Ill Property Tax Rebate For Seniors Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income

Web SPRINGFIELD Ill The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim Web 20 mai 2022 nbsp 0183 32 Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable

Ill Property Tax Rebate For Seniors

Ill Property Tax Rebate For Seniors

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

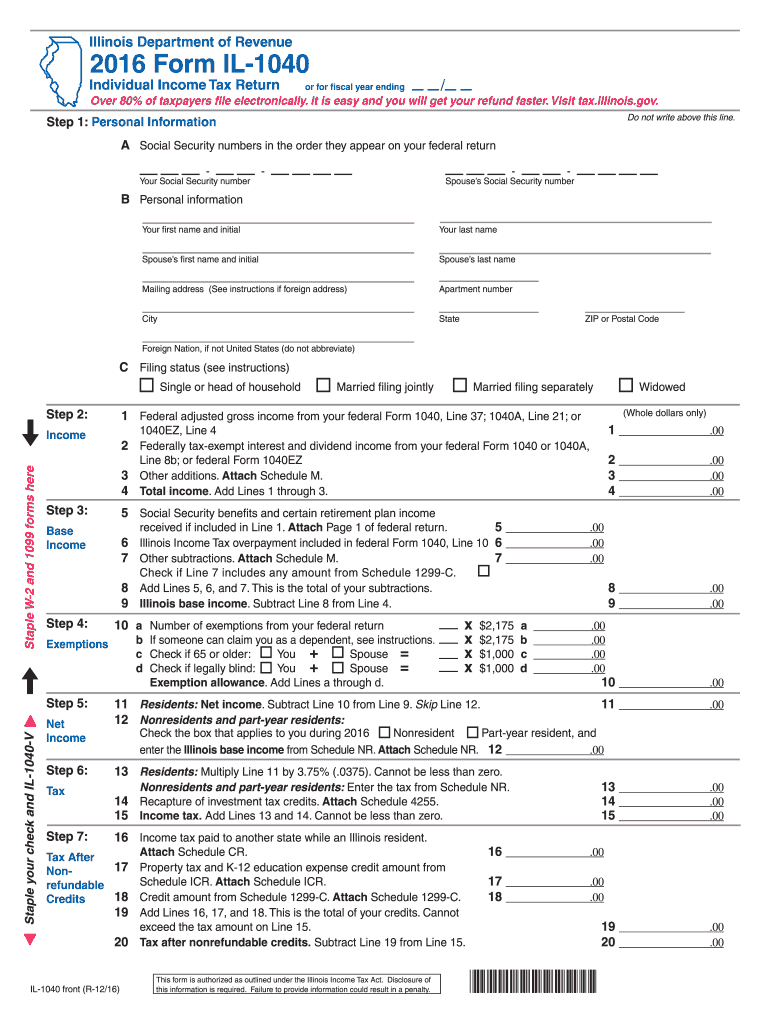

Il 1040 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

https://www.senatorstadelman.com/images/PropertyTaxRebate_2022_FB.JPG

Web 10 sept 2023 nbsp 0183 32 The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are Web The property s total EAV must be less than 250 000 after subtracting any portion used for commercial purposes The amount of the exemption depends on the percentage of the

Web The property tax rebate was created by Public Act 102 0700 and is equal to the lesser of the property tax credit you could qualify for 2020 property taxes payable in 2021 or Web 2 f 233 vr 2023 nbsp 0183 32 The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on

Download Ill Property Tax Rebate For Seniors

More picture related to Ill Property Tax Rebate For Seniors

Illinois Form Tax 2016 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/396/726/396726807/large.png

Boise Will Offer Property Tax Rebate To Low income Seniors Veterans

https://boisedev.com/wp-content/uploads/2022/03/prop-tax-1024x540-1-768x405.png

Property Tax Rebate For Seniors Bc PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/canadian-seniors-homeowner-grants-over-100-grants-rebates-tax-2.jpg

