Cancer Patient Income Tax Rebate Web 17 juil 2019 nbsp 0183 32 Q Is cancer covered under section 80DDB of the Income Tax Act Yes section 80DDB of the income tax act specifically includes Malignant cancers and

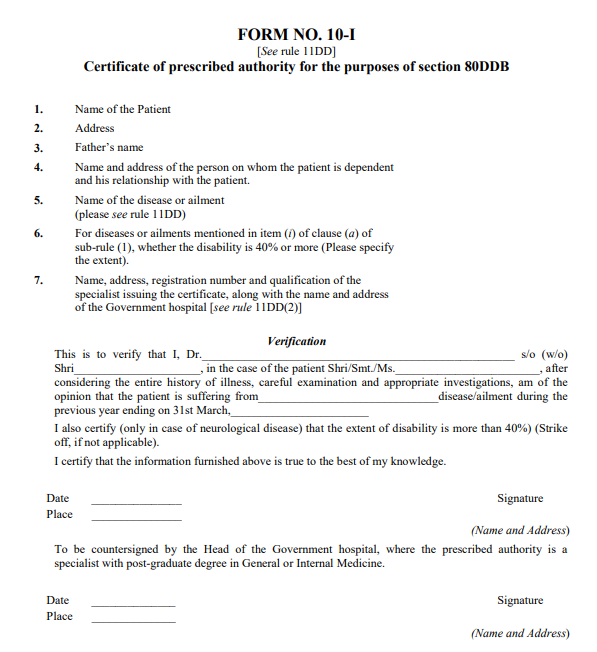

Web 14 d 233 c 2022 nbsp 0183 32 Cancer patients eligible for the federal income tax credit save thousands of dollars off their medical bills by filing jointly with their spouses Cancer patients who Web 8 janv 2023 nbsp 0183 32 This form must then be duly signed by the head doctor in the hospital as per the respective case You can submit this while filing your taxes under Section 80DDB to avail Income Tax Exemption for cancer

Cancer Patient Income Tax Rebate

Cancer Patient Income Tax Rebate

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

https://content.govdelivery.com/attachments/fancy_images/ILDOR/2022/08/6364888/tax-rebates-082922-facebook_original.jpg

Tax Deductions For Cancer Patients

https://www.thetaxadviser.com/content/tta-home/issues/2019/dec/charitable-deduction-rules-trusts-estates-lifetime-transfers/_jcr_content/contentSectionArticlePage/article/articleparsys/image.img.jpg/1574370826491.jpg

