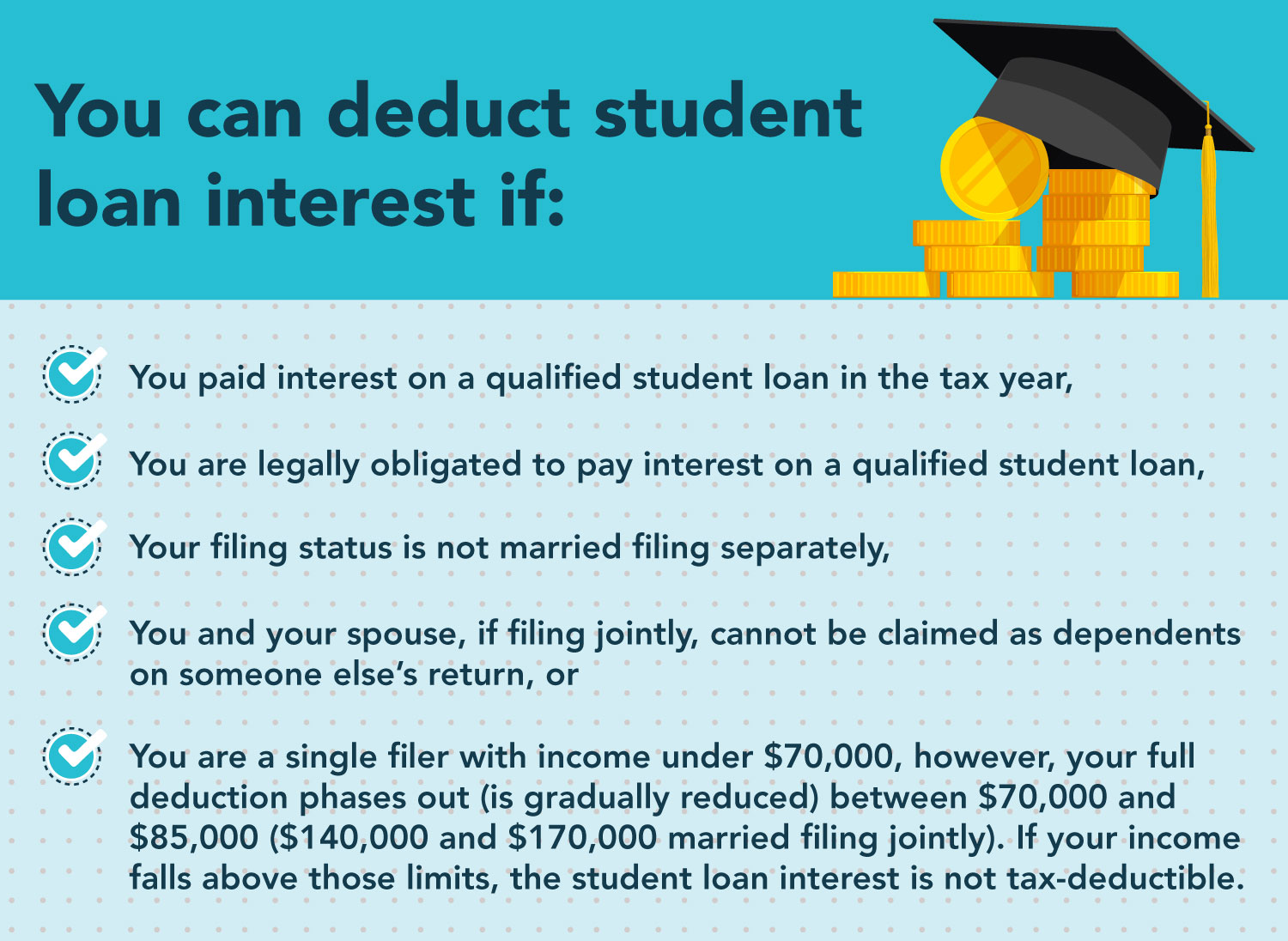

Tax Rebate For Student Loans Web 27 nov 2017 nbsp 0183 32 The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in

