Child Care Expenses Tax Credit 2022 Income Limit Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income

A tax credit however directly reduces your taxes dollar for dollar A 1 000 tax credit cuts your tax bill by 1 000 A lot of tax breaks have income limits and are not available at all to people with incomes above those limits In most years you can claim the credit regardless of your income Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

Child Care Expenses Tax Credit 2022 Income Limit

Child Care Expenses Tax Credit 2022 Income Limit

https://indianapublicmedia.org/images/news-images/child-tax-credit.jpg

Child Tax Credit 2022 Age Limit Latest News Update

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

2022 Child Tax Credit Chart Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t16-0179.gif

Your or your spouse s earned income for each month is 250 if there is one qualifying person 500 if two or more qualifying individuals See the topic Earned Income Limit in Publication 503 PDF for further information Care providers You must identify all persons or organizations that provide care for your child or dependent 2021 For tax year 2021 the dependent care credit is a refundable credit

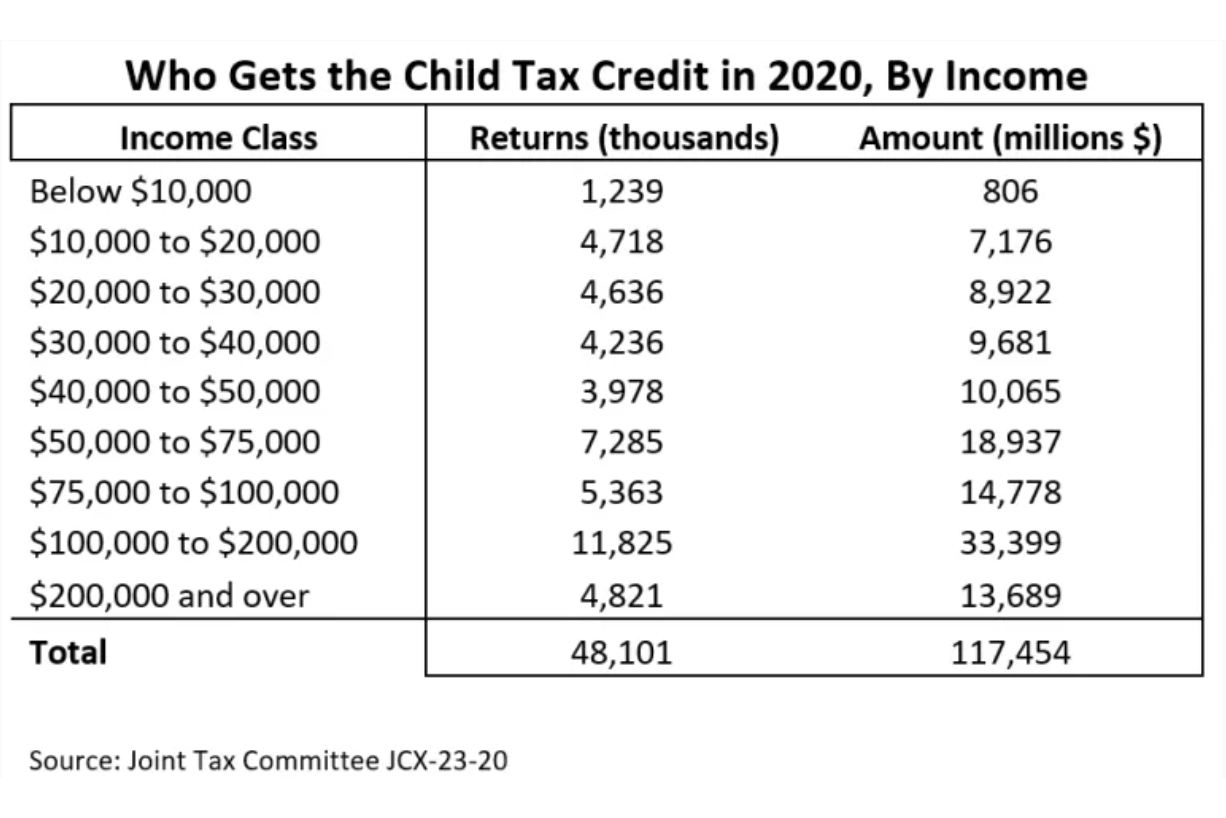

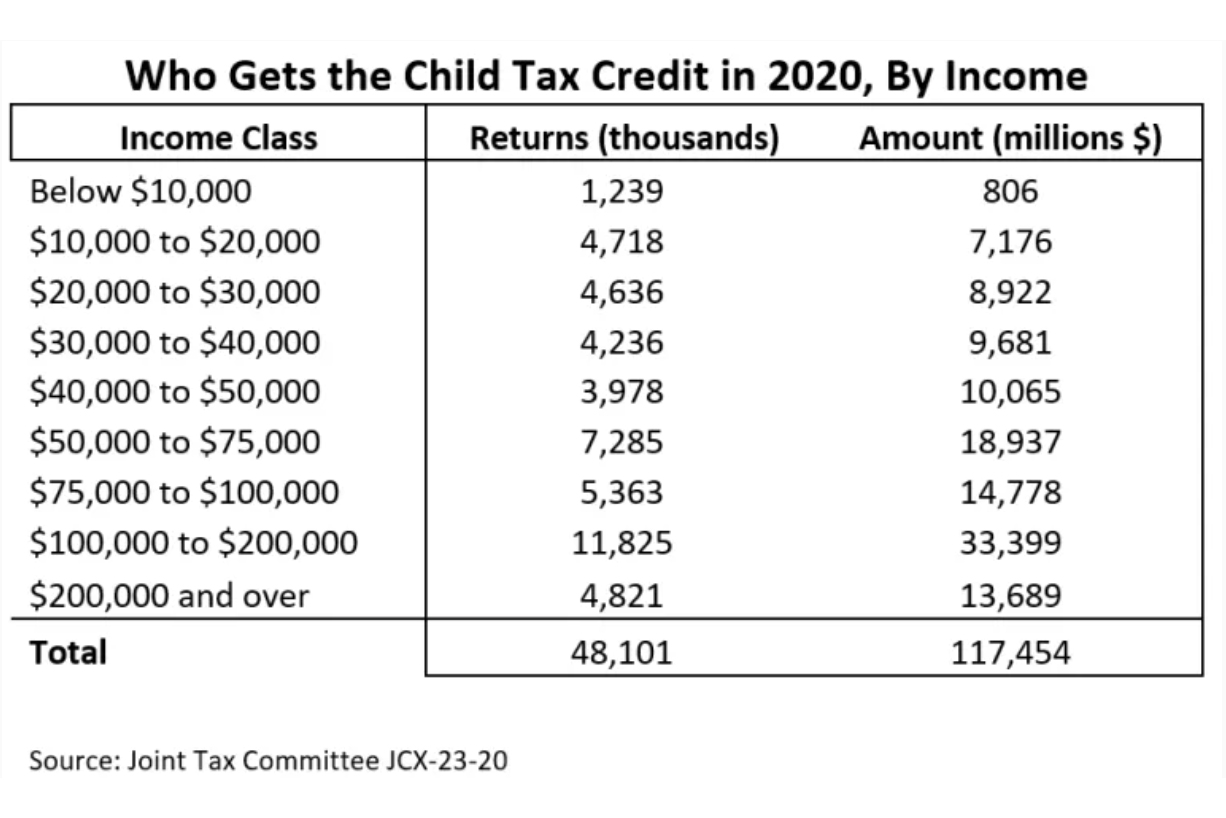

The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable The maximum child dependent tax credit is 35 of the employment related expenses Therefore the greater the adjusted gross income AGI the lower the percentage of employment related expenses that are considered in calculating the tax credit Once the AGI is over 43 000 the maximum tax credit is 20 of the

Download Child Care Expenses Tax Credit 2022 Income Limit

More picture related to Child Care Expenses Tax Credit 2022 Income Limit

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Child And Dependent Care Expenses Credit 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/10/Child-Tax-Credit-CTC-Update-TaxUni-Cover-1-1536x864.jpg

