Cares Act Refund 2022 The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund

Through the Coronavirus Relief Fund the CARES Act provides for payments to State Local and Tribal governments navigating the impact of the COVID 19 outbreak The CARES Act established the 150 billion Coronavirus Relief Fund Section 2202 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 provides for special distribution options and rollover rules for retirement plans

Cares Act Refund 2022

Cares Act Refund 2022

https://www.marcumllp.com/wp-content/uploads/insights-coronavirus-cash-rebate.jpg

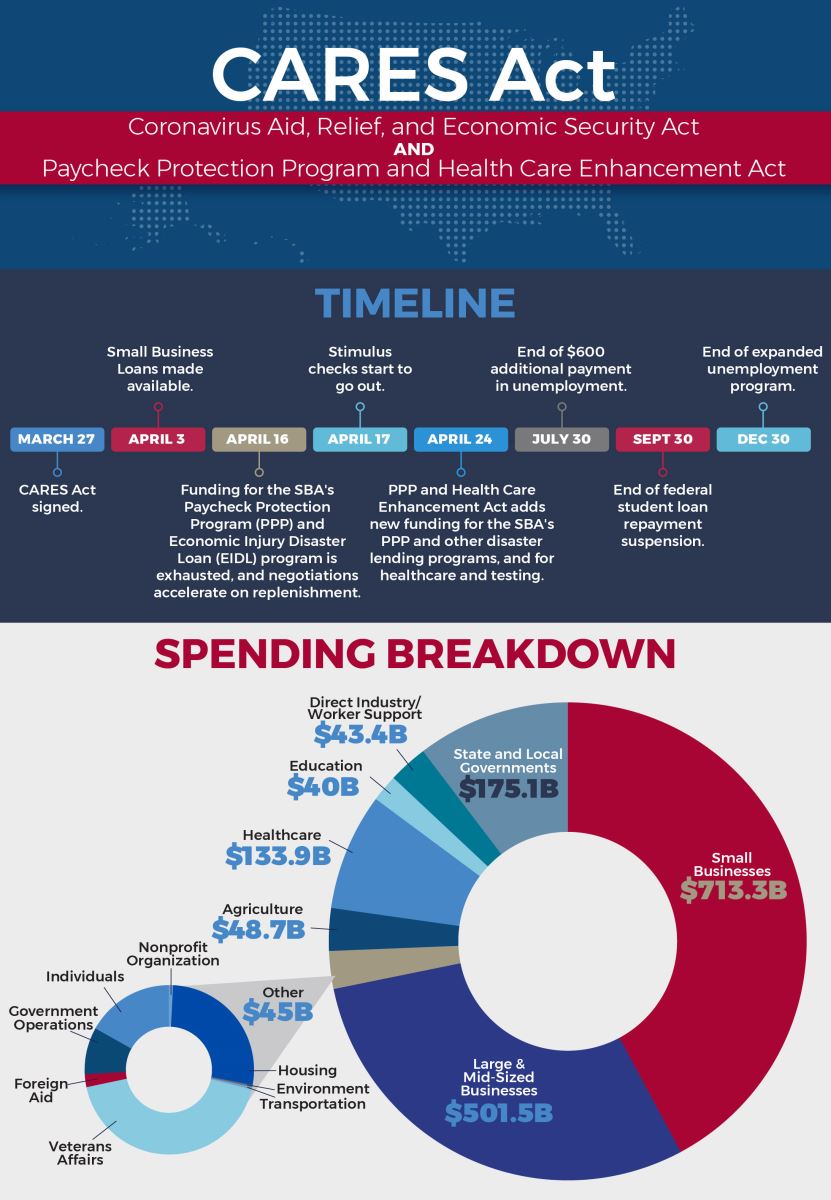

The CARES Act Funding Breakdown

https://www.gray-robinson.com/uploads/images/CARES-Act-Infographic_MainGraphic.jpg

The CARES ACT What You Need To Know Latest

https://i1.wp.com/www.grantwatch.com/grantnews/wp-content/uploads/2020/04/the-cares-act.jpg?resize=800%2C445&ssl=1

A complete list of frequently asked questions FAQs issued by the IRS regarding coronavirus COVID 19 tax relief and Economic Impact Payments for quick reference by the media and The American Rescue Plan Act is providing support to families across the country to help access stable and affordable housing In addition more than 2 000 governments across the country have invested more than 13 billion made