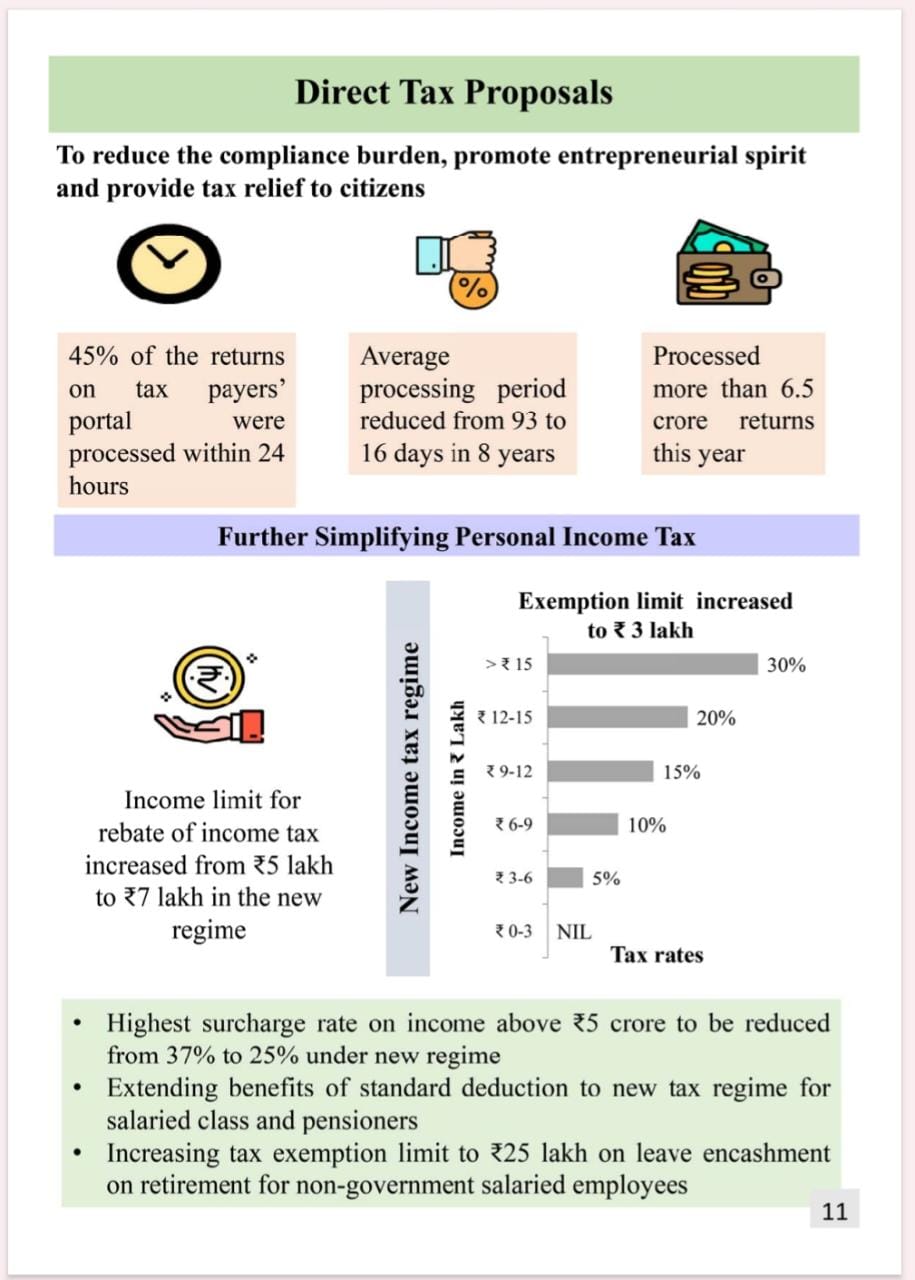

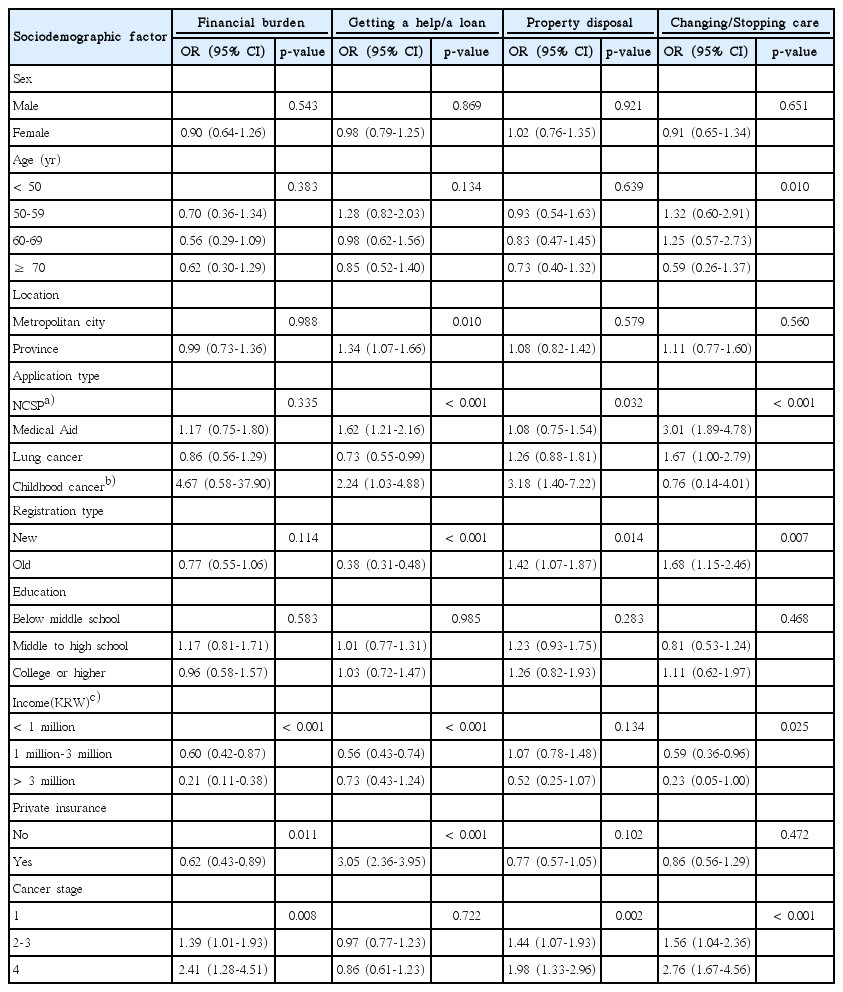

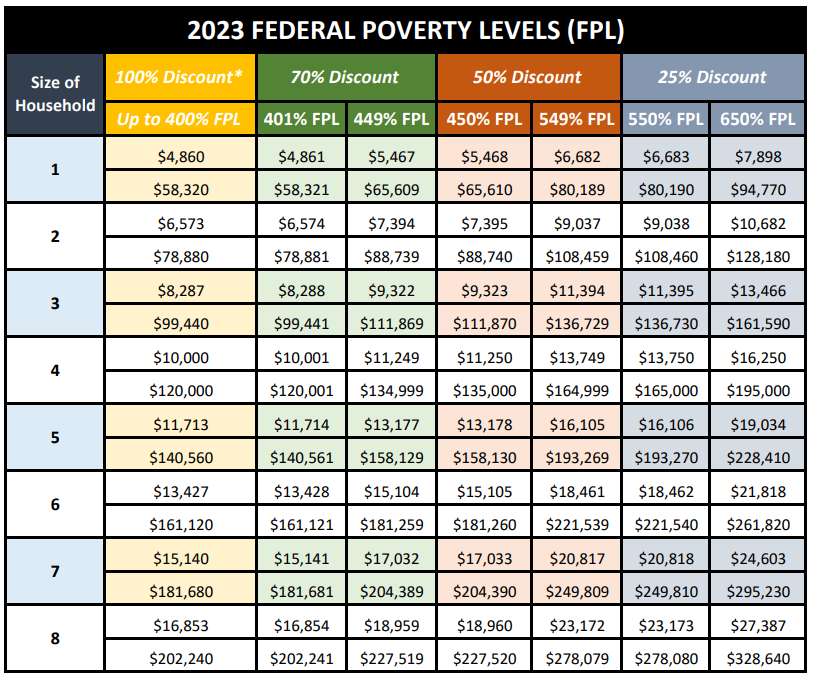

Web Claiming benefits You may be able to get Universal Credit or Housing Benefit if you are renting you have a low income The benefit you need to apply for depends on the type of Web 24 ao 251 t 2020 nbsp 0183 32 In 2018 someone whose AGI is 50 000 would be able to deduct out of pocket medical expenses if they exceed 3 750 50 000 x 7 5 TurboTax will automatically figure out whether you benefit from

Web 6 juil 2023 nbsp 0183 32 Section 80DDB provides that if an individual or a HUF has incurred medical expenses for treatment of a specified disease or ailment such expense is allowed as a deduction subject to such conditions and Web 29 juin 2018 nbsp 0183 32 1 Medical treatment of specified ailments under section 80DDB Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be claimed under

Download Cancer Patient Income Tax Rebate

More picture related to Cancer Patient Income Tax Rebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

FORM 80DDB PDF

https://www.paisabazaar.com/wp-content/uploads/2017/06/Section-80DDB-Form-Format.png

Cancer Patients On Lower Incomes Have radically Different Outcomes

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17078m.img?h=315&w=600&m=6&q=60&o=t&l=f&f=jpg&x=276&y=124

Web 31 mars 2016 nbsp 0183 32 You can claim tax deductions on expenses on medical treatment of specified ailments such as cancer under Section 80DDB The maximum amount of Web The taxpayer is eligible for tax deduction of Rs 40 000 or the actual amount paid for medical treatment whichever is lower Senior citizens between the ages of 60 years and 80

Web i Neurological Diseases where the disability level has been certified to be of 40 and above a Dementia b Dystonia Musculorum Deformans c Motor Neuron Web 23 janv 2021 nbsp 0183 32 In case of your tax deductions being itemized the medical costs incurred should be more than 7 5 of your Adjusted Gross Income AGI for the year 2019 Also

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Q Is cancer covered under section 80DDB of the Income Tax Act Yes section 80DDB of the income tax act specifically includes Malignant cancers and

https://www.joingivers.com/learn/cancer-tax-break

Web 14 d 233 c 2022 nbsp 0183 32 Cancer patients eligible for the federal income tax credit save thousands of dollars off their medical bills by filing jointly with their spouses Cancer patients who

The Private Health Insurance Rebate Explained ISelect

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Illinois Tax Rebate Tracker Rebate2022