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://i.pinimg.com/originals/67/62/b1/6762b1bcb53c6074dab4289dd09b60a5.jpg

Taxpayers with one child can submit up to 8 000 of qualifying expenses while U S households with two or more children can claim up to 16 000 The IRS will then reimburse 50 percent of what you Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income go to school or carry on research under a grant If eligible you can claim certain child care expenses as a deduction on your personal income tax return

Personal Finance Your 2021 child care costs could mean an 8 000 tax credit Here s who qualifies Published Thu Feb 24 20228 30 AM EST Sarah O Brien sarahtgobrien Key Points You may be The Child and Dependent Care Credit reverted to is pre 2021 provisions and could get you up to 35 of 3 000 1 050 of child care expenses for a dependent child under 13 an incapacitated spouse or parent or another dependent so that you can work or look for work For families with two or more dependents the credit was up to

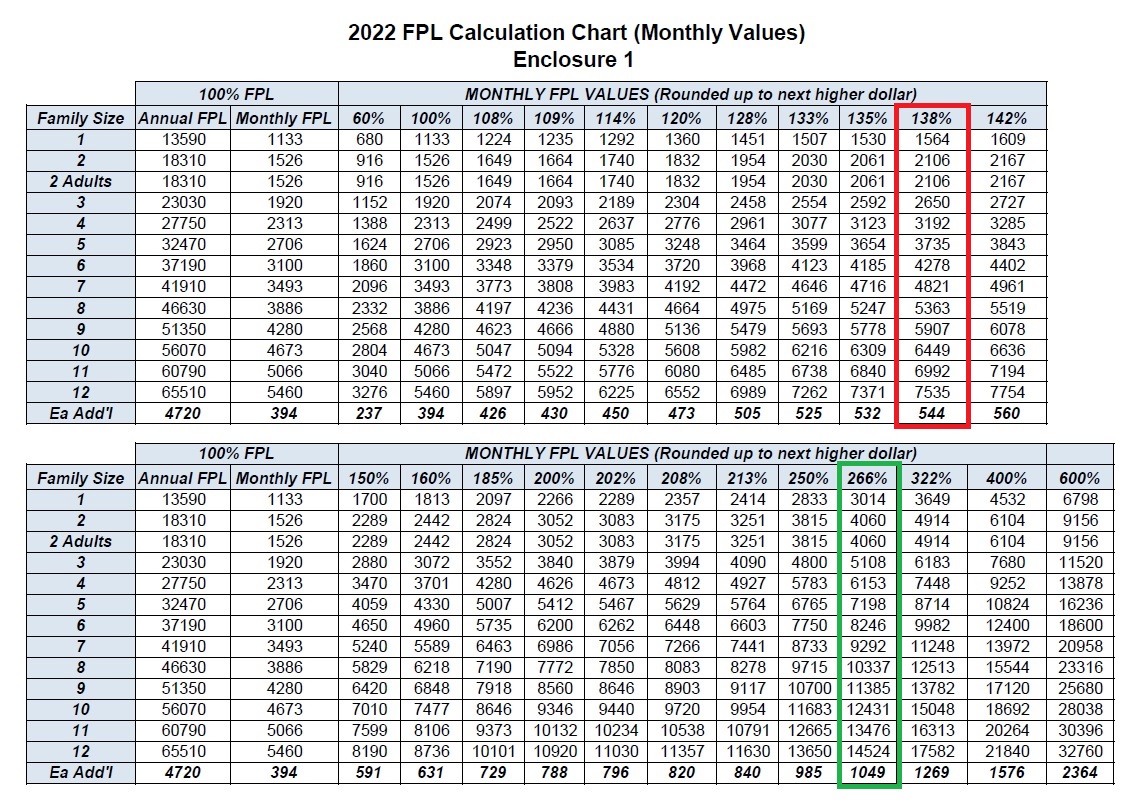

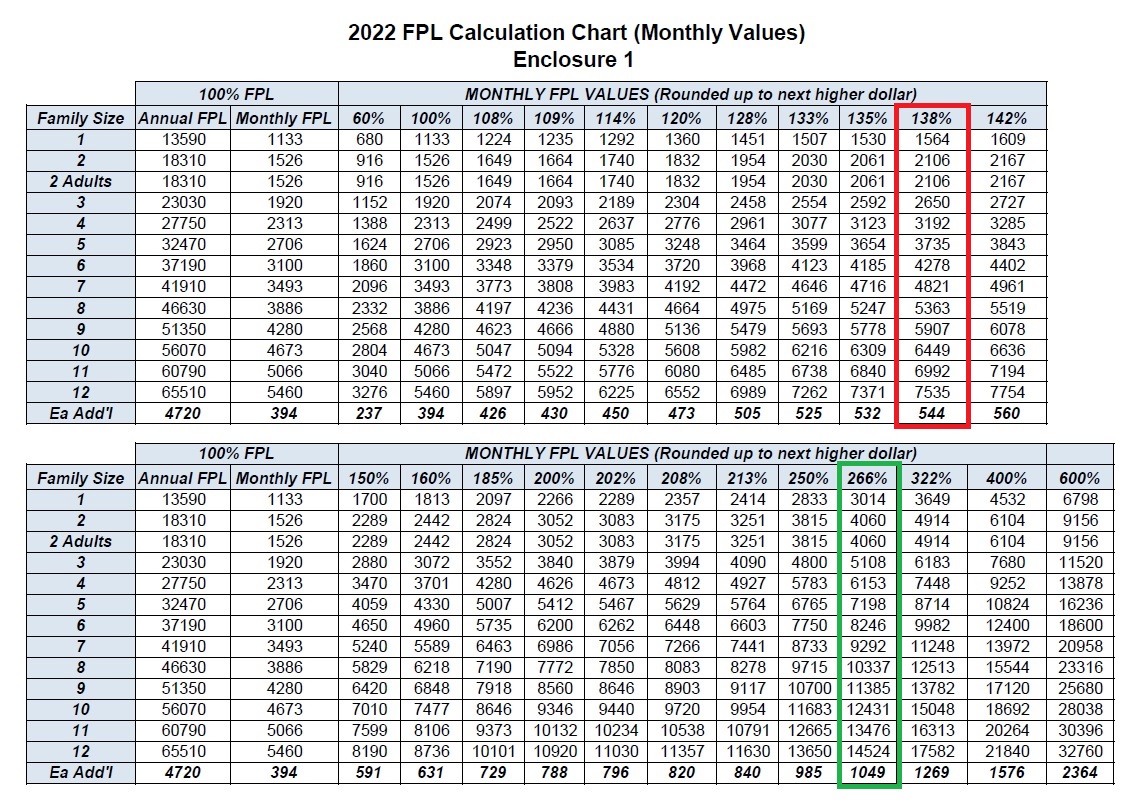

Big Increase For The 2022 Medi Cal Income Amounts

https://insuremekevin.com/wp-content/uploads/2022/02/Monthly-FPL-2022-Income-Chart-Medi_Cal.jpg

