Child Care Tax Credit 2023 Schedule You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 The child and dependent care credit can be claimed on tax returns filed in mid April You ll need to attach two forms to the standard Form 1040 Form 2441 and Schedule 3

Child Care Tax Credit 2023 Schedule

Child Care Tax Credit 2023 Schedule

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

Understanding The 2023 Child Care Tax Credit Types Eligibility And

https://images.squarespace-cdn.com/content/v1/5d940768938dd828fc033675/77a228a5-aaee-47f8-a4be-e62a1c4783b2/Web+capture_25-10-2023_224527_showme.redstarplugin.com.jpeg

If the care provider is your household employee you may owe employment taxes For details see the Instructions for Schedule H Form 1040 If you incurred care expenses in 2023 but didn t pay them until 2024 or if you prepaid in 2023 for care to be provided in 2024 don t include these expenses in column d of line 2 for 2023 Here is what you should know about the child tax credit for this year s tax season and whether you qualify Tax credit per child for 2023 The maximum tax credit per qualifying

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the

Download Child Care Tax Credit 2023 Schedule

More picture related to Child Care Tax Credit 2023 Schedule

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

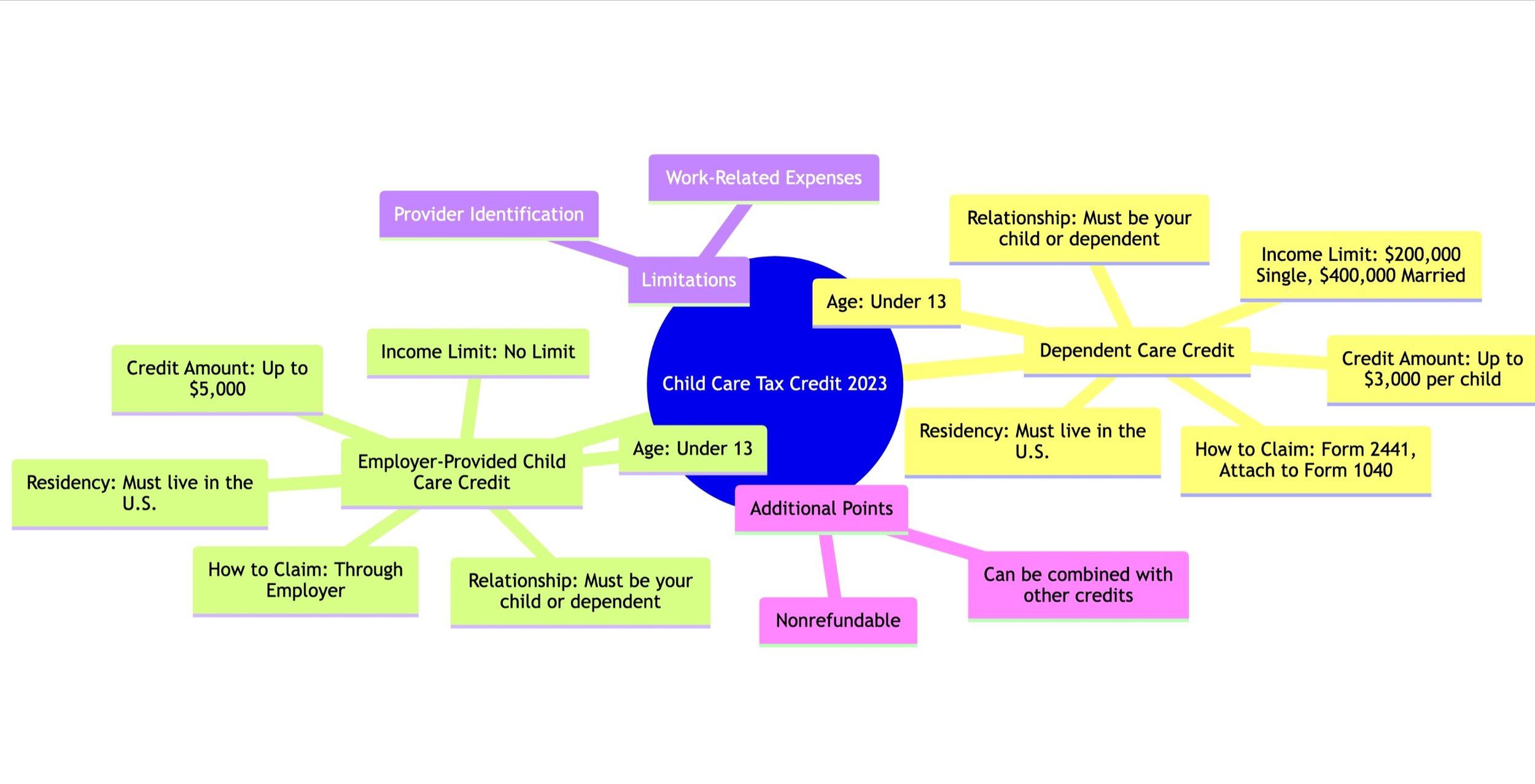

How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child The Child Care Tax Credit is a financial relief mechanism designed to help parents offset the costs of child care The credit comes in different types each with its own set of eligibility criteria and claiming process

2023 and 2024 Child Tax Credit Thanks to the tax law changes in the Tax Cuts and Jobs Act of 2017 the Child Tax Credit CTC is now worth up to 2 000 per qualifying child A tax credit is a powerful tool because it reduces the amount of tax you owe by one dollar for each dollar of a tax credit Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/NINTCHDBPICT000653939782-7.jpg

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

https://www.nerdwallet.com/article/taxes/qualify...

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15

2022 Education Tax Credits Are You Eligible

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

What Do I Do If I Haven t Received Child Tax Credit In August

COMPLIANCE ALERT IRS Issues Child Dependent Care Tax Credit FAQs

CURRENT CHILD CARE TAX CREDIT Download Table

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Free Daycare Contract Template PDF Word

Care Credit Printable Application Printable Word Searches

Bipartisan Bill To Improve Child Care Tax Credit Introduced In Senate

Child Care Tax Credit 2023 Schedule - How the child tax credit will look in 2023 Will Congress approve more monthly child tax credit payments How the scaled down child tax credit could impact the 2023 tax filing season