Child Care Tax Credit Canada 2023 You can claim the expenses you incurred while the eligible child was living with you You will need to fill out Form T778 Child Care Expenses Deduction for 2023 to calculate your deduction

Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years For disabled You can use form T778 Child care expenses deduction to claim child care expenses you paid for your child ren in 2023 You can claim child care expenses if you or your spouse or common

Child Care Tax Credit Canada 2023

Child Care Tax Credit Canada 2023

https://prescottenews.com/wp-content/uploads/2021/08/Child-Tax-Credit.jpg

Can I Opt Out Of The Child Tax Credit Payments Here s The Answer Dogwood

https://vadogwood.com/wp-content/uploads/sites/12/2021/07/Child-Tax-Credit1.jpg

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

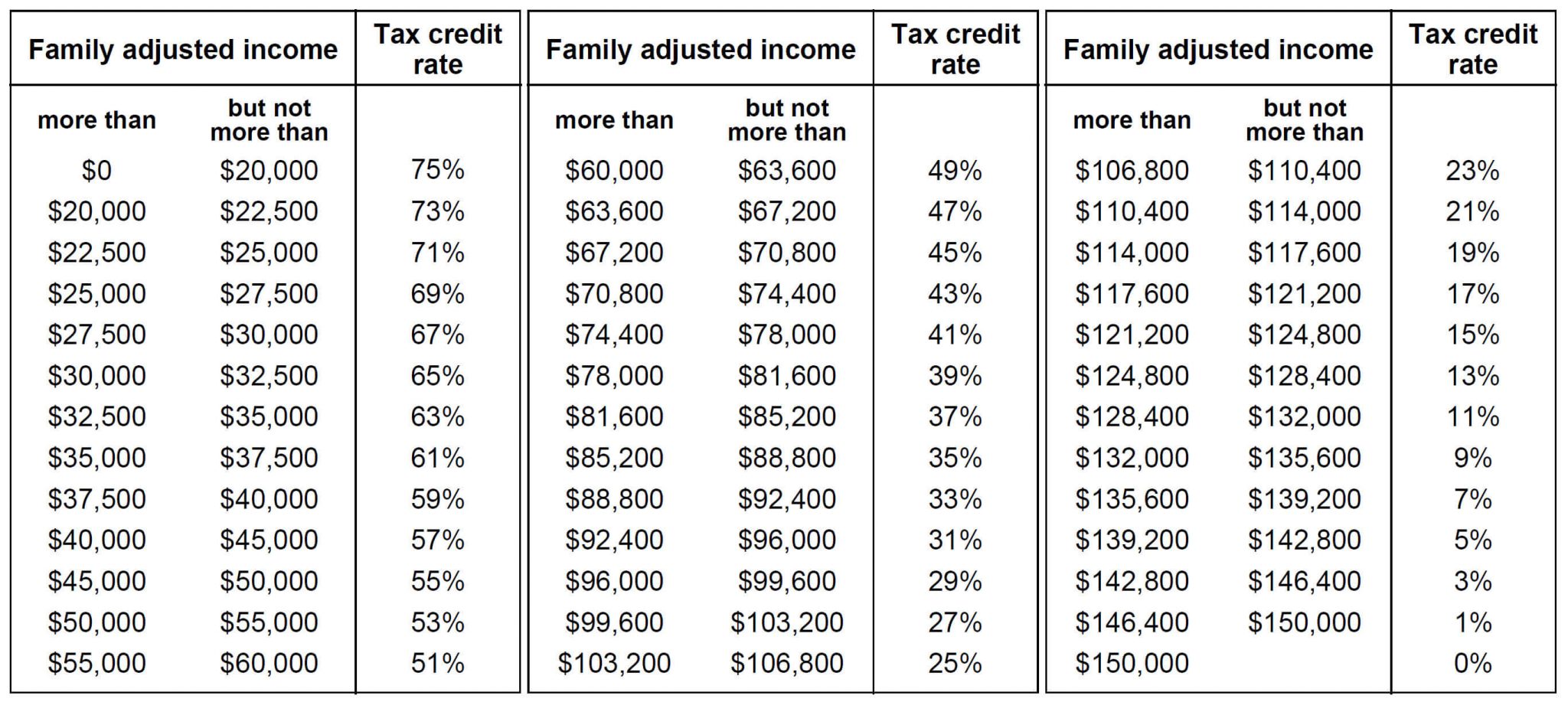

Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may The Ontario Child Care Tax Credit supports families with incomes up to 150 000 particularly those with low and moderate incomes Learn how the credit is calculated To claim the Ontario

