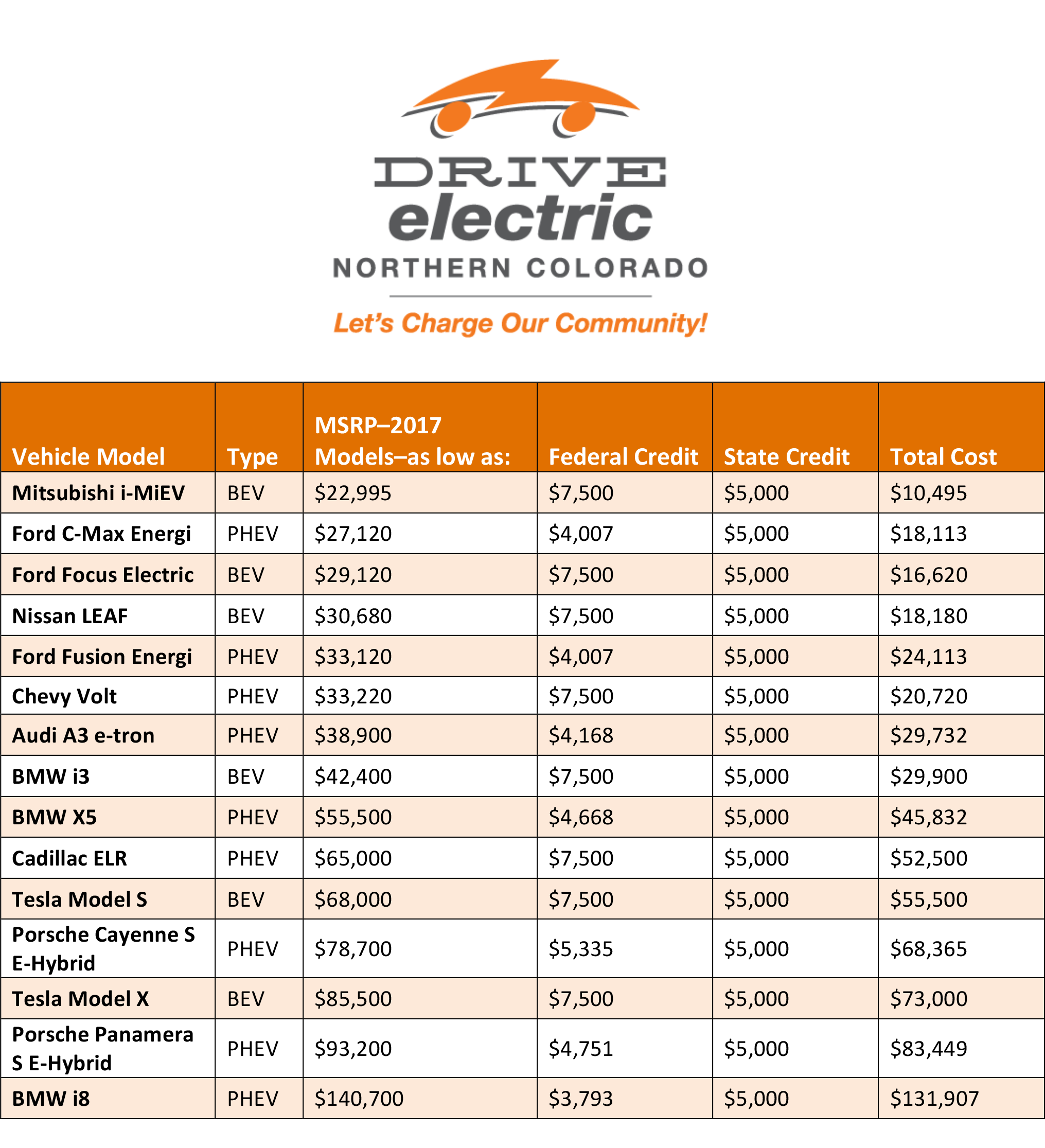

Car Tax Rebate 2024 The Inflation Reduction Act of 2022 will shake up the electric vehicle market heading into 2024 Buyers will still receive a 7 500 federal tax credit when purchasing a new EV or 4 000 on a

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer

Car Tax Rebate 2024

Car Tax Rebate 2024

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/going-green-states-with-the-best-electric-vehicle-tax-incentives-the-9.png

Why Are Chevy Volts So Cheap 11 Biggest Reasons

https://motorhills.com/wp-content/uploads/2022/01/Car-tax-rebate.jpg

Luxury Vehicle Owners Missing Out On Important Australian Electric Car Tax Rebate

https://www.dmarge.com/wp-content/uploads/2021/06/4-porsche-taycan-scaled-2-1200x801.jpg

