Car Lease Expenses Tax Deductible Uk BIM47714 Specific deductions travel and subsistence cars restriction of hiring costs contents In certain cases the deduction for the cost of hiring a car which can be made

You can claim allowable business expenses for vehicle insurance repairs and servicing fuel parking hire charges vehicle licence fees breakdown cover train bus air and taxi Is leasing a vehicle tax deductible when you re self employed Hiring or leasing a car is an allowable and tax deductible expense but you must disallow 15 of your costs if the vehicle CO2 emissions are more than

Car Lease Expenses Tax Deductible Uk

Car Lease Expenses Tax Deductible Uk

https://www.racomi.org/wp-content/uploads/2023/08/overview-of-the-almighty-tax-deduction-for-small-businesses.png

Is Leasing A Car Tax Deductible Money Donut

https://www.moneydonut.co.uk/sites/default/files/untitled_design_2.png

What Are Tax Deductible Car Expenses GOFAR

https://www.gofar.co/wp-content/uploads/2019/12/gofar-car-expenses-tax-deductible.jpg

Business car leasing is typically cheaper than a personal lease as you can claim the VAT back on monthly instalments In most cases you can claim up to 50 VAT back but if When a company leases a car for an employee the cost of the vehicle and associated costs come off the profit However the employee has to pay company car tax based on the BIK value The

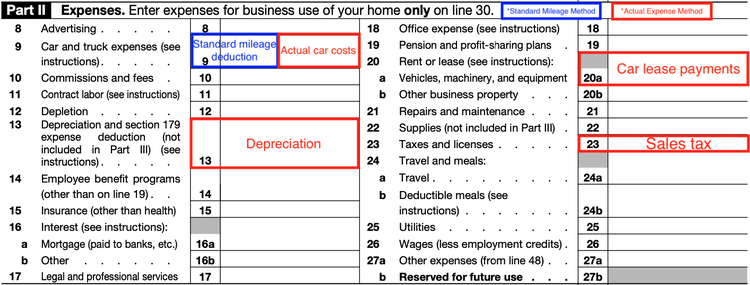

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicle s CO 2 Leasing or hiring a car is tax deductible but CO2 emissions should be considered when choosing a vehicle to lease As explained by HMRC In some cases if

Download Car Lease Expenses Tax Deductible Uk

More picture related to Car Lease Expenses Tax Deductible Uk

Are Parking Tickets Tax Deductible Uk Travel Tickets

https://static01.nyt.com/images/2022/08/07/multimedia/07dc-consumer/07dc-consumer-videoSixteenByNine3000-v2.jpg

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

https://m.foolcdn.com/media/affiliates/images/Car_Tax_Deduction_-_01_-_Schedule_C_dtwP5ng.width-750.png

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

But what about if you re leasing a car Let s see how the HMRC treats car leasing when it comes to tax relief If your company is leasing a vehicle you don t own it That means that you can claim your monthly lease Are business car lease payments tax deductible Yes if you re a Limited Company you can use your monthly lease payments to offset your corporation tax If

This means that if the car has emissions under 110g km you can get tax relief on all of the payments However if the car s emissions are above 110g km then Can a car lease be tax deductible Managing levels of corporation tax forms a key part of any incorporated business financial planning This means the question of

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Deductible Non deductible Expenses Corporate Income Tax UAE

https://kgrnaudit.com/wp-content/uploads/Deductible-Non-deductible-Expenses-Under-Corporate-Income-Tax-UAE-min-3-scaled.jpg

https://www.gov.uk/hmrc-internal-manuals/business...

BIM47714 Specific deductions travel and subsistence cars restriction of hiring costs contents In certain cases the deduction for the cost of hiring a car which can be made

https://www.gov.uk/expenses-if-youre-self-employed/travel

You can claim allowable business expenses for vehicle insurance repairs and servicing fuel parking hire charges vehicle licence fees breakdown cover train bus air and taxi

Understanding Nondeductible Expenses For Business Owners

13 Tax Deductible Expenses Business Owners Need To Know About CPA

How Much Of My Lease Payment Is Tax Deductible Payment Poin

Lower Your Taxes 10 Deductible Expenses In The Philippines

8 Lesser Known Tax Deductible Expenses Exceed

Tax Worksheettax Deductible Expense Logtax Deductions Etsy In 2022

Tax Worksheettax Deductible Expense Logtax Deductions Etsy In 2022

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

How To Deduct Medicare Expenses From Your Taxes

Is Omaze Tax Deductible UK Eye Opening Facts About Omaze UK Tax

Car Lease Expenses Tax Deductible Uk - If you use the car for personal reasons as well as business you can reclaim 50 back But if the vehicle is solely used for company reasons you can claim 100 back For more