Mortgage Loan Rebate In Income Tax Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the

Mortgage Loan Rebate In Income Tax

Mortgage Loan Rebate In Income Tax

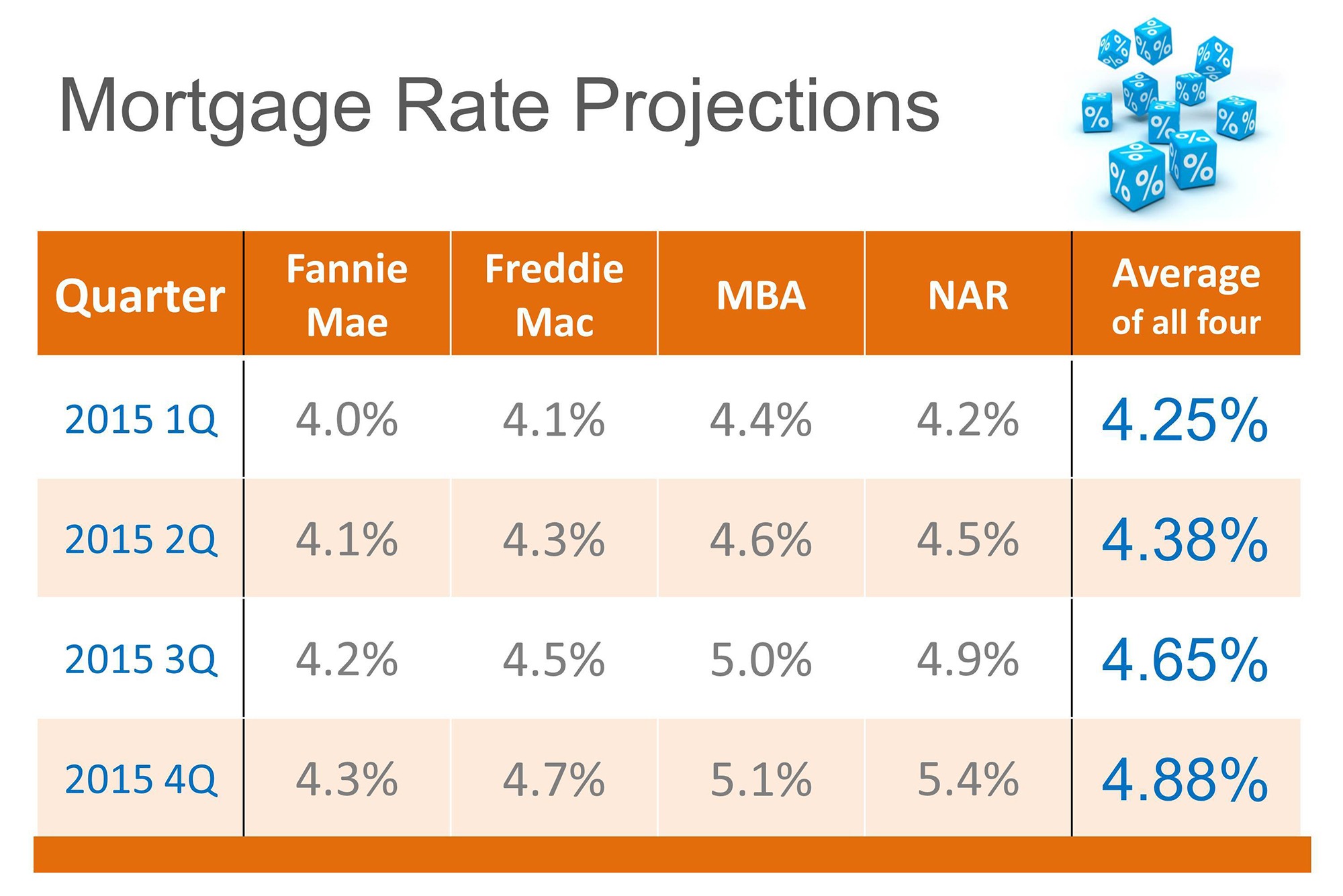

http://therealestatetrainer.com/wp-content/uploads/2015/02/Mortgage-Rate-Projections-2015.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web 1 sept 2023 nbsp 0183 32 In a nutshell yes If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the Web 19 janv 2023 nbsp 0183 32 Income tax Updated 19 Jan 2023 Buy to let mortgage interest tax relief explained Changes to tax relief rules mean some landlords face higher bills We explain what the changes mean for you

