Canadian Hst Tax Rebate Web Some of these expenses you paid may have included GST or HST If you deducted these expenses from your employment income you may be able to get a rebate of the GST or

Web Go to GST HST credit income levels and the GST HST credit payments chart to find out if you are entitled to receive the GST HST credit for the 2022 base year You can also use Web Employee whose employer is a GST HST registrant Report the rebate amount on line 10400 of your income tax and benefit return For example if in 2021 you received the

Canadian Hst Tax Rebate

Canadian Hst Tax Rebate

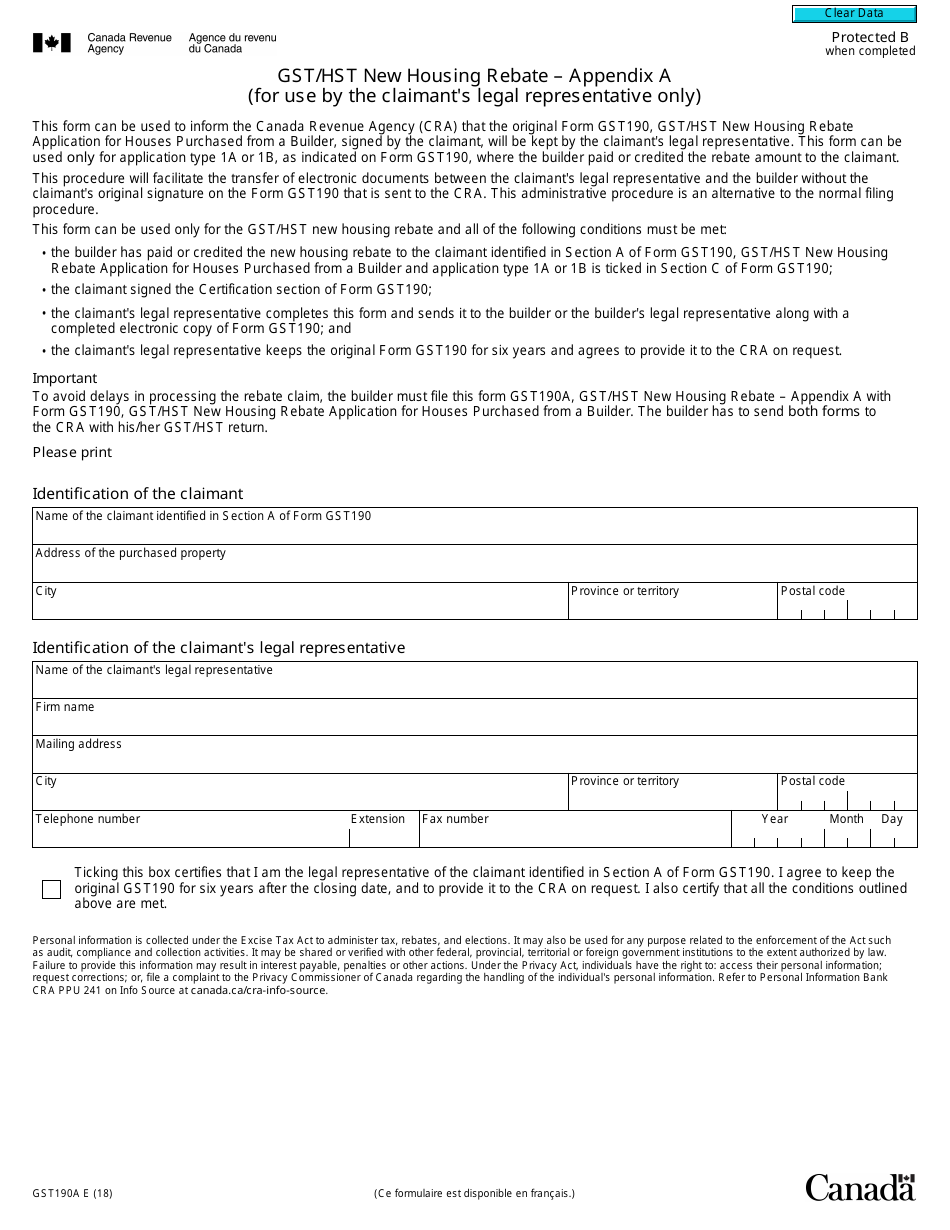

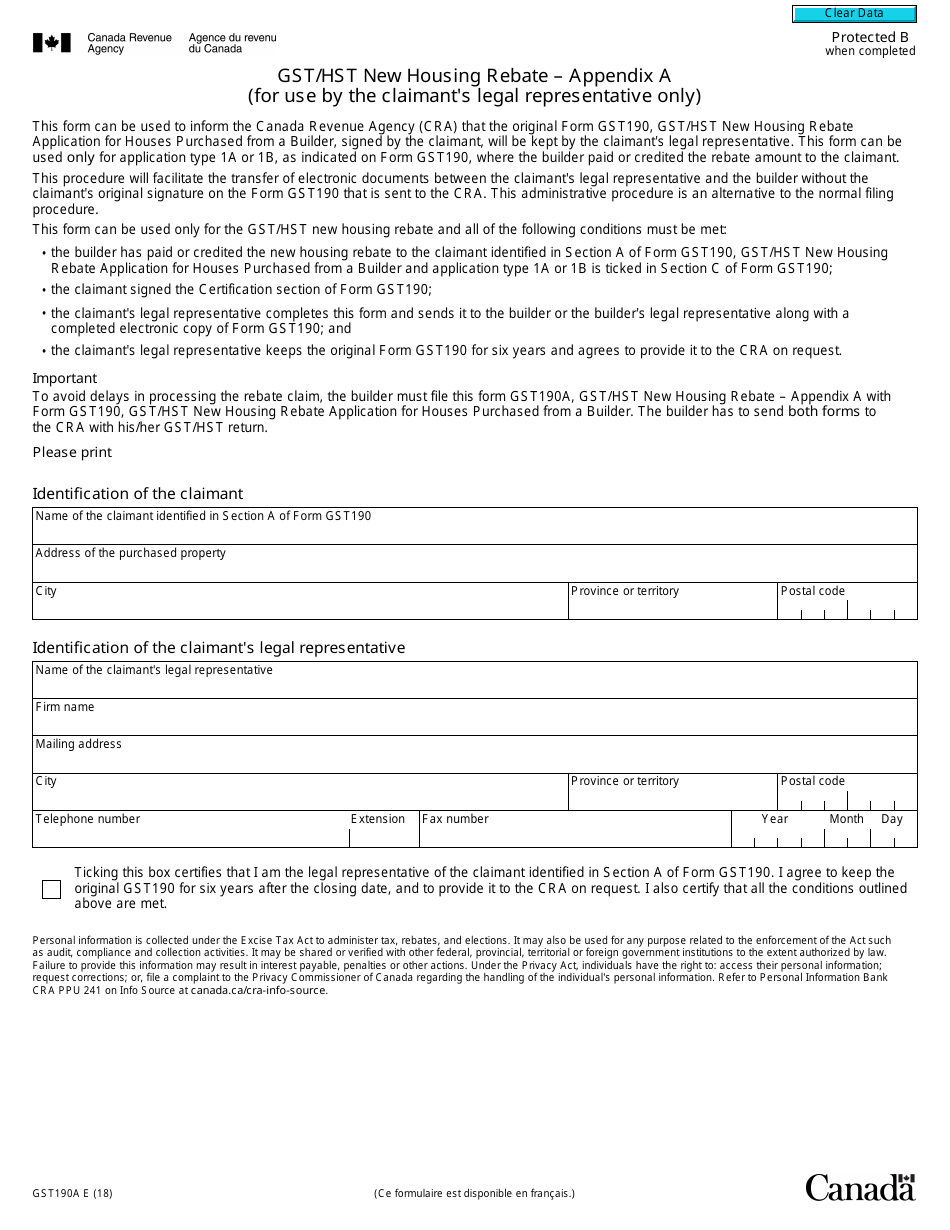

https://data.templateroller.com/pdf_docs_html/1869/18694/1869424/form-gst190a-schedule-a-gst-hst-new-housing-rebate-canada_print_big.png

