Home Loan Rebate In Income Tax Limit Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can

You can claim income tax rebates on your ongoing Home Loan by following these steps Calculate the tax deduction that you are eligible for Ensure that you have all the Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Home Loan Rebate In Income Tax Limit

Home Loan Rebate In Income Tax Limit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Due Date Extension Under Income Tax And Benami Law

https://img.indiafilings.com/learn/wp-content/uploads/2019/07/12004316/Income-Tax-Due-Date-Extended.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and Rs 1 5 lakh on the principal amount Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only

Section 80EEA of Income Tax Act offers first time homebuyers Rs 1 50 lakh deduction against home loan interest payment Know eligibility documents If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

Download Home Loan Rebate In Income Tax Limit

More picture related to Home Loan Rebate In Income Tax Limit

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

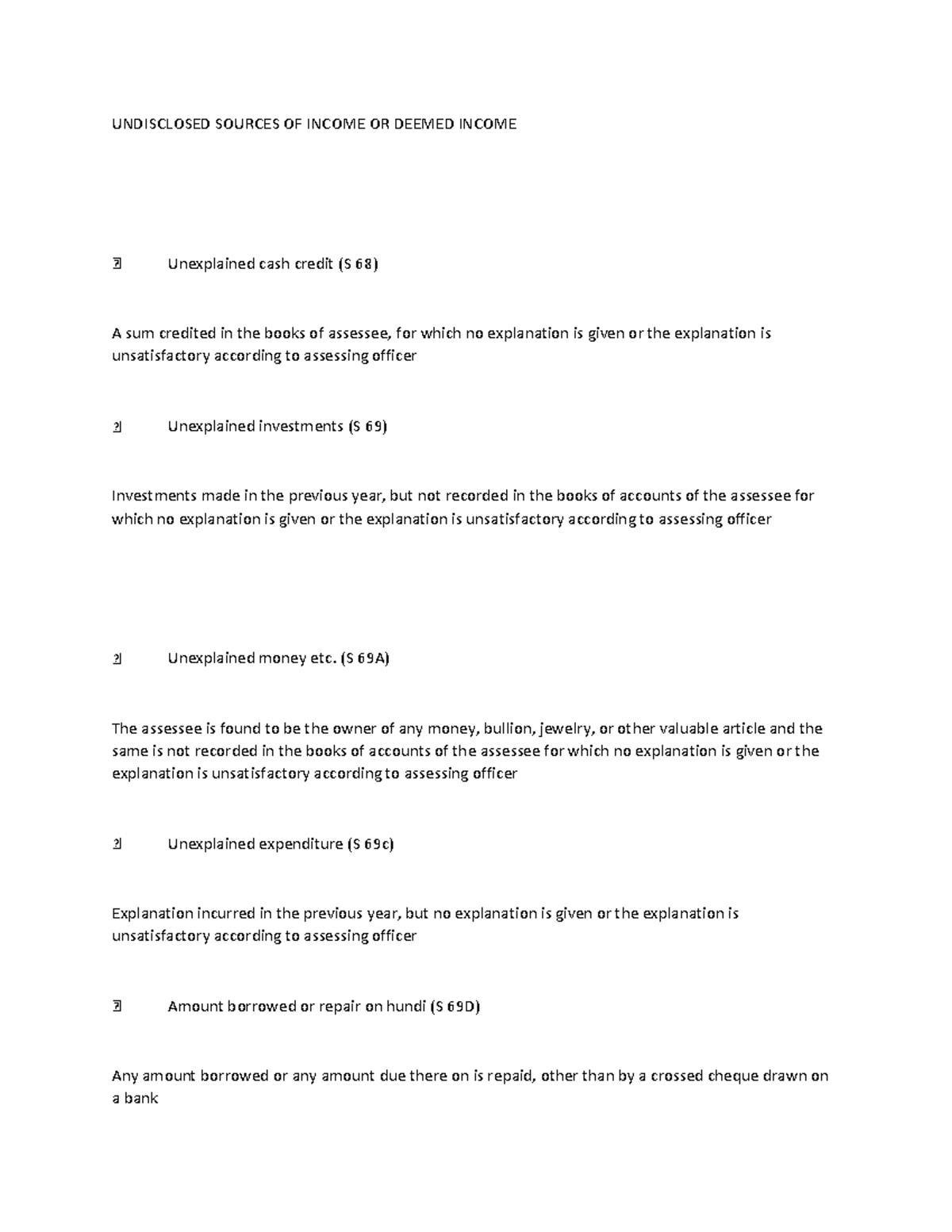

Document In This Notes About Undisclosed Source Of Income In Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/df429db1b5f472adb16157417bc4c332/thumb_1200_1553.png

How To Get Tax Rebate In Income Tax

https://lh3.googleusercontent.com/-jJ4zZZJpzu4/XkYh5zpW4bI/AAAAAAAALlw/03vDaCyfckIn2RjNTnWAHgi9ClX_V6MrACLcBGAsYHQ/s1600/Image_1.jpeg

Table 1 can help you figure your qualified loan limit and your deductible home mortgage interest Home Acquisition Debt Home acquisition debt is a mortgage you took out after October 13 1987 to buy build or Yes you can avail of tax benefits on the principal amount repaid on the home loan from total income under Section 80C What is the maximum amount I can avail of for deduction of interest paid on my housing loan