Section 87A Tax Rebate Under Section 87A

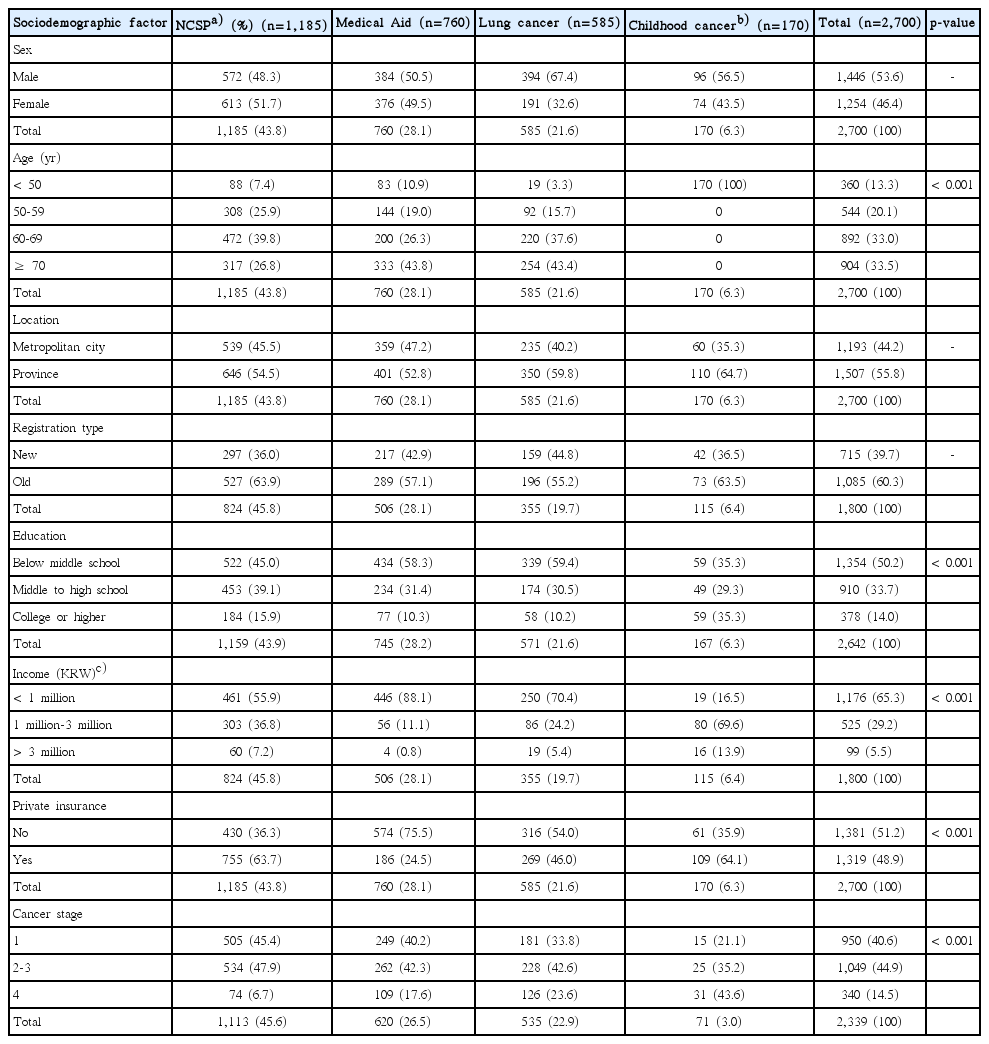

Supporting Low income Cancer Patients Recommendations For The Public

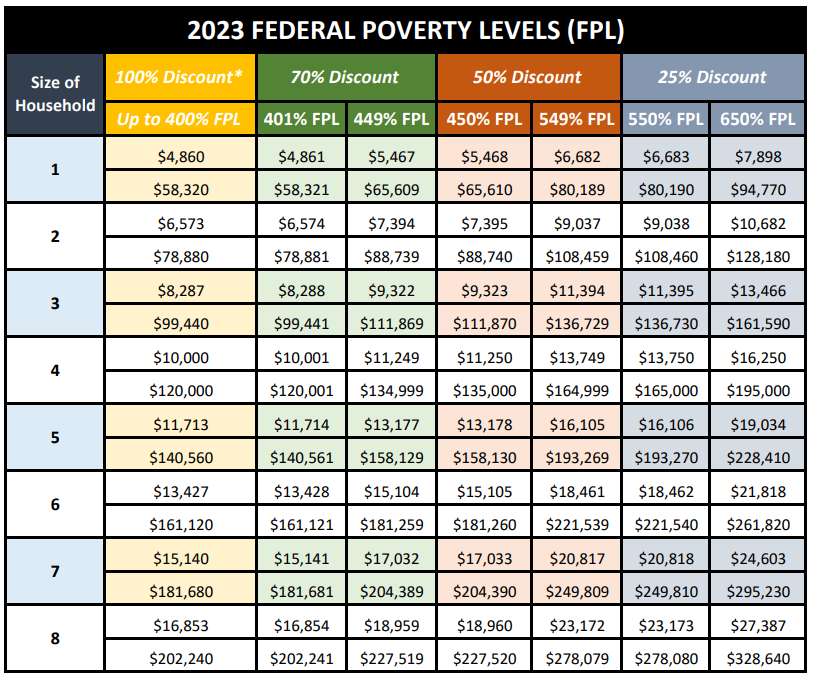

Healthcare Access Program HAP Health System County Of Santa Clara

Healthcare Access Program HAP Health System County Of Santa Clara

Supporting Low income Cancer Patients Recommendations For The Public

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Individual Income Tax Rebate

Cancer Patient Income Tax Rebate - Web 24 ao 251 t 2020 nbsp 0183 32 In 2018 someone whose AGI is 50 000 would be able to deduct out of pocket medical expenses if they exceed 3 750 50 000 x 7 5 TurboTax will automatically figure out whether you benefit from