Cares Act Refund Request Requesting a student loan refund is likely possible for any payments up to August 30 2023 when the CARES Act forbearance expires and student loan repayment resumes

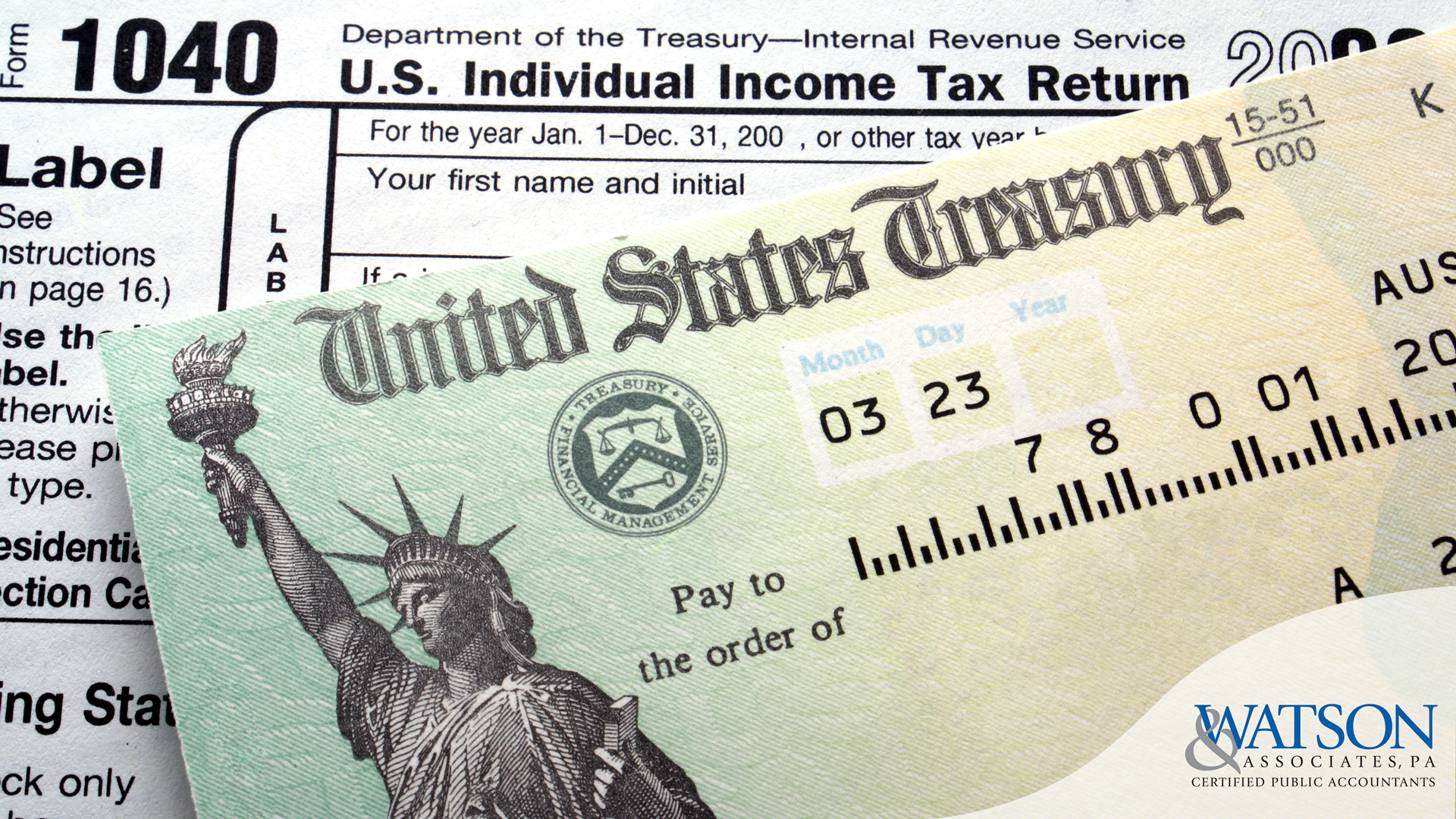

If you made federal student loan payments from March 13 2020 through the end of the payment pause in August 2023 the CARES Act states that you are entitled to a refund if you want it The refund is a worthwhile possibility You can find information about claiming the 2020 Recovery Rebate Credit with your tax return to get the relief payments you re owed Get more info on the Recovery Rebate Credit Find