The Canada Child Benefit CCB is a tax free monthly payment made to eligible families to help with the cost of raising children under 18 years of age The CCB might include As a Canadian taxpayer the maximum amount you can claim is 8 000 for each child under 7 years of age at the end of the year 5 000 for each child between 7 and 16

Download Child Care Tax Credit Canada 2023

More picture related to Child Care Tax Credit Canada 2023

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

DAYCARE TAX STATEMENT Childcare Center Printable End Of The Etsy In

https://i.pinimg.com/originals/32/9e/c2/329ec24df04c77c70081e4a28267c980.jpg

Child care costs are not claimed as a non refundable tax credit but as a deduction from income on the personal tax return A non refundable tax credit is always at the If you live in Canada and have a child below the age of 18 you may be eligible for the Canada Child Benefit CCB a monthly tax exempt payment administered by the Canada

For the 2024 25 benefit year families most in need can receive up to 7 787 per child under the age of 6 and 6 570 per child aged 6 through 17 Employment and Social Family child care and caregivers deductions and credits Find information on the most common deductions and credits that can be claimed for your children spouse or common law partner

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

FSA Or Tax Credit Which Is Best To Save On Child Care

https://blog.havenlife.com/wp-content/uploads/2018/06/FSA-or-tax-credit_-Which-is-best-to-save-on-child-care_.jpg

https://www.canada.ca/en/revenue-agency/services/...

You can claim the expenses you incurred while the eligible child was living with you You will need to fill out Form T778 Child Care Expenses Deduction for 2023 to calculate your deduction

https://turbotax.intuit.ca/tips/claiming-child-care-expenses-5175

Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years For disabled

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Tax Credit Or FSA For Child Care Expenses Which Is Better

