers-Forgiveness.jpg?quality=85

Certificate Courses Student Loans Higher Education Expand Goo

https://i.pinimg.com/originals/77/3c/34/773c34226e31586700a3c5640808a657.jpg

Verkko 18 jouluk 2023 nbsp 0183 32 Your loan servicer will issue Form 1098 E detailing the interest paid during the year This information allows you to potentially deduct up to 2 500 in annual interest on your tax return Verkko 12 jouluk 2023 nbsp 0183 32 The resumption of student loan payments this fall means borrowers can claim the interest deduction again at tax time Here s what to know There s one piece of good news for student loan

Verkko 10 marrask 2022 nbsp 0183 32 Taxes Advertiser Disclosure Yes Student Loans Can Impact Your Taxes Here s How Janet Berry Johnson Contributor Reviewed By Doug Whiteman editor Updated Nov 10 2022 3 42pm Editorial Verkko 28 elok 2020 nbsp 0183 32 The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year American Opportunity Tax Credit

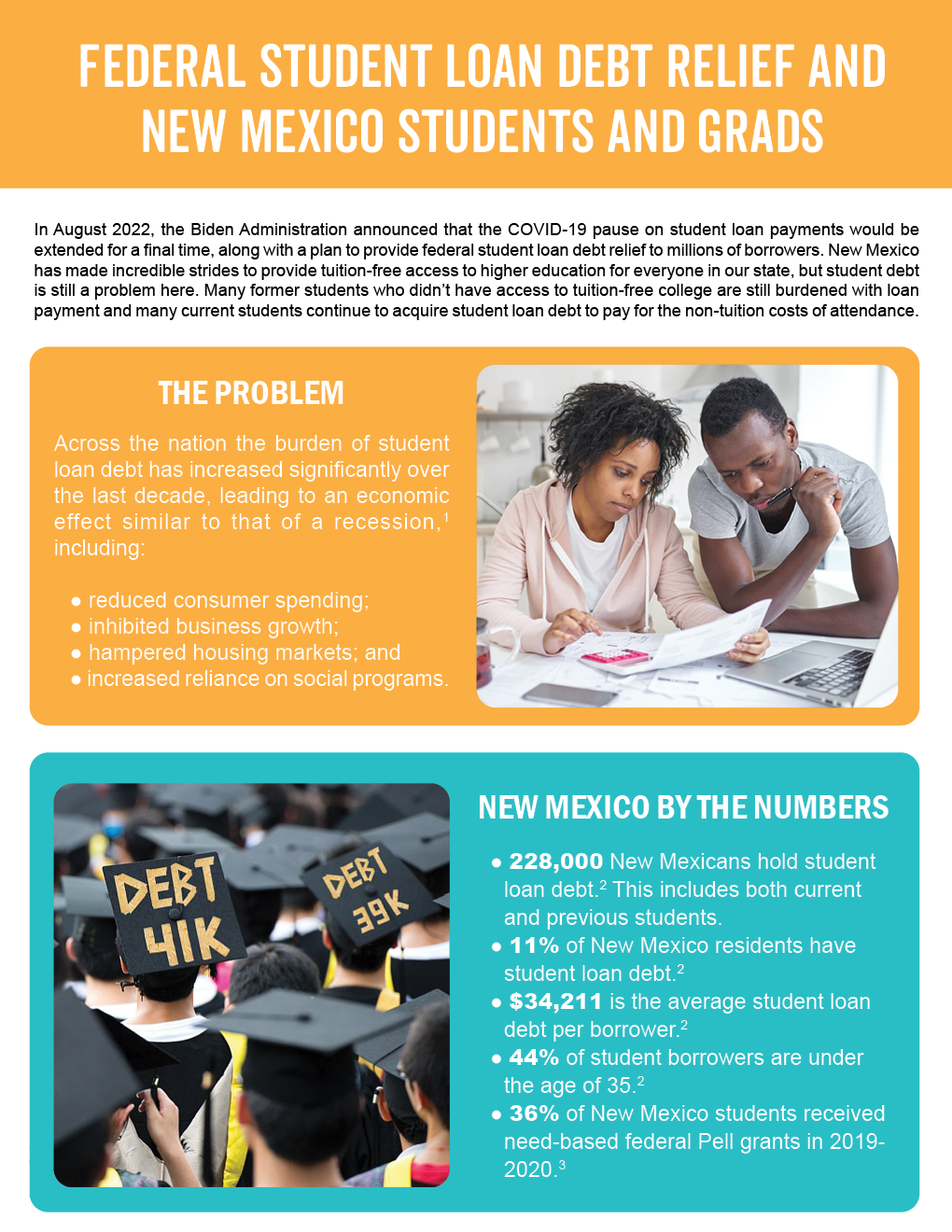

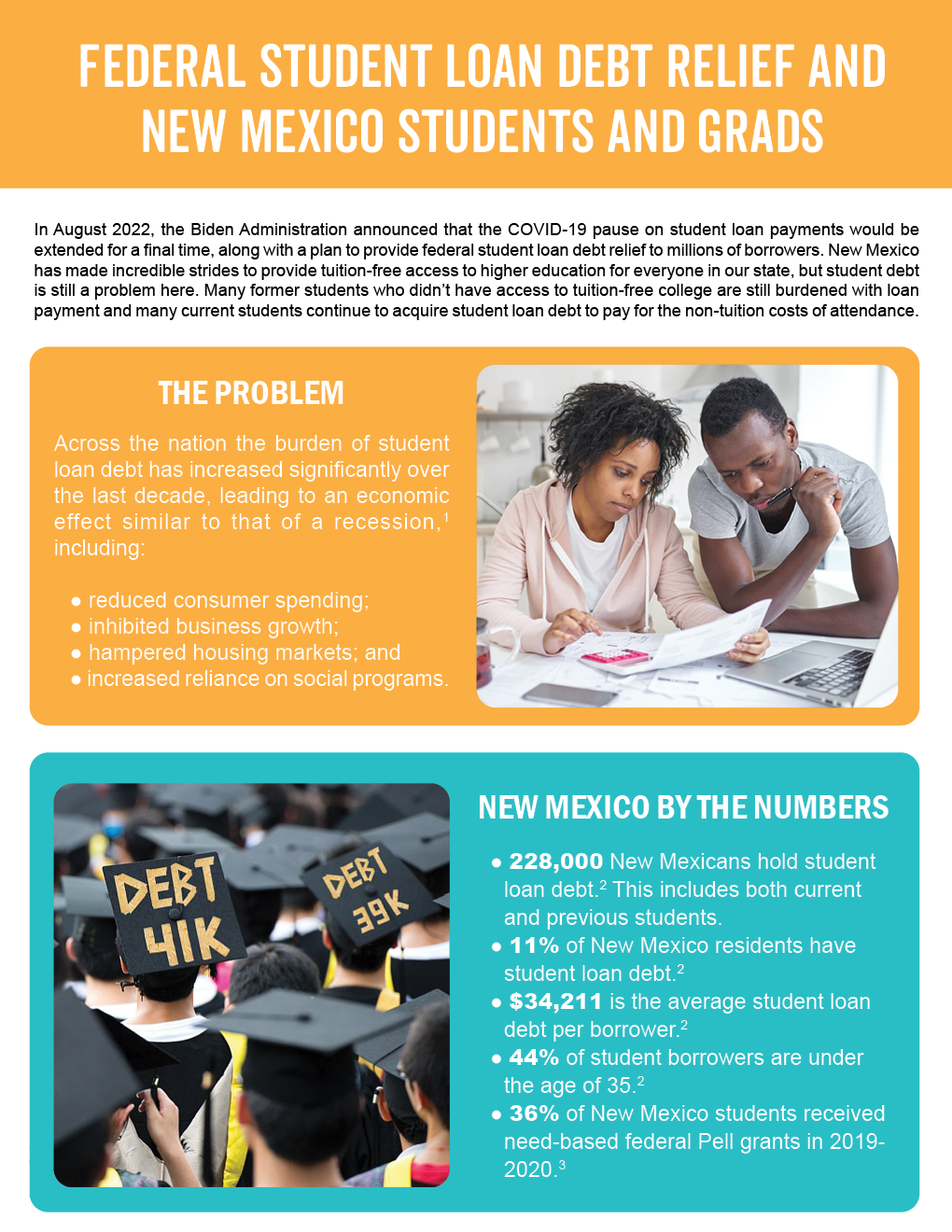

Federal Student Loan Debt Relief And New Mexico Students And Grads

https://www.nmvoices.org/wp-content/uploads/2022/10/Student-debt-fact-sheet_fontpage.png

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

https://www.investopedia.com/terms/s/slid.asp

Verkko 26 lokak 2023 nbsp 0183 32 The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable

https://turbotax.intuit.com/.../about-student-loan-tax-credits/L0mIiywan

Verkko 12 jouluk 2023 nbsp 0183 32 The student loan interest tax deduction The tax benefits of your student loan don t end with the above credits A deduction is also available for the interest payments you make when you start repaying your loan As of 2023 the deduction is available to the following filers Single filers with MAGIs of 90 000 or less

How To Prepare For Student Loan Payments Restarting In 2022 NFCC

Federal Student Loan Debt Relief And New Mexico Students And Grads

The Line Between The Child Tax Credit And The Pause On Student Loan

How To Quickly Pay Off Your Student Loans Debt Cupcakes Student

How Will Student Loan Forgiveness Affect Your Credit Lexington Law

How To Get The Student Loan Interest Deduction NerdWallet

How To Get The Student Loan Interest Deduction NerdWallet

Treasury Sets Student Loan Interest Rates Near Historic Lows

Sbi Student Loan Shop Cheap Save 62 Jlcatj gob mx

Is My First Student Loan Bill Really Over 1 000

Tax Credit On Student Loan Interest - Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes for interest on student loans Learn how it works and if you qualify The student loan interest deduction allows you to deduct up to 2 500 from your taxes for interest on student loans Learn how it works and if you qualify Skip to