Web 20 juin 2017 nbsp 0183 32 The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies Web You can ask for a refund if you made repayments but your income over the whole tax year 6 April to 5 April the following year was less than 163 22 015 a year for Plan 1 163 27 295 a

Tax Rebate For Student Loans

Tax Rebate For Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png?fit=840%2C691&ssl=1

Will The Department Of Education Refund Offset TAXW

https://global-uploads.webflow.com/5ef3cd596e3d7e43d18dbac7/5ef75b5f1f17deb65c4ad813_RLvh0dSR9mdVbxKOilbC0LKZtfcU3jl1W08L7Ctz1HbCT-yZorRokdj4UNGiCmeEI5rP5waAACnGHewzRBFcKM0ul__V7AEMnvXVb-HvizpPwj8s2g3HCnpjMHq1HglJ2qveItRJ.png

Web 20 sept 2022 nbsp 0183 32 You can get a refund without applying if your payments brought your loan balance below the maximum debt relief amount 10 000 for all borrowers and 20 000 for Pell Grant recipients Borrowers Web 30 mars 2022 nbsp 0183 32 Once the federal student loan forbearance ends and the IRS has the green light to start collection activities again any tax refund you receive can be garnished and used for your unpaid

Web 10 nov 2022 nbsp 0183 32 President Joe Biden has announced a program to forgive up to 20 000 in federal student loan debt each for tens of millions of borrowers Applications for the Web 29 d 233 c 2016 nbsp 0183 32 Your student loan Plan 1 2 or 4 deduction will be calculated based on 9 of your total income above the threshold of your plan type Your PGL deduction will be

Download Tax Rebate For Student Loans

More picture related to Tax Rebate For Student Loans

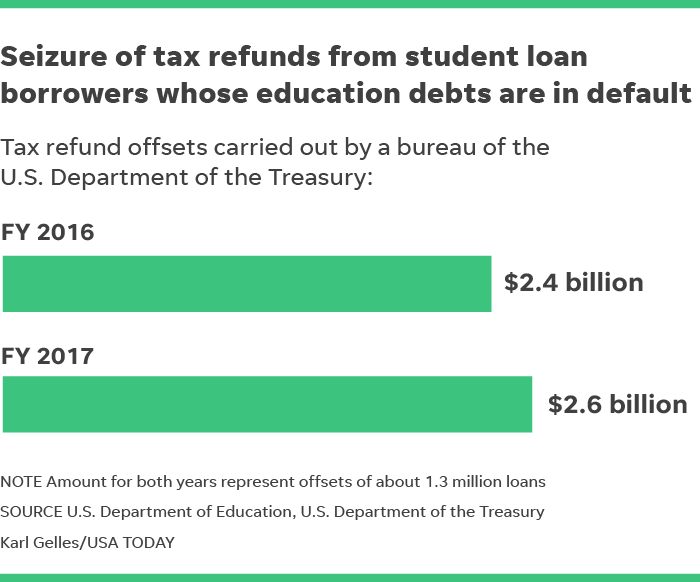

Tax Refunds Of 2 6B Were Seized During 17 To Repay Student Loans In

https://www.gannett-cdn.com/media/2018/04/17/USATODAY/USATODAY/636595805484628789-041718-TAX-SEIZURES-Online.png

How To Find My Student Loan Disbursement Date

https://studentloanhero.com/wp-content/uploads/1b1f5294-3e8d-49d3-b7d3-2398c85eea63_pasted20image200.png

When You Owe Student Loans Do They Take Your Taxes Student Gen

https://global-uploads.webflow.com/5ef3cd596e3d7e43d18dbac7/5ef762441883fa2a4c8c4f26_Q3VHUPa1n1KwVqe6tJQtyEK8BzdSnD7wyTv2hBddQAPpliiflJ0MH-pNc1ellmquG0bzNGOp9XdNFXPPaWVy3AGD1NiOstH_teFmTDTF3CcR-gSptyw4WJk42_IM0vhChtqndZln.jpeg

Web Il y a 1 jour nbsp 0183 32 Student Loan Forgiveness Under IDR Account Adjustment Continues While millions of borrowers will be receiving bills in the next few weeks over 800 000 Web 21 mars 2023 nbsp 0183 32 Before the Covid pandemic nearly 13 million taxpayers took advantage of the student loan interest deduction which allows borrowers to deduct up to 2 500 a

Web 31 ao 251 t 2023 nbsp 0183 32 Here are three drawbacks of the SAVE plan 1 Borrowers with mid level balances don t stand to benefit as much Your monthly payment on the SAVE plan is Web 11 oct 2022 nbsp 0183 32 Yes the interest portion of your student loan payments is tax deductible in 2022 However you cannot deduct the principal portion of your loan payments the

Student Loans Deduction Nitisara Omran

https://mygreatlakes.org/mglstatic/educate/images/knowledge-center/1098e_interest_statement.jpg

Where Do I Mail Hardship Deferment Student Loan

https://i2.wp.com/www.studentloanplanner.com/wp-content/uploads/2019/08/317d3eba-4a22-4dd5-bd52-a7f80aa01ba5_Screen20Shot202019-07-2420at202.56.2520PM.png

https://www.nerdwallet.com/article/loans/student-loans/8-student-faqs...

Web 27 nov 2017 nbsp 0183 32 The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in

https://www.nerdwallet.com/article/loans/stud…

Web 20 juin 2017 nbsp 0183 32 The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies

FitBUX Frequently Asked Questions

Student Loans Deduction Nitisara Omran

The Top 8 Can Student Loans Be Taken Out Of Taxes Best Showbiz Secrets

What Does Rebate Lost Mean On Student Loans

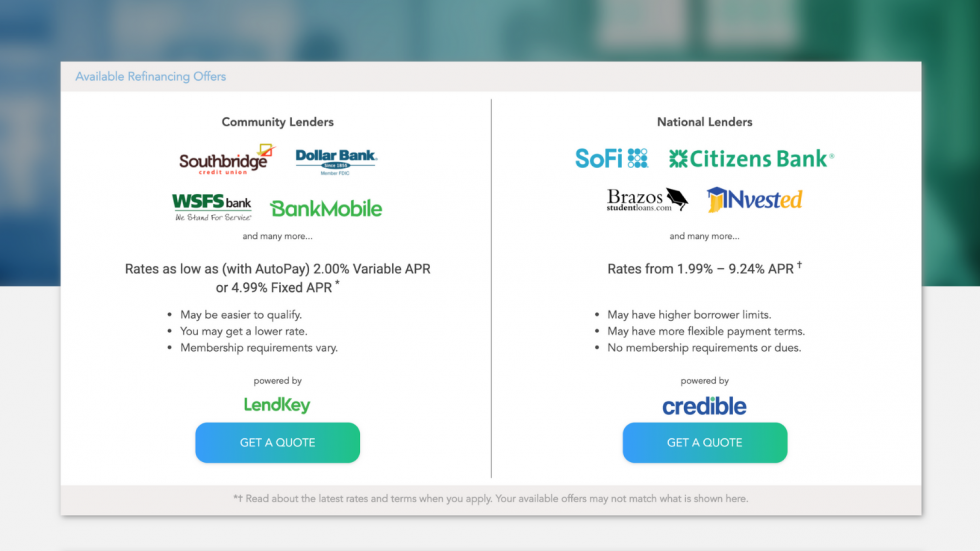

200 Rebate For Refinancing Peanut Butter Student Loan Assistance

Continue To Claim Interest Deduction Even If Interest Continues To

Continue To Claim Interest Deduction Even If Interest Continues To

Should I Use Tax Credits Or Deductions To Save On My Student Loans

Parent Plus Loan Repayment Calculator TaurabMaies

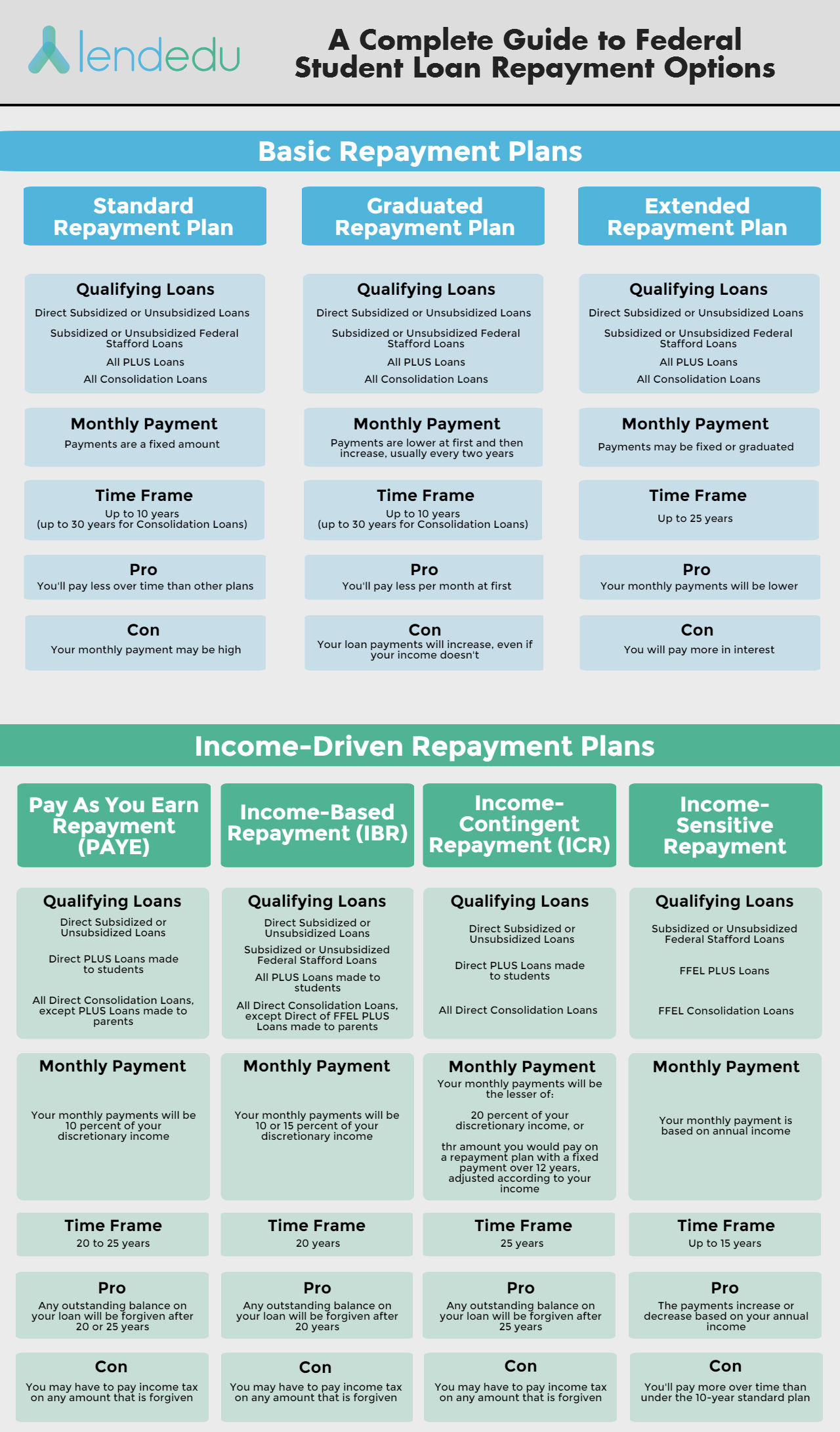

Calculating Your Student Loan Payments In 2023 Funaya Park

Tax Rebate For Student Loans - Web 29 d 233 c 2016 nbsp 0183 32 Your student loan Plan 1 2 or 4 deduction will be calculated based on 9 of your total income above the threshold of your plan type Your PGL deduction will be