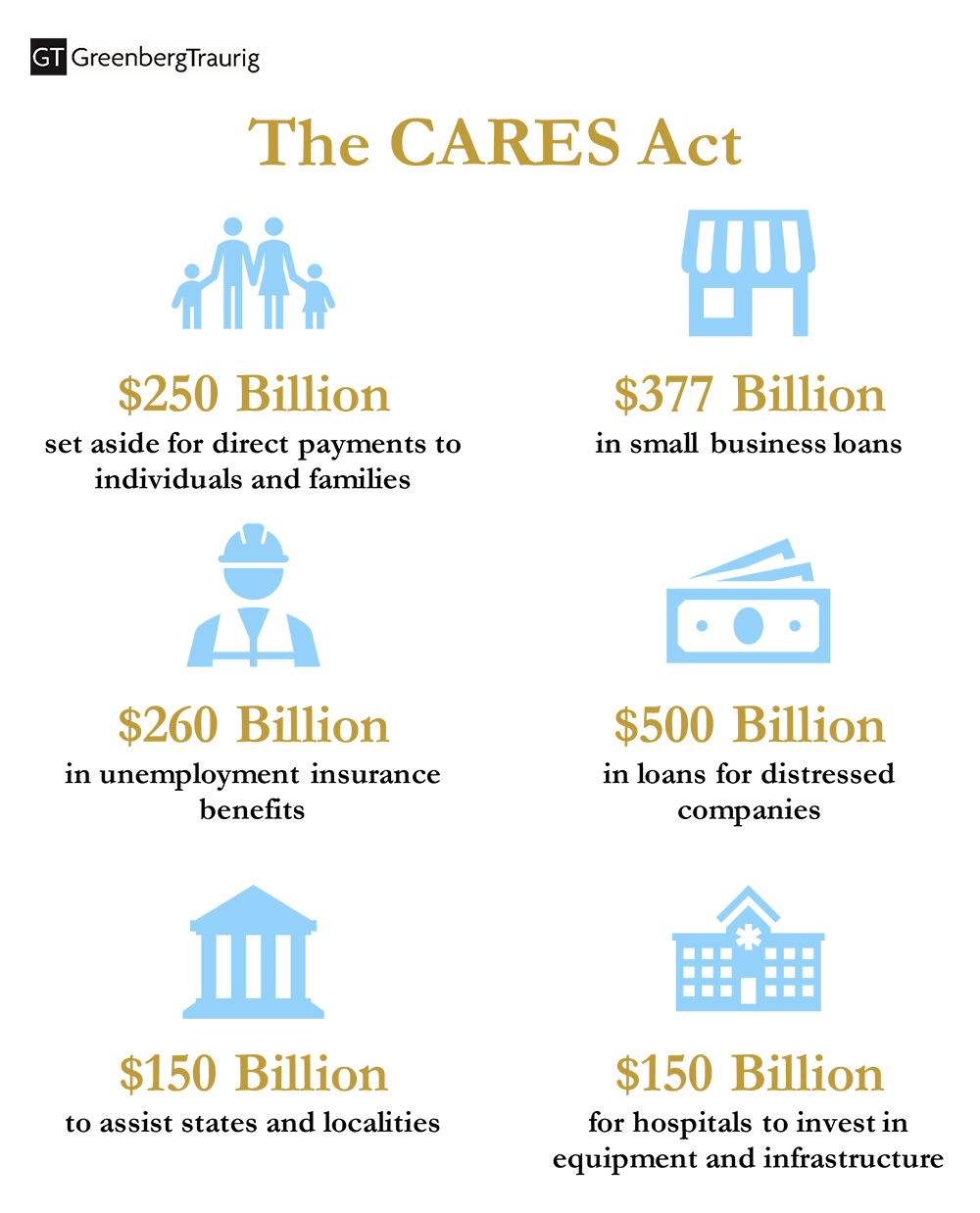

The Coronavirus Aid Relief and Economic Security Act b 1 also known as the CARES Act 2 is a 2 2 trillion economic stimulus bill passed by the 116th U S Congress and signed into law by President Donald Trump on March 27 2020 The Coronavirus Aid Relief and Economic Security Act CARES authorized direct payments to individuals generous monthly rebates to families with children and extended unemployment benefits

Download Cares Act Refund 2022

More picture related to Cares Act Refund 2022

The CARES Act Who Will Get A Rebate And How Much American

https://www.aei.org/wp-content/uploads/2020/03/Pomerleau-chart-3_30-2.png?x91208

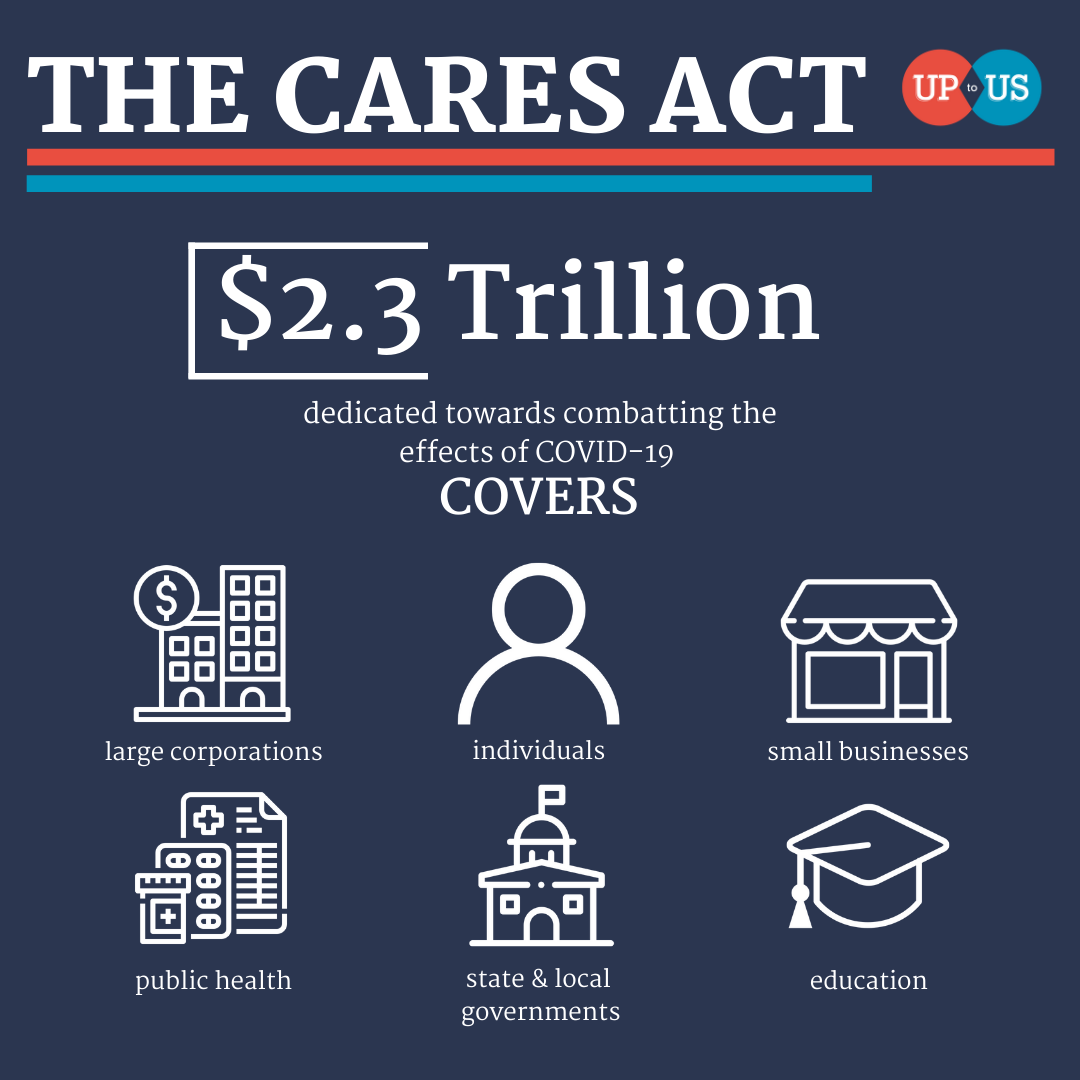

Visual Breakdown Of The CARES Act And Its Economic Impact UpToUs

https://www.itsuptous.org/sites/default/files/images/2020-04/3.png

Cares Act Student Loans Refund

https://i.pinimg.com/originals/13/39/bb/1339bb47235e6e91bdd792e017784ffe.jpg

Additionally if employers are entitled to refundable tax credits for paid leave under the Families First Coronavirus Response Act FFCRA or for qualified wages under the CARES Act employee retention credit the HCC has received funding from three federal grants to provide relief to qualified students and for allowable institutional expenditures from the effects of the Coronavirus

Disbursements including the CARES Act HEERF award If you qualify you will receive your refund selection kit in a bright green envelope in the mail from Bankmobile within 7 10 days of Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against certain

Get Fast ERTC Refund Take This Free CARES Act Rebate Eligibility

https://image.isu.pub/220804102809-26b762d3fd0961ec65a61830192e85f2/jpg/page_1.jpg

WIOA To Refund Claimants For Deductions On CARES Act Benefits Island

https://i0.wp.com/islandtimes.org/wp-content/uploads/2022/10/WIOA.jpg?fit=1200%2C518&ssl=1

https://www.irs.gov › newsroom › cares-act-coronavirus...

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund

https://home.treasury.gov › policy-issues › c…

Through the Coronavirus Relief Fund the CARES Act provides for payments to State Local and Tribal governments navigating the impact of the COVID 19 outbreak The CARES Act established the 150 billion Coronavirus Relief Fund

Visual Breakdown Of The CARES Act And Its Economic Impact UpToUs

Get Fast ERTC Refund Take This Free CARES Act Rebate Eligibility

COVID 19 Recap Of The CARES Act Graham Co

Additional Guidance Clarifying NOL Refund Claims Under The CARES Act

Additional CARES Act Funding Available Set Up Direct Deposit To Get

CARES Act Funding Wenatchee Valley College

CARES Act Funding Wenatchee Valley College

2022 CARE Act Eligibility Employee Retention Credit ERC Services

CARES Act Allows For 300 Above the Line Charitable Giving Deduction

CARES Act Relief For Small And Other Business Concerns

Cares Act Refund 2022 - The U S Secretary of Education in response to the CARES Act has determined that financial resources will be made available to colleges and universities to provide grants to