Canadian Tax Return Form For Non Residents If you are still not sure whether you were a non resident of Canada for tax purposes in 2023 complete Form NR74 Determination of Residency Status entering Canada or

To ensure that the correct portion of tax is deducted by your Canadian payers people employers or other entities who pay you money you should notify To file your Canadian non resident tax return you need your Social Insurance Number but if you don t have one you need to apply for an Individual Tax Number using Form T1261 Application for a CRA

Canadian Tax Return Form For Non Residents

Canadian Tax Return Form For Non Residents

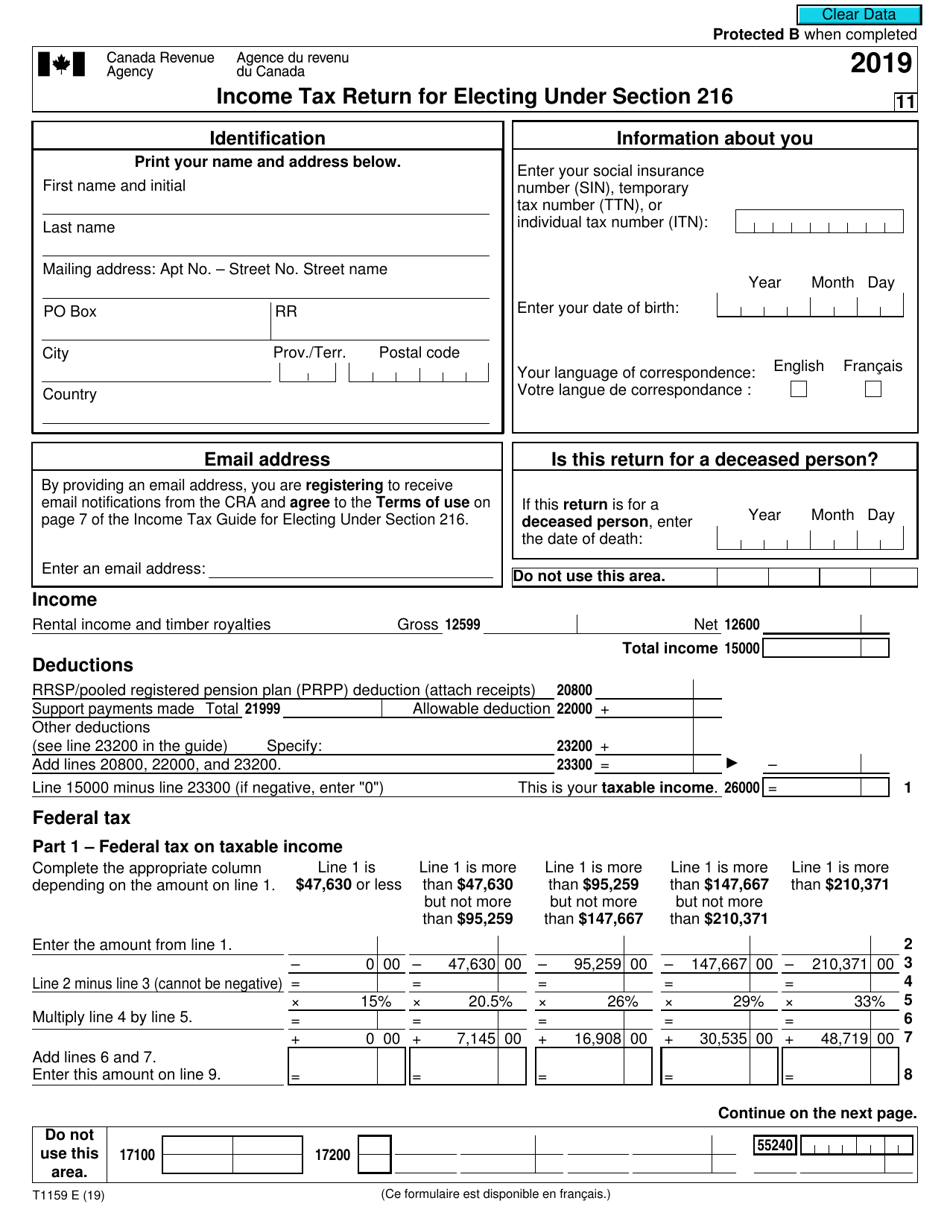

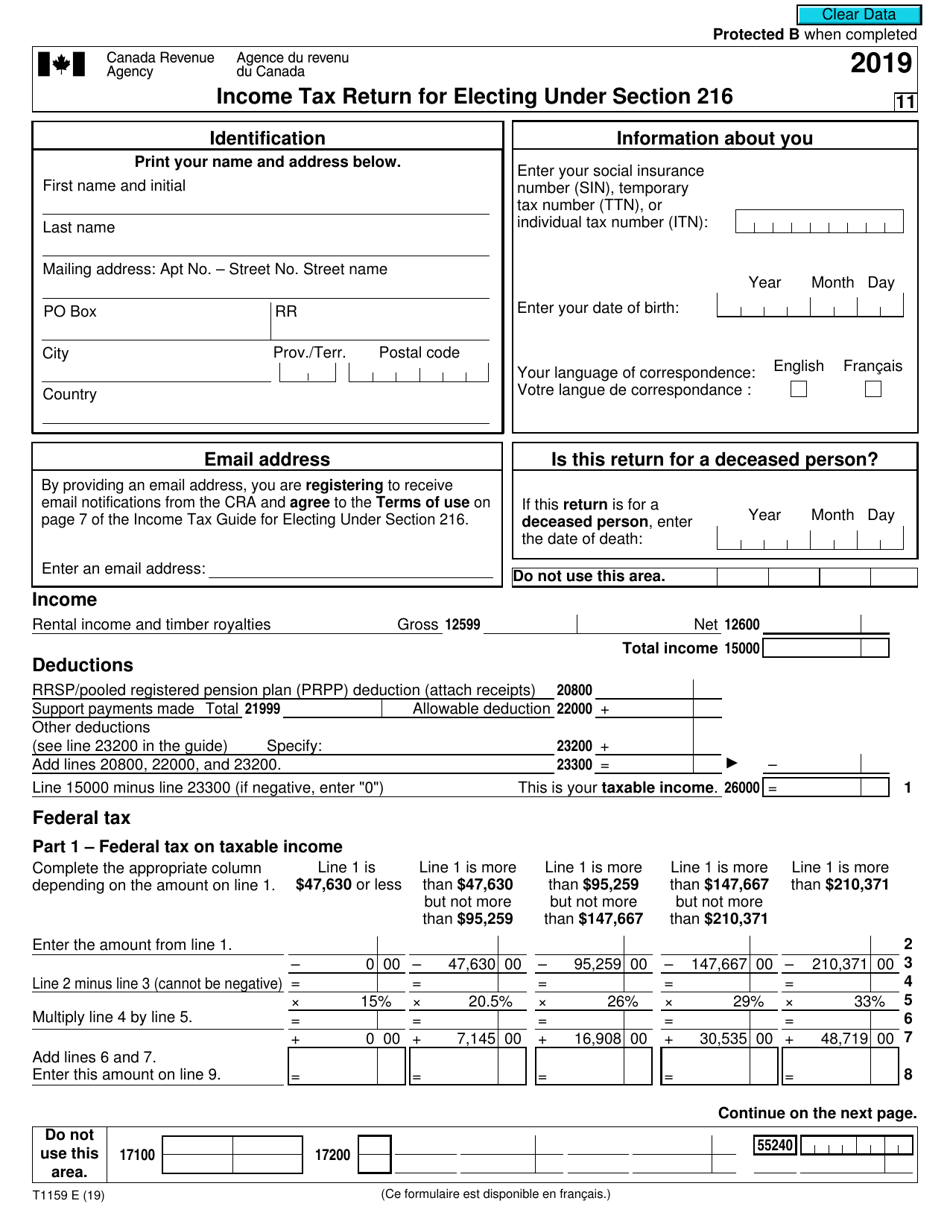

https://data.templateroller.com/pdf_docs_html/2066/20662/2066251/form-t1159-income-tax-return-for-electing-under-section-216-canada_print_big.png

Bx91as 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/512/699/512699834/large.png

