Canada Sales Tax Return Due Date You are liable for the GST HST you charge on property or services on the day you receive payment or the day the payment is due whichever is earlier We usually consider a payment to be due on the date you issue an invoice or the date specified in an agreement whichever comes first

When a due date falls on a Saturday Sunday or public holiday recognized by the CRA your return is considered on time if the CRA receives it or if it is postmarked on or before the next business day Learn about the sales tax in Canada including the federal GST Provincial Sales Tax rates PST and the Harmonized Sales Tax HST

Canada Sales Tax Return Due Date

Canada Sales Tax Return Due Date

https://www.bcjgroup.ca/assets/uploads/2021/04/iStock_96978059_MEDIUM.jpg

2023 Tax Due Dates Decimal

https://uploads-ssl.webflow.com/5e41d080471798e913648c3e/63b5e591f30ddf62c7b5d0c9_tax due date.jpg

The Biggest Problem With Income Tax Return Filing And Due Date How You

https://www.avcindia.co.in/wp-content/uploads/2021/03/Income-Tax-Return-Filing.png

Sales tax HST This guide provides general information such as how to collect record calculate and remit the GST HST It also includes line by line instructions to help you fill out your GST HST return Due Date if your reporting period is one or more months your due date is the last day of the month after the end of your reporting period For example if you re reporting for a period ending July 31 the due date for your PST return is August 31

The GST HST credit payment dates for the 2022 tax year are July 5 2023 October 5 2023 January 5 2024 and April 5 2024 As long as you file your tax return you ll automatically be considered for the HST payment deadlines vary based on your reporting period Most businesses file annually quarterly or monthly Annual filers typically have to pay their HST by April 30 quarterly filers by the end of the month following the quarter and monthly filers by the end of the following month

Download Canada Sales Tax Return Due Date

More picture related to Canada Sales Tax Return Due Date

Sales Tax Technology Tax Consulting Sales Tax Agnostic

https://i.pinimg.com/originals/45/ff/11/45ff11e655967526f991bd40035b4711.jpg

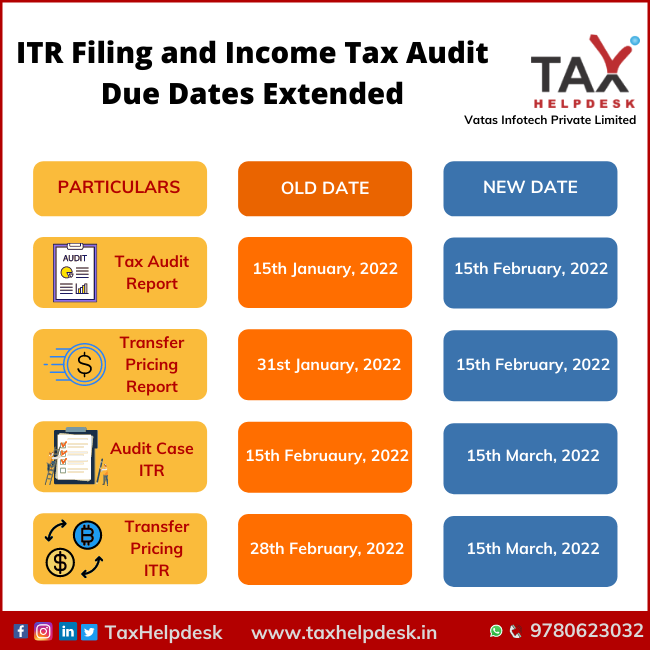

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/01/ITR-Filing-and-Income-Tax-Audit-Due-Dates-Extended.png

Explained All About Belated Filing Of Income Tax Returns

https://images.moneycontrol.com/static-mcnews/2022/01/Filing-a-belated-income-tax-return.jpg

In this article we ll highlight the tax deadlines for 2024 explain what happens if you file your taxes late and review the GST HST and QST if in Qu bec return filing and payment deadlines When do I need to file GST HST return The due date for filing your GST HST return depends on your reporting period You can check the due date of your filing period on Form GST34 2 You must file a GST HST return even if you do not have business transactions or no net tax to remit Refer to the table below for the different filing periods

For example a December 31 2023 year end would have a June 30 2024 due date When the last day of the tax year is not the last day of a month the return is due the same day of the 6th month after the year end For If you are filing a personalized GST HST return the due date is located at the top of your GST34 2 GST HST Return for Registrants If your due date is a Saturday Sunday or public holiday recognized by the CRA your payment is on time if

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

https://pbs.twimg.com/media/Ftfrk2DagAECRKs.jpg

Income Tax India On Twitter Dear Taxpayers Do Remember To File Your

https://pbs.twimg.com/media/FYUq-cDVEAE1wYC.jpg:large

https://www.canada.ca/en/revenue-agency/services/...

