Application For Income Tax Rebate Web 2 avr 2022 nbsp 0183 32 La premi 232 re 233 tape consiste 224 t 233 l 233 charger gratuitement l application Impots gouv Notons qu elle est disponible sur l App Store Google Play et Windows

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax Web 21 avr 2023 nbsp 0183 32 D 233 clarer l utilisation de services 224 la personne aux imp 244 ts pour b 233 n 233 ficier de la d 233 duction fiscale correspondante d 233 pend du type de d 233 claration effectu 233 entre la

Application For Income Tax Rebate

Application For Income Tax Rebate

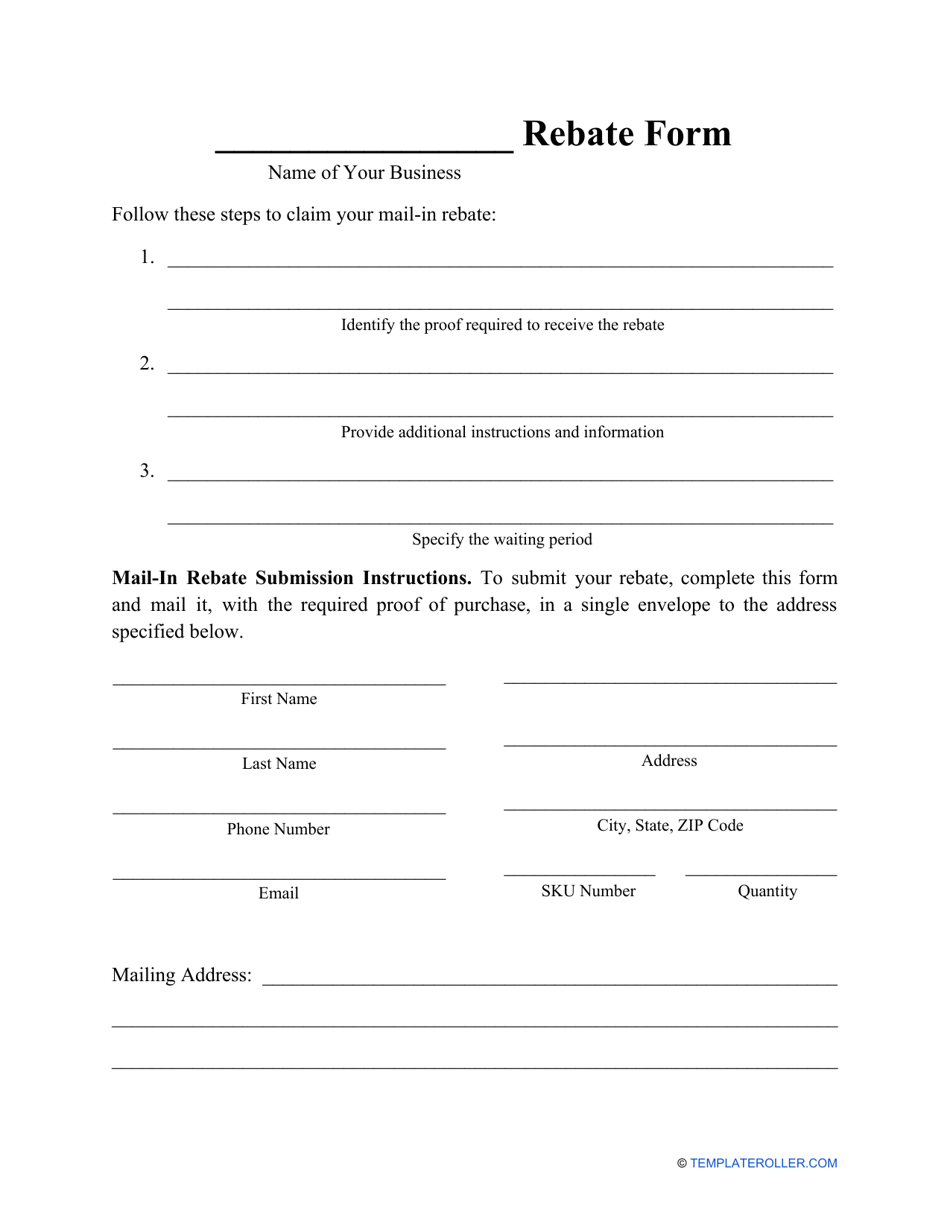

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

P55 Tax Rebate Form Application Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 20 d 233 c 2022 nbsp 0183 32 Individuals should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021 Find the Amount of Your Web Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early Web Il y a 21 heures nbsp 0183 32 California Times Sept 11 2023 2 14 PM PT California is eliminating its popular electric car rebate program which often runs out of money and has long

