Child Care Worker Tax Return Web 6 Apr 2017 nbsp 0183 32 Provided that your child is registered in your household and has not reached the age of 14 you may consider 2 3 of the child care

Web To complete your return as a child care worker child care assistant nanny kindergarten assistant or pre school aide employed by a company you ll first need an income Web Child care workers teach parent and take care of children and teenagers They promote and support their development and that of their families in different social situations and

Child Care Worker Tax Return

Child Care Worker Tax Return

https://i.etsystatic.com/23403566/r/il/69a95f/3736849799/il_1588xN.3736849799_qvr5.jpg

Care Worker Tax Rebate How To Claim On Employment Expenses

https://www.safeworkers.co.uk/wp-content/uploads/2023/02/careworkertaxrebate.jpg

Child Care Worker Tax Deductions 1 Xero Business Accountant

https://www.claritaxaccountants.com.au/wp-content/uploads/2021/06/child-care-worker-tax-deductions-800x358.png

Web 2023 Tax Return For your income between 01 July 2022 30 June 2023 Click To Start Your 2023 Tax Return 2022 Tax Return For your Web 1 Dez 2023 nbsp 0183 32 A 2023 Tax Guide for Childcare Providers Are you ready to file 2023 childcare business taxes Find out the important tax information all providers need to

Web Vor einem Tag nbsp 0183 32 Through tax free childcare eligible parents can get up to 163 500 every three months up to 163 2 000 a year for each of their children to help with the costs of Web 16 Okt 2023 nbsp 0183 32 Tax benefits of hiring your child If you follow IRS rules hiring your child to work for your business can lower your taxable income as you can deduct their salaries

Download Child Care Worker Tax Return

More picture related to Child Care Worker Tax Return

A Remote Worker s Guide To Taxes And Expenses The Daily CPA

https://i0.wp.com/thedailycpa.com/wp-content/uploads/2021/10/Guide-to-Taxes-2.jpeg?resize=1320%2C881&ssl=1

Care Worker Tax Rebate Hmrc 2024 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/care-worker-tax-rebate-1.png

Child care worker 624742 1920 Rossana Giorgi Neuro Psicomotricit

https://centroevoluzionebambino.it/_mamawp/wp-content/uploads/2019/06/child-care-worker-624742_1920-1600x1178.jpg

Web 9 Nov 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum Web 19 Okt 2023 nbsp 0183 32 You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of

Web Eligible child care expenses will be limited to 3 000 per dependent up to 6 000 for two or more dependents Higher credit rates apply to families with lower adjusted gross income For 2021 there is a two part phase Web Vor 3 Tagen nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or

Child Care Assistant Interview Questions And Answers Support Your Career

https://yourcareersupport.com/wp-content/uploads/2022/06/Child_Care_Worker02.png

Childcare Receipts For Parents Taxes Daycare Receipts For Parents Taxes

https://i.etsystatic.com/27501955/r/il/df84d7/3597285216/il_1080xN.3597285216_4adk.jpg

https://www.lifeinduesseldorf.com/childr…

Web 6 Apr 2017 nbsp 0183 32 Provided that your child is registered in your household and has not reached the age of 14 you may consider 2 3 of the child care

https://www.hrblock.com.au/tax-academy/childcare-worker-tax-ded…

Web To complete your return as a child care worker child care assistant nanny kindergarten assistant or pre school aide employed by a company you ll first need an income

