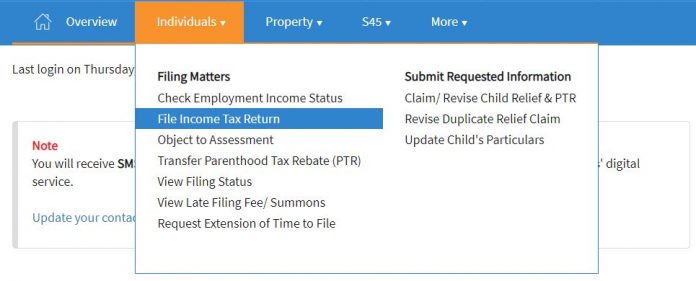

Parenthood Tax Rebate One Time Web The Parenthood Tax Rebate PTR scheme is a one time tax abatement that can be claimed in the year following a child s birth though any child born after 2008 is

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and

Parenthood Tax Rebate One Time

Parenthood Tax Rebate One Time

https://www.raisingangels.sg/wp-content/uploads/2021/11/PTR2-696x281.jpg

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

https://financialhorse.com/wp-content/uploads/2022/01/posb-696x706.jpg

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=348504300640971

Web The Parenthood Tax Rebate PTR is a one time tax abatement that can be claimed in the year following your child s birth Each qualifying child entitles you to a rebate of up to 20 000 making it a fantastic incentive Web Parenthood Tax Rebate PTR The PTR is a credit to offset your tax payable You can make a one time claim for PTR in the year following your child s year of birth Any

Web PARENTHOOD TAX REBATE PTR claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you Web Check your Eligibility for Parenthood Tax Rebate PTR only applies to children born to the family adopted by family on or after 1 Jan 2008 Is your child a Singapore citizen at the

Download Parenthood Tax Rebate One Time

More picture related to Parenthood Tax Rebate One Time

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2781915438586529

Parenthood Pays Off Singapore s Tax Rebate For Families

https://static.cdntap.com/tap-assets-prod/wp-content/uploads/sites/12/2011/12/iStock-932775232.jpg?width=700&quality=95

Discover The Joy Of Being A Parent With Singapore s Parenthood Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cCarR.img?w=670&h=445&m=4&q=84

Web The Parenthood Tax Rebate PTR is a one time tax abatement that can be claimed in the year following your child s birth Each qualifying child entitles you to a rebate of up to Web 3 mai 2023 nbsp 0183 32 Last reviewed 03 May 2023 Parenthood tax rebate A rebate against either or both parents tax liability of SGD 5 000 SGD 10 000 and SGD 20 000 is available for

Web 23 f 233 vr 2023 nbsp 0183 32 In this calculation we will assume that the one time PTR has already been fully utilised and the father is the one claiming for 4 000 QCR per child If you are Web Taxes Individual Income Tax Basics of Individual Income Tax Tax reliefs rebates and deductions Qualifying Child Relief QCR Handicapped Child Relief HCR Qualifying

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

https://financialhorse.com/wp-content/uploads/2022/01/maternity-leave-1024x708.jpg

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Depositphotos_97954768_L.jpg

https://www.sassymamasg.com/family-life-parenthood-tax-rebate-singap…

Web The Parenthood Tax Rebate PTR scheme is a one time tax abatement that can be claimed in the year following a child s birth though any child born after 2008 is

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

All About The Parenthood Tax Rebate In Singapore

One Time Tax Rebates Will Fall Short Of Political

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Parenthood Tax Rebate Singapore 2021 How Much You Can Claim

Parenthood Tax Rebate Singapore 2021 How Much You Can Claim

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

IFG 3 PAP Nee Soon

Parenthood Pays Off Singapore s Tax Rebate For Families

Parenthood Tax Rebate One Time - Web PARENTHOOD TAX REBATE PTR claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you