CNN The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 bringing some good and bad news The bad news is that fewer Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a maximum credit of 4 000

Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer starting January 1 2024 This will effectively lower the vehicle s purchase price by providing consumers with an upfront down payment on their clean In 2024 50 of critical minerals must be recycled sourced or processed in North America Home electric car chargers and installation costs get a rebate Federal incentives include a 30 tax

Download Car Tax Rebate 2024

More picture related to Car Tax Rebate 2024

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

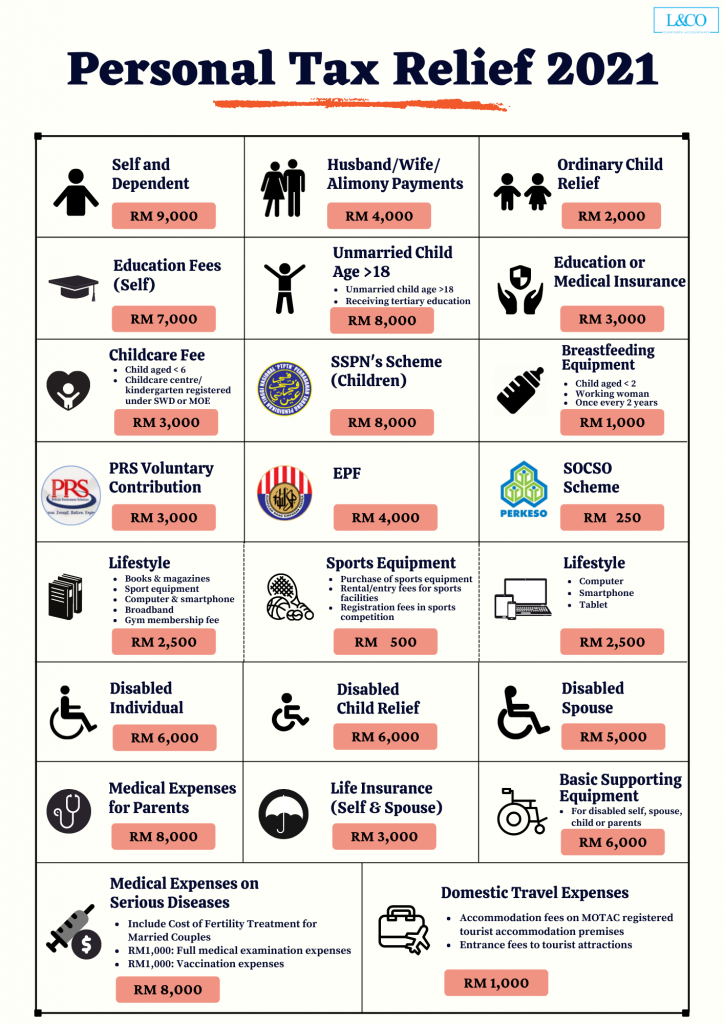

Personal Tax Relief 2021 L Co Accountants

https://landco.my/wp-content/uploads/2021/11/Personal-Tax-Relief-2021-724x1024.png

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an In 2024 the IRS will expand access to the tax benefit by allowing consumers to choose between claiming a nonrefundable credit on their tax returns to lower their tax liability or

Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 for 2023 and 2024 By Keith

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink Charging

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

Company Car Tax BIK Rates And Bands 2023 24 Up To 2027 28 Covase Fleet Management Company

https://images.squarespace-cdn.com/content/v1/52ebb01ae4b05068ce86fa9b/1692012135714-TUVICSMCFEI4H42VN17X/Company+car+tax+bands+BIK+rates+table+2023+to+2028+blog+banner+image.png

https://carbuzz.com/features/only-10-cars-will-get-the-7500-electric-vehicle-tax-credit-in-2024

The Inflation Reduction Act of 2022 will shake up the electric vehicle market heading into 2024 Buyers will still receive a 7 500 federal tax credit when purchasing a new EV or 4 000 on a

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink Charging

Is An Electric Car 100 Tax Deductible Leia Aqui Can You Write Off 100 Electric Car Fabalabse

Virginia Tax Rebate 2024

Pg e Rebate For Hybrid Cars 2023 Carrebate

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Get Your 20 000 Instant Asset Write off FENCiT

Opinion Don t Repeal The Electric Car Tax Rebate The Washington Post

Car Tax Rebate 2024 - In 2024 50 of critical minerals must be recycled sourced or processed in North America Home electric car chargers and installation costs get a rebate Federal incentives include a 30 tax