Child Care Rebate Percentage Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their

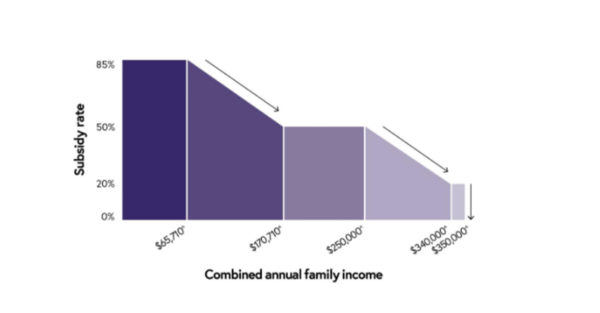

Web 10 juil 2023 nbsp 0183 32 The Child Care Subsidy commenced in July 2018 to replace the Child Care Benefit CCB and Child Care Rebate CCR with a single means tested subsidy From Web 1 care for your child 2 or more nights per fortnight or have at least 14 care 2 be responsible for paying the childcare fees 3 live in Australia for at least 46 weeks of the

Child Care Rebate Percentage

Child Care Rebate Percentage

http://cdn.mamamia.com.au/wp/wp-content/uploads/2015/01/childcarepicfacebook.png

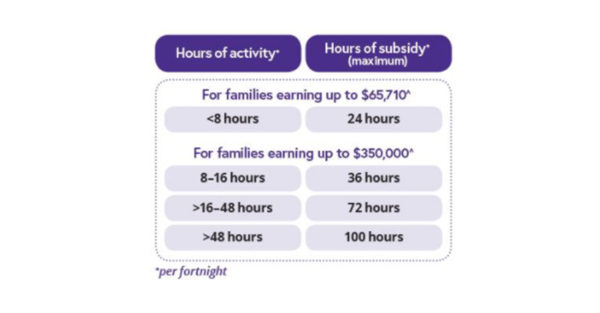

Child Care Rebate Income Tax Return 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/your-us-expat-tax-return-and-the-child-care-credit-when-abroad.png

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate

https://www.petitjourney.com.au/wp-content/uploads/2017/01/apply-for-child-care-rebate-e1513120148548.jpg

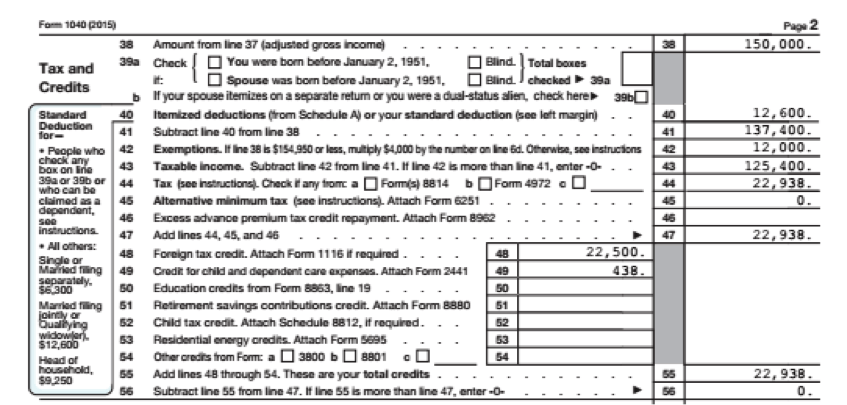

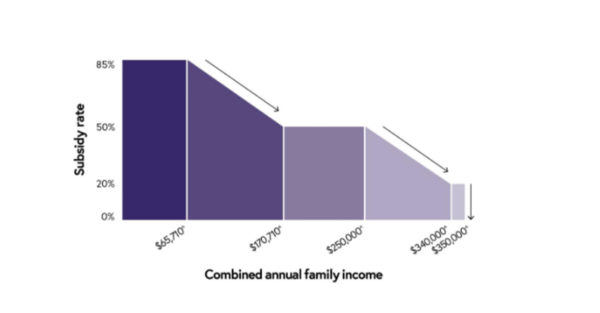

Web 10 juil 2023 nbsp 0183 32 From today about 1 2 million Australian families are in line for a childcare rebate boost Here s what the new federal government changes could mean for you What is changing from July 10 Web Child Care Subsidy income test Family s combined annual income The Australian Government will subsidise a percentage of a family s childcare fees or the hourly rate

Web Child Care Subsidy percentage 0 to 138 188 95 More than 138 118 to below 183 118 Between 95 and 80 The percentage goes down by 1 for every 3 000 Web Adjusting your Child Care Benefit percentage Rounding your percentage Child Care Rebate Family Tax Benefit Part A Family Tax Benefit Part A is worked out on your

Download Child Care Rebate Percentage

More picture related to Child Care Rebate Percentage

What Is Child Care Rebate And How To Apply For Childcare Rebate

https://www.kidsworldkindy.com.au/wp-content/uploads/2017/05/ChildCareRebate-768x234.jpg

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate

https://www.petitjourney.com.au/wp-content/uploads/2017/01/child-care-rebate.jpg

The Baby Bonus Failed To Increase Fertility But We Should Still Keep It

https://images.theconversation.com/files/6114/original/b68e45101625a702-1322799260.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=1120&fit=crop&dpr=2

Web 10 juil 2023 nbsp 0183 32 Now that s increased to 90 per cent The more a family earns the smaller the subsidy gets The income cap for eligibility has been increased from 356 756 to 530 000 That will mean more higher Web The rate would gradually reduce by one percentage point for every 5 000 of family income above 72 406 Labor s CCS design does not have an upper income limit and no annual cap but the CCS rate reaches zero for

Web 2 juil 2018 nbsp 0183 32 Combined Family Income Subsidy per cent of the actual fee charged up to relevant percentage of the hourly fee cap Up to 70 015 Standard CCS 85 per cent Web 10 juil 2023 nbsp 0183 32 Families earning up to 80 000 can get an increased maximum CCS amount from 85 to 90 If you earn over 80 000 you may get a subsidy starting from 90

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate

https://www.petitjourney.com.au/wp-content/uploads/2017/01/child-care-rebate-eligibility-requirements-e1513120686959.jpg

Child Care Rebate 2017 Parental Leave Pay Schoolkids Bonus Changes

http://cdn.newsapi.com.au/image/v1/9bff2981e3d4cc0a147b86aa84ed3596?width=1024

https://www.education.gov.au/early-childhood/announcements/child-care...

Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their

https://www.childcaresubsidycalculator.com.au

Web 10 juil 2023 nbsp 0183 32 The Child Care Subsidy commenced in July 2018 to replace the Child Care Benefit CCB and Child Care Rebate CCR with a single means tested subsidy From

Changes To The Child Care Benefit And Child Care Rebate How Will They

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate

Parents Must Complete Online Centrelink Form To Continue Receiving

Enrolment Leylands Learning Centre

/https://www.thestar.com/content/dam/thestar/news/gta/2019/04/08/ford-governments-expected-child-care-rebate-will-fuel-poor-quality-care-expert-says/gord_cleveland_999.jpg)

Ford Government s Expected Child Care Rebate Will Fuel Poor Quality

Five Things You Need To Know About The New Child Care Subsidy

Five Things You Need To Know About The New Child Care Subsidy

Five Things You Need To Know About The New Child Care Subsidy

Your Ultimate Guide To The Child Care Benefit And Child Care Rebate

Child Care Expenses Tax Credit Colorado Free Download

Child Care Rebate Percentage - Web 22 sept 2023 nbsp 0183 32 Services Australia pays the subsidy to your child care provider to reduce the fees you pay This payment has changed From 10 July 2023 Child Care Subsidy CCS