Chevrolet New Electric Vehicle Federal Tax Credit Eligibility Form If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum Find the Vehicle Identification Number VIN of the GM vehicle you re interested in and enter it below to find out if it qualifies for the New Vehicle Purchase Federal Tax Credit

Chevrolet New Electric Vehicle Federal Tax Credit Eligibility Form

Chevrolet New Electric Vehicle Federal Tax Credit Eligibility Form

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Electric Vehicles Qualifying For US Federal Tax Credit In 2021

https://www.austincartransport.com/wp-content/uploads/2021/03/electric-charge-2301604_1920-1536x1128.jpg

The Federal Tax Credit For Electric Vehicles Explained Timesherald

https://www.timesherald.com/wp-content/uploads/migration/2021/07/8670ab22805aed72200eebeae7be8608.jpg?w=1200

The U S Department of Energy s website currently lists 21 vehicles that are eligible for the full 7 500 tax credit with models like the Chevy Bolt EV Bolt EUV Cadillac Lyriq and GMC Hummer Tax and utility savings New Bolt EV and EUV purchases qualify for a federal tax credit of up to 7 500 for eligible buyers which can be applied toward vehicle price at time of sale by qualified and participating dealers

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to

Download Chevrolet New Electric Vehicle Federal Tax Credit Eligibility Form

More picture related to Chevrolet New Electric Vehicle Federal Tax Credit Eligibility Form

Solved Suppose You Want To Purchase A New Electric Vehicle Chegg

https://media.cheggcdn.com/study/941/941f4563-13f0-4e6d-991e-6129dd6fc333/image

Can You Get Federal Tax Credit For Leasing An Electric Car

https://electricvehiclesfaqs.com/wp-content/uploads/2022/09/Can-You-Get-Federal-Tax-Credit-for-Leasing-an-Electric-Car-768x480.jpg

UPDATE Here Are All The EVs Eligible Now For The 7 500 Federal Tax Credit

https://cdn.motor1.com/images/custom/thumbnail/ford-ev-models-eligible-for-federal-tax-credit.jpg

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit When an OEM satisfies the first two requirements buyers of its EVs can claim the full 7 500 credit for up to 10 years after eligibility begins If an OEM satisfies just the 50 battery

The idea in theory is quite simple per the IRS You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify

https://thumbor.forbes.com/thumbor/fit-in/960x/filters:format(jpg)/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png

Volkswagen ID 4 How To Charge Your New Electric Vehicle

https://www.motorbiscuit.com/wp-content/uploads/2021/04/VWID4.jpg?w=1536&h=1025

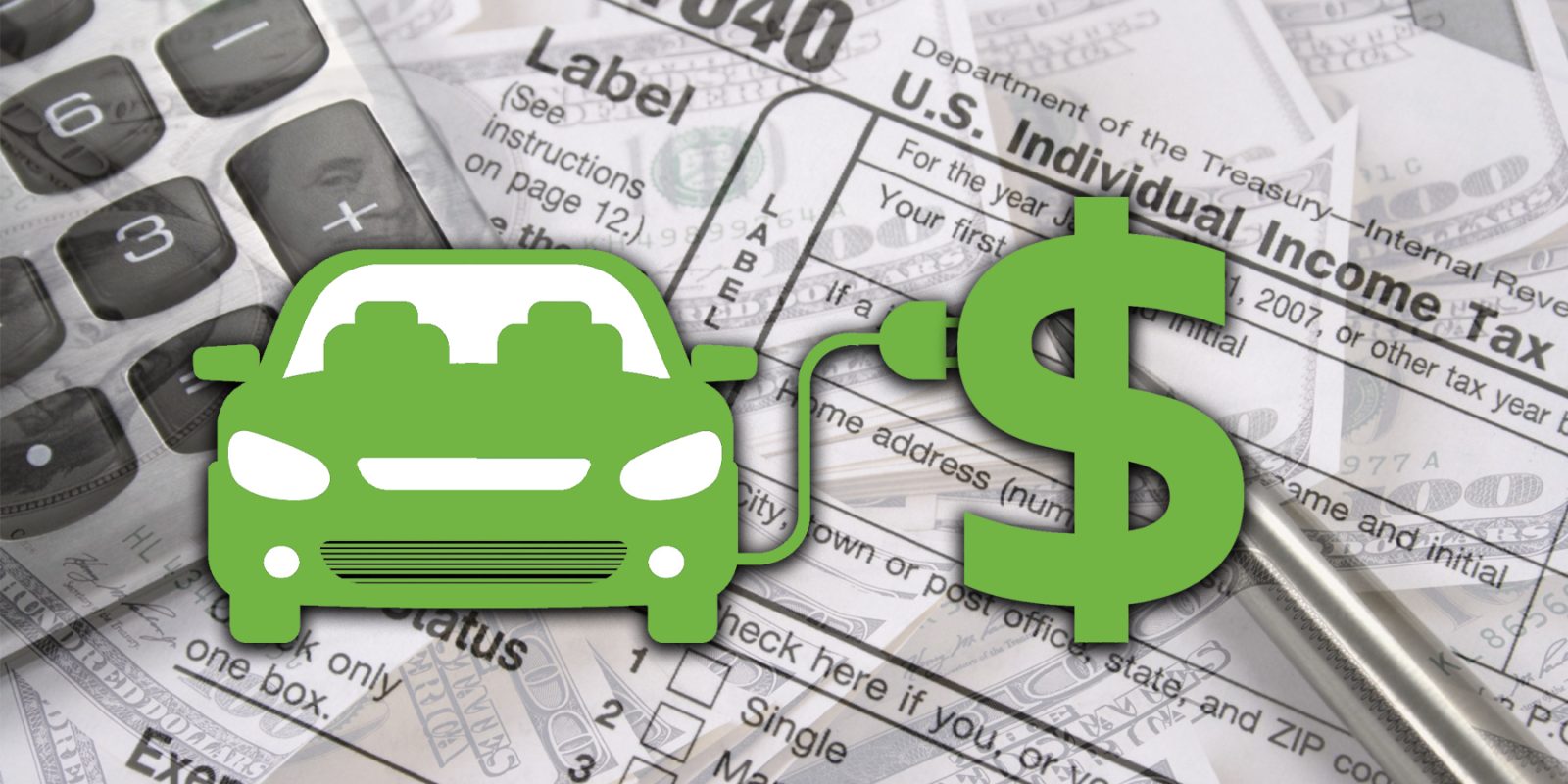

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

The Federal Tax Credit For Electric Cars How To Save 7 500

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify

CER Market Snapshot Record high Electric Vehicle Sales In Canada

Electric Vehicle Tax Credit News Ev Electrek Money Qualify

Act Fast The Solar Tax Credit Will Soon Expire

The Work Opportunity Tax Credit WOTC In Vermont Cost Management

The Work Opportunity Tax Credit WOTC In Vermont Cost Management

2021 VW ID 4 Prototype Review Decidedly Average Electric Power To The

The 30 Solar Tax Credit Has Been Extended Through 2032

How Does The Solar Tax Credit Work A M Sun Solar

Chevrolet New Electric Vehicle Federal Tax Credit Eligibility Form - A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models