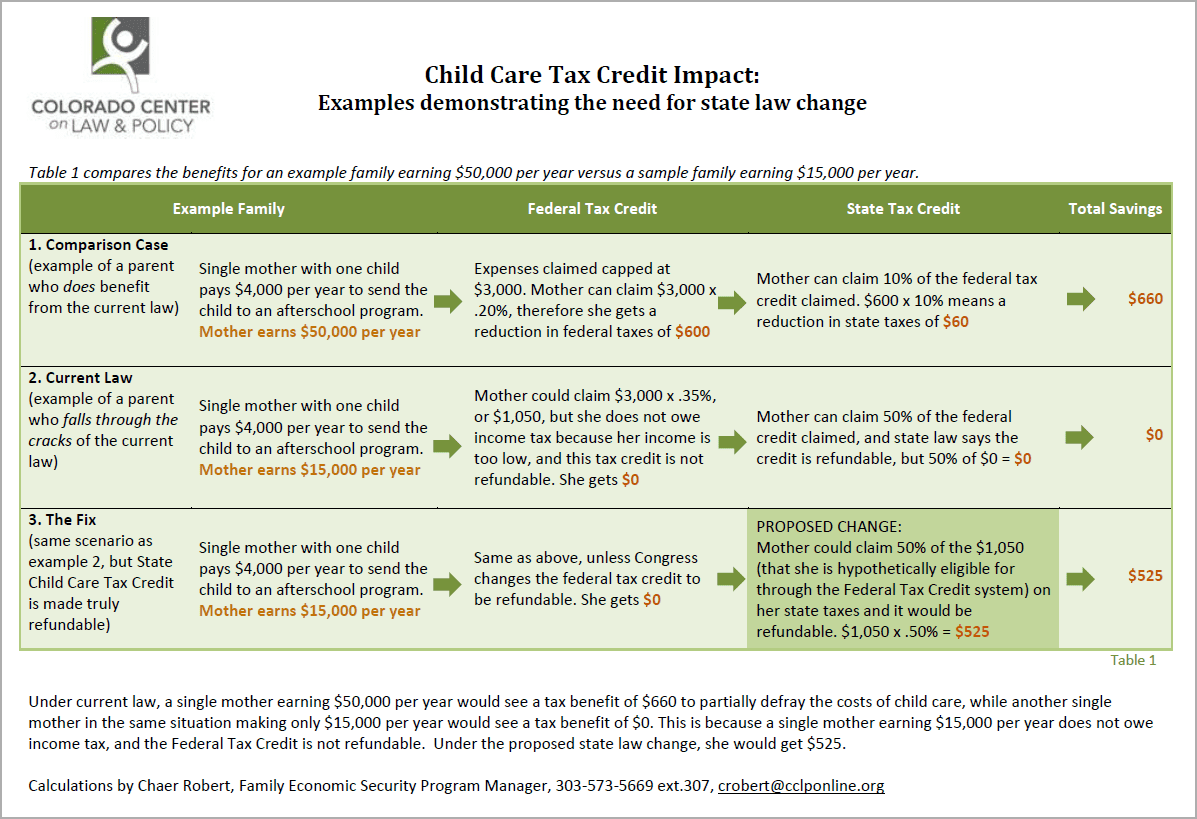

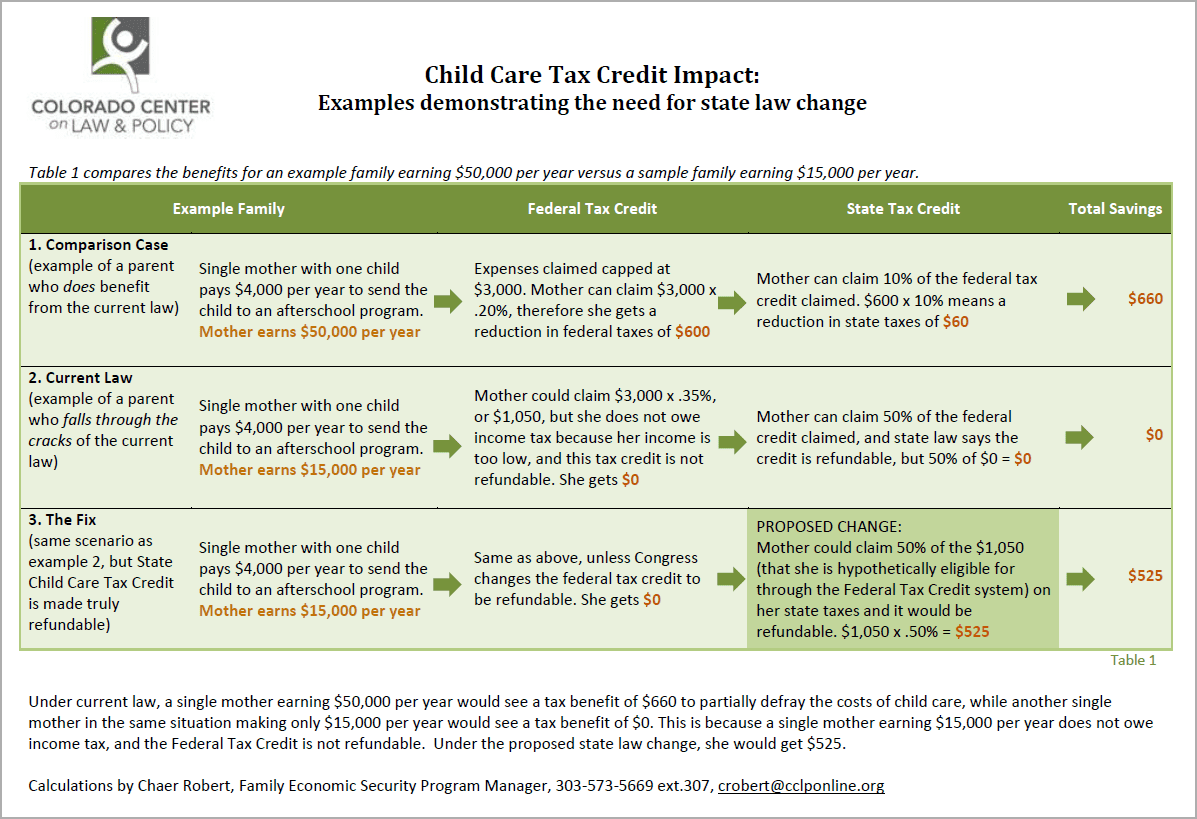

Fixing The Child Care Tax Credit EOPRTF CCLP

Fixing The Child Care Tax Credit EOPRTF CCLP

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

What Is The Phase Out For Dependent Care Credit Latest News Update

Child And Dependent Care Credit 2022 2022 JWG

Child Care Tax Credit Canada 2023 - Canada child benefit The Canada child benefit CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may