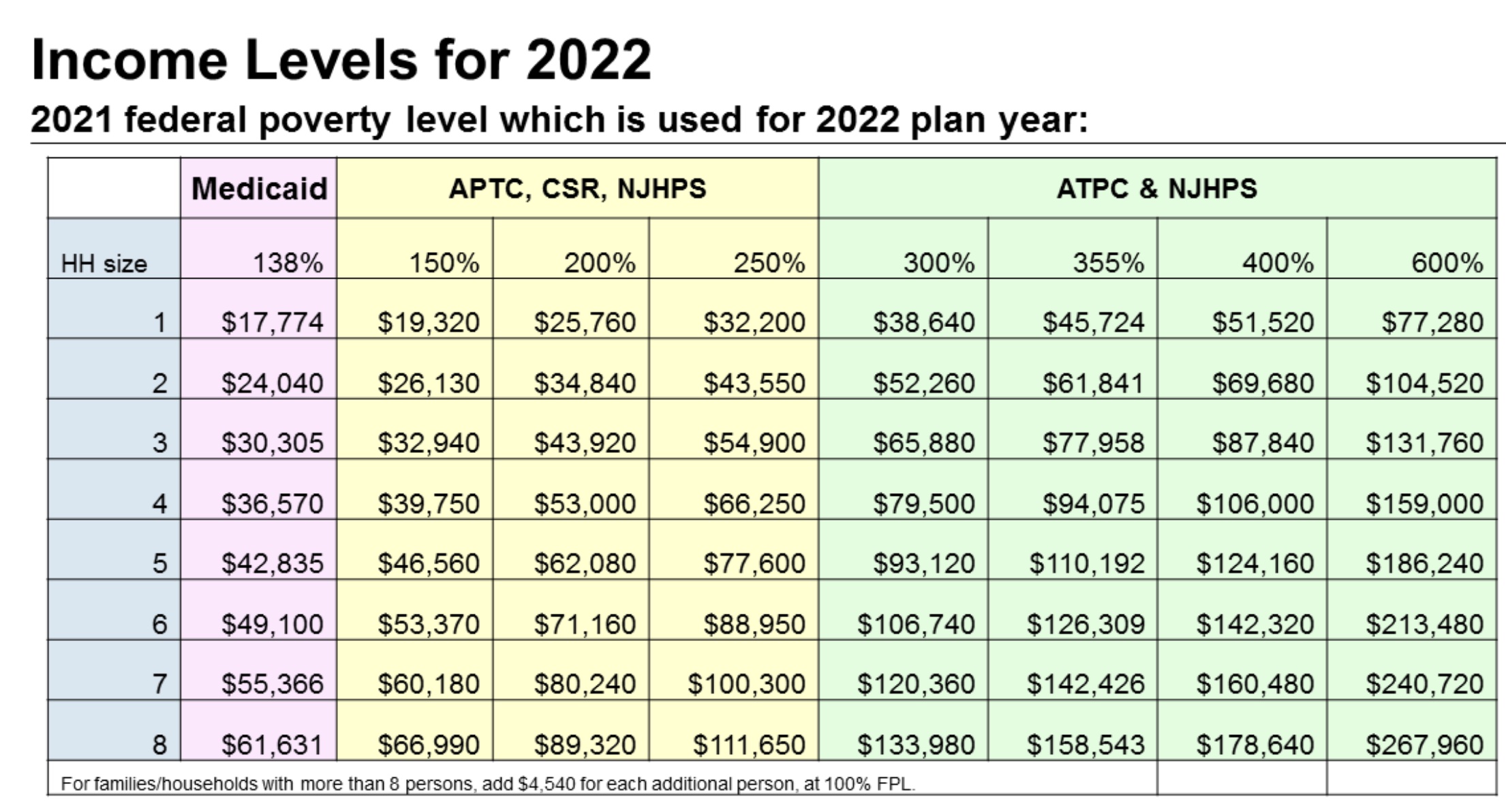

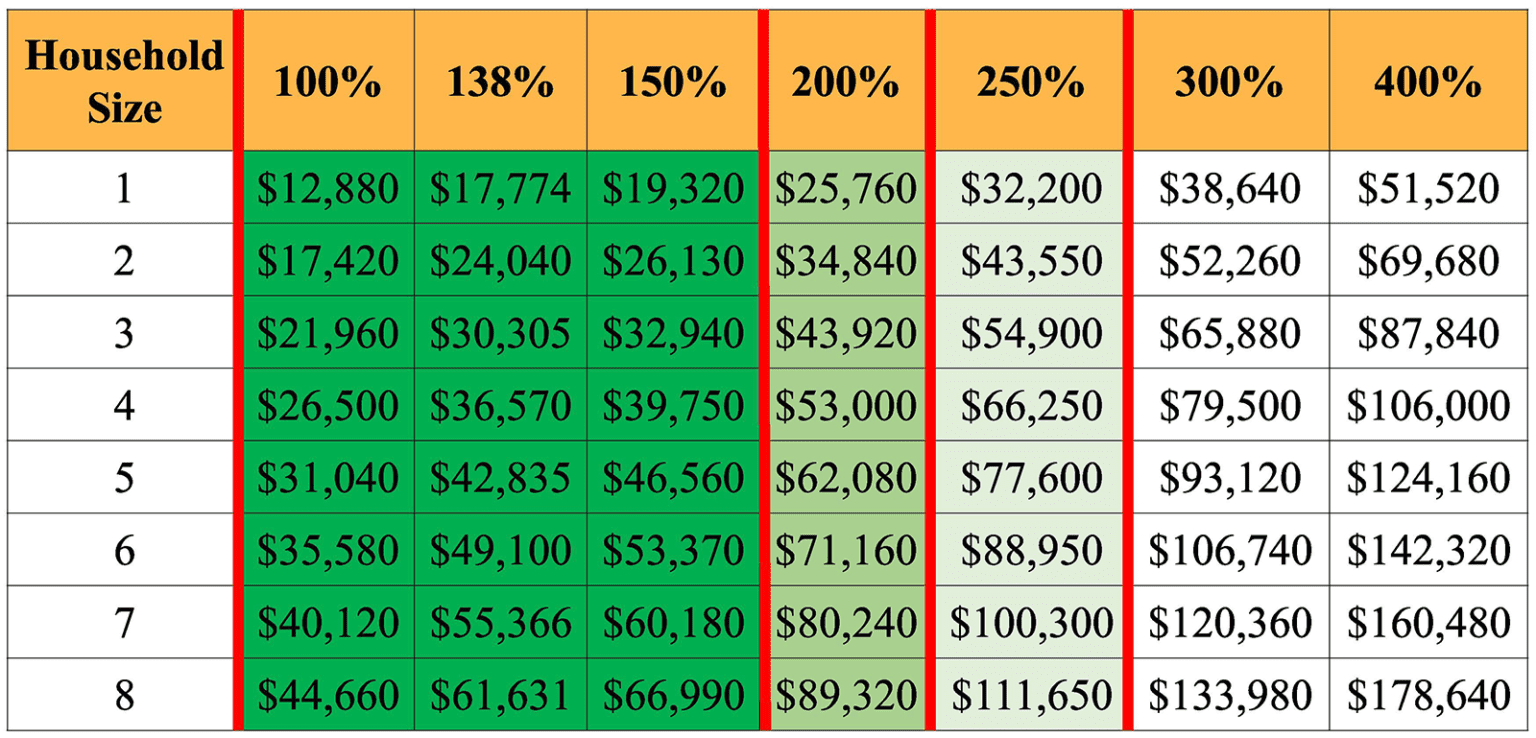

What Are The 2022 Federal Poverty Levels For The New Jersey Marketplace

https://help.ihealthagents.com/hc/article_attachments/4410492108055/2022_NJ_Income_Levels.jpg

https://www.irs.gov/newsroom/understanding-the...

Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income

https://turbotax.intuit.com/tax-tips/family/the...

A tax credit however directly reduces your taxes dollar for dollar A 1 000 tax credit cuts your tax bill by 1 000 A lot of tax breaks have income limits and are not available at all to people with incomes above those limits In most years you can claim the credit regardless of your income

See The EIC Earned Income Credit Table Income Tax Return Income

Big Increase For The 2022 Medi Cal Income Amounts

Claiming Childcare Expenses In Canada Blueprint Accounting

Earned Income Tax Credit For Households With One Child 2023 Center

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Aca Percentage Of Income 2022 INCOMUNTA

Aca Percentage Of Income 2022 INCOMUNTA

ACA Tax Credits To Help Pay Premiums White Insurance Agency

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

What Is The Phase Out For Dependent Care Credit Latest News Update

Child Care Expenses Tax Credit 2022 Income Limit - Your or your spouse s earned income for each month is 250 if there is one qualifying person 500 if two or more qualifying individuals See the topic Earned Income Limit in Publication 503 PDF for further information Care providers You must identify all persons or organizations that provide care for your child or dependent