Canadian Tax Return All online services Income tax package for 2023 Make a payment to the CRA Personal income tax rates File income tax get the income tax and benefit package and check the status of your tax refund Business or professional income Calculate business or professional income get industry codes and report various income types

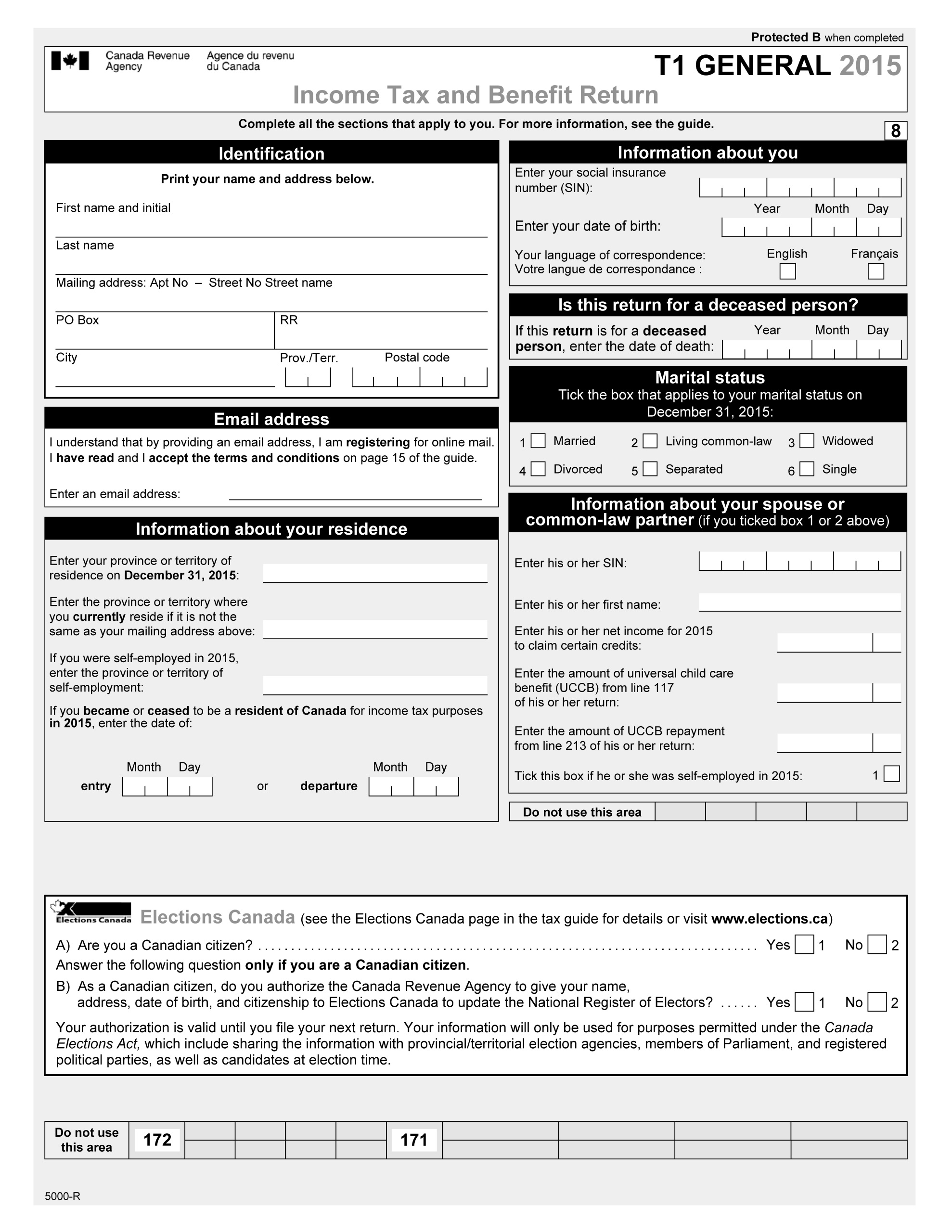

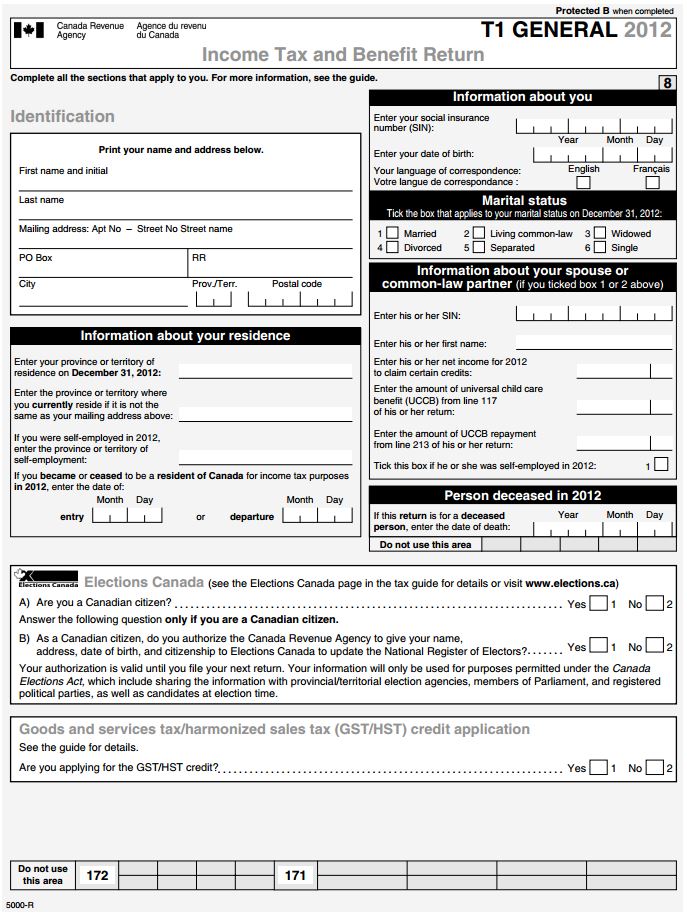

Find options to make a payment for your personal income taxes business taxes or some government programs Payments the CRA sends you Refunds credit and benefit payments direct deposit and uncashed cheques T1 income tax and benefit package for 2023 Each package includes the tax information the return related schedules provincial and territorial information and related forms

Canadian Tax Return

Canadian Tax Return

http://www.expatax.ca/uploads/7/0/5/7/70574555/s373847989345217695_p1_i1_w2560.jpeg