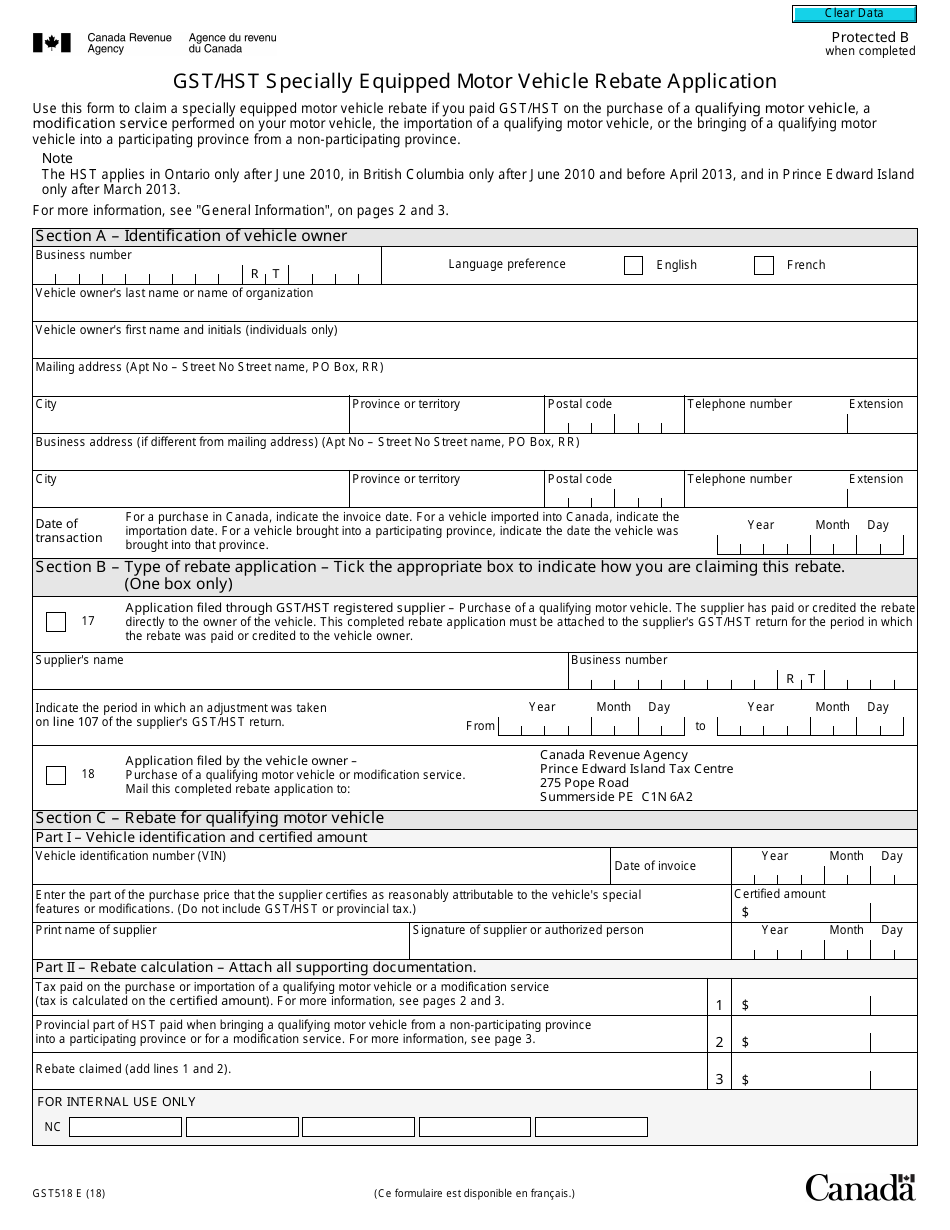

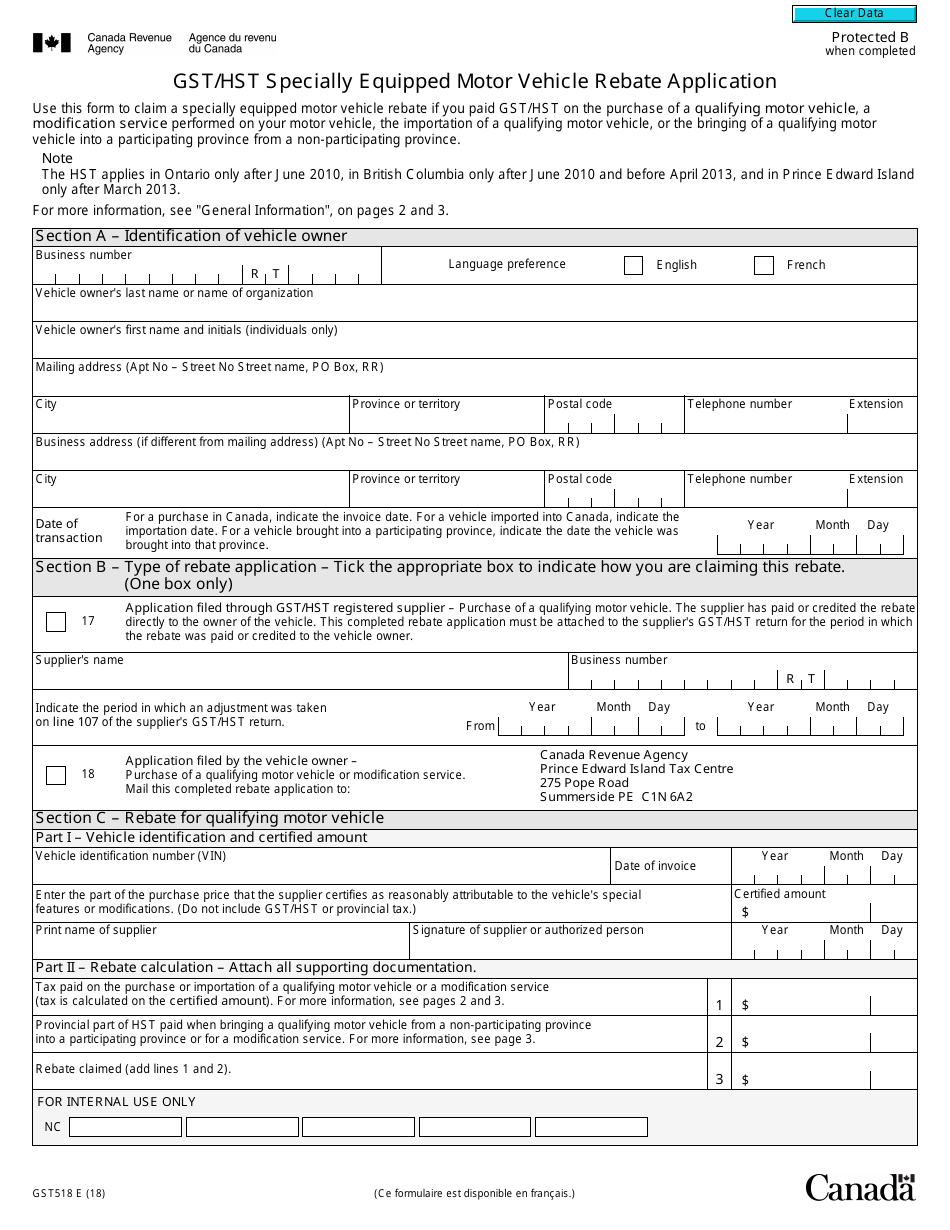

Form GST518 Download Fillable PDF Or Fill Online Gst Hst Specially

https://data.templateroller.com/pdf_docs_html/1869/18693/1869355/form-gst518-gst-hst-specially-equipped-motor-vehicle-rebate-application-canada_print_big.png