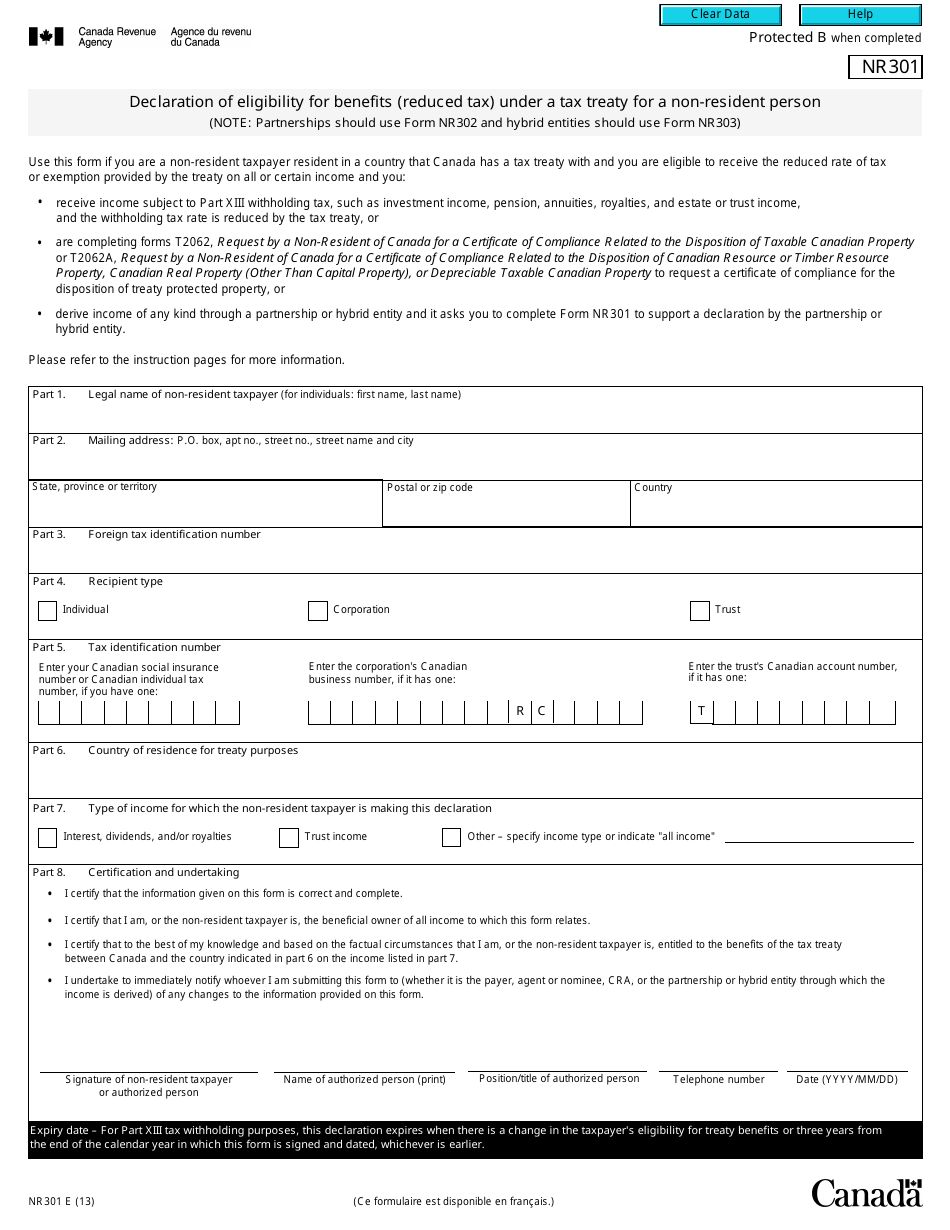

Form NR301 Fill Out Sign Online And Download Fillable PDF Canada

https://data.templateroller.com/pdf_docs_html/1869/18692/1869299/form-nr301-declaration-of-eligibility-for-benefits-reduced-tax-under-a-tax-treaty-for-a-non-resident-person-canada_print_big.png

If you are a non resident you need to file a special tax return Form 5013 R T1 Income Tax and Benefit Return for Non Residents and Deemed Residents of Income Tax and Benefit Guide for Non Residents and Deemed Residents of Canada It includes the return you will need For more information see Electing under section 217

You can apply to the CRA for an assessment of your resident status by filling out Form NR74 Determination of Residency Status Entering Canada or Form NR73 Determination of Residency Status Here s key information you need when filing your tax return and claiming your Canadian tax refund as a non resident

Download Canadian Tax Return Form For Non Residents

More picture related to Canadian Tax Return Form For Non Residents

Marginal Tax Rates For Each Canadian Province Kalfa Law Firm

https://kalfalaw.com/wp-content/uploads/2020/04/Marginal-Tax-Rates-2020_Ontario.png

Finance Blog Ottawa

https://blogottawa.ca/wp-content/uploads/2017/03/Tax-Preparation-for-Non-Residents.jpeg