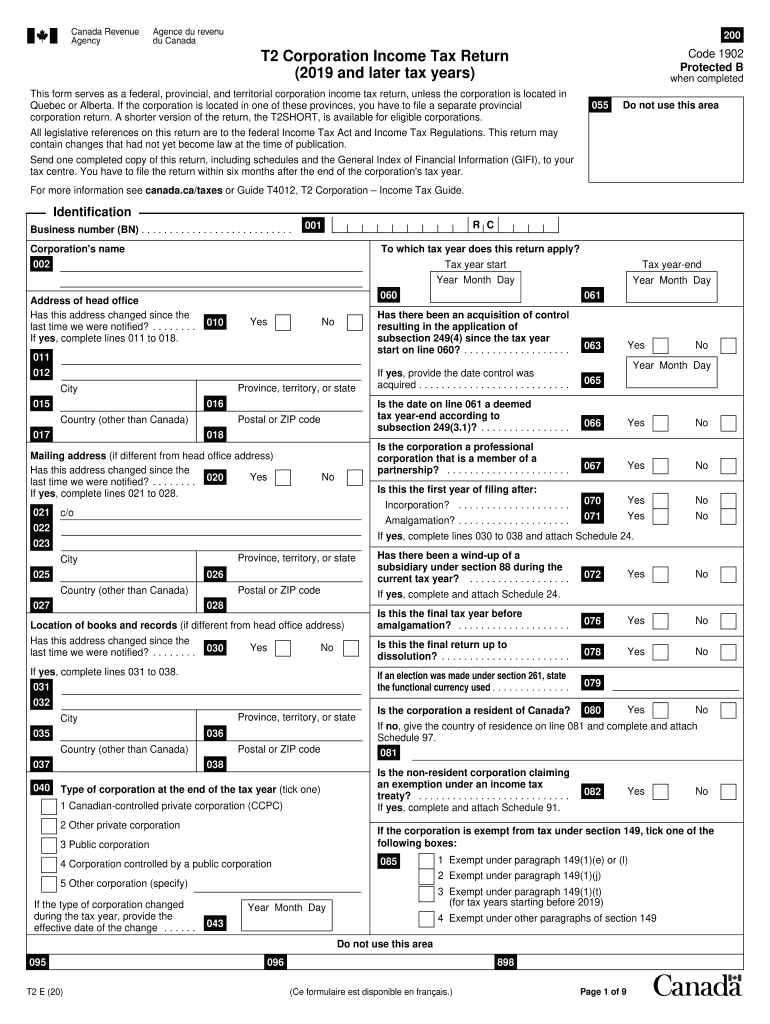

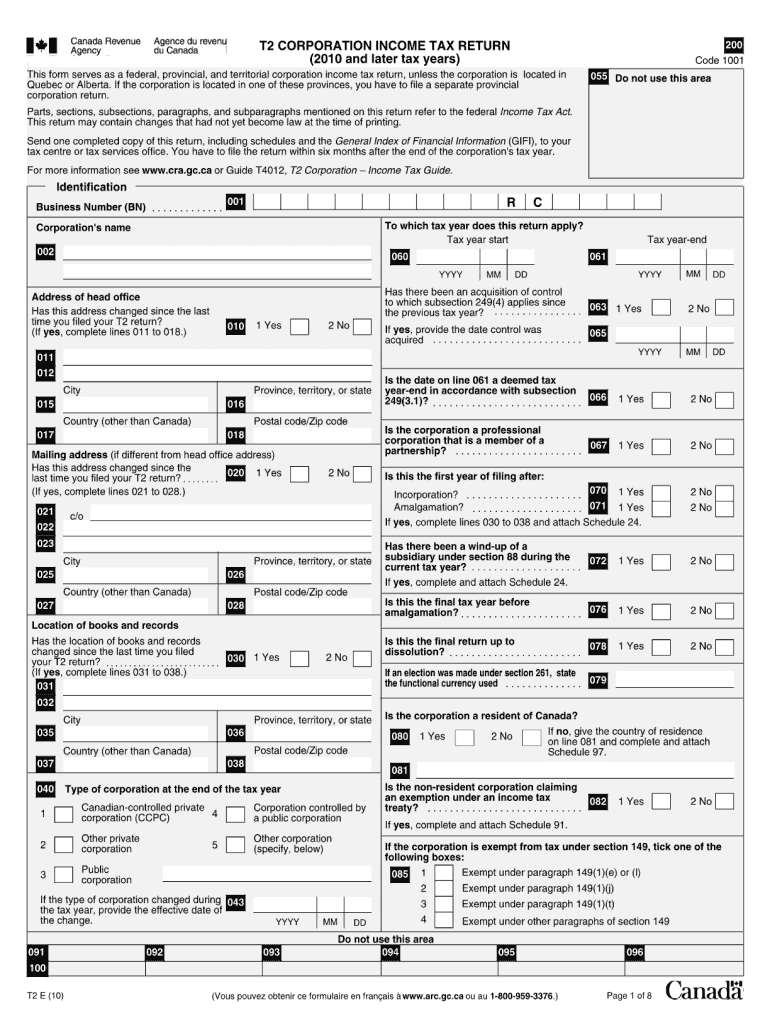

2020 2023 Form Canada T2 Corporation Income Tax ReturnFill Online

https://www.pdffiller.com/preview/531/94/531094278/large.png

Free Canada Forms PDF Template Form Download

https://formdownload.org/wp-content/uploads/2013/09/Alberta-Canada-Income-Tax-and-Benefit-Return-Form-T1-General.jpg

