Federal Budget 2024 Ev Rebate The federal government s 7 500 tax break for electric vehicle purchases has never been easier to claim But let s address the elephant in the room There aren t that

Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is

Federal Budget 2024 Ev Rebate

Federal Budget 2024 Ev Rebate

https://i.stack.imgur.com/39w95.png

Federal Budget Pie Chart EdrawMax Templates

https://edrawcloudpublicus.s3.amazonaws.com/work/864984/2021-12-24/1640340566/main.png

Federal Budget 2023 2024 Start Fresh Accounting

https://www.startfreshaccounting.com.au/wp-content/uploads/2023/05/federal-budget-2023.jpg

EV rebates and incentives Leasing and the EV tax credit The bottom line MORE LIKE THIS Tax credits and deductions Tax preparation and filing Taxes People CNN The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 bringing some good and bad news

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two In 2023 the required percentage of battery materials is 40 This will increase by 10 annually maxing out at 80 in 2027 For a car to qualify for the other

Download Federal Budget 2024 Ev Rebate

More picture related to Federal Budget 2024 Ev Rebate

Federal Budget 2023 2024 In Pakistan

https://blog-cdn.el.olx.com.pk/wp-content/uploads/2022/06/10155430/federal-budget-O.jpg

2024 24 Federal Budget Analysis

https://www.cameronsaa.com.au/volumes/images/News/_1920x600_crop_center-center_none/23-24-Federal-Budget.jpg

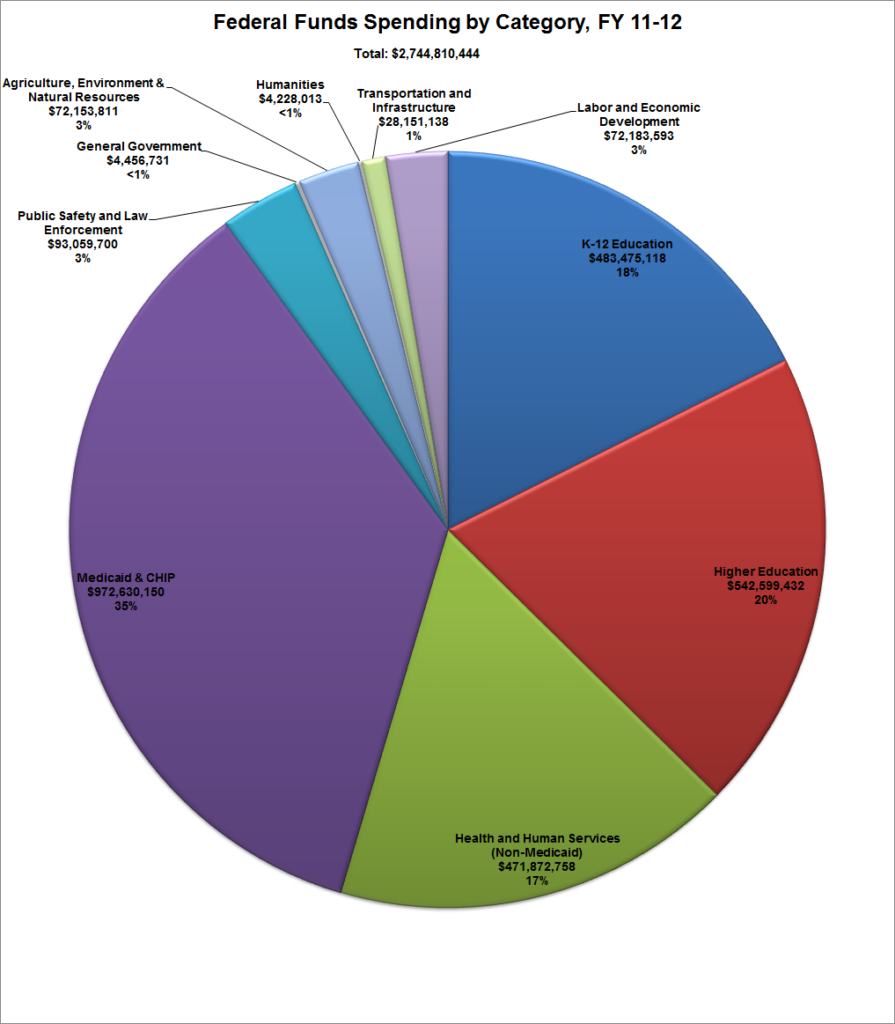

Federal Funds Spending By Category FY 11 12 Open Sky Policy Institute

https://www.openskypolicy.org/wp-content/uploads/2012/07/FF-Spending-FY12-895x1024.png

The Biden administration is trying to entice consumers to buy electric vehicles by offering tax credits of up to 7 500 per vehicle The federal government is also Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and

Rules for claiming the federal tax credit for electric vehicles have changed for 2024 Here s what you need to know if you want to buy an EV Image credit Getty The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000

2024 Proposed Federal Budget 25 Minimum Tax Atlanta CPA

https://www.wilsonlewis.com/wp-content/uploads/2023/03/Federal-Budget-2024-Atlanta-CPA.jpg

