Illinois Property Tax Discount For Seniors Most senior homeowners are eligible for this exemption if they are 65 years of age or older born in 1958 or prior and own and occupy their property as their principal place of residence Once this exemption is applied the Assessor s

The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on their principal

Illinois Property Tax Discount For Seniors

Illinois Property Tax Discount For Seniors

https://files.illinoispolicy.org/wp-content/uploads/2017/07/2-1.png

Property Tax Savings For Seniors Prop 60 YouTube

https://i.ytimg.com/vi/2fALDcUifj0/maxresdefault.jpg

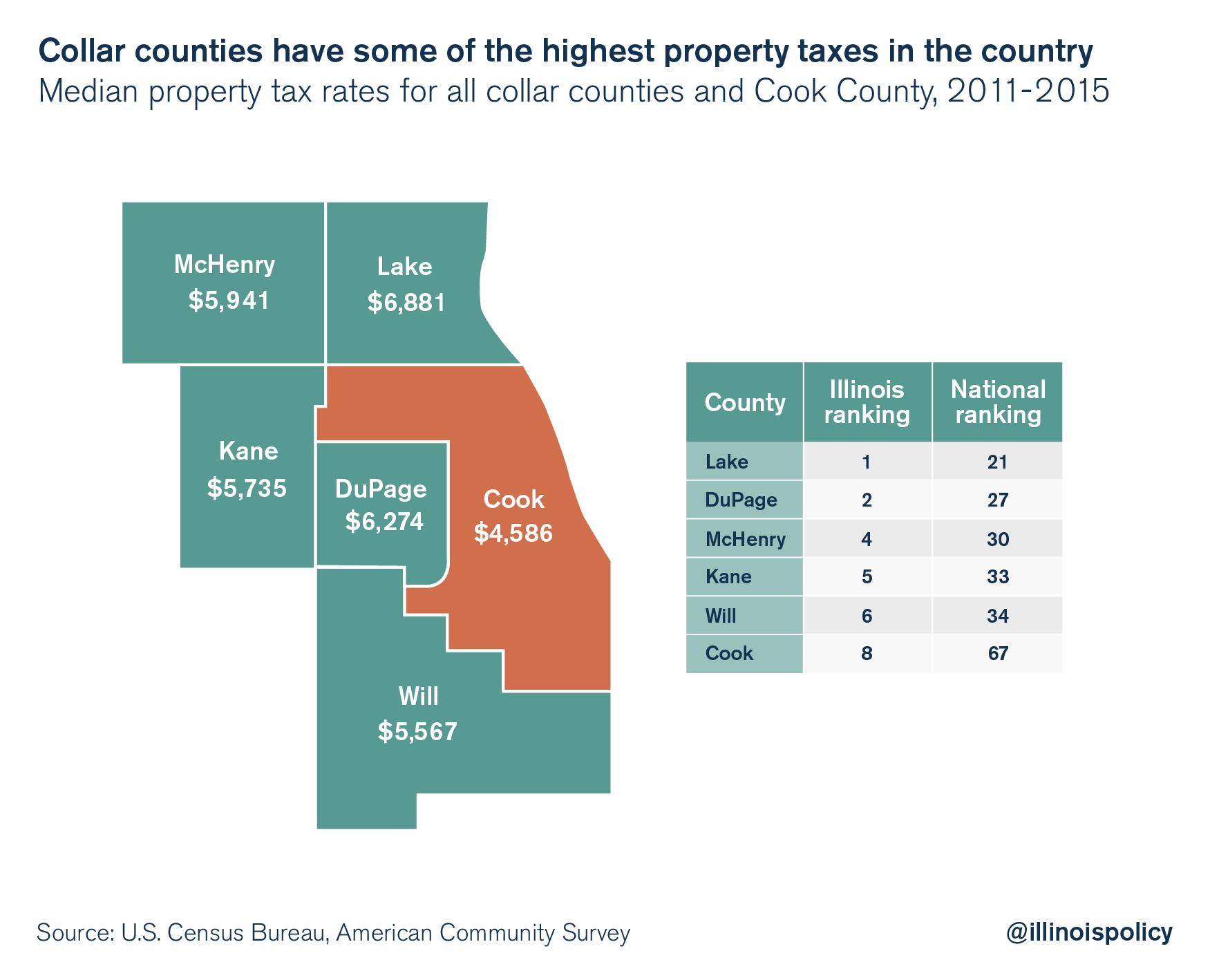

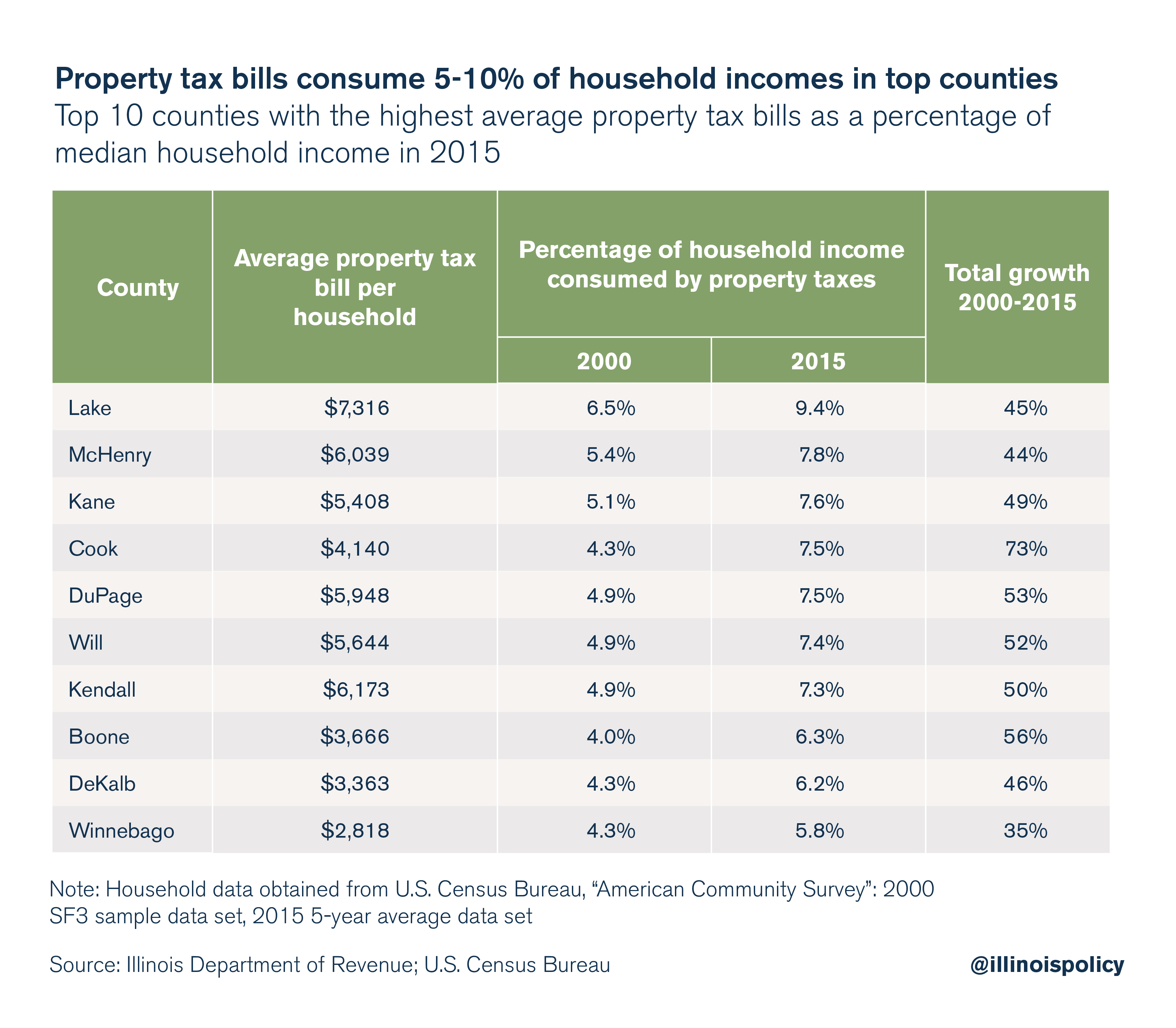

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

https://files.illinoispolicy.org/wp-content/uploads/2017/04/Collar-counties.png

Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for

The Senior Citizen Real Estate Tax Deferral Program is similar to a loan against a home s market value that allows a qualifying taxpayer to defer property taxes or special Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of 65 000 or less in the 2022 calendar year A Senior Freeze Exemption provides property tax savings by