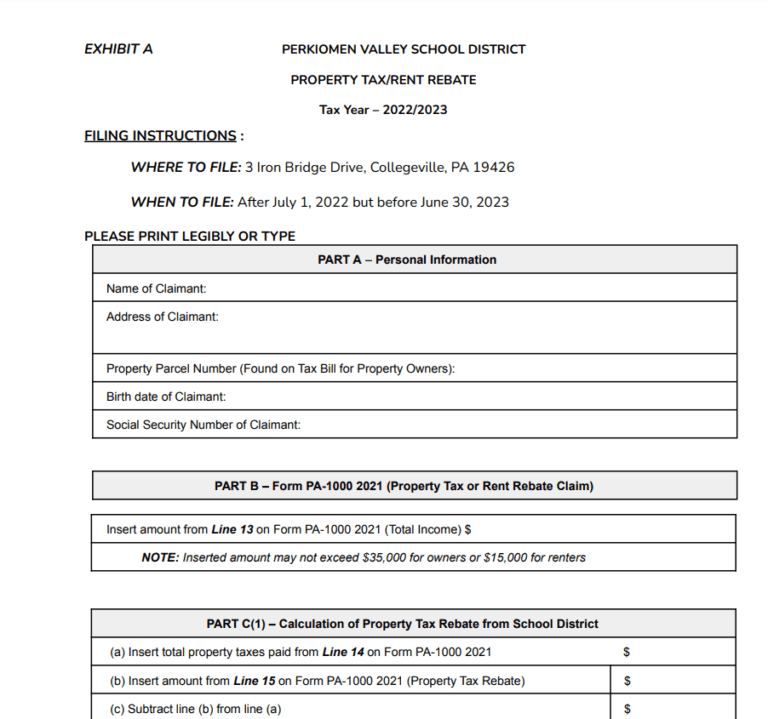

Web 29 avr 2022 nbsp 0183 32 Ill Property Tax Rebate For Seniors If you own a property in Pennsylvania you can apply for a Property Tax Rebate This program can help reduce Web 3 oct 2022 nbsp 0183 32 The Property Tax Rebate In Illinois Those who qualify for the Property Tax Rebate in Illinois will be able to receive up to 650 in tax breaks per year The amount will be calculated by taking their adjusted

Web 20 mai 2022 nbsp 0183 32 Gov J B Pritzker speaks to reporters in the state Capitol in Springfield Ill on Tuesday April 5 2022 The Center Square Seniors veterans and persons with Web 3 ao 251 t 2022 nbsp 0183 32 Illinois is offering an income tax rebate of 50 for individuals and 100 for couples filing jointly with an additional 100 for each dependent up to three Therefore

New Jersey Property Tax Relief For Seniors Property Walls

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/new-jersey-property-tax-relief-for-seniors-property-walls-1.jpg

Gov Shapiro Visits Erie Touts Rent Property Tax Rebates For Seniors

https://www.goerie.com/gcdn/presto/2023/05/04/NETN/4b8fcff0-237b-499a-9c58-4199420d30a0-p1shapiro050423.jpg?crop=3242,1824,x0,y0&width=3200&height=1801&format=pjpg&auto=webp

https://tax.illinois.gov/programs/rebates.html

Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income

https://www2.illinois.gov/IISNews/25471-Illinois_Department…

Web SPRINGFIELD Ill The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

New Jersey Property Tax Relief For Seniors Property Walls

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Village Of Orland Park Extends Property Tax Rebate Deadline Because Of

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

How To Get Property Tax Rebate PropertyRebate

How To Get Property Tax Rebate PropertyRebate

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

More Pa Seniors Would Qualify For The Property Tax Rent Rebate

Ill Property Tax Rebate For Seniors - Web The property tax rebate was created by Public Act 102 0700 and is equal to the lesser of the property tax credit you could qualify for 2020 property taxes payable in 2021 or