Tax Return On Student Loan Payments The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Student loans can factor into your taxes as the interest is often tax deductible So you can reduce your tax bill if you include the amount of interest you ve paid during the tax year Taxpayers filing a self assessment tax return will have their student loan repayments calculated as part of the self assessment process Payments will be due on 31 January following the tax year and are not

Tax Return On Student Loan Payments

Tax Return On Student Loan Payments

https://cdn1.img.sputnikglobe.com/img/07e6/08/18/1099952048_276:0:2323:2047_1920x0_80_0_0_02ac0ef8c28ca57752d9afcc5f878c26.jpg

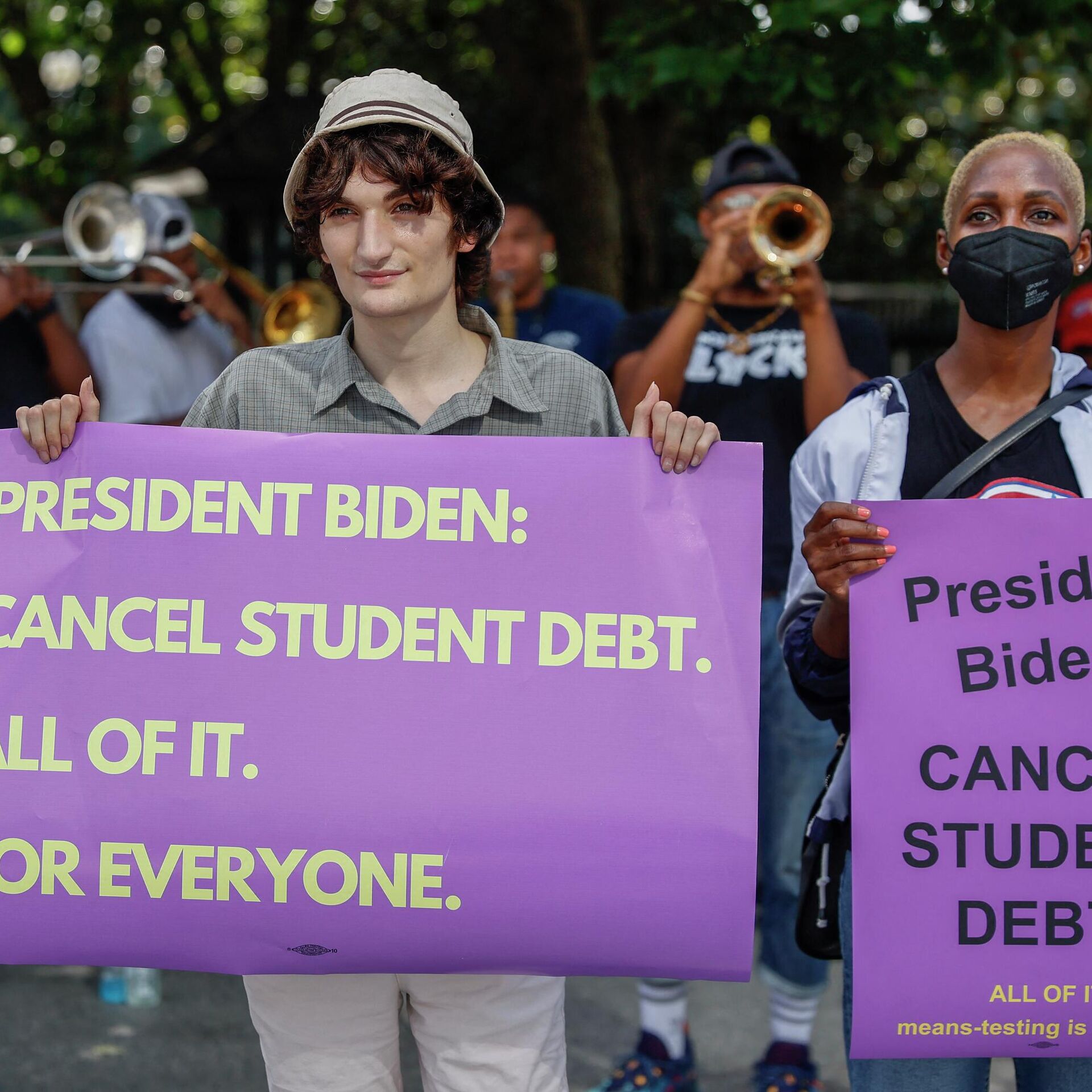

Supreme Court Strikes Down Biden s Student Debt Plan Payments Resume

https://wordpress.wbur.org/wp-content/uploads/2023/07/AP23181633060915-1000x667.jpg

Student Loan Debt Update How Government Shutdown Affects Payments

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1gMelA.img?w=2500&h=1667&m=4&q=89

Loan repayments to the Student Loan Company SLC had until recently major drawbacks If a SL was paid off during the tax year through PAYE deductions HMRC would How much tax you owe depends on the income tax band you re in and HMRC will calculate this based on what you declare in your self assessment form Paying tax this way can be tricky to budget and having a big lump sum

1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your If you took out a student loan for yourself your spouse or your child you paid some interest on that loan and your modified adjusted gross income is below certain limits you can

Download Tax Return On Student Loan Payments

More picture related to Tax Return On Student Loan Payments

7 Ways To Lower Student Loan Payments Credit Debt

https://creditanddebt.org/wp-content/uploads/2023/10/iStock-1301217920-scaled.jpg

How To Quickly Pay Off Your Student Loans Debt Cupcakes Student

https://i.pinimg.com/originals/60/bd/82/60bd82aefb1c608770132716fbcd0ada.jpg

Some Student Loan Borrowers Get Inaccurate Bills After Miscalculations

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/S5P2SZ2YUH2XSNR2IH4BODFQBM.JPG&w=1440

Information on student loans needed for tax returns When filling in your tax return you will need to include the total of any student loan repayments you have already To claim education credits taxpayers must file IRS Form 8863 with their tax return Taxpayers typically can deduct interest paid on student loans with eligibility and

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid Student loans are not included in self assessment payments on account They should only be included in the balancing payment paid in January after the tax year end The

Student Loan Payment Pause What To Expect

https://imageio.forbes.com/specials-images/imageserve/1210427901/0x0.jpg?format=jpg&crop=5040,2835,x0,y69,safe&width=1200

Report 2 Million Missed Out On Student Loan Forgiveness Money

https://img.money.com/2021/03/News-2021-Student-Loan-Borrowers-Forgiveness.jpg?quality=85

https://www.forbes.com › advisor › taxe…

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

https://www.investopedia.com

Student loans can factor into your taxes as the interest is often tax deductible So you can reduce your tax bill if you include the amount of interest you ve paid during the tax year

Attorney General Warns Of Student Loan Scams As Payments Resume FOX31

Student Loan Payment Pause What To Expect

The Top Four Reasons To File Your Personal Tax Return On Time SCARROW

Student Loan Payments Set To Resume What Borrowers Need To Know About

How To Save Money While Still Making Student Loan Payments

When Do Student Loan Payments Resume What You Need To Know

When Do Student Loan Payments Resume What You Need To Know

Income Tax Return

Here s What You Need To Know About Student Loan Payments Cbs8

How To Prepare For The Return Of Federal Student Loan Payments

Tax Return On Student Loan Payments - Official Statistics Student loan repayments via PAYE eligible for refund Tax year 2023 24 6 April 2023 5 April 2024