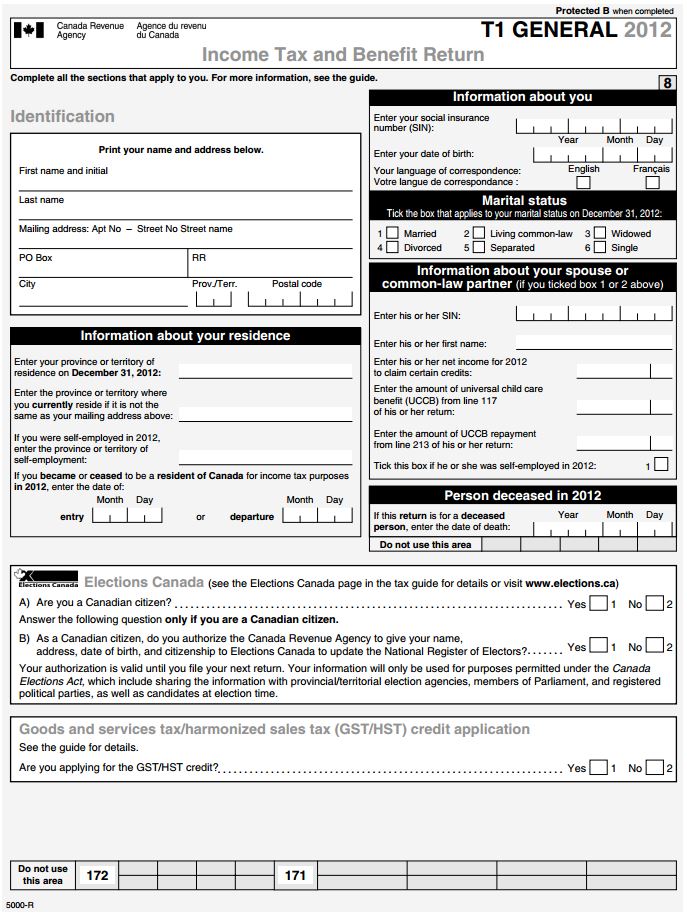

Free Alberta Canada Income Tax And Benefit Return Form T1 General

https://formdownload.org/wp-content/uploads/2013/09/Alberta-Canada-Income-Tax-and-Benefit-Return-Form-T1-General.jpg