Cares Act Refund Request

Cares Act Refund Request

https://www.calistacorp.com/wp-content/uploads/2021/09/CARES-act-graphic-1024x1024.png

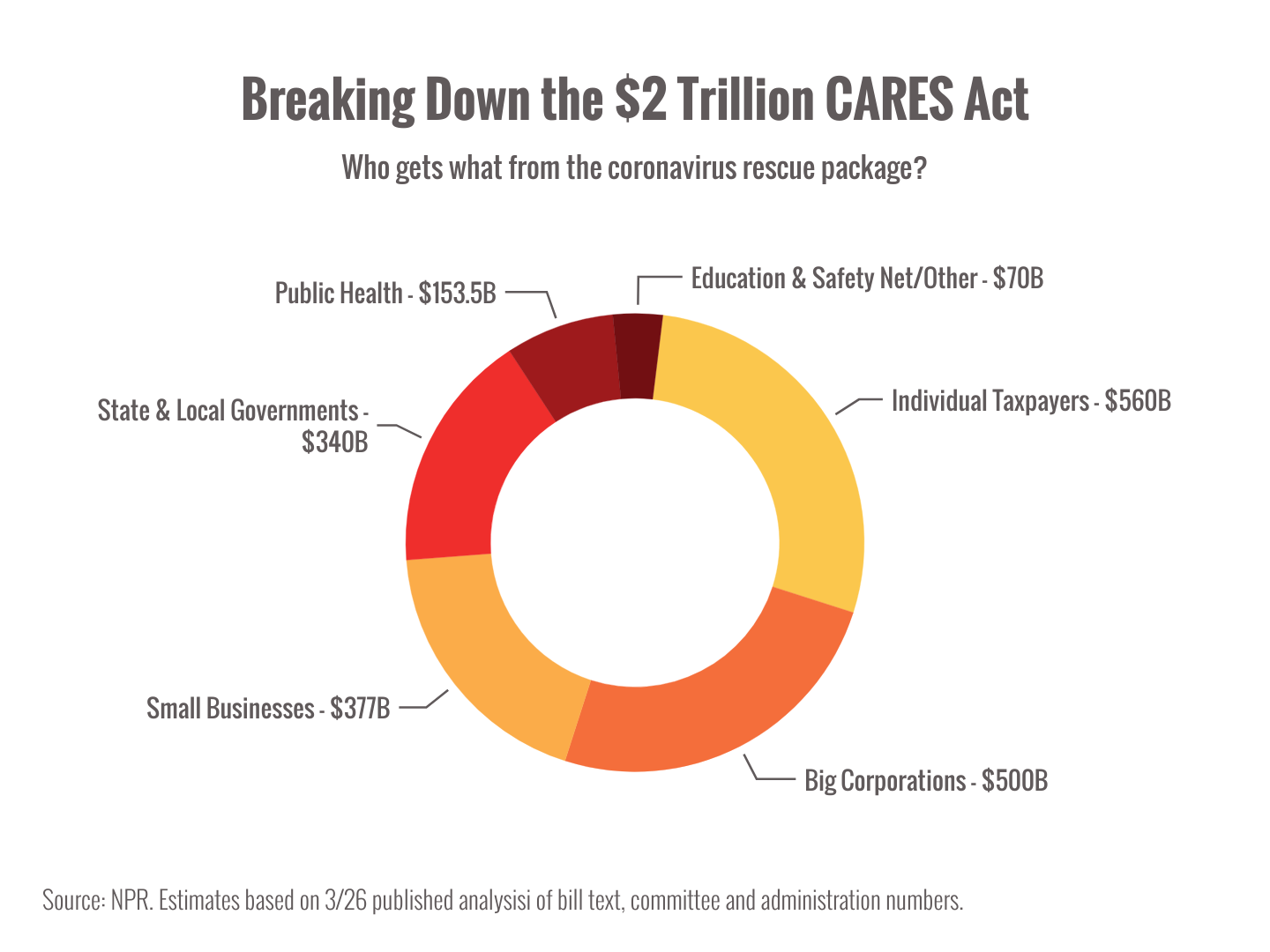

Did You Know The CARES Act Might Allow For A Refund For You If You Own

https://costsegregationservices.com/wp-content/uploads/2021/07/July-2021-CARES-Act.jpg

The CARES Act SBA Loans KAASS LAW

https://kaass.com/wp-content/uploads/2020/03/CARES-ACT_.png

Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return If you made any payments toward your federal student loans since March 2020 you may request a refund of these payments by contacting us at 800 722 1300 If you do not

Another provision in the Coronavirus Aid Relief and Economic Security CARES Act allows borrowers who made payments during the forbearance period to request a refund Any and all payments made since Any money garnished will be refunded Make sure the Default Resolution Group has your most up to date contact info so that any refunds are sent to the correct address Eligible borrowers

Download Cares Act Refund Request

More picture related to Cares Act Refund Request

CARES Act K 12 Funds Need To Reach States But Not Without Some

https://imageio.forbes.com/specials-images/imageserve/1208441564/0x0.jpg?format=jpg&width=1200

Important Stimulus Payment Details From The CARES Act Pathway Financial

https://images.squarespace-cdn.com/content/v1/5f358181012c6a797d00d688/1601476656478-D0NBF2AMKDO0RLP442WV/CARES+ACT+What+Need+to+Know

CARES Act Financial Aid

http://www.yvcc.edu/financial-aid/wp-content/uploads/sites/9/2022/01/1642177330140.png

If you made a Student Loan payment after the president signed the CARES Act on March 27 2020 you can receive a refund Contact your loan servicer to request that your Borrowers who hold eligible federal student loans and have made voluntary payments since March 13 2020 can get a refund according to the Department of Education

If you happen to be part of the Student Loan Forgiveness Program you can ask for a refund and not hurt your status Even though you asked for the money back as long as If you made federal student loan payments during the pandemic before learning you were eligible for debt forgiveness you should be able to request a refund through your

Landlords Lenders May Receive Direct Payments From CARES Act Relief

https://www.rothmangordon.com/wp-content/uploads/2020/07/CARES-act-re-scaled.jpg

A Brief Overview Of The CARES Act Individual Provisions Watson

https://mywatsoncpa.com/wp-content/uploads/2020/02/WAA_BLOG-IMAGE_TAX-1080_V01_.jpg

https://www.studentloanplanner.com › federal-student-loan-refund

Requesting a student loan refund is likely possible for any payments up to August 30 2023 when the CARES Act forbearance expires and student loan repayment resumes

https://thecollegeinvestor.com

If you made federal student loan payments from March 13 2020 through the end of the payment pause in August 2023 the CARES Act states that you are entitled to a refund if you want it The refund is a worthwhile possibility

The CARES Act Amended EALG

Landlords Lenders May Receive Direct Payments From CARES Act Relief

The CARES Act And Subchapter 5 Of The Bankruptcy Code

The CARES Act And Your Federal Student Loans

Understanding Covid Relief Funds Federal Programs Natchez Adams

CARES Act Returning To Campus

CARES Act Returning To Campus

Your Guide To CARES Act Funding Brite

Sign In ACT 2

County Commissioners Allocate 461 669 More In CARES Act Funds Wadena

Cares Act Refund Request - Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return