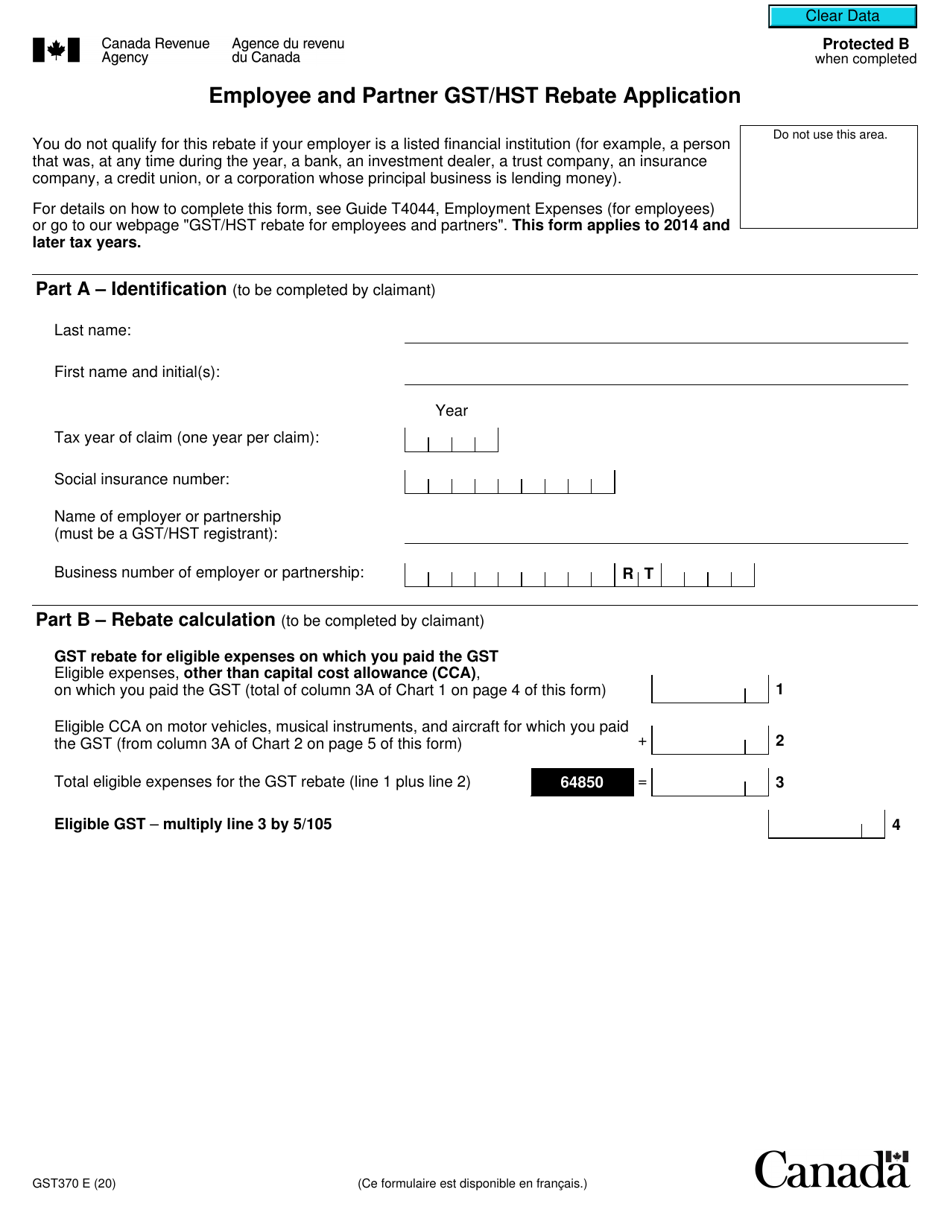

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

https://data.templateroller.com/pdf_docs_html/2066/20661/2066170/form-gst370-employee-and-partner-gst-hst-rebate-application-canada_print_big.png

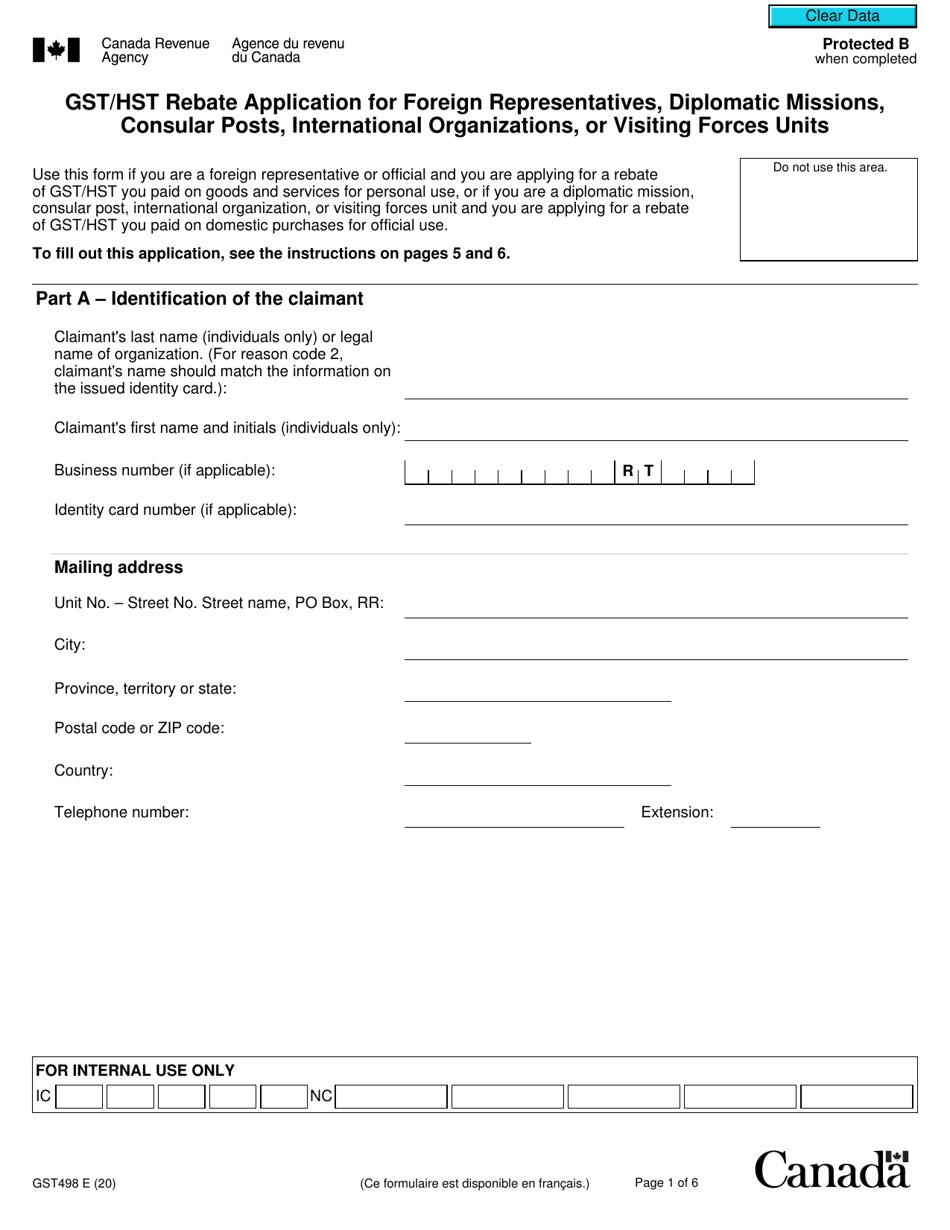

Web If you are eligible you can claim a GST HST rebate for foreign representatives diplomatic missions consular posts international organizations or visiting forces units This is a Web Eligibility for a rebate of the provincial part of the HST for eligible specified motor vehicles Other rebates for the provincial part of the HST on imported goods or on services

Web 21 avr 2023 nbsp 0183 32 To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2021 tax year ranges from 49 166 to 64 946 Web 20 d 233 c 2020 nbsp 0183 32 Completing Your GST HST Rebate From You must complete the GST370 Employee and Partner GST HST Rebate Application form to apply for the rebate Part A Report your identification information and

Download Canadian Hst Tax Rebate

More picture related to Canadian Hst Tax Rebate

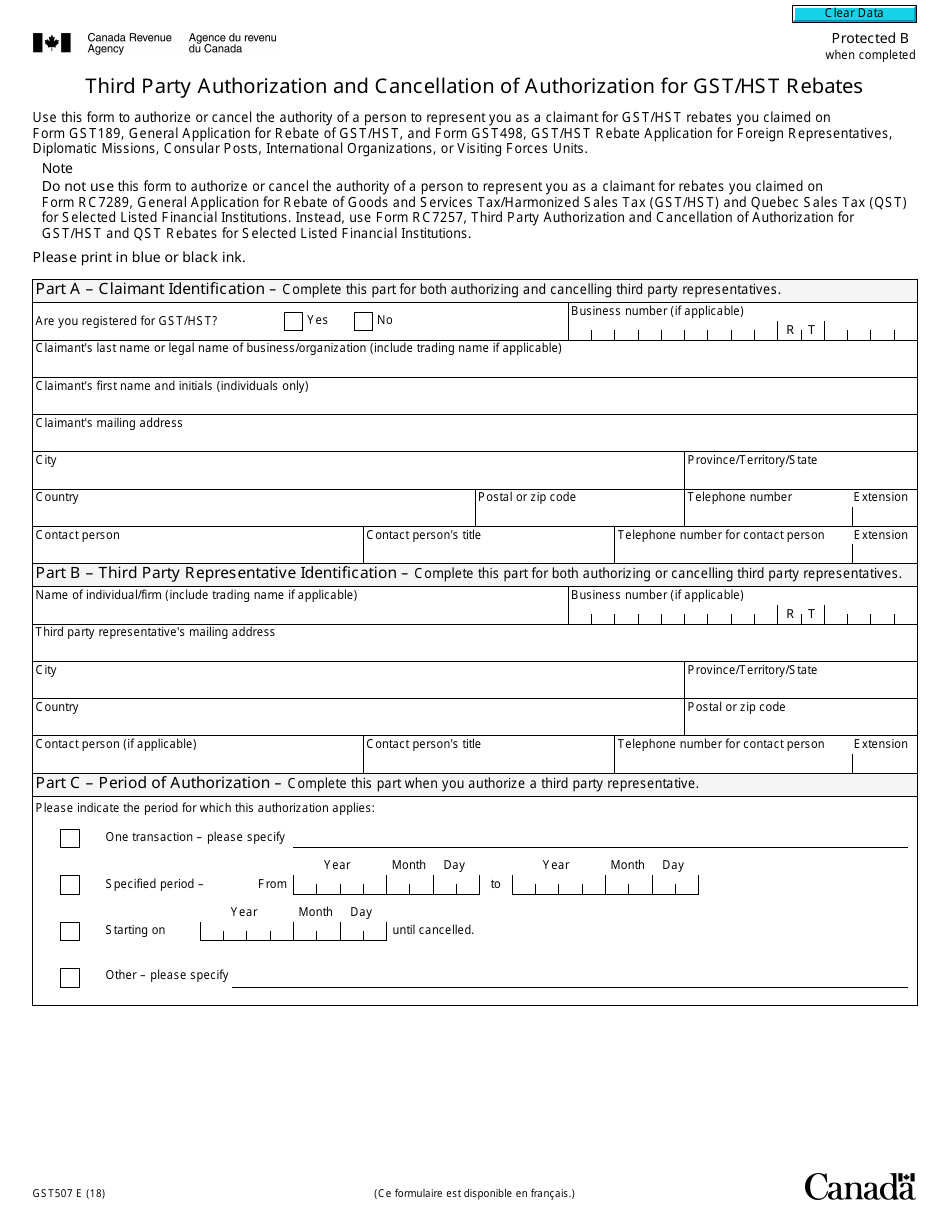

Form GST507 Download Fillable PDF Or Fill Online Third Party

https://data.templateroller.com/pdf_docs_html/1869/18693/1869350/form-gst507-third-party-authorization-and-cancellation-of-authorization-for-gst-hst-rebates-canada_print_big.png

HST Rebate Forms Ontario Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

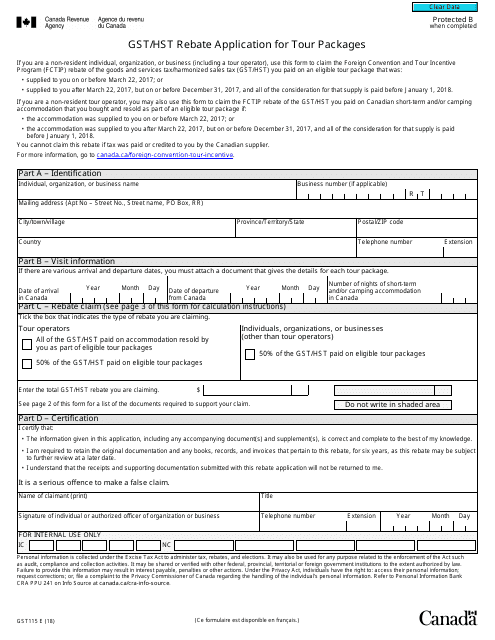

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

https://data.templateroller.com/pdf_docs_html/1869/18694/1869445/form-gst115-gst-hst-rebate-application-for-tour-packages-canada_big.png

Web Jurisdiction The HST is in effect in five of the ten Canadian provinces New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island The HST Web 1 Who is entitled to GST HST rebate In Canada suppliers charge the GST HST on taxable goods and services to foreign states international organizations and other offices and

Web In Canada there are two types of sales taxes levied These are Provincial sales taxes PST levied by the provinces Goods and services tax GST harmonized sales tax Web Tax rebate and exports of property outside Canada or the shipping of property outside Qu 233 bec See Exports of Property Outside Canada and Shipping of Property Outside

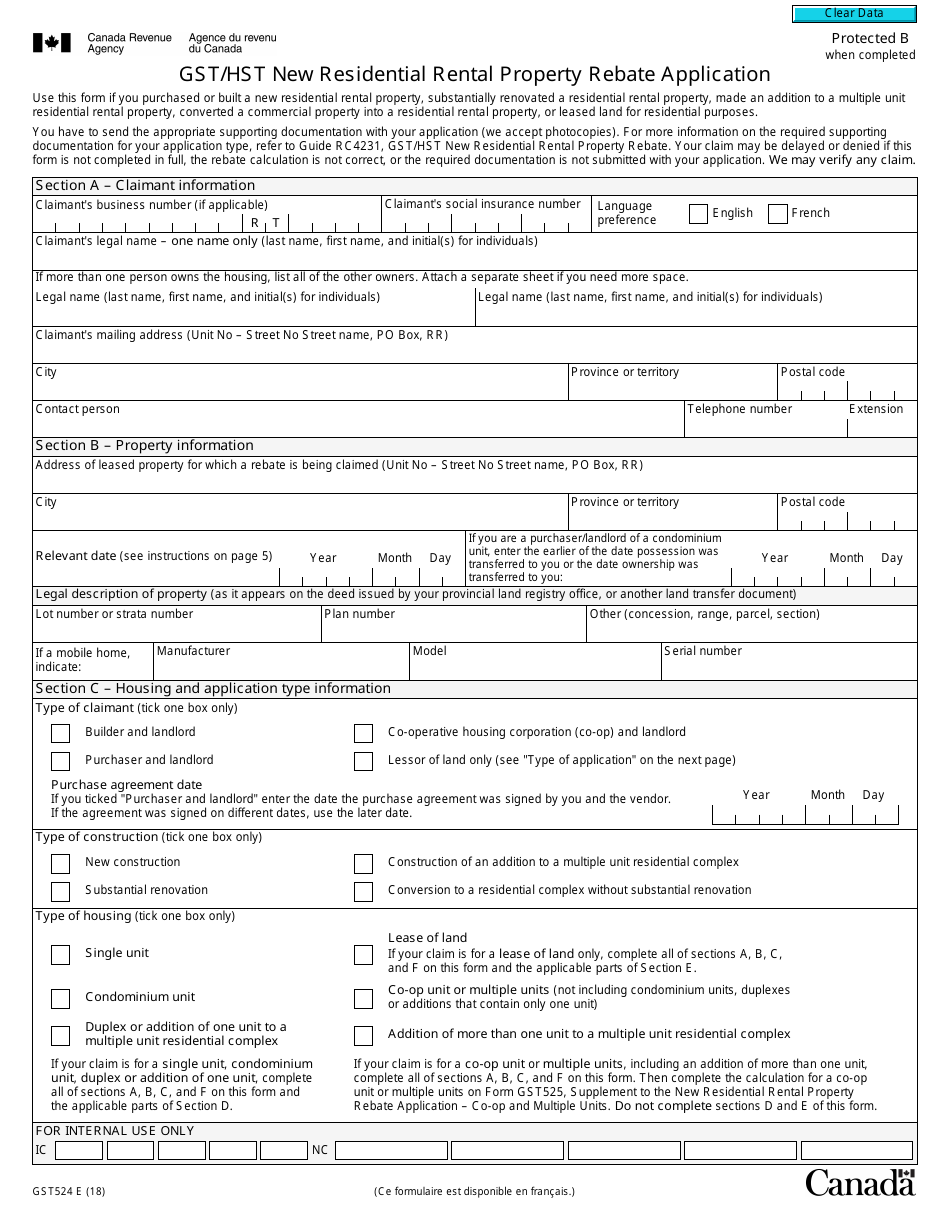

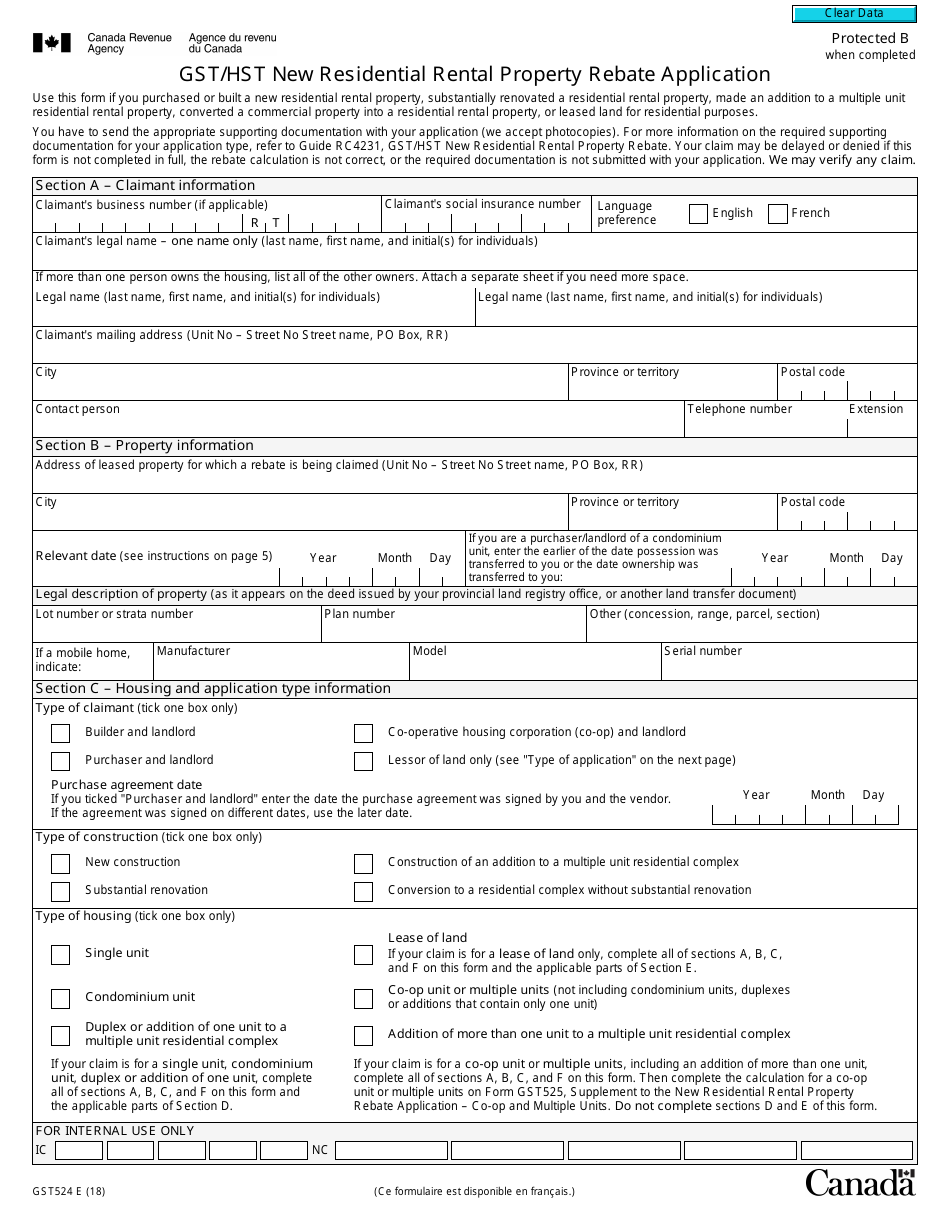

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://data.templateroller.com/pdf_docs_html/1869/18693/1869358/form-gst524-gst-hst-new-residential-rental-property-rebate-application-canada_print_big.png

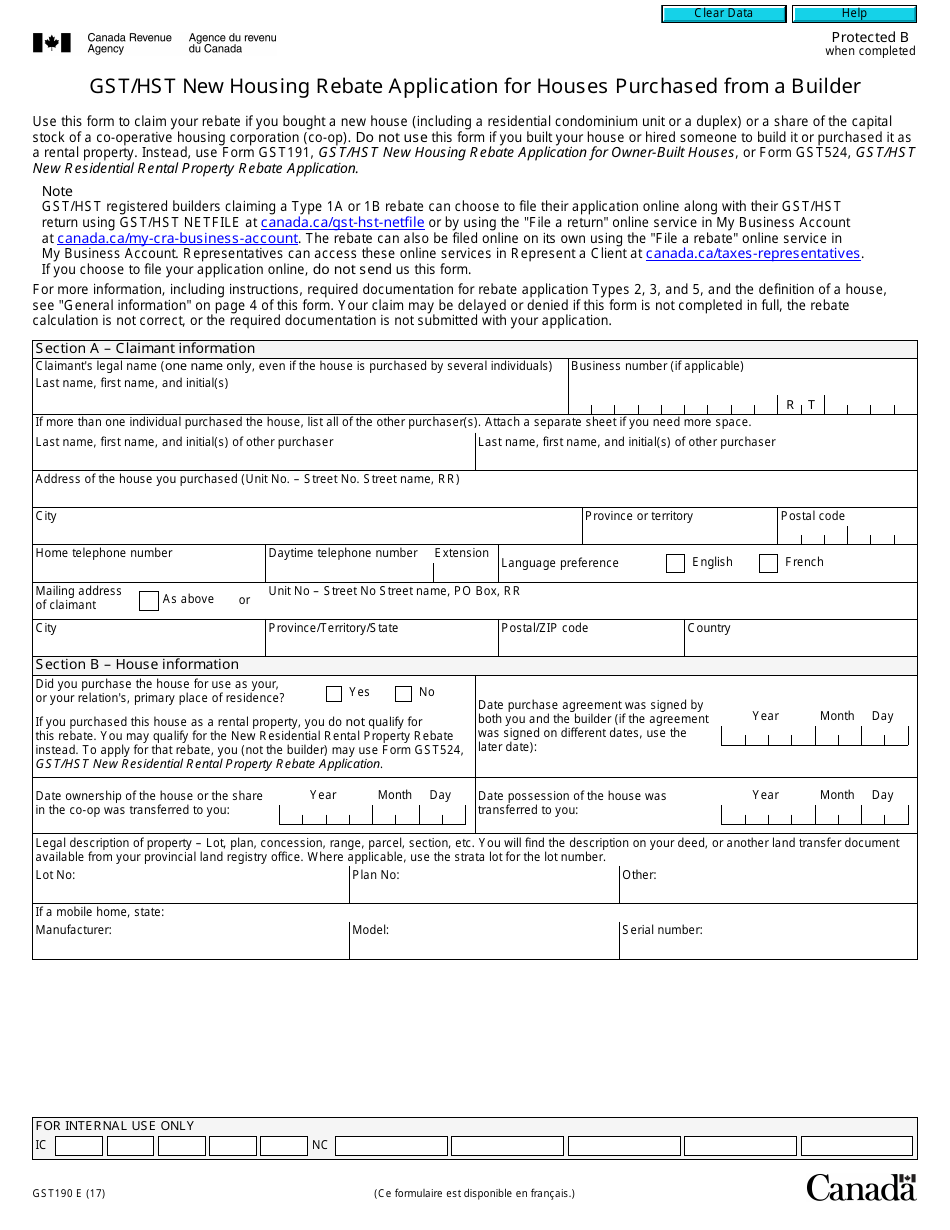

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

https://data.templateroller.com/pdf_docs_html/1867/18672/1867279/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_print_big.png

https://www.canada.ca/.../employee-gst-hst-rebate.html

Web Some of these expenses you paid may have included GST or HST If you deducted these expenses from your employment income you may be able to get a rebate of the GST or

https://www.canada.ca/en/revenue-agency/services/child-family-benefits/...

Web Go to GST HST credit income levels and the GST HST credit payments chart to find out if you are entitled to receive the GST HST credit for the 2022 base year You can also use

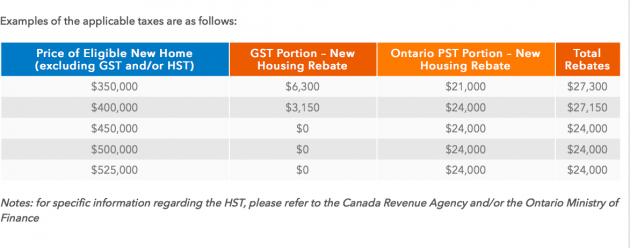

New Home HST Rebate Calculator Ontario

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

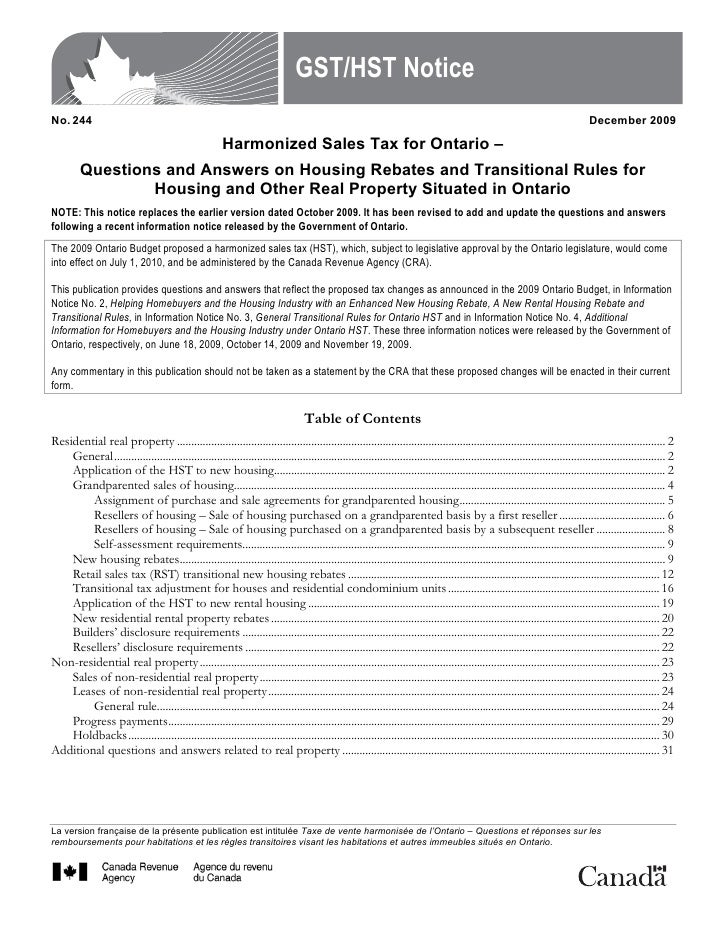

Canada Revenue GST HST Notice

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

Calculator Tax For GST Cananda

Calculator Tax For GST Cananda

This Graphic Shows The Amount Of Tax Charged In Each Province Of Canada

Taxes Ontario HST

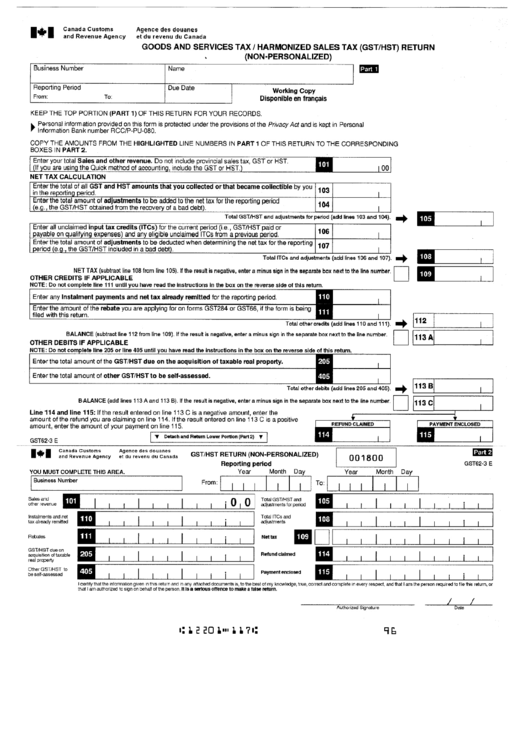

Goods And Services Tax harmonized Sales Tax Gst hst Return Non

Canadian Hst Tax Rebate - Web If you are eligible you can claim a GST HST rebate for foreign representatives diplomatic missions consular posts international organizations or visiting forces units This is a