Download Illinois Property Tax Discount For Seniors

More picture related to Illinois Property Tax Discount For Seniors

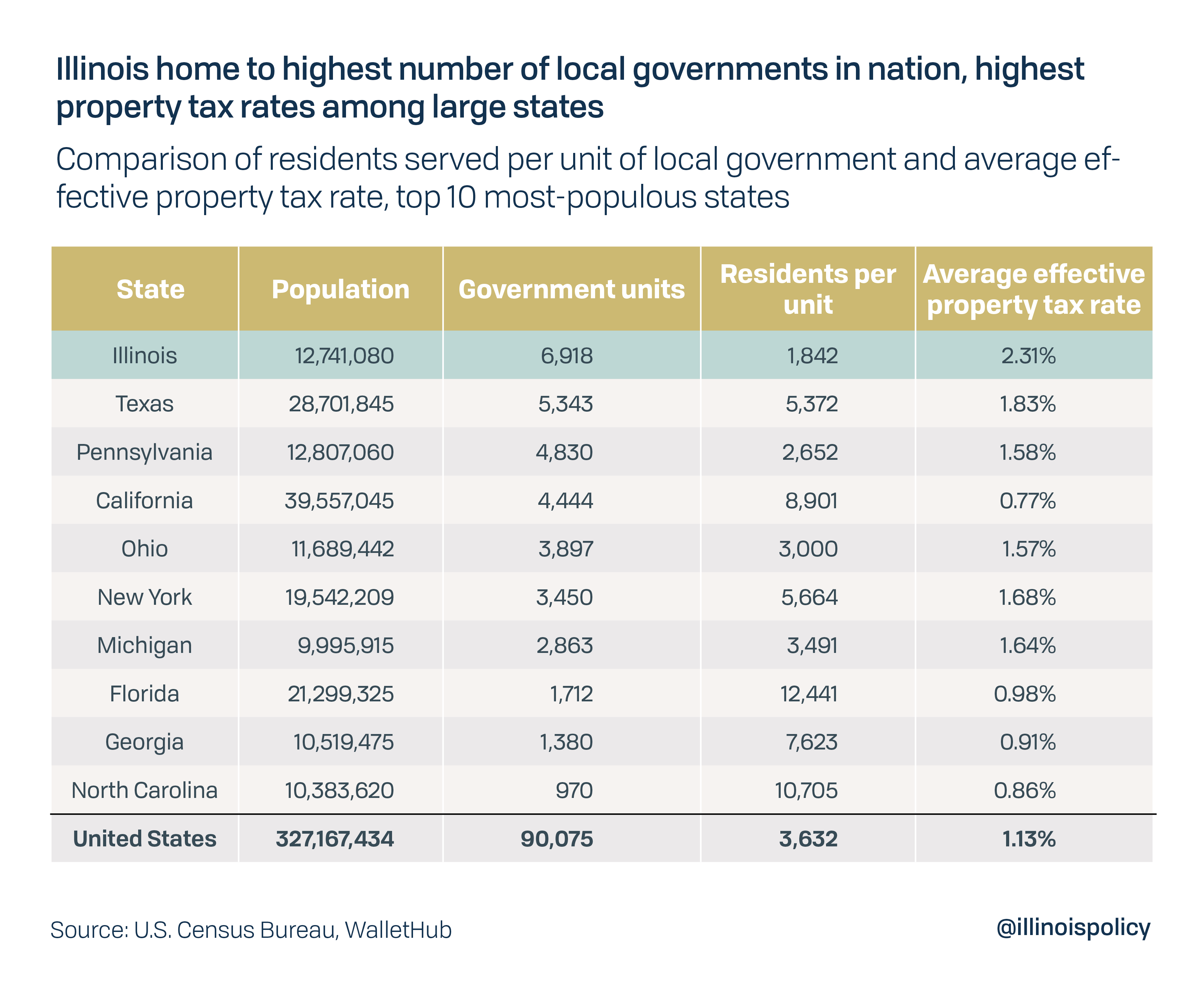

Illinois Property Tax Relief Begins By Culling Nearly 7 000 Local

https://files.illinoispolicy.org/wp-content/uploads/2019/10/2019.10.07_GG_localgov.png

