Child Care Rebate In Tax Return Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Web 24 f 233 vr 2022 nbsp 0183 32 For your 2021 tax return the cap on the expenses eligible for the credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more

Child Care Rebate In Tax Return

Child Care Rebate In Tax Return

https://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-d1.png

Child Care Rebate Income Tax Return 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/daycare-business-income-and-expense-sheet-to-file-your-daycare-business-1.jpg

Childcare Tax Rebate Google Docs

https://lh3.googleusercontent.com/docs/AOD9vFr_UKhK8qduqUufb1KgrPjWuQgA9bQz6e_fB4Id6GSAU9bertsDMt_QDKuWXxNyOwyWifG2KNWPFPPizPhVuqSffuQxD5RfFL3awCjHxPMH=w1200-h630-p

Web 19 ao 251 t 2022 nbsp 0183 32 To receive this payment you must Have a dependent child or full time secondary school student from 16 19 who isn t receiving a pension payment or benefit Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from

Web 12 f 233 vr 2022 nbsp 0183 32 What does that mean In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the Web 29 mai 2023 nbsp 0183 32 For 2022 this credit is worth up to 20 to 35 of up to 3 000 of child care or similar costs for a child under 13 or up to 6 000 for 2 or more dependents The exact

Download Child Care Rebate In Tax Return

More picture related to Child Care Rebate In Tax Return

Child Care Rebate Income Tax Return 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/your-us-expat-tax-return-and-the-child-care-credit-when-abroad.png?w=836&h=400&ssl=1

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l3.png

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

Web 17 ao 251 t 2023 nbsp 0183 32 The child tax credit is a tax benefit for people with qualifying children For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable Web 2 d 233 c 2022 nbsp 0183 32 If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3 000 1 050 for one child or dependent or up to 6 000 2 100 for two or more children or dependents

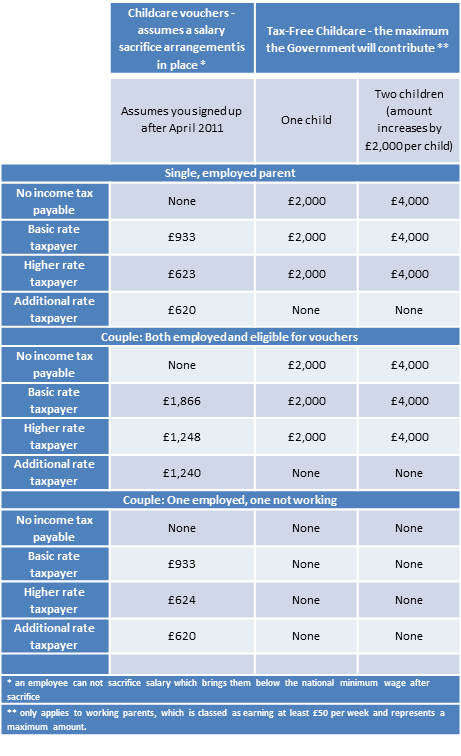

Web 10 juil 2023 nbsp 0183 32 From 10 July 2023 Child Care Subsidy increased which means most families using child care now get more subsidy The maximum amount of CCS increased from Web You can get up to 163 500 every 3 months up to 163 2 000 a year for each of your children to help with the costs of childcare This goes up to 163 1 000 every 3 months if a child is disabled up to

Form For Daycare Tax Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/315/100315789/large.png

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

https://www.servicesaustralia.gov.au/balancing-child-care-subsidy

Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy

https://www.irs.gov/newsroom/understanding-the-child-and-dependent...

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Form For Daycare Tax Fill Online Printable Fillable Blank PdfFiller

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

New Tax free Childcare Is It The End Of Salary Sacrifice For

New Child Care Rebate Calculator 2023 Carrebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Pin On Childcare Providers

Child Care Rebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Child Care Rebate In Tax Return - Web Child Care Tax Information 2 100 from the federal Child and Dependent Care Tax Credit up to 1 050 for each of your first two children the exact amount depends on your income and actual child care expenses 2 000 per child from the federal Child Tax Credit and 6 660 from the federal Earned Income Tax Credit