Download Application For Income Tax Rebate

More picture related to Application For Income Tax Rebate

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Tax Application Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/27/773/27773189/large.png

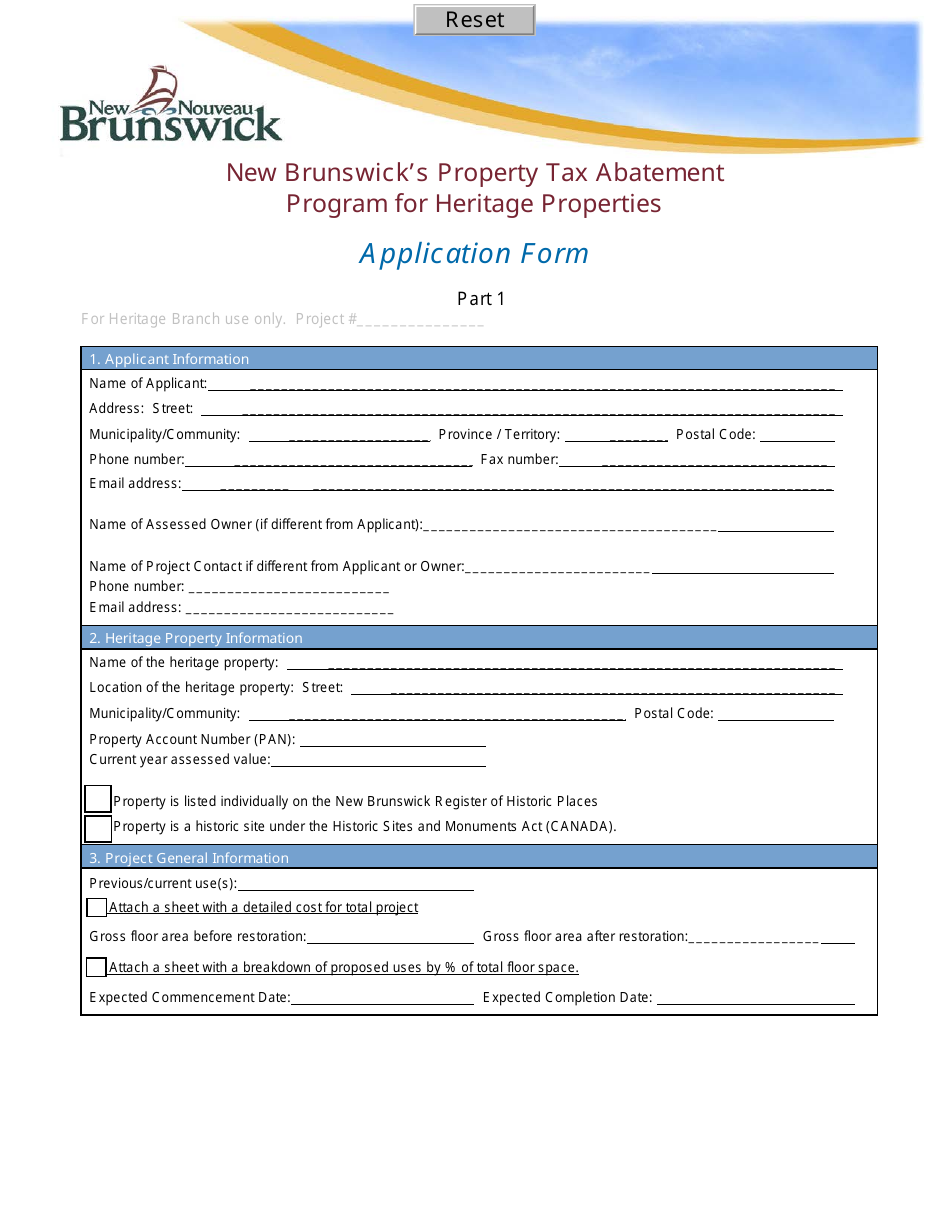

New Brunswick Canada New Brunswick s Property Tax Abatement Program For

https://data.templateroller.com/pdf_docs_html/1871/18719/1871964/new-brunswick-s-property-tax-abatement-program-for-heritage-properties-application-form-new-brunswick-canada_print_big.png

Web If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate Web 7 sept 2023 nbsp 0183 32 Apply for benefits and credits Check out our benefits and credits factsheet for students for everything you need to know here are some important things to be aware

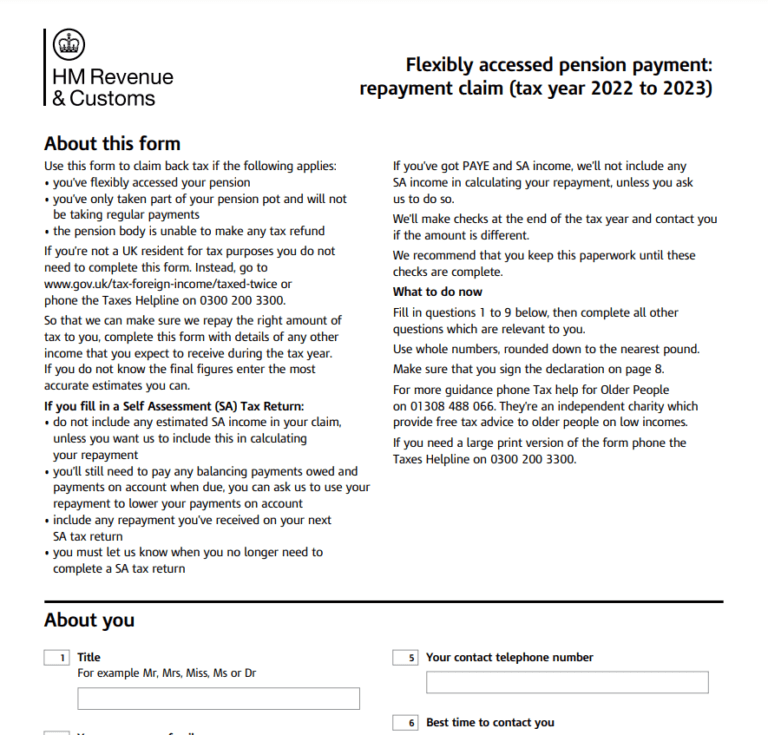

Web The IRS is also taking an additional step to help those who paid these penalties already To qualify for this relief eligible tax returns must be filed on or before September 30 Web 15 ao 251 t 2014 nbsp 0183 32 Claim a tax refund if you ve overpaid tax You can also use this form to authorise a representative to get the payment on your behalf From HM Revenue amp

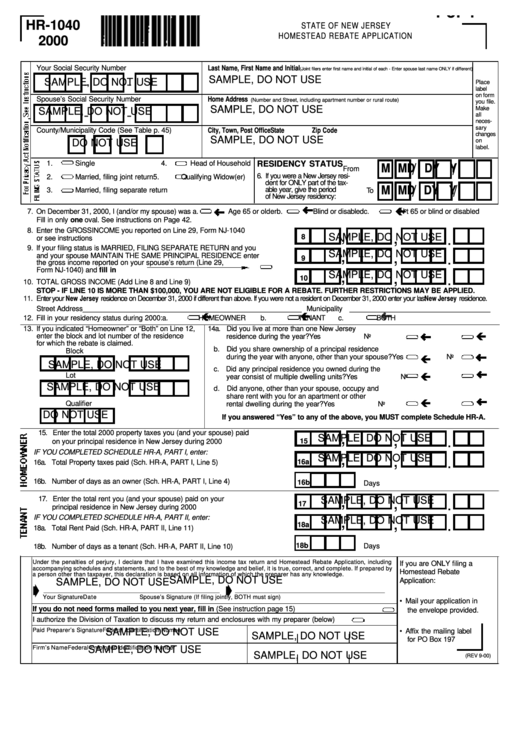

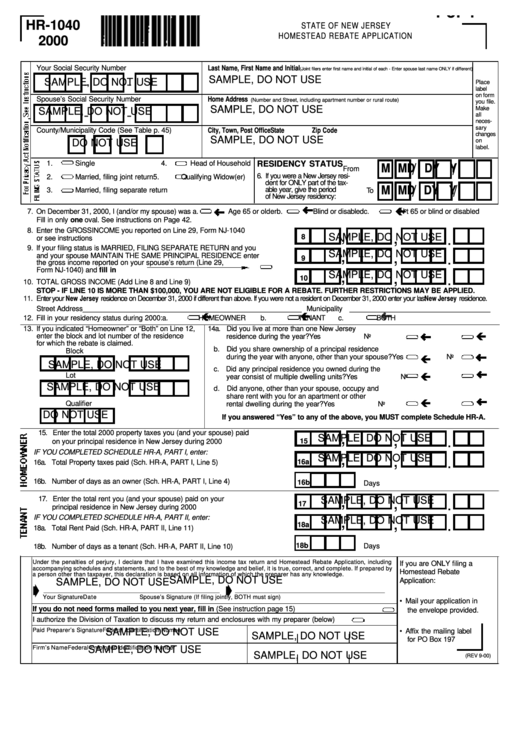

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

https://data.formsbank.com/pdf_docs_html/275/2756/275601/page_1_thumb_big.png

Carbon Tax Rebate 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Carbon-Tax-Rebate-2022-Income-Information.png

https://demarchesadministratives.fr/actualites/impots-2022-comment...

Web 2 avr 2022 nbsp 0183 32 La premi 232 re 233 tape consiste 224 t 233 l 233 charger gratuitement l application Impots gouv Notons qu elle est disponible sur l App Store Google Play et Windows

https://www.irs.gov/coronavirus/economic-impact-payments

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax

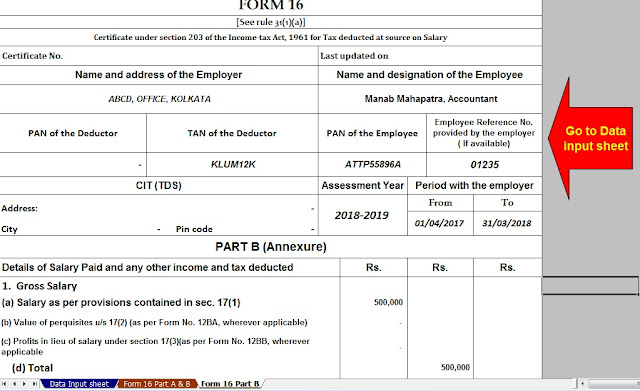

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

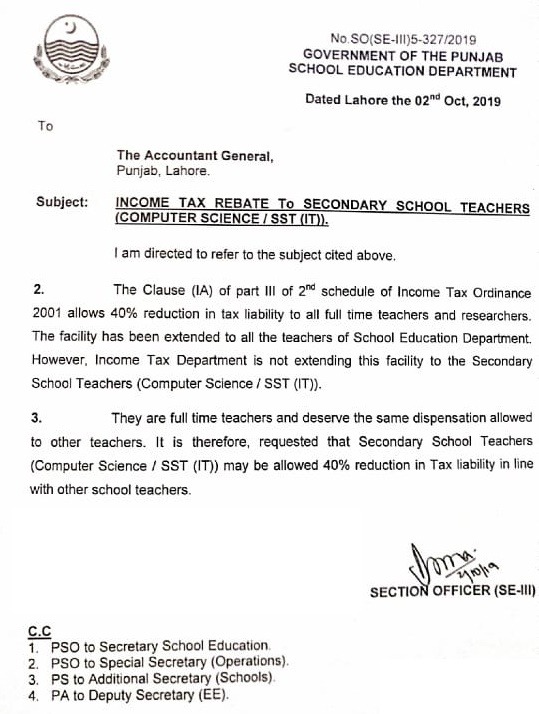

Income Tax Rebate 40 To All Teachers Of School Education Department

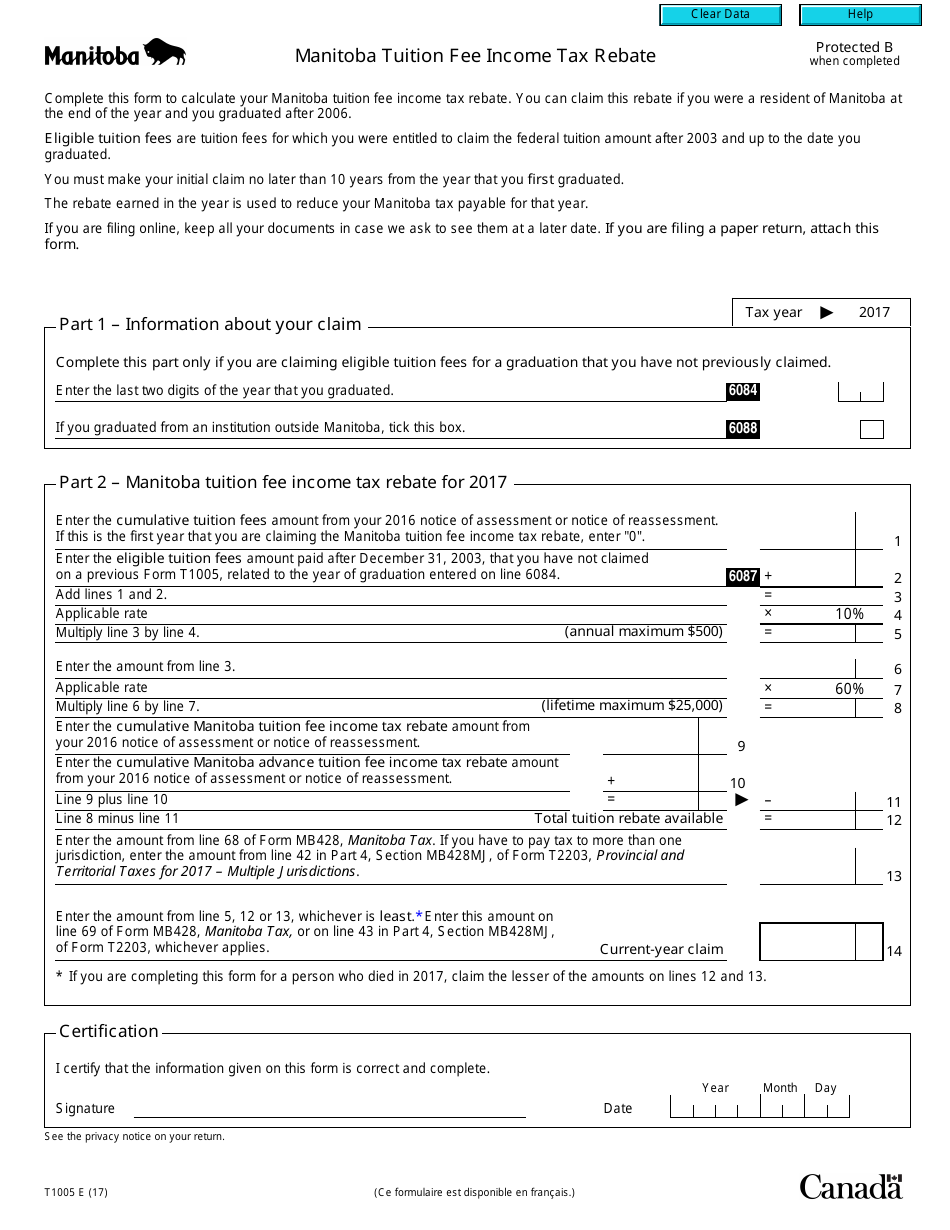

Form T1005 Download Fillable PDF Or Fill Online Manitoba Tuition Fee

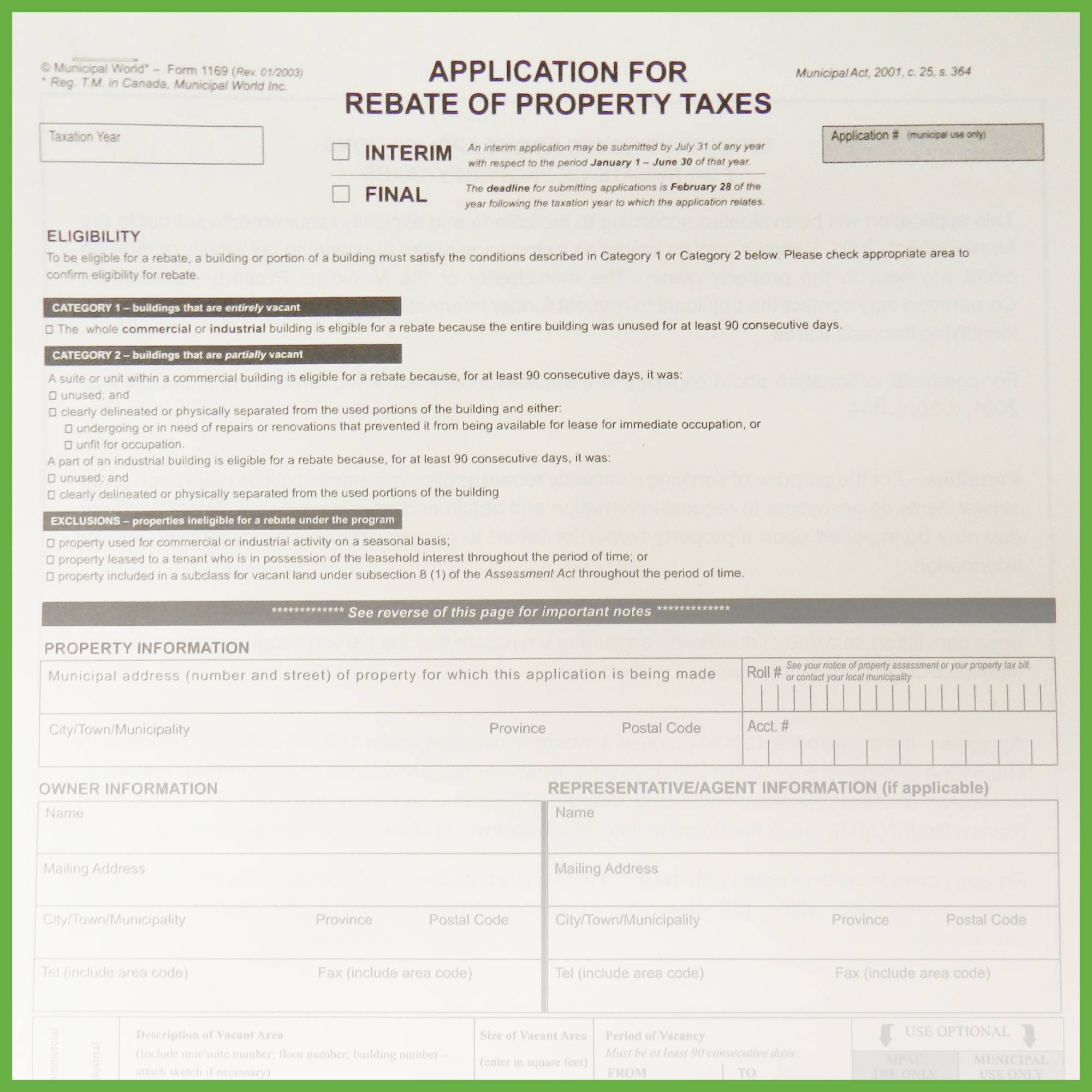

Application For Rebate Of Property Tax 2 Pages Verification Sheet

Mass Save Rebate Forms 2022 Mass Save Rebate

Mass Save Rebate Forms 2022 Mass Save Rebate

Ptr Tax Rebate Libracha

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

How Much Rebate Application Form For Tax

Application For Income Tax Rebate - Web What is rebate income Calculate your rebate income What is rebate income Your rebate income is the total amount of your taxable income excluding any assessable