Steps to get ready for 2023 taxes Learn what s new for 2023 taxes Changes to benefits credits and expenses for individuals and families and updates to the 2023 income tax package Be aware of key dates for 2023 taxes Filing and payment due dates for taxes instalment payments and any amounts you may owe Filing dates for 8 sections 1 question to test yourself C Reporting your income What income and information slips are and how to report your income on your tax return Time to complete about 14 minutes Start this lesson This lesson includes 8 sections 3 questions to test yourself D Claiming your deductions

You can file your completed tax return with the Canada Revenue Agency CRA online or by mail If you are a non resident you can only send your tax return by mail Online Filing online is the fastest and easiest way to do your taxes Before you file your taxes online make sure your CRA information is up to date May 30 2024 the 30th day after you file your return the day you overpaid your taxes For more information see Prescribed interest rates Check the status of your refund

Download Canadian Tax Return

More picture related to Canadian Tax Return

Changes You Need To Know About On Your 2016 Income Tax Return Save

http://www.savewithspp.com/wp-content/uploads/2017/03/6Apr-taxreturn-1000x664.jpg

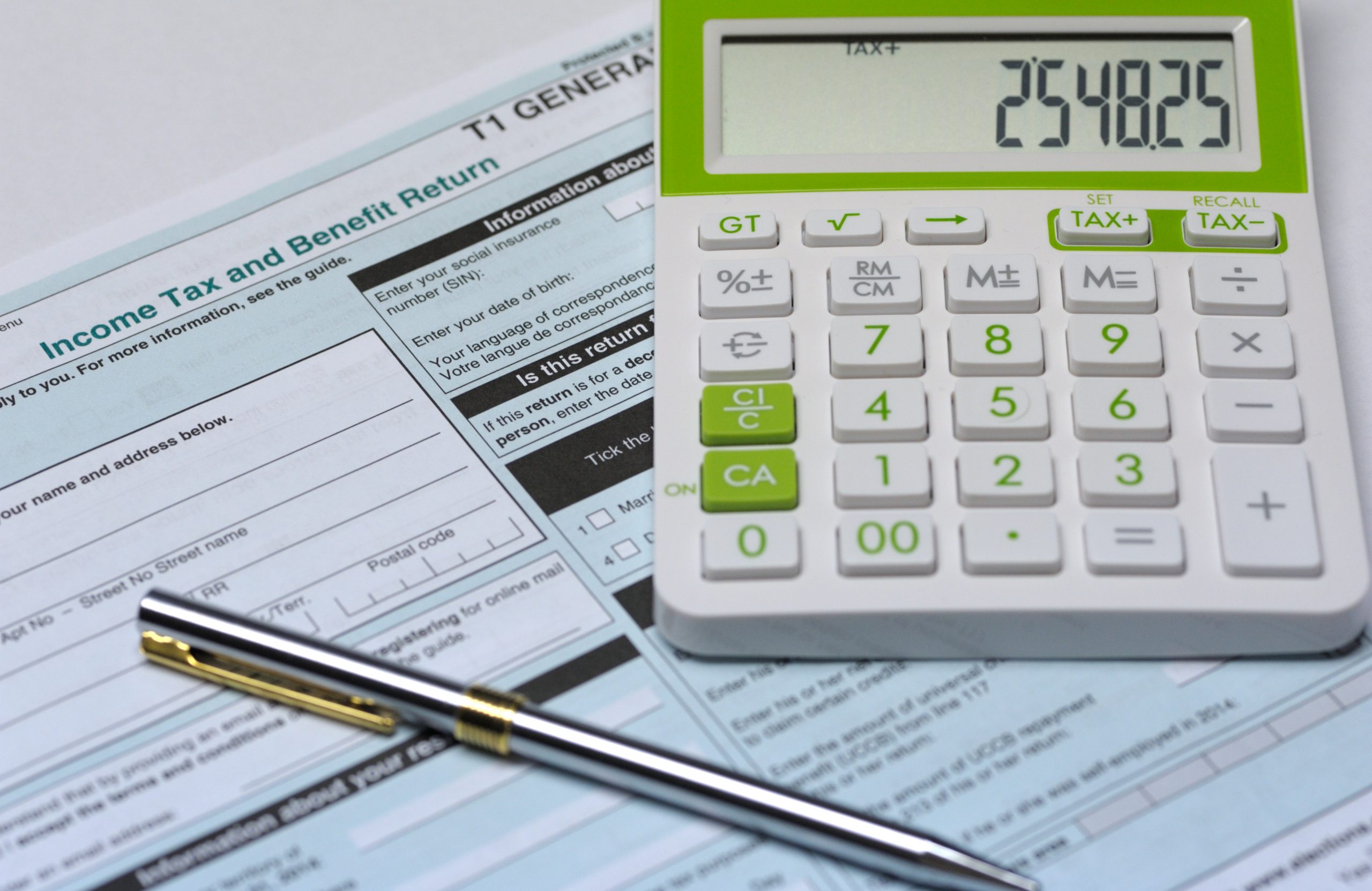

Canadian Tax Return Stock Photo Download Image Now IStock

https://media.istockphoto.com/photos/canadian-tax-return-picture-id155158109

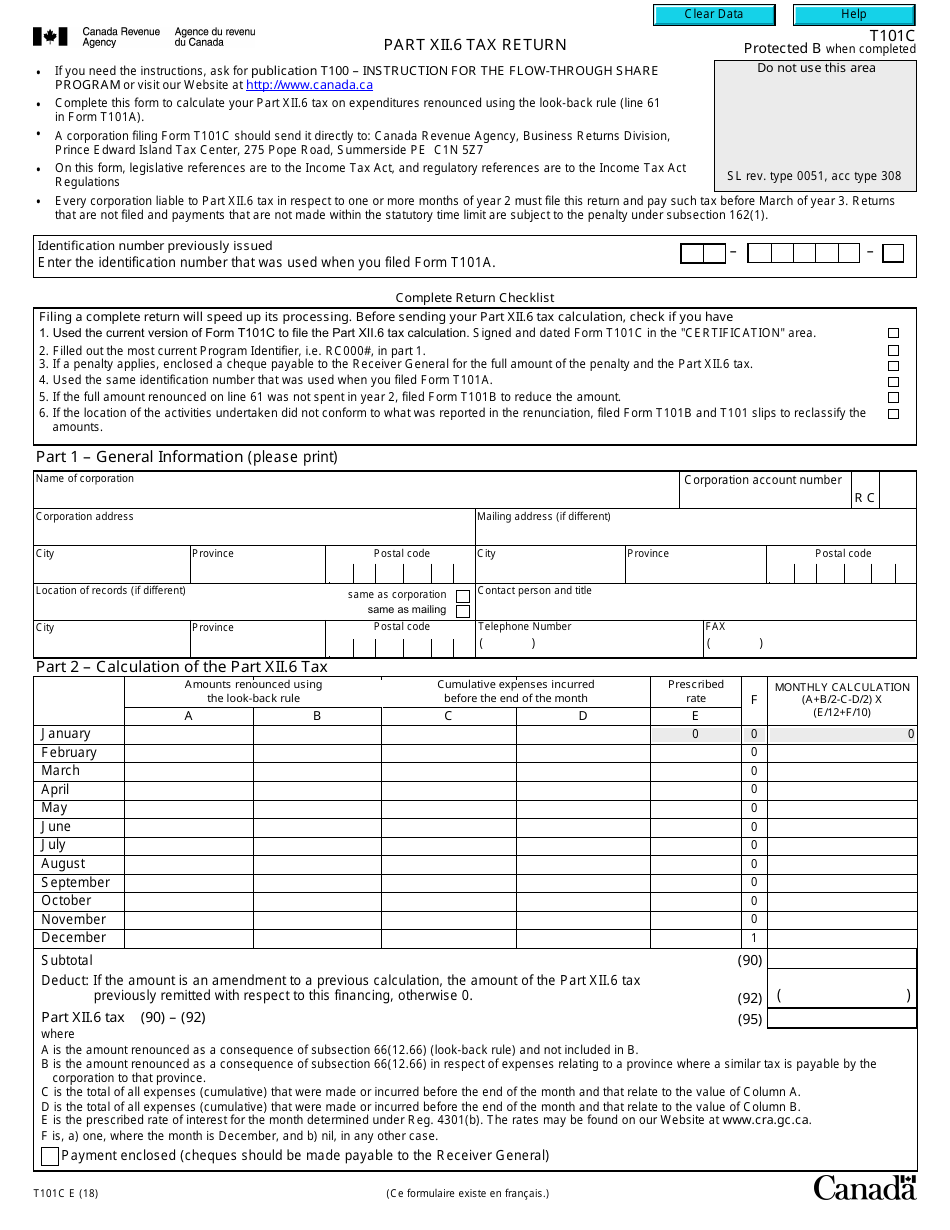

Form T101C Download Fillable PDF Or Fill Online Part XII 6 Tax Return

https://data.templateroller.com/pdf_docs_html/1868/18689/1868940/form-t101c-part-xii-6-tax-return-canada_print_big.png

You re required to report your income to the CRA annually by filing paperwork known as a tax return In this return you must list all your income sources and note your eligibility for tax deductions or tax credits The tax system is based on trust According to the Canada Revenue Agency CRA in the 2022 tax year 92 of Canadians chose to file their taxes online Alternatively you can fill out a paper copy and mail it to the CRA

File your simple Canadian tax return for free with no hidden fees Do your taxes easily Follow a simple step by step process to fill out your return and our software does the math for you and stores your information to use on next year s return Auto fill your return A tax return refers to the forms an individual or a corporation must submit to the Canada Revenue Agency CRA if earning an income in Canada The Canadian income tax year starts in January and runs through December and includes all

Canadian Tax Return Do You Know If You Need To File SDG Accountant

https://accountingtoronto.ca/wp-content/uploads/2017/07/accountingtoronto-blog-amb.png

Canadian Final Income Tax Return US Canadian Cross Border Tax

https://cbfinpc.com/wp-content/uploads/2020/04/Canadian-Income-Tax-Return-Preparation-cbfinpc.com_-scaled.jpg

https://www.canada.ca/en/services/taxes/income-tax

All online services Income tax package for 2023 Make a payment to the CRA Personal income tax rates File income tax get the income tax and benefit package and check the status of your tax refund Business or professional income Calculate business or professional income get industry codes and report various income types

https://www.canada.ca/en/revenue-agency

Find options to make a payment for your personal income taxes business taxes or some government programs Payments the CRA sends you Refunds credit and benefit payments direct deposit and uncashed cheques