The amount paid as Repayment of Principal Amount of Home Loan by an Individual HUF is allowed as tax deduction under Section 80C of the Income Tax Act The maximum tax All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments Every

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

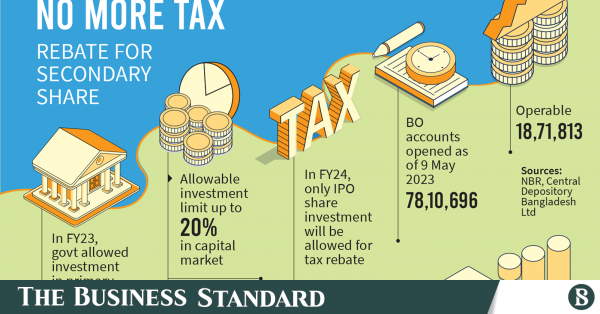

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

https://www.tbsnews.net/sites/default/files/styles/social_share/public/images/2023/05/10/p1_infograph_no-more-tax-rebate-for-secondary-share.png

https://housing.com/news/home-loans-…

Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim can

https://www.bajajhousingfinance.in/home-loan-tax-benefit

You can claim income tax rebates on your ongoing Home Loan by following these steps Calculate the tax deduction that you are eligible for Ensure that you have all the

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Income Tax Rebate Is A Bait Video Dailymotion

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Province Of Manitoba School Tax Rebate

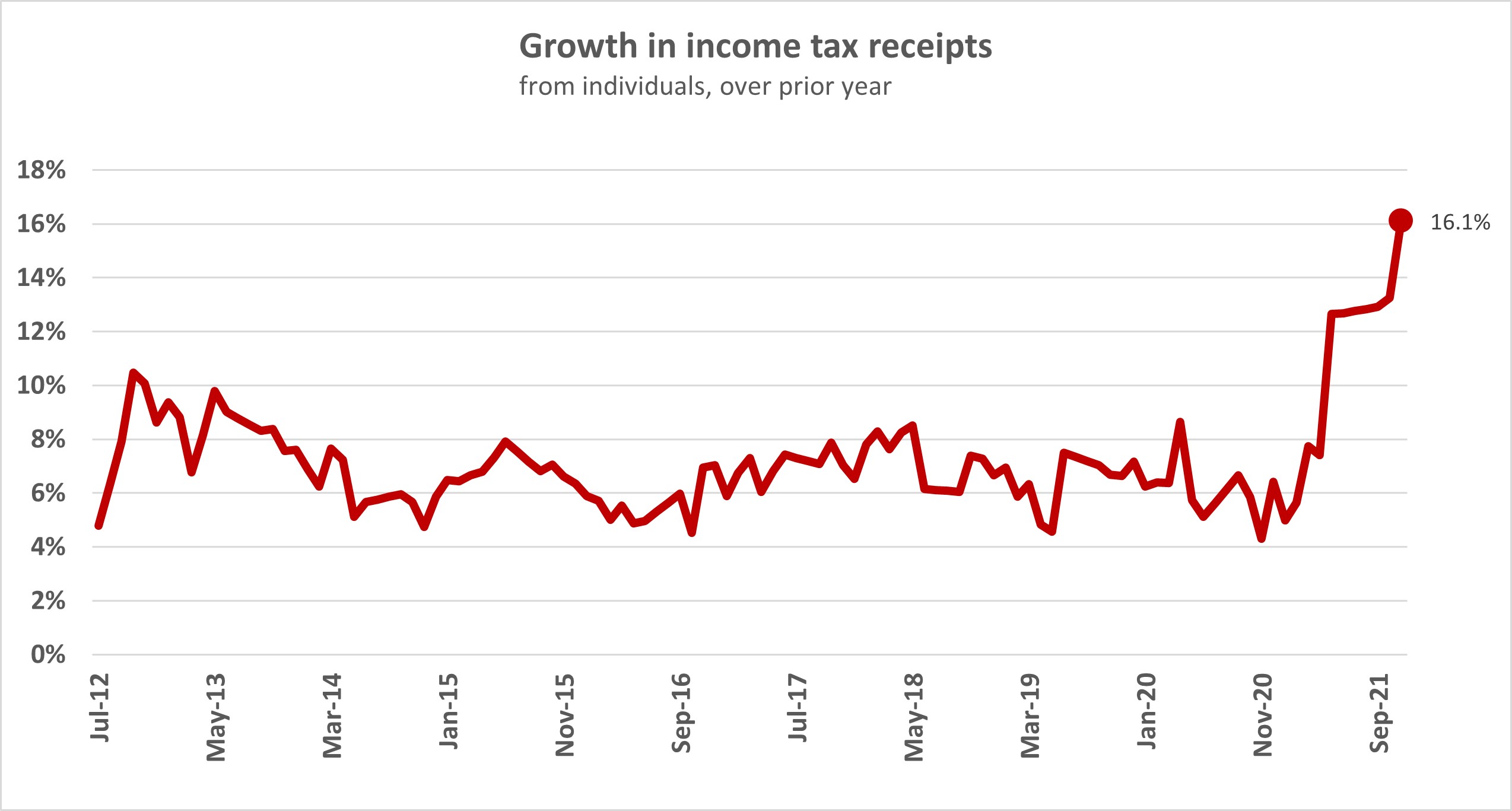

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Rebate Under New Tax Regime PrintableRebateForm

Home Loan Rebate In Income Tax Limit - Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified