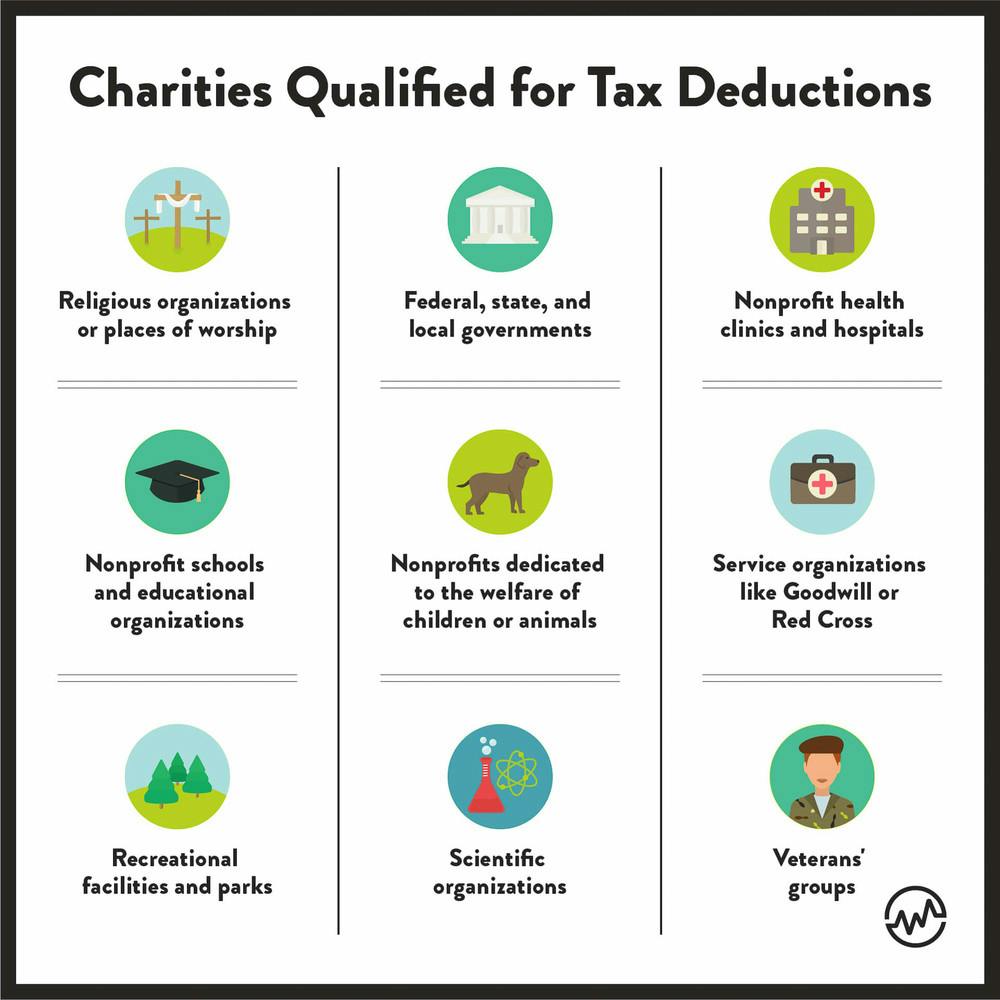

Charity Tax Return Not only does the charity benefit but taxpayers enjoy tax savings by deducting part or all of their contributions on their tax returns if they itemize their deductions using Schedule A

Understand the rules covering income tax deductions for charitable contributions by individuals To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI

Charity Tax Return

Charity Tax Return

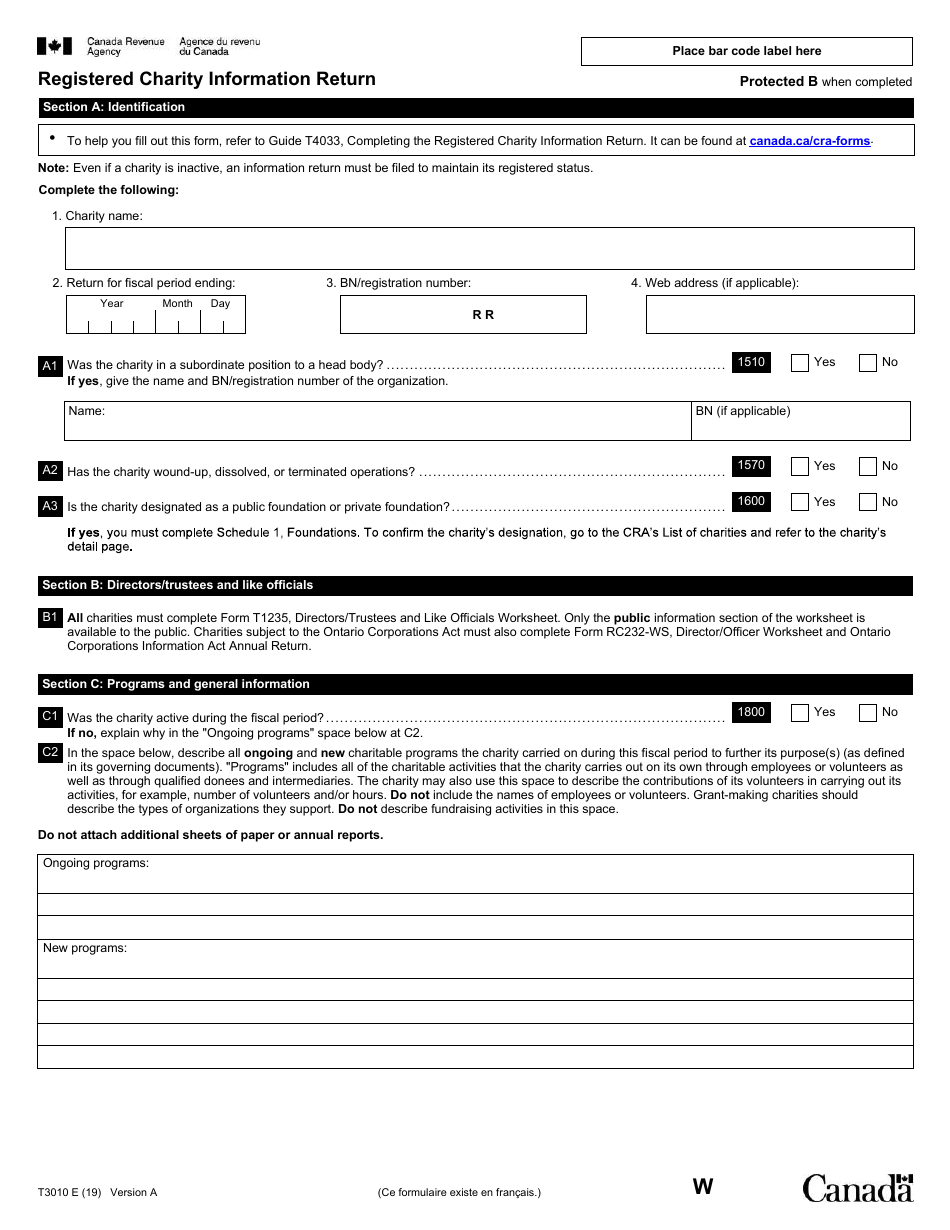

https://data.templateroller.com/pdf_docs_html/1868/18682/1868261/form-t3010-registered-charity-information-return-canada_print_big.png

Charity Tax Return Marietta GA

https://www.akspickup.org/wp-content/uploads/2016/12/tax-donation-dallas.jpg

Charity Tax Return Requests From HMRC News WMT LLP

https://wmtllp.com/wp-content/uploads/2019/06/tax-return-request-1024x683.jpg

The IRS requires all U S tax exempt nonprofits to make public their three most recent Form 990 or 990 PF annual returns commonly called 990s and all related supporting documents Calculating the Value of Your Charitable Donations A clear understanding of the value of your charitable donations is important for your tax return especially if you donate items instead of cash For cash donations it s

To help you prepare your nonprofit s tax returns we ve included information on why and when nonprofits must file which organizations don t need to file a return and links to IRS Your charitable contributions may be deductible if you itemize Find forms and check if the group you contributed to qualifies as a charitable organization for the deduction

Download Charity Tax Return

More picture related to Charity Tax Return

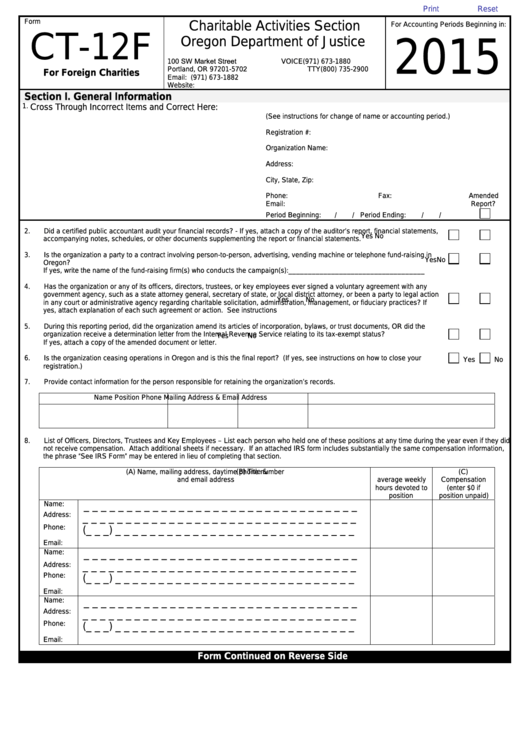

Fillable Form Ct 12f Tax Return For Foreign Charities 2015

https://data.formsbank.com/pdf_docs_html/350/3505/350541/page_1_thumb_big.png

Uk Hmrc Tax Documents Hot Sex Picture

https://fakeutilities.com/uploads/l_8.gif

Giving To Charity Here Are 5 Must Knows About Tax Deductions The

https://g.foolcdn.com/editorial/images/551670/charity-gettyimages-186059084.jpg

Charities do not pay tax on most types of income as long as they use the money for charitable purposes You can claim back tax that s been deducted for example on bank interest and Most charitable nonprofits that are recognized by the IRS as tax exempt have an obligation to file IRS Form 990 which is an annual information return to be filed with the IRS by the 15th day of

Individual Taxation Deductions and Credits 2024 Returns Individual Taxation Income and Deductions 2024 Returns With over 700 on demand courses 1 000 annual live Find and check a charity using Candid s GuideStar Look up 501 c 3 status search 990s create nonprofit organizations lists and verify nonprofit information

Charity Accounts Tax Return Software Charity Compliance

https://www.btcsoftware.co.uk/wp-content/uploads/business-type-charity.jpg

Form T2046 Fill Out Sign Online And Download Fillable PDF Canada

https://data.templateroller.com/pdf_docs_html/2002/20028/2002811/form-t2046-tax-return-where-registration-of-a-charity-is-revoked-canada_print_big.png

https://www.investopedia.com/articles/personal...

Not only does the charity benefit but taxpayers enjoy tax savings by deducting part or all of their contributions on their tax returns if they itemize their deductions using Schedule A

https://www.irs.gov/charities-non-profits/...

Understand the rules covering income tax deductions for charitable contributions by individuals

How To Maximize Your Charity Tax Deductible Donation WealthFit

Charity Accounts Tax Return Software Charity Compliance

Make Sure You Claim Your Charitable Tax Deductions On Form 1040 Or

File Your Uk Company Accounts And Tax Return By Tashapb 54 OFF

Charity Filing Deadline Approaching Thompson Taraz Rand

The Ethical Investment Of Donor Advised Funds The Charity Service

The Ethical Investment Of Donor Advised Funds The Charity Service

GIVING CENTER 501C3 NON PROFIT CHARITY EIN 46 1883892 Charity

Preparing A Charity Annual Return Thompson Taraz Rand

At HiS Charity Mens Mental Health Charity We Are Here To Listen And Help

Charity Tax Return - If your charity has income that does not qualify for tax relief you must complete a tax return If you have no tax to pay complete a tax return only if HM Revenue and Customs HMRC asks