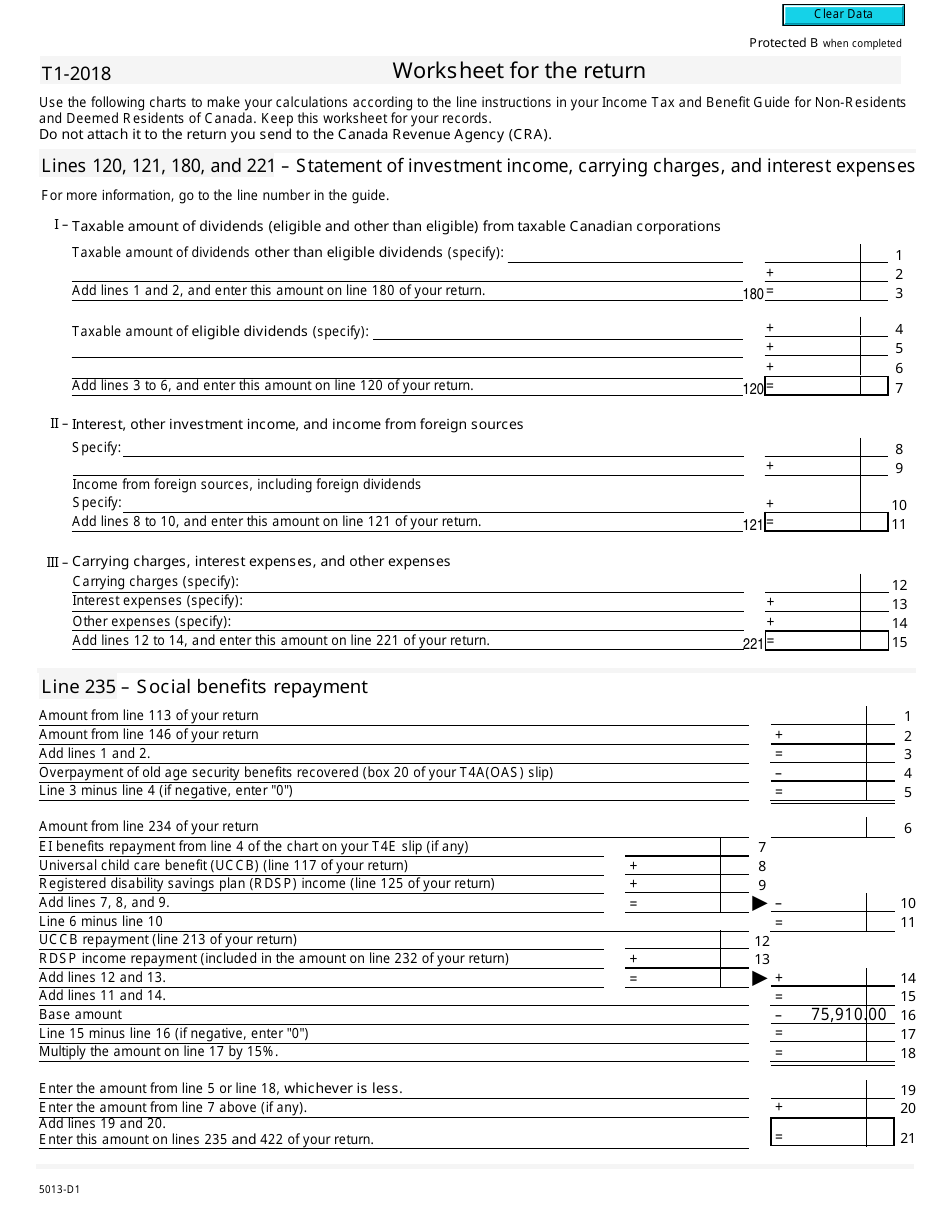

Return Income Tax and Benefit Return for Non Residents and Deemed Residents of Canada Federal Worksheet for non residents and deemed residents of Canada Maximize your refund with these 7 essential tips for filing a non resident tax return in Canada including insights on NR4 NR6 T1159 and T2062 forms

Learn about the process of filing a Canadian income tax return as a non resident including the use of income tax packages based on your income sources and 21 Income Tax and Benefit Return for Non Residents and Deemed Residents of Canada Use the information in this tax package along with y ave to file a return to get t S

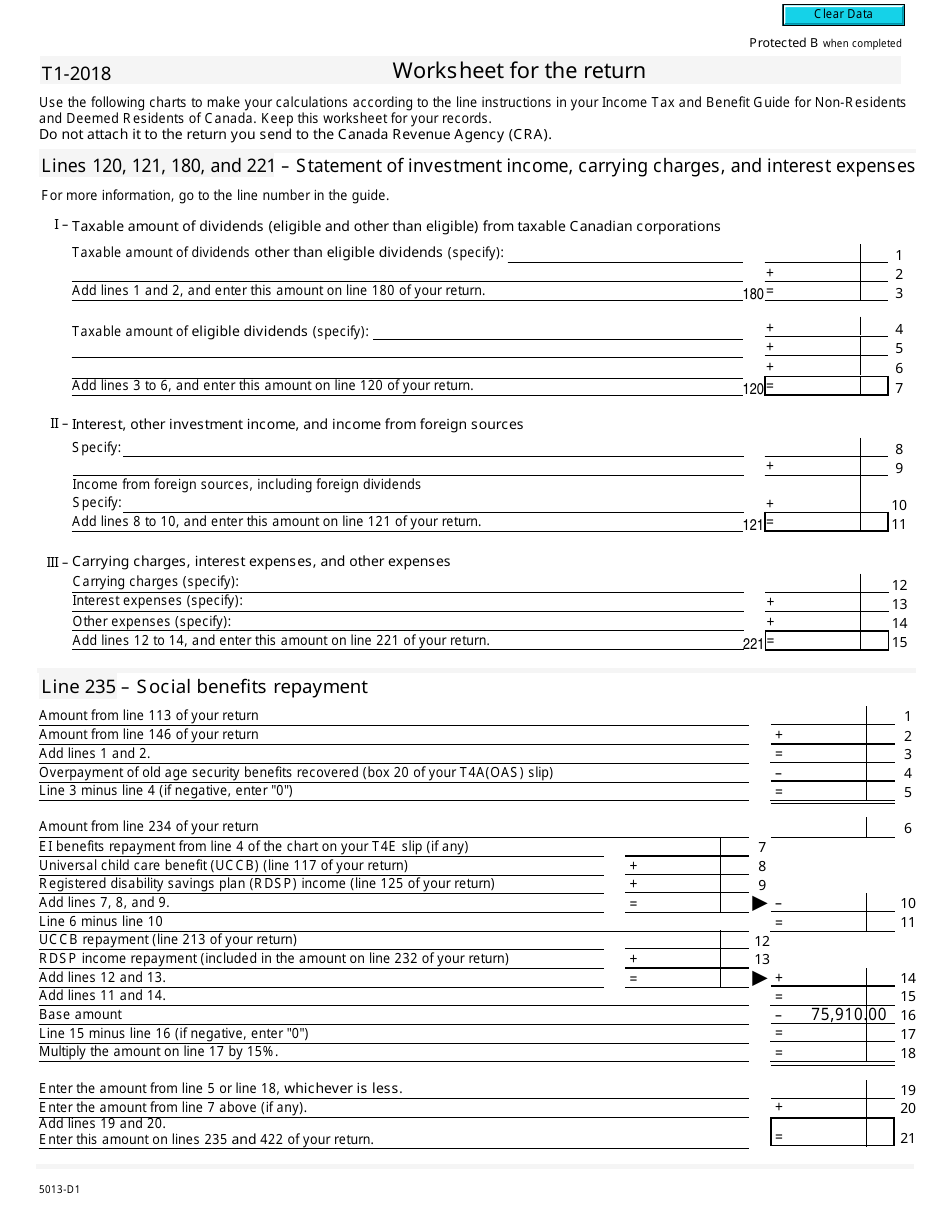

Form 5013 D1 2018 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/1867/18679/1867925/form-5013-d1-worksheet-for-the-return-canada_print_big.png

What s New For Your Tax Return New Credits Should Mean Bigger Refunds

https://i.pinimg.com/originals/a2/bd/94/a2bd94c5b840498e9ba4ddc8abcbcbb9.png

https://www.canada.ca/en/revenue-agency/services/...

If you are still not sure whether you were a non resident of Canada for tax purposes in 2023 complete Form NR74 Determination of Residency Status entering Canada or

https://turbotax.intuit.ca/tips/filing-income-tax...

To ensure that the correct portion of tax is deducted by your Canadian payers people employers or other entities who pay you money you should notify

New Push On US run Free Electronic Tax filing System For All

Form 5013 D1 2018 Fill Out Sign Online And Download Fillable PDF

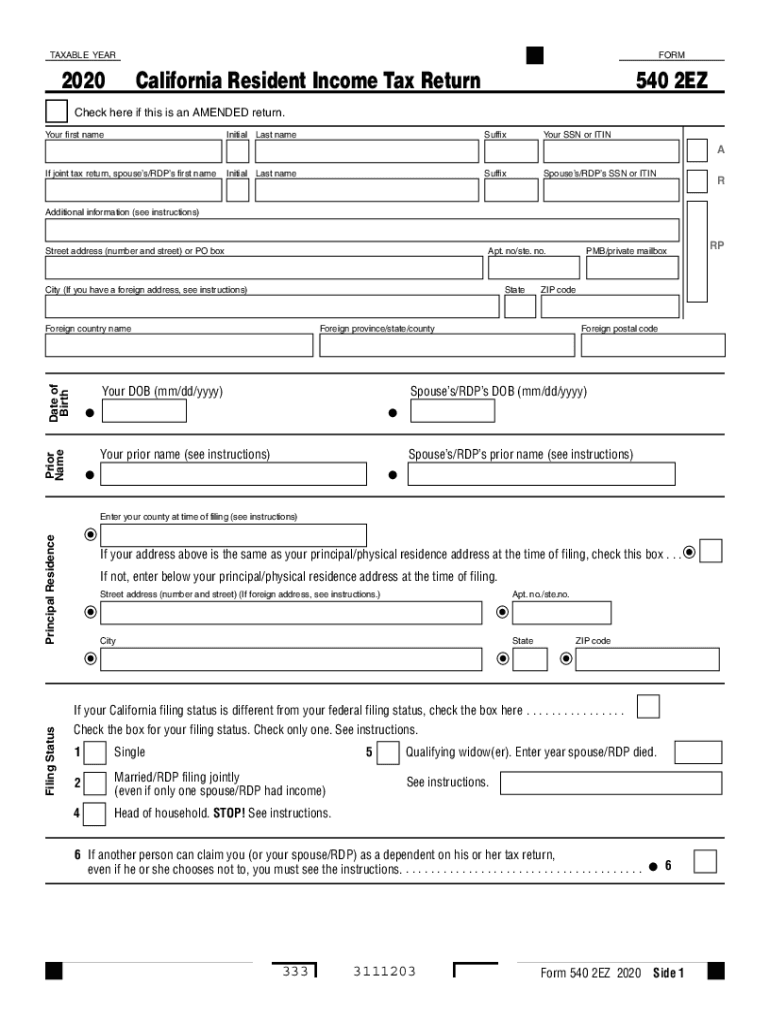

2014 Printable 540 2Ez Form Fill Out And Sign Printable PDF Template

Canada T2 Corporation Income Tax Return 2020 2022 Fill And Sign

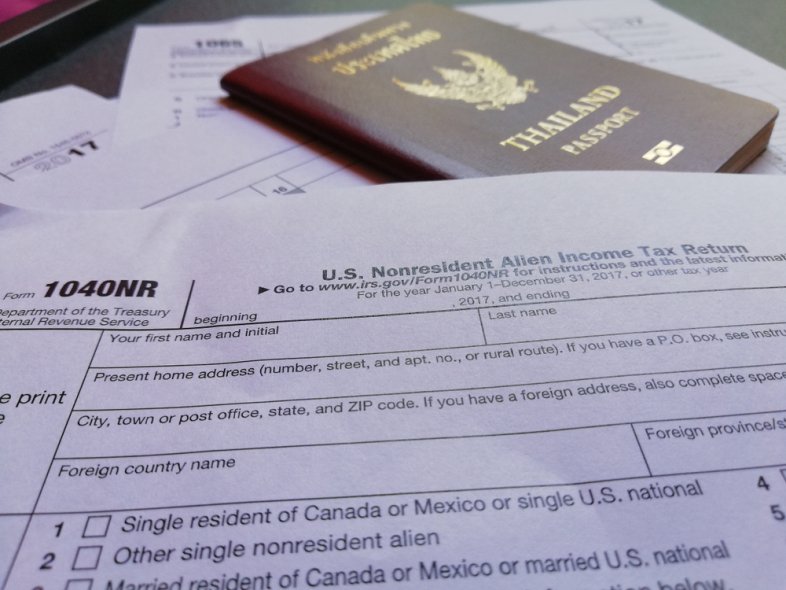

What Non U S Citizens Should Know About Filing U S Tax Returns And

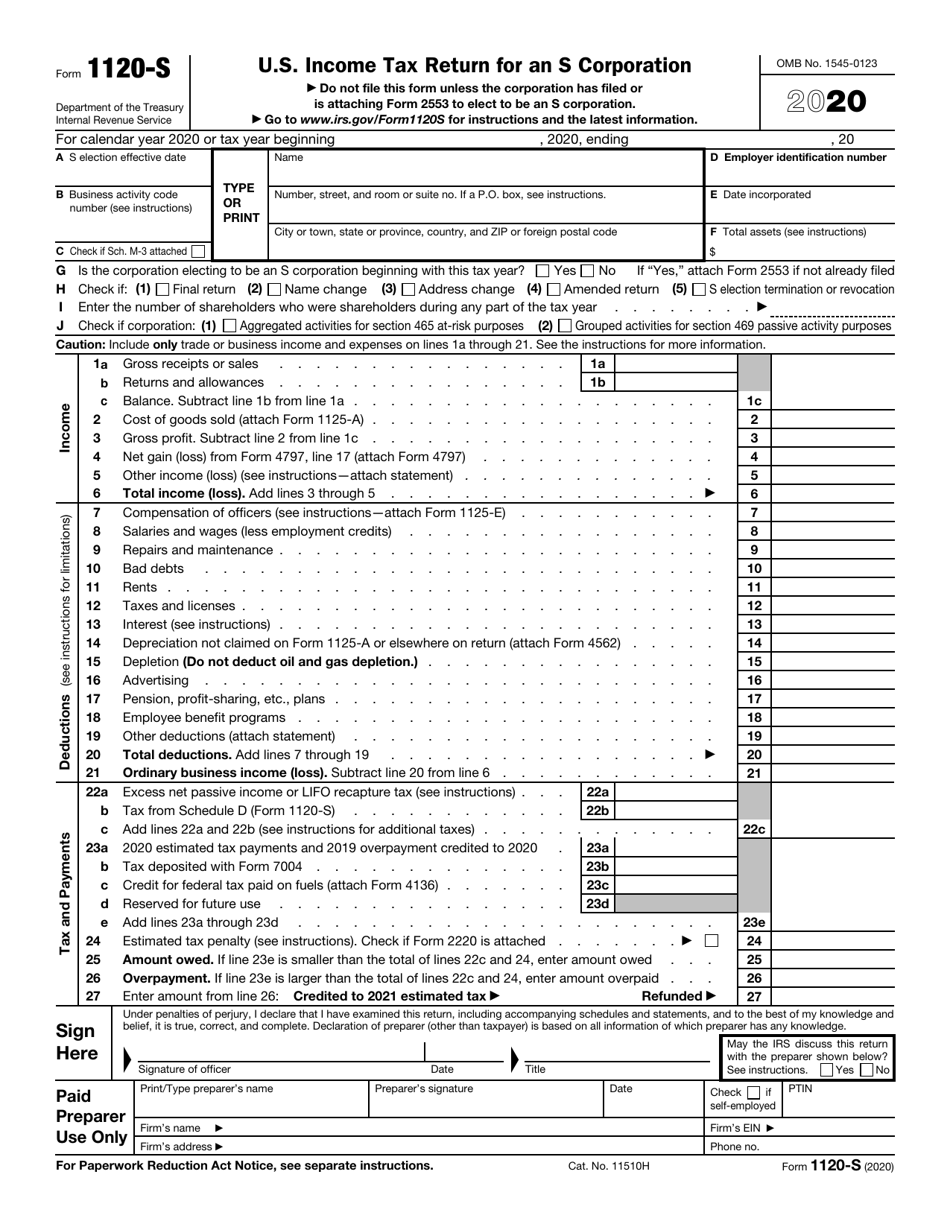

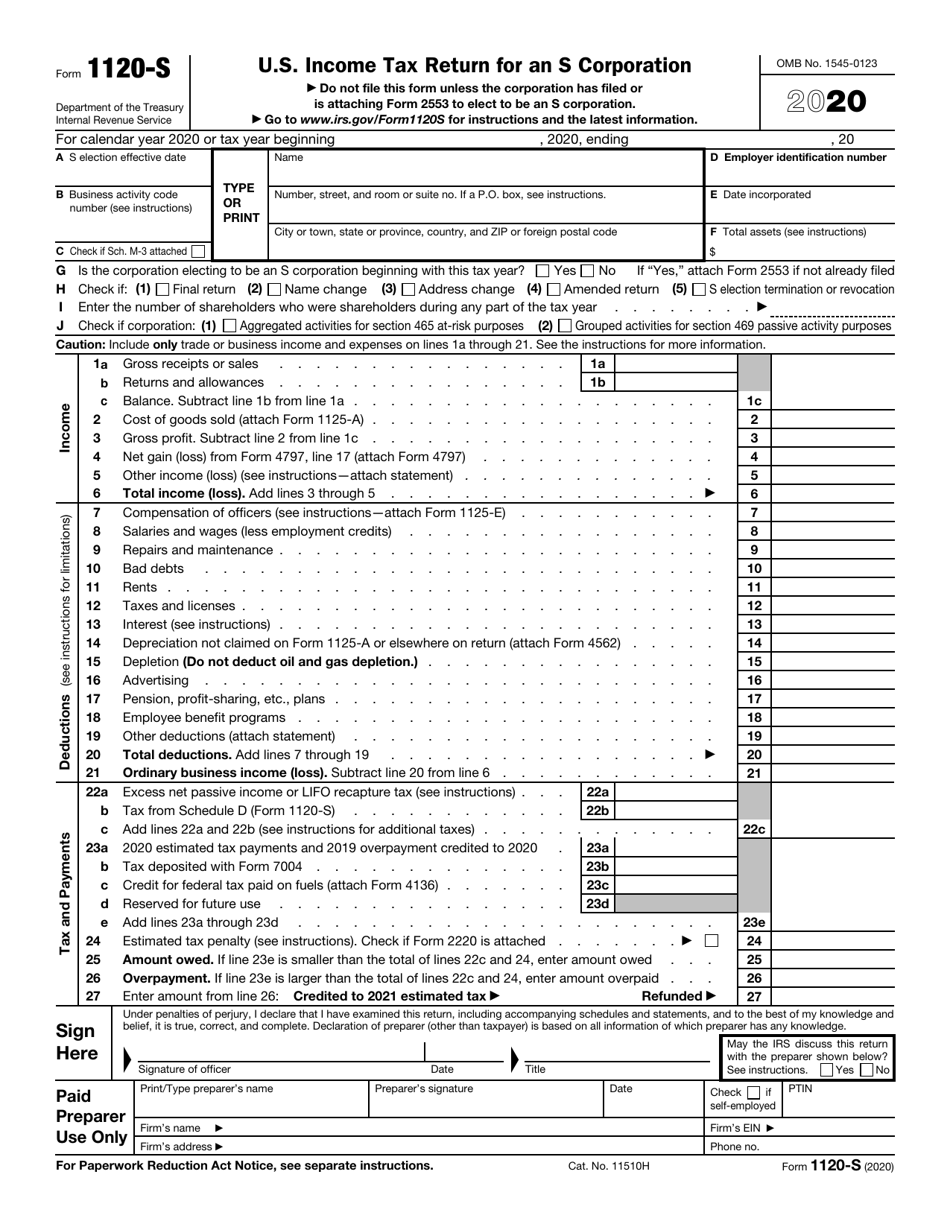

IRS Form 1120 S Download Fillable PDF Or Fill Online U S Income Tax

IRS Form 1120 S Download Fillable PDF Or Fill Online U S Income Tax

Do It Yourself Tax Return Canada How To File Your Taxes Online In

Canadian Corporate Tax T2 Return Form With Calculator To Calculate

What Is Line 15000 Tax Return formerly Line 150 In Canada

Canadian Tax Return Form For Non Residents - Income Tax and Benefit Guide for Non Residents and Deemed Residents of Canada It includes the return you will need For more information see Electing under section 217