Home Loan Rebate In Income Tax Before Possession Web 16 mai 2013 nbsp 0183 32 Acquiring a home loan makes an individual eligible for tax deduction under section 80C and section 24 of Income Tax Act Housing Loan taken and possession

Web 12 janv 2022 nbsp 0183 32 You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the Web 22 juin 2023 nbsp 0183 32 Repayment of the loan before possession does not affect the interest claim There is however provision for reversal of tax benefits

Home Loan Rebate In Income Tax Before Possession

Home Loan Rebate In Income Tax Before Possession

https://images.livemint.com/img/2021/12/24/600x338/residential_houses_4C--621x414_1640344520089.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax Web 24 d 233 c 2021 nbsp 0183 32 Answer Since you have already sold the house in respect of which you were entitled to claim pre EMI interest for the next two years as no income is taxable in respect of the same house property

Download Home Loan Rebate In Income Tax Before Possession

More picture related to Home Loan Rebate In Income Tax Before Possession

A Complete Guide On Tax Rebate On Second Home Loan Derek Time

https://www.derektime.com/wp-content/uploads/2019/02/home-loan-768x432.jpg

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

https://static.india.com/wp-content/uploads/2023/01/budget-2023-banner.png

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web 28 janv 2014 nbsp 0183 32 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial year can be claimed Web 9 sept 2023 nbsp 0183 32 In case of delayed possession over the stipulated period considering that the tax deduction limit over the first 5 years in Rs 2 lakh and the tax deductible limit after

Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the Web 31 mai 2022 nbsp 0183 32 One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

https://roofandfloor.thehindu.com/raf/real-estate-blog/wp-content/uploads/sites/14/2017/04/thumbnail_MoU-for-home-loan-rebate_Banner-840x560.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-for-Joint-House-Loan-750x362.jpg

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 mai 2013 nbsp 0183 32 Acquiring a home loan makes an individual eligible for tax deduction under section 80C and section 24 of Income Tax Act Housing Loan taken and possession

https://www.tatacapital.com/blog/loan-for-home/home-loan-tax-benefits...

Web 12 janv 2022 nbsp 0183 32 You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the

Income Tax Rebate Under Section 87A

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

LHDN IRB Personal Income Tax Rebate 2022

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

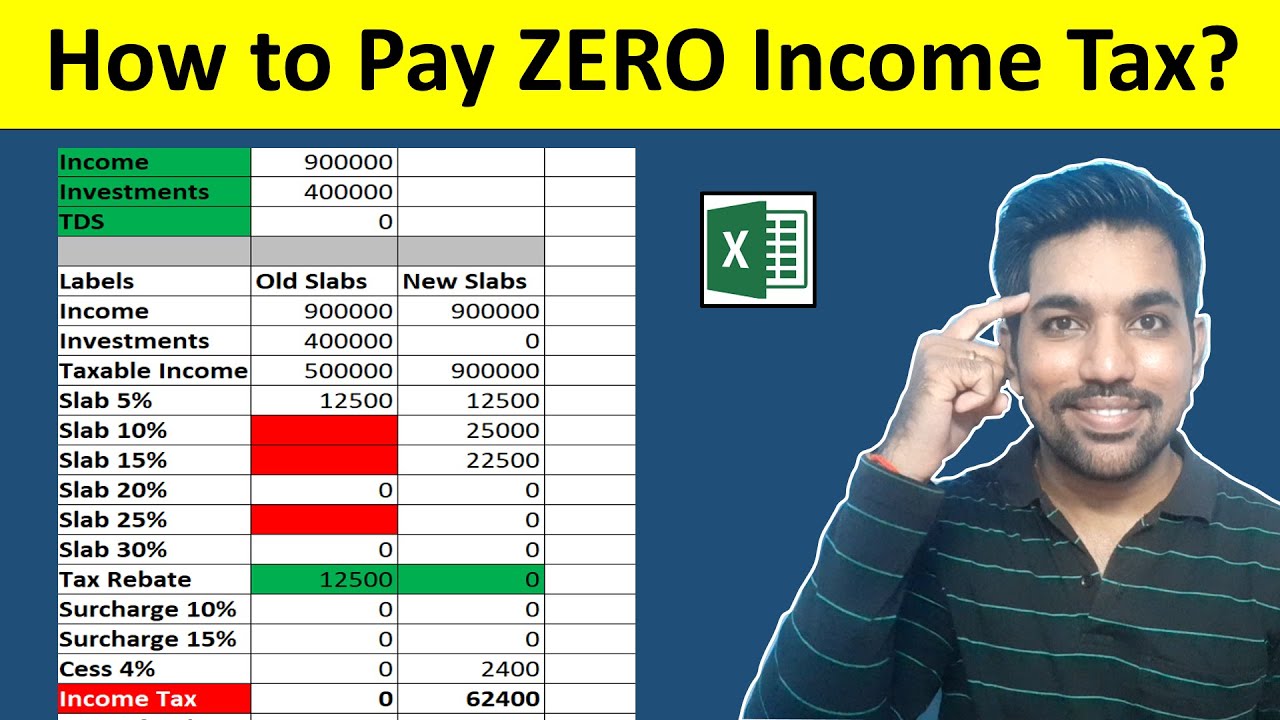

How To Pay ZERO Income Tax With Tax Rebate Income Tax Calculation

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Tax Rebate On Income Upto 5 Lakh Under Section 87A

PSBank PSBank Home Loan With Prime Rebate

Home Loan Rebate In Income Tax Before Possession - Web First time home buyers who opt for a home loan can avail of certain tax deductions to reduce their tax liability Here are some important points to consider Section 80EEA