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

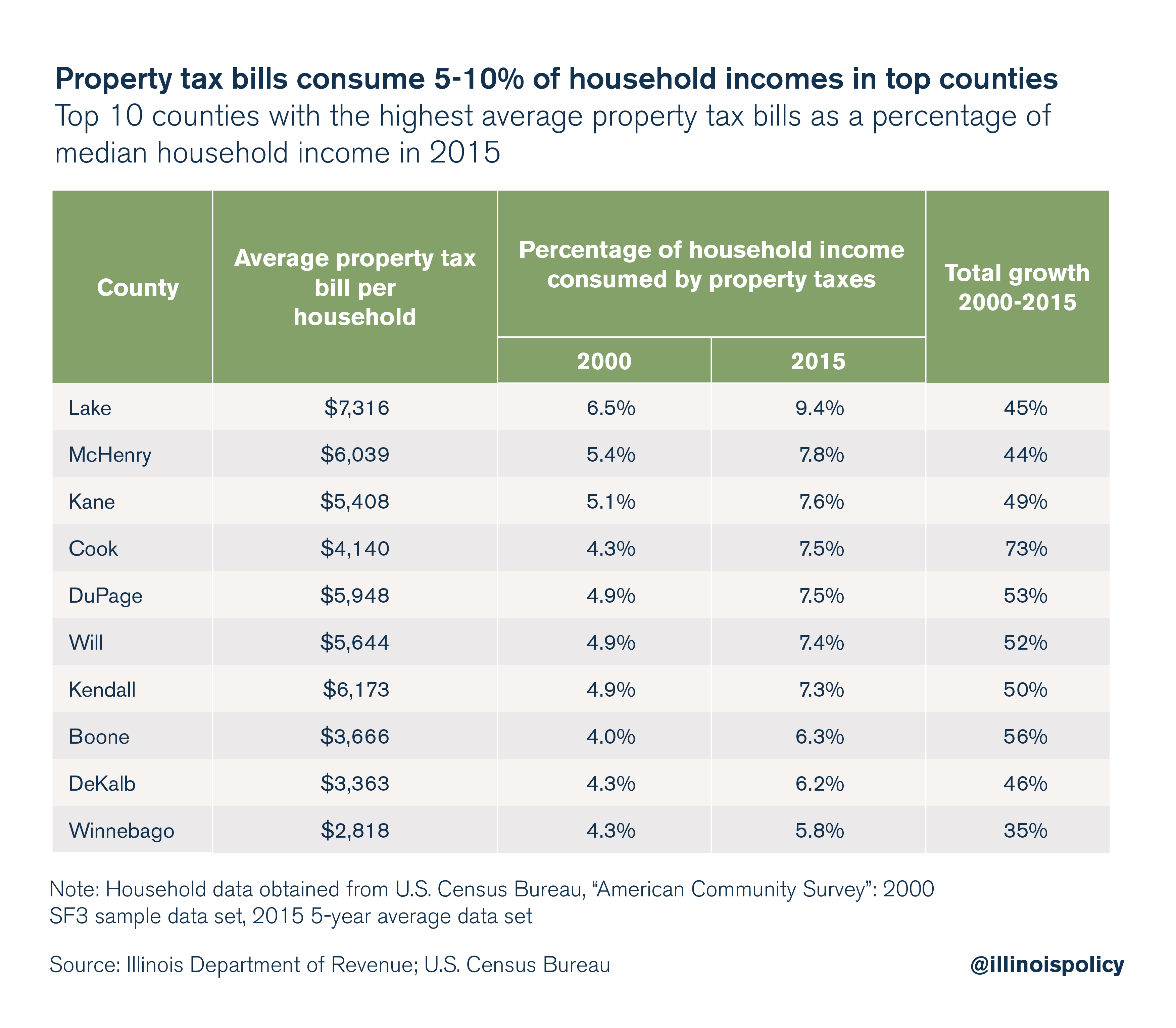

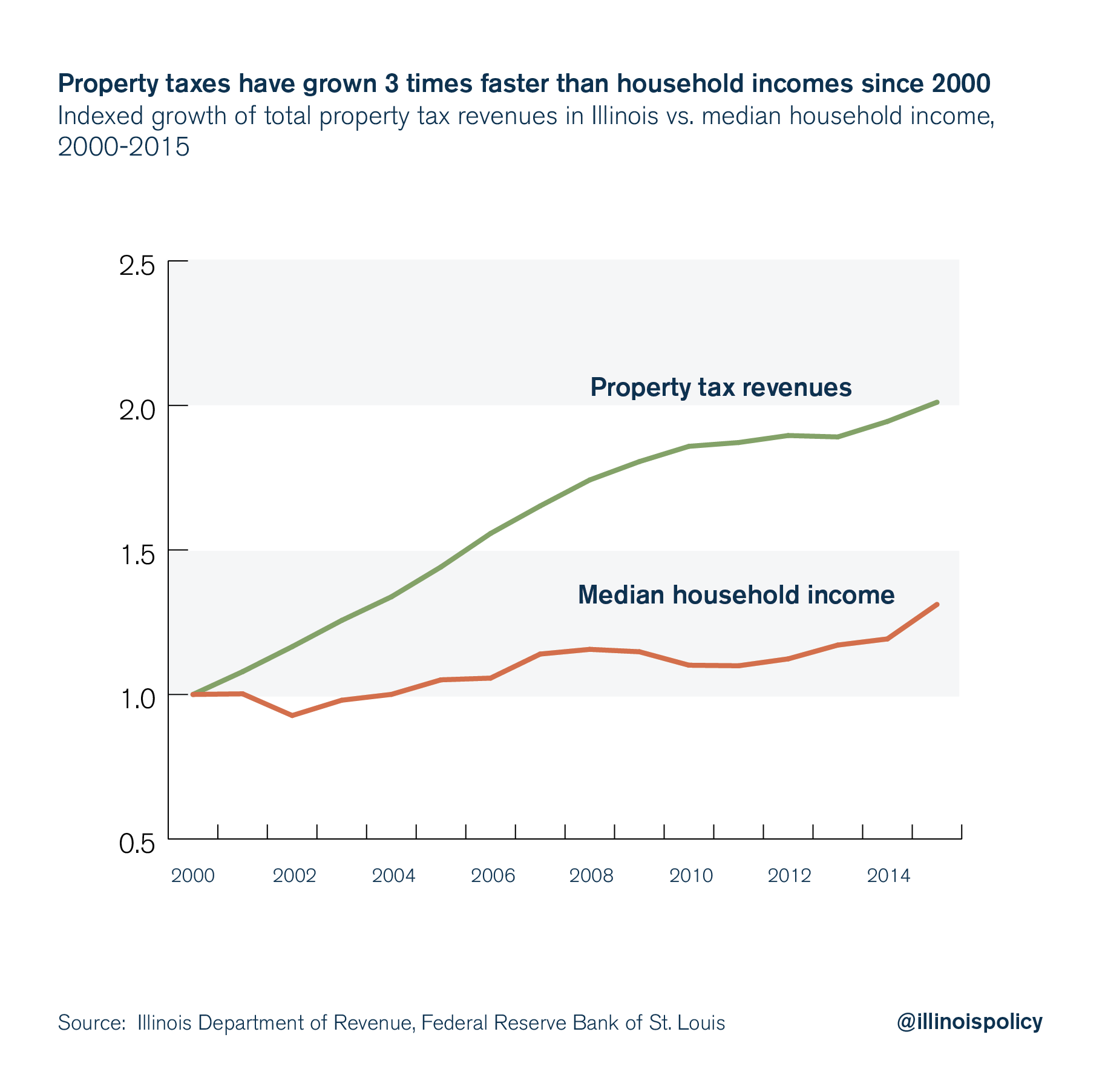

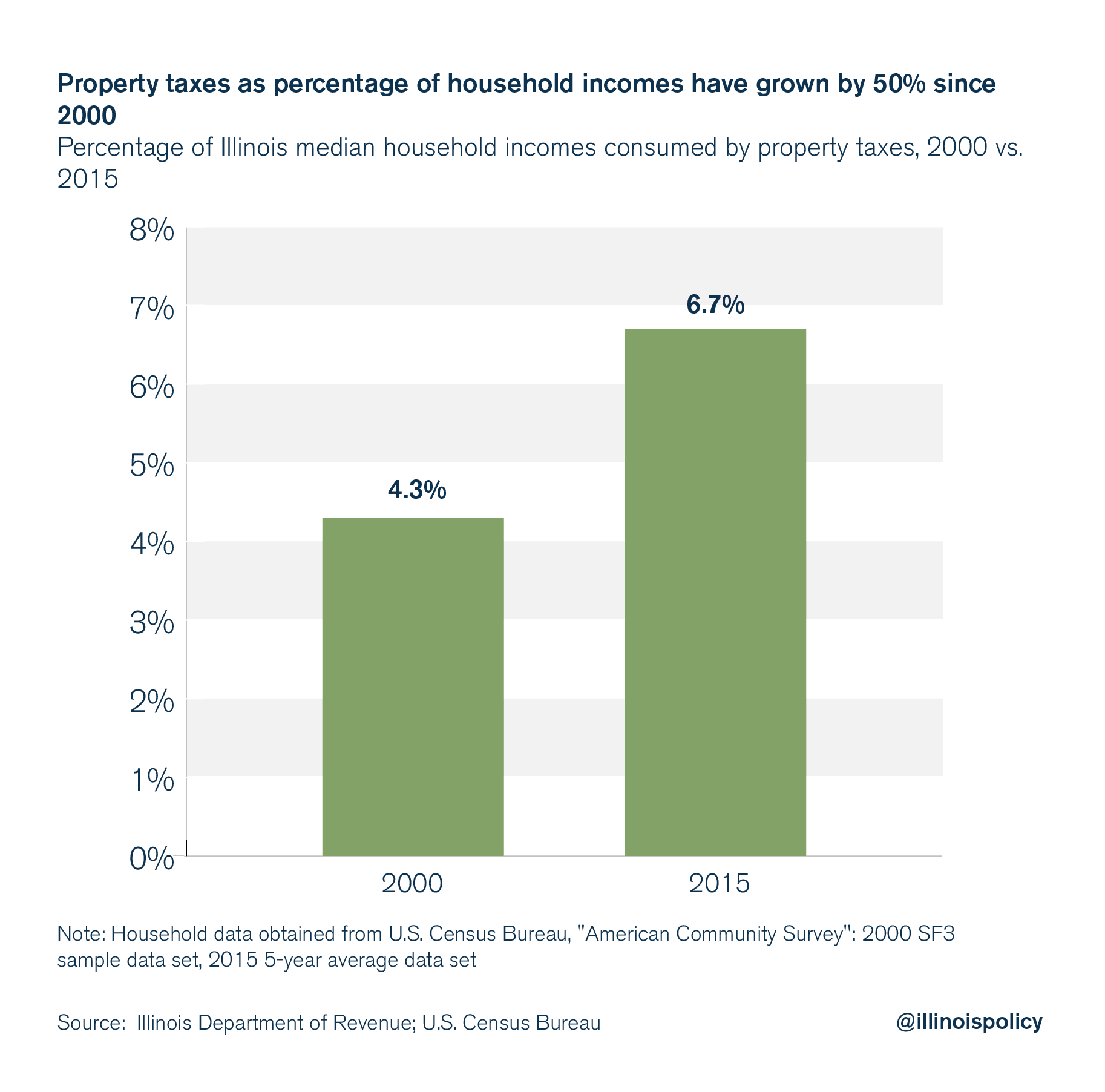

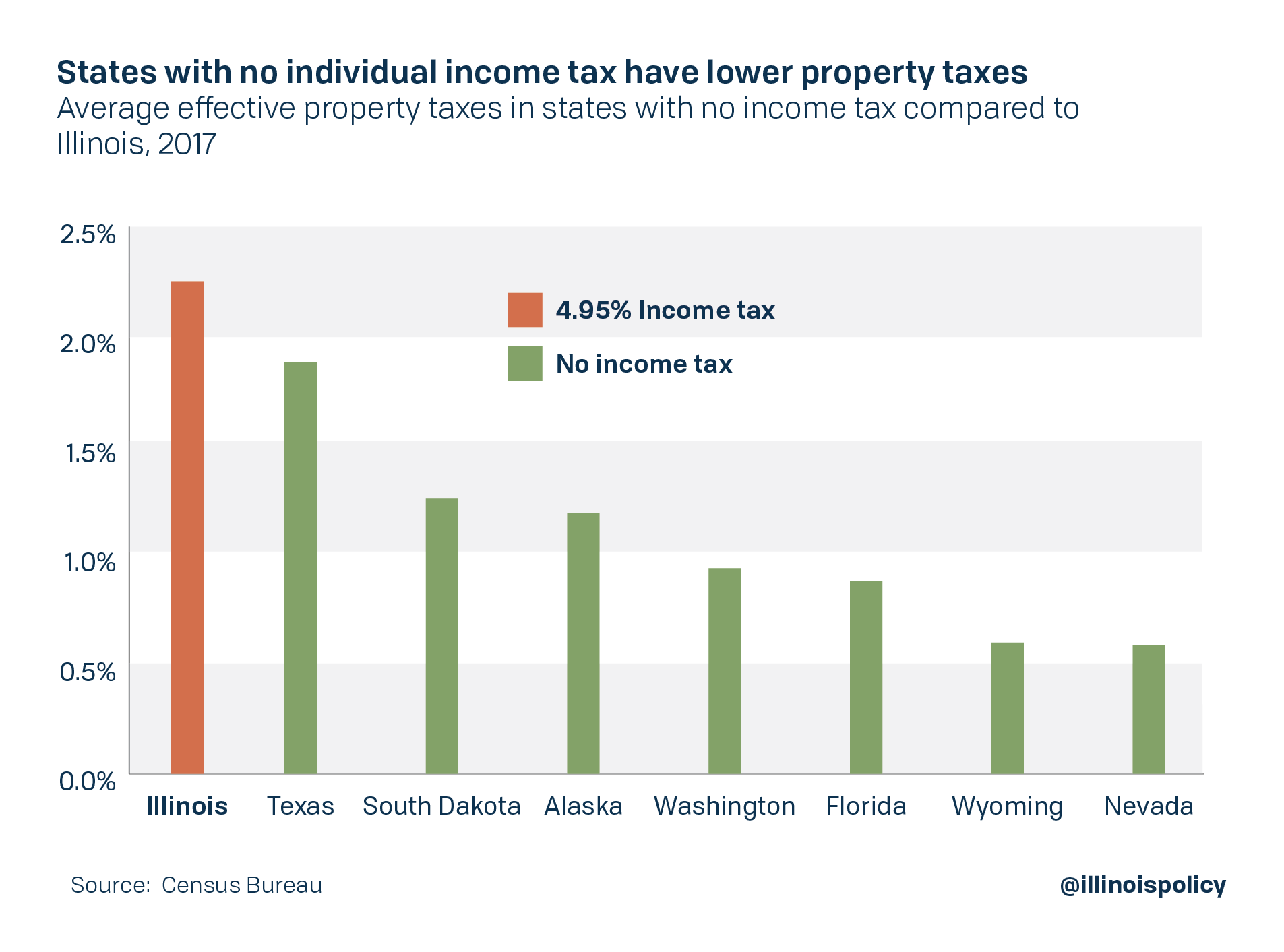

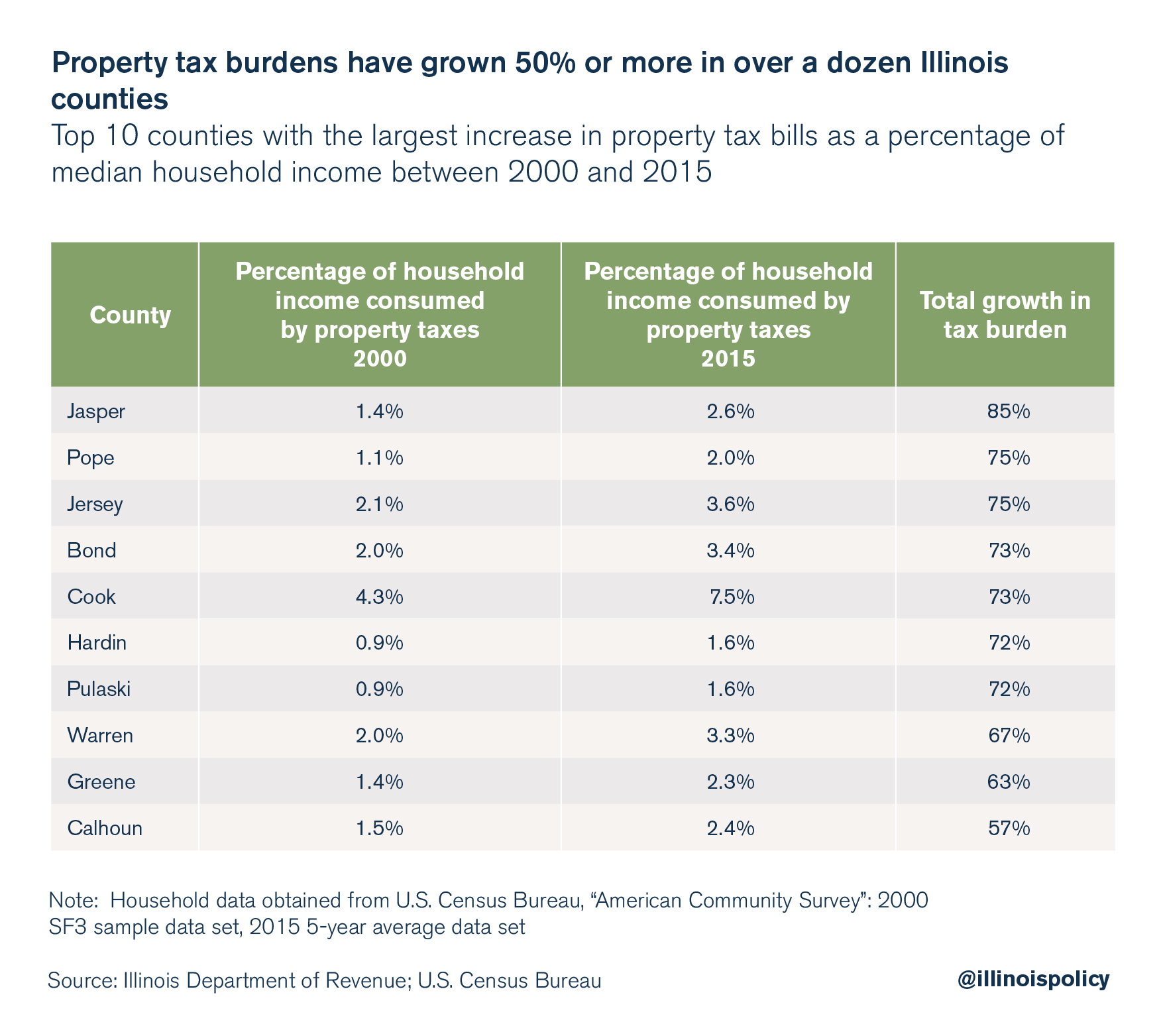

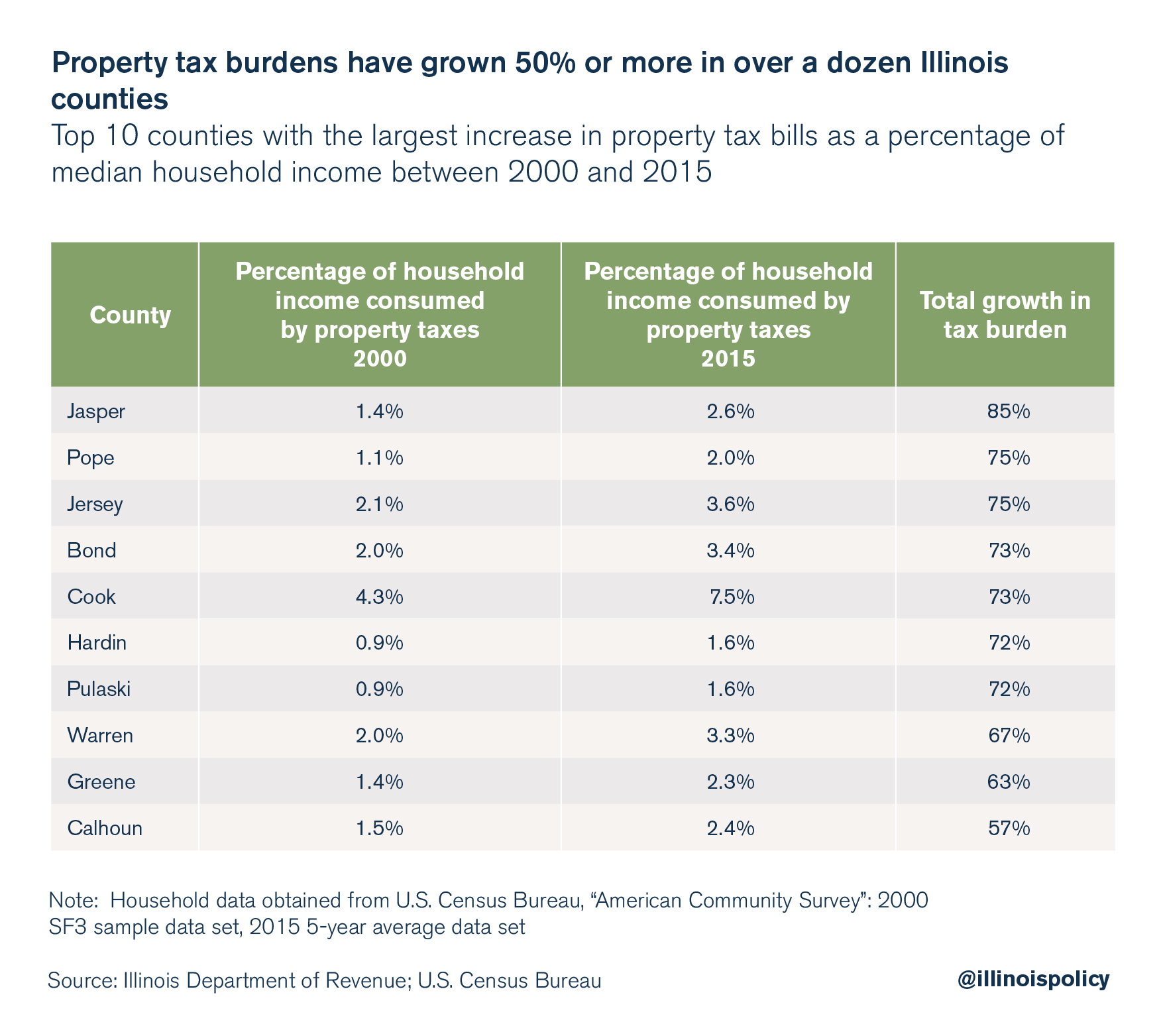

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

https://files.illinoispolicy.org/wp-content/uploads/2017/07/3.png

The Senior Homestead Exemption provides for a maximum of an 8 000 reduction from the equalized assessed valuation For a senior whose property is subject to an average tax rate of SPRINGFIELD Ill The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their

The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment Senior Homestead Exemption Benefit Following the Illinois Property Tax Code this exemption lowers the equalized assessed value of the property by 8 000 and may be claimed in addition

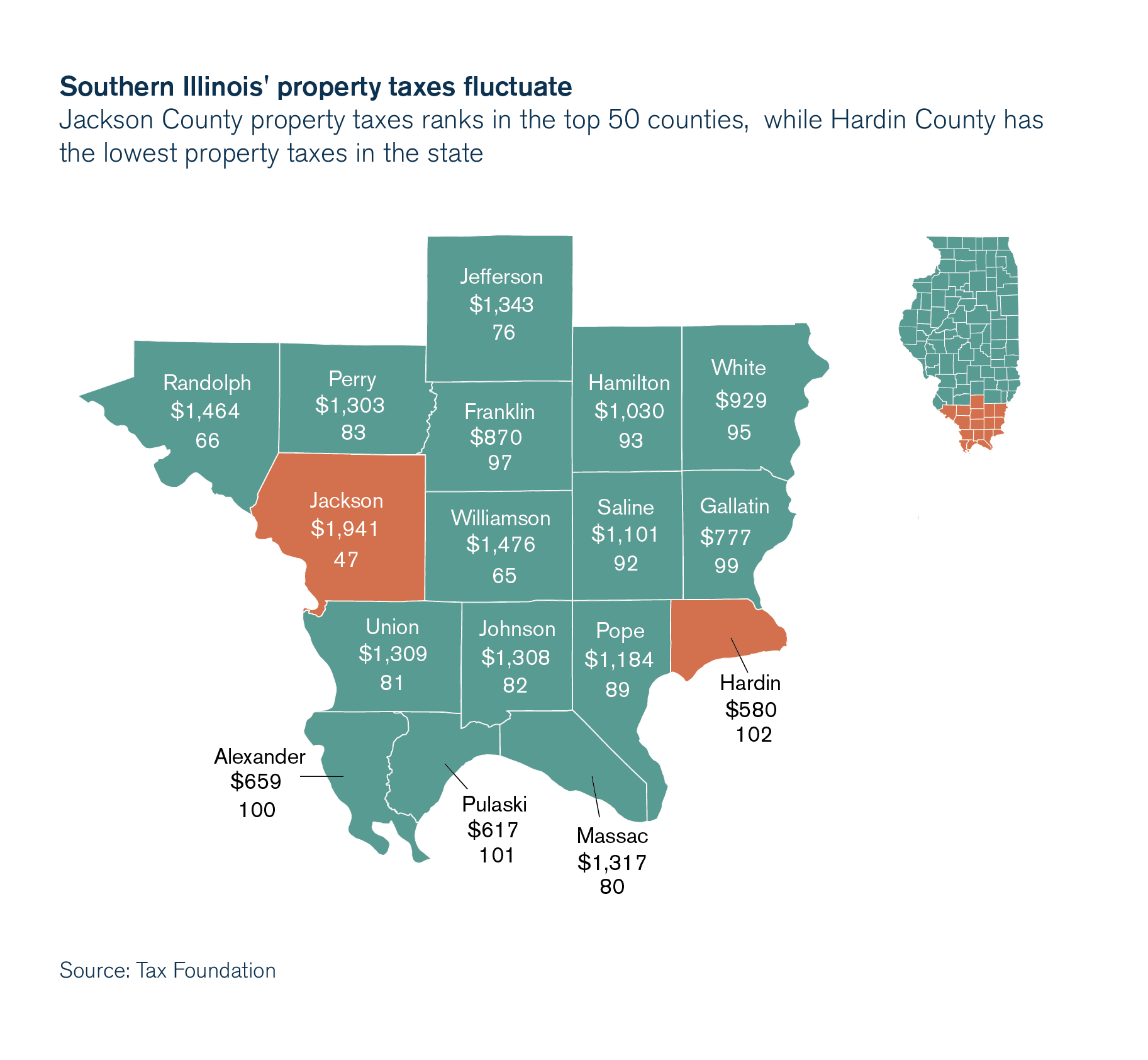

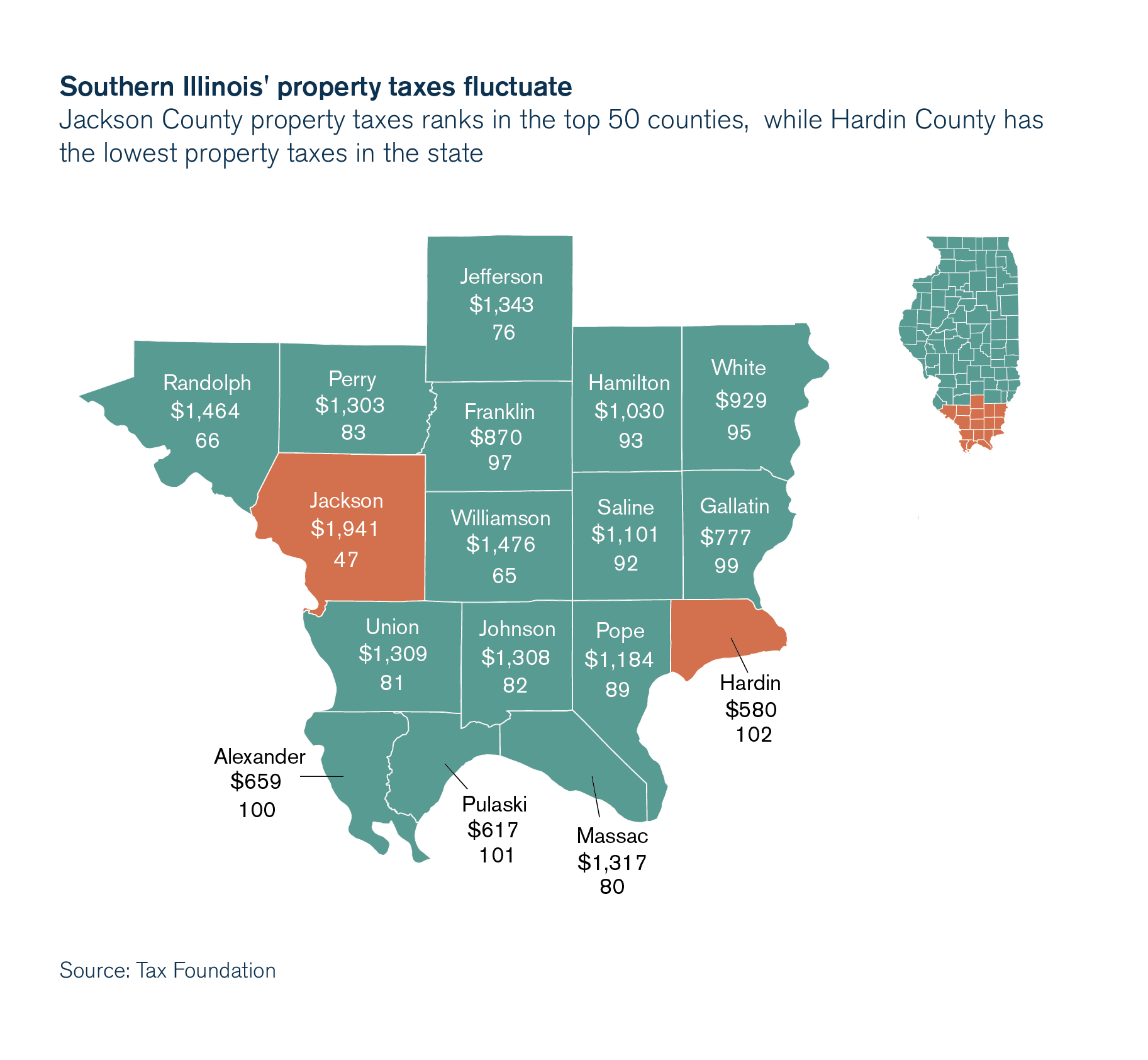

Southern Illinois Wide Range Of Property Taxes

https://files.illinoispolicy.org/wp-content/uploads/2017/05/southern-counties-01-1.png

Meaningful Substantive Property Tax Relief In Illinois Is Critical

https://repweber.com/wp-content/uploads/sites/9/2020/01/Property-Taxes-in-Illinois-SQUARE-2.png

https://www.cookcountyassessor.com…

Most senior homeowners are eligible for this exemption if they are 65 years of age or older born in 1958 or prior and own and occupy their property as their principal place of residence Once this exemption is applied the Assessor s

https://tax.illinois.gov/research/publications/pio-64.html

The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

Southern Illinois Wide Range Of Property Taxes

Study Illinois Property Taxes Still Second highest In Nation

Meaningful Substantive Property Tax Relief In Illinois Is Critical

Draft Illinois Property Tax Relief Report Calls For School

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

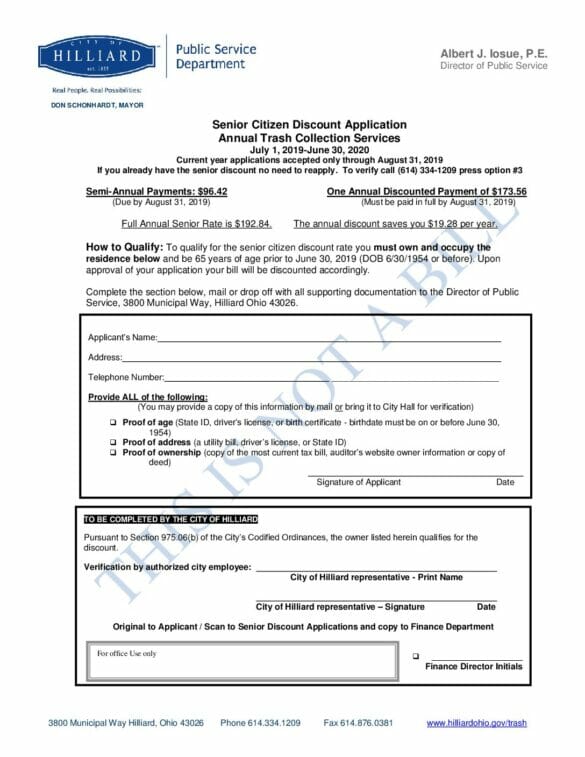

Senior Discount Form 2019 2020 City Of Hilliard

Illinois Property Tax Rate And Levy Manual Illinois Department Of

Il 1040 Instructions Fill Out Sign Online DocHub

Illinois Property Tax Discount For Seniors - Property Tax Aide features three statewide programs for older Illinois residents Low income Senior Citizens Assessment Freeze Homestead Exemption SCAFHE Senior Citizens