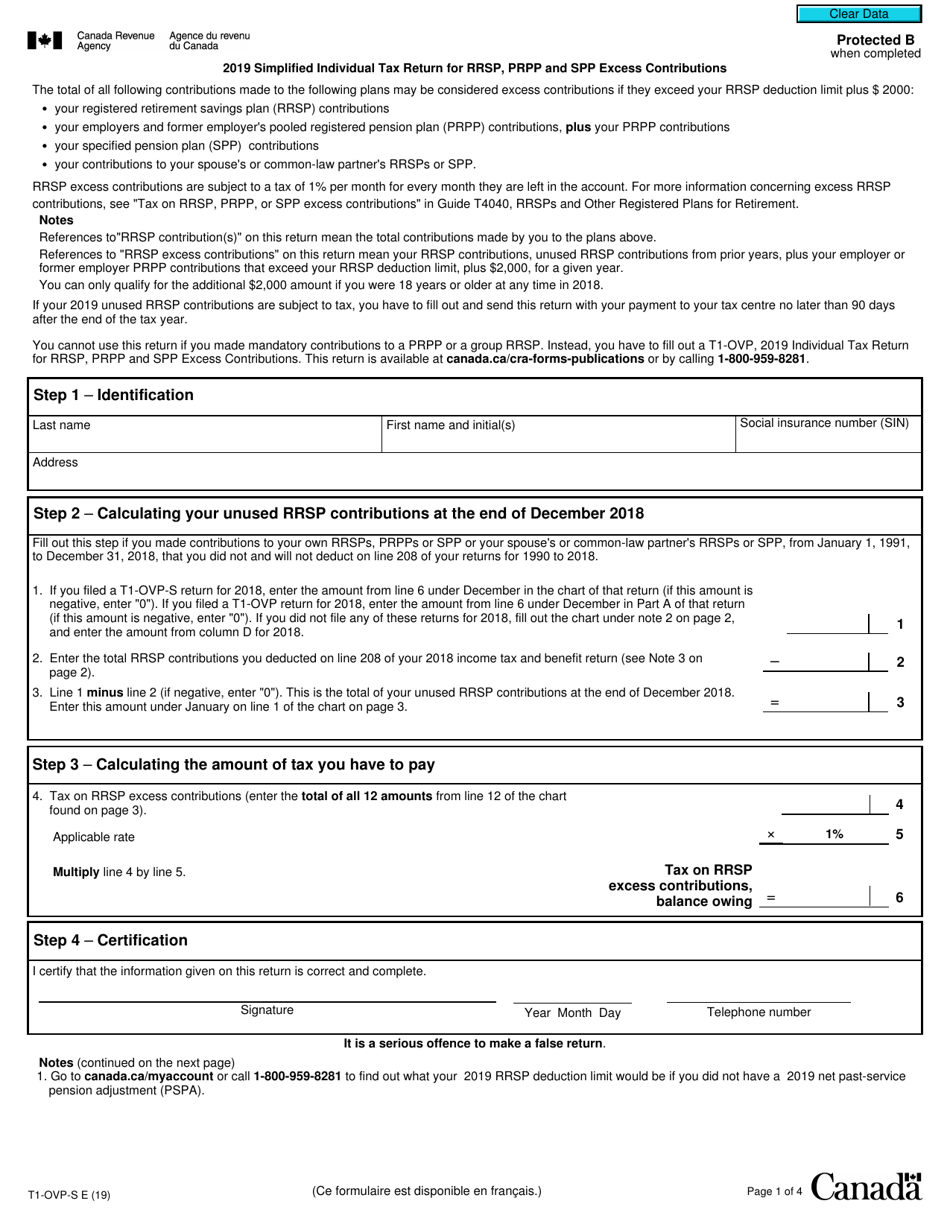

Form T1 OVP S Download Fillable PDF Or Fill Online Simplified

Canadian Tax Return Do You Know If You Need To File SDG Accountant

Canadian Tax Return Preparation Greenback Expat Tax Services

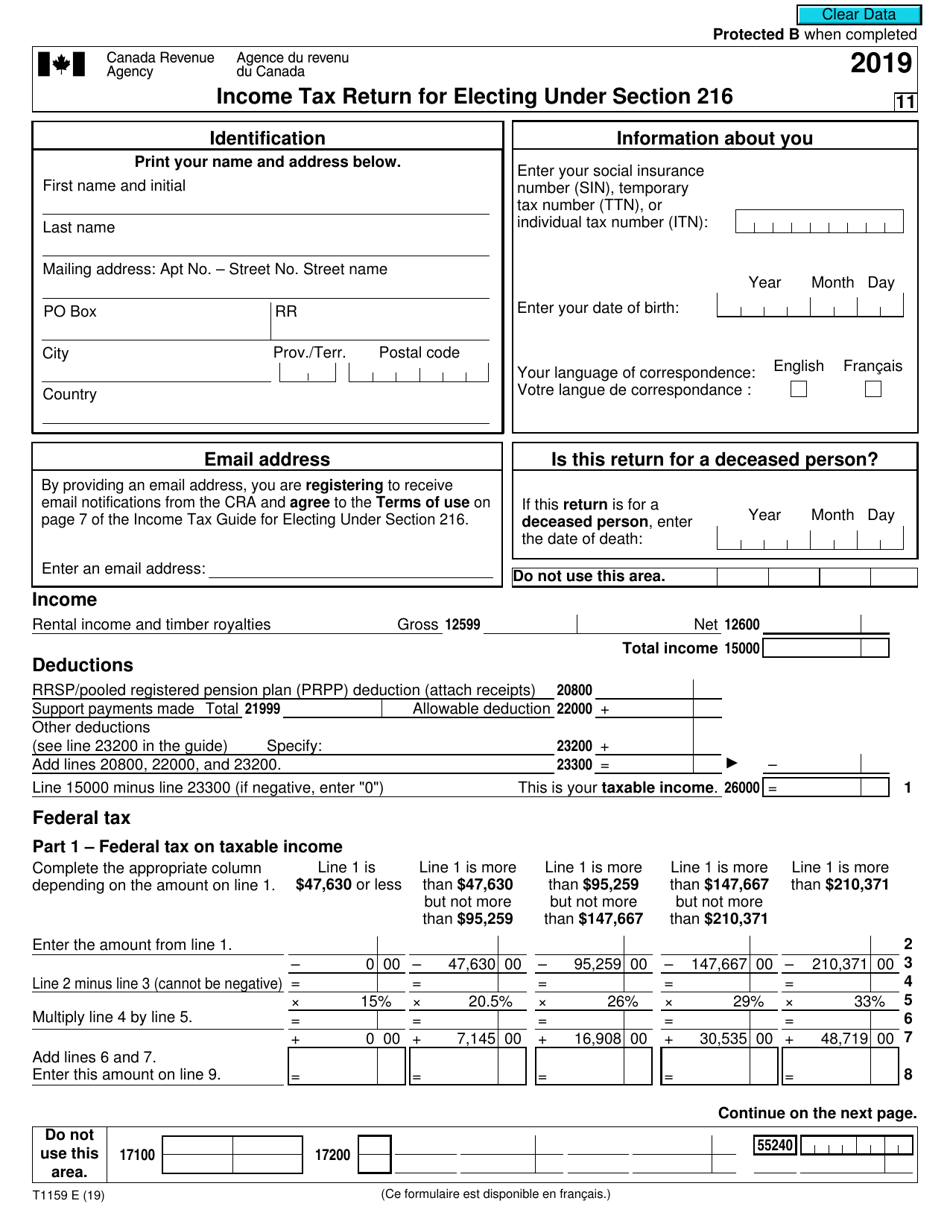

Form T1159 2019 Fill Out Sign Online And Download Fillable PDF

How Taxes Work In Canada Individual Income Tax Canadian Tax For

Leave A Reply Cancel Reply

Leave A Reply Cancel Reply

T2 Corporation Tax Fill Online Printable Fillable Blank PdfFiller

6 Tax Tips For Your Canadian Tax Return File Your Tax Return Canada

EFile Canadian Tax Return Android Apps On Google Play

Canadian Tax Return - Personal taxes Tax credits Canada Child Benefit CCB List of all services for My Account My Business Account or how to register for My Business Account View and update your business information for Business taxes Payroll GST HST List of all services for My Business Account Represent a Client or how to register for Represent a Client