You are liable for the GST HST you charge on property or services on the day you receive payment or the day the payment is due whichever is earlier We usually consider a payment to be due on the date you issue an invoice or the date specified in an agreement whichever comes first

https://www.canada.ca/en/revenue-agency/news/...

When a due date falls on a Saturday Sunday or public holiday recognized by the CRA your return is considered on time if the CRA receives it or if it is postmarked on or before the next business day

Sales Tax Rates By Province In Canada Retail Council Of Canada

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Request For Revison Of Sales Tax Return U S 26 Of The Sales Tax Act

Your Colorado Sales Tax Return Is Due Soon

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

New Orleans Sales Tax 2021 Jarrett Joyner

New Orleans Sales Tax 2021 Jarrett Joyner

Where Can I See The Sales Tax Amount Printify

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

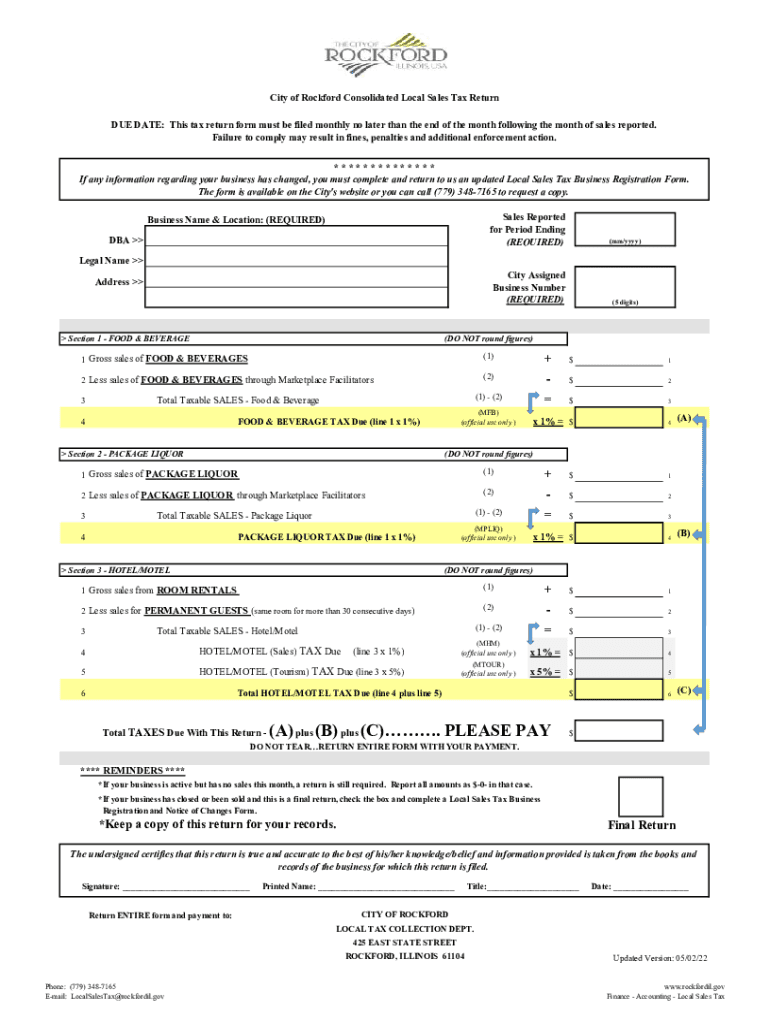

Fillable Online PDF Total TAXES Due With This Return City Of Rockford

Canada Sales Tax Return Due Date - Due Date if your reporting period is one or more months your due date is the last day of the month after the end of your reporting period For example if you re reporting for a period ending July 31 the due date for your PST return is August 31