Time To Think

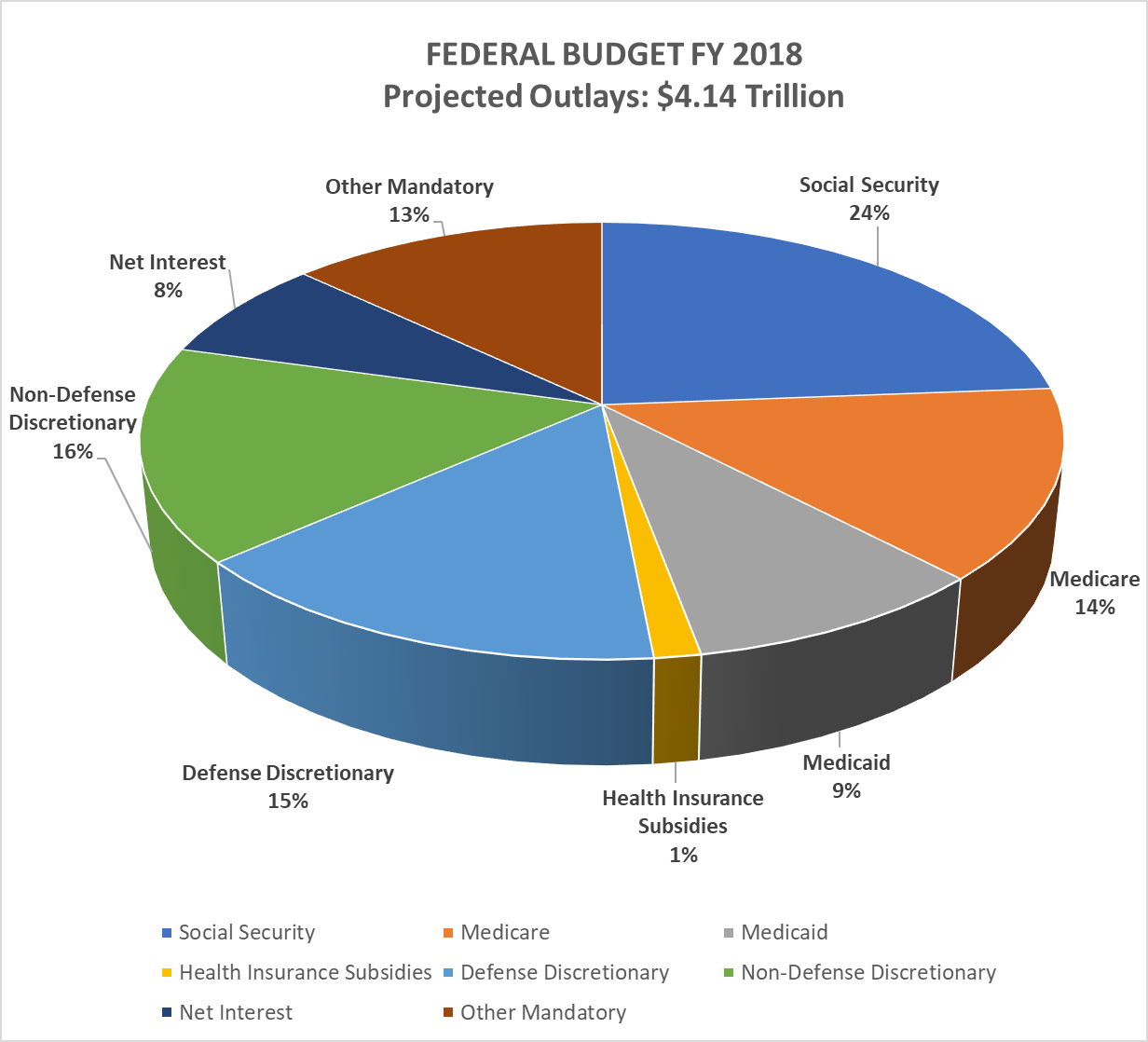

https://4.bp.blogspot.com/-qg-jLdptJBs/XKo3d5BLNMI/AAAAAAAAA04/GS5ykPfRRO0wYcwyQy1QULLAN8y1chVYwCLcBGAs/s1600/2018-Budget-Pie-Chart.png

https://www.cnet.com/roadshow/news/the-2024-ev-tax...

The federal government s 7 500 tax break for electric vehicle purchases has never been easier to claim But let s address the elephant in the room There aren t that

https://electrek.co/2024/01/03/which-electric...

Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers

2021 Federal Government Budget Programs The Political Tourist

2024 Proposed Federal Budget 25 Minimum Tax Atlanta CPA

The Canadian Federal Rebate For Electric Cars Encouraging Canadians To Switch To Electric

Federal Budget 2023 24 Oreon

Federal Budget 2023 24 HLB Mann Judd

Federal Budget Free Of Charge Creative Commons Chalkboard Image

Federal Budget Free Of Charge Creative Commons Chalkboard Image

Federal Budget May 2023 Russell Investments

Federal Budget 2023 24

CARFAC RAAV s Submission For The 2024 Federal Budget Consultation CARFAC

Federal Budget 2024 Ev Rebate - Jan 1 2024 at 3 09pm ET By Patrick George A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a tax credit of up to 7 500 provided it was