Web 5 f 233 vr 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax

Download Mortgage Loan Rebate In Income Tax

More picture related to Mortgage Loan Rebate In Income Tax

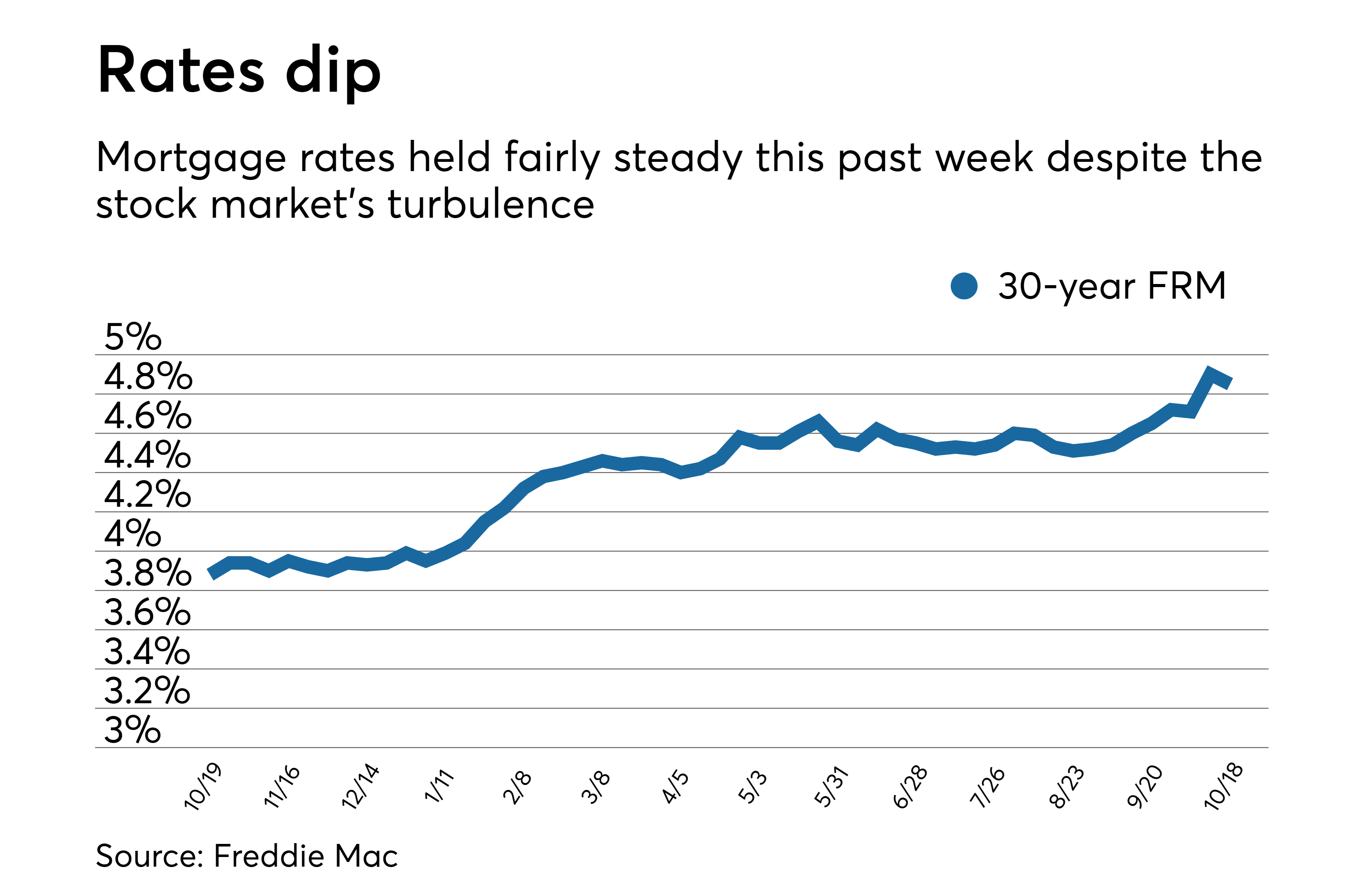

Average Mortgage Rates Decline At Least For One Week National

https://arizent.brightspotcdn.com/39/1d/6eea3689485fb4ffbe23f91599d5/nmn101818-rates.png

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 while Web If your are an owner occupant of a property in the Netherlands you can get part of the financing costs refunded The rules for the refund are gradually changing over the year

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good Web Will I be able to get income tax benefits on a mortgage loan in India Quora Something went wrong

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

BB BlackBerry Limited Short Interest And Earnings Date Annual Report

https://financeai.com/stock/securities/nyse-bb/chart?ts=loan-rebate-rate

https://www.thebalancemoney.com/home-mortgage-interest-tax-deductio…

Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

Home Loan Tax Benefits In India Important Facts

Income Tax Rebate On Home Loan Fy 2019 20 A design system

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

IVR Invesco Mortgage Capital Short Interest And Earnings Date Annual

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Advantages Of Limited Partnerships

Tax Advantages Of Limited Partnerships

Lowest Fixed Rate Home Loans Singapore Sep 2017

52 What Is The Current Mortgage Rate For 15 Year Fixed HawkeHarriet

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Mortgage Loan Rebate In Income Tax - Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax