Is There A Property Tax Break For Seniors In Illinois The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

Published May 20 2022 Updated on May 20 2022 at 3 17 pm Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax Exemption Revenue Finance Greg Bishop Associate Editor The Center Square Seniors veterans and persons with disabilities in Illinois could get property tax relief under legislation the governor signed Friday

Is There A Property Tax Break For Seniors In Illinois

Is There A Property Tax Break For Seniors In Illinois

https://seniorlivingheadquarters.com/wp-content/uploads/2021/11/Do-Seniors-Get-a-Tax-Break-in-Florida-2-1024x576.jpg

Do Seniors Get A Property Tax Break In Arizona Senior Living

https://seniorlivingheadquarters.com/wp-content/uploads/2021/11/Arizona-Property-Taxesa-2-pdf-1024x576.jpg

Tax Breaks For Seniors And Low fixed Income Taxpayers In California

https://danielsgonzales.com/wp-content/uploads/2015/09/AdobeStock_74911462-1024x683.jpg

The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment payments on their principal residences The deferral is similar to a loan against the property s market value The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on their principal residences Seniors needing assistance paying their property taxes have until March 1 2023 to apply for the program

Senior Citizens Homestead Exemption Statutory Citation 35 ILCS 200 15 170 Who is eligible To qualify you must be age 65 by December 31st of the assessment year for which the application is made own and occupy the property be liable for the payment of real estate taxes on the property How do I apply The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue

Download Is There A Property Tax Break For Seniors In Illinois

More picture related to Is There A Property Tax Break For Seniors In Illinois

Miss Lawmakers Propose Property Tax Break For Seniors

https://www.hattiesburgamerican.com/gcdn/-mm-/103c04469430b58cbf5dac6541e29d493611eded/c=0-30-1999-1159/local/-/media/Hattiesburg/2015/02/17/B9316290596Z.1_20150217181031_000_GINA03279.1-0.jpg?width=1999&height=1129&fit=crop&format=pjpg&auto=webp

NJ Property Tax Break For Seniors In Budget After Agreement

https://www.northjersey.com/gcdn/presto/2019/12/26/PNJM/4631d3ec-e98f-4078-97d9-a42438a784e3-YearinPhotos2019-Gallery_44.JPG?crop=4522,2544,x0,y0&width=3200&height=1801&format=pjpg&auto=webp

That 20 Percent Tax Break For Small Businesses Is No Free for all

https://image.cnbcfm.com/api/v1/image/104910009-GettyImages-896192830.jpg?v=1532563709&w=1920&h=1080

August 5 2020 6 min read In a Nutshell Illinois offers 11 different property tax exemptions and a deferral option With so many programs to apply for you may have a good chance to qualify for a property tax break in Illinois if you re a local homeowner Scherer s House Bill 3054 would amend the property tax code by allowing the maximum income limitation for the Low Income Senior Citizens Assessment Freeze Homestead Exemption to be 85 000 Currently access to the freeze exemption is limited to seniors who earn 65 000 or less annually Inflation has hit seniors especially hard

A property tax exemption for seniors is a great benefit for homeowners 65 years of age or older Here s how to qualify for one in your state The program allows eligible seniors to defer up to 5 000 per tax year including both first and second installment payments It works like a loan with a 6 interest rate Full or partial payments are borrowed from the state The state pays the municipality on behalf of the homeowner A lien is placed on the home

Deadline Nears To Apply For Property Tax Break For Seniors

https://www.daytondailynews.com/resizer/kbWXk4N76KIIBGedTTKo-M0BXvc=/1200x630/cloudfront-us-east-1.images.arcpublishing.com/coxohio/KCTCRYRRT6556Y3KRVCE3VRIAA.jpg

Edmonton Grant Offers Property Tax Break For Non profits Affordable

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1b3O36.img?w=1024&h=768&m=4&q=84

https://www.illinoislegalaid.org/legal-information/...

The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

https://www.nbcchicago.com/news/local/new-illinois...

Published May 20 2022 Updated on May 20 2022 at 3 17 pm Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax

Spahealthy

Deadline Nears To Apply For Property Tax Break For Seniors

Top Tax Breaks And Deductions For Seniors Hello Krystof

New Texas Law Gives Elderly And Disabled Property Tax Break KEYE

The Local Tax Break Many Retirees Don t Know About but Should

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

2022 Pa Property Tax Rebate Forms PropertyRebate

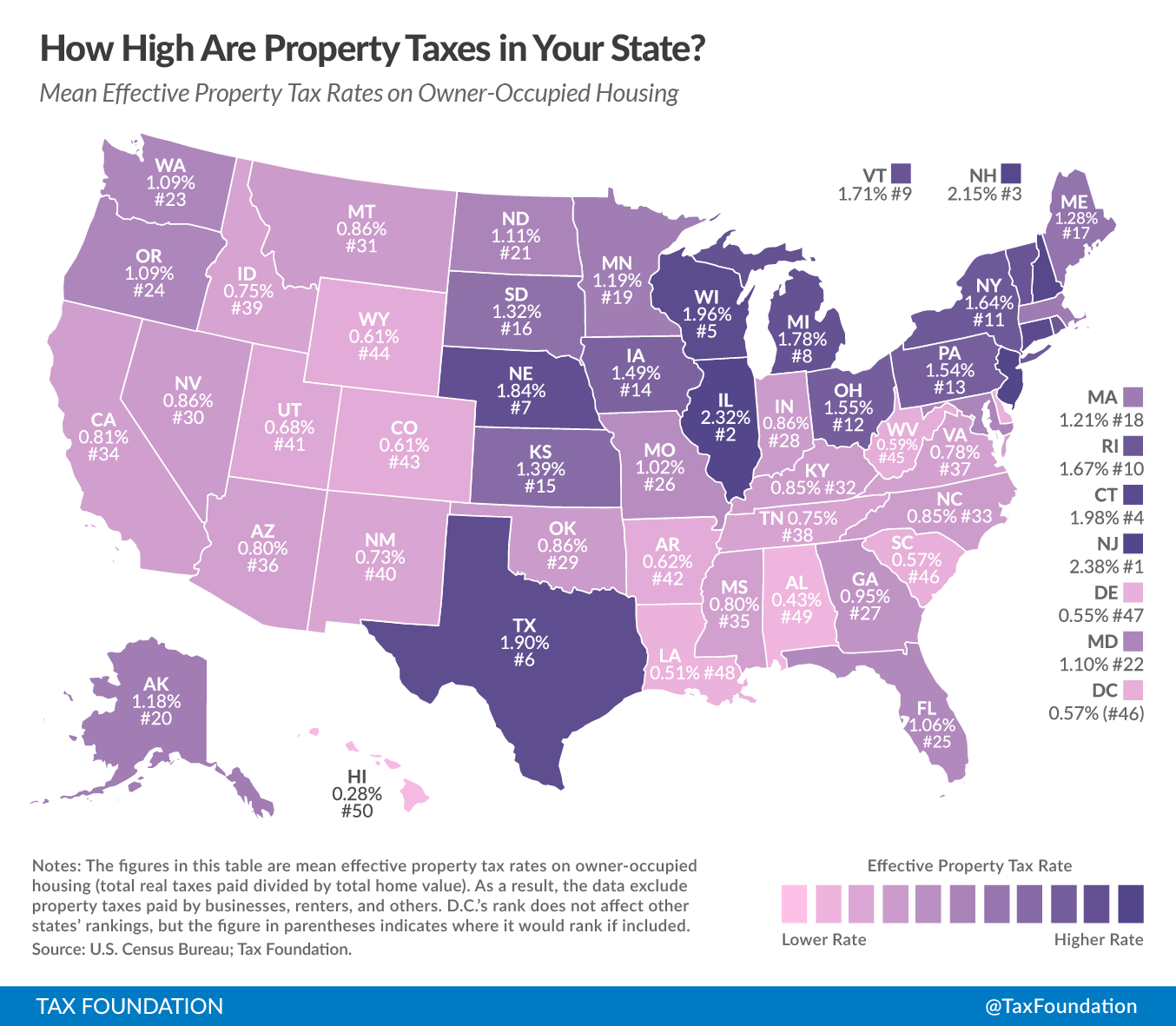

How High Are Property Taxes In Your State Tax Foundation

Tax Break For Landlords

Is There A Property Tax Break For Seniors In Illinois - The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment payments on their principal residences The deferral is similar to a loan against the property s market value