Daycare Business Income And Expense Sheet To File childcare

Child Care Assistant Interview Questions And Answers Support Your Career

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

A Day In The Life Of A Child Care Worker Community Helpers At Work

Care Worker Tax Rebate Reviews Read Customer Service Reviews Of

Celebrating Child Care Worker And Early Childhood Educator Appreciation

Celebrating Child Care Worker And Early Childhood Educator Appreciation

Care Worker Tax Rebate Email Address 2024 Carrebate

Why There s A Child Care Worker Shortage

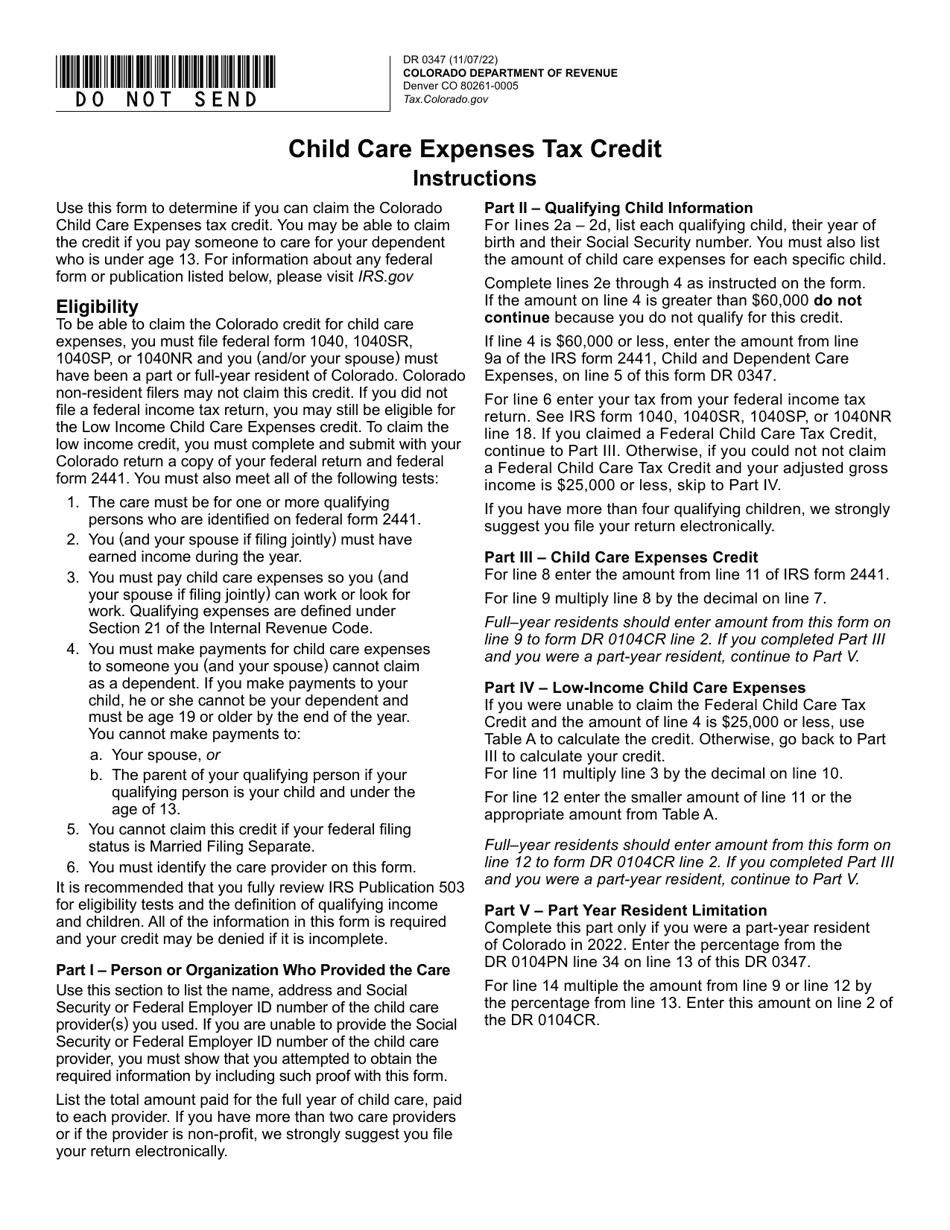

Form DR0347 Download Printable PDF Or Fill Online Child Care Expenses

Child Care Worker Tax Return - Web Total tax benefit child care credit claim plus deduction 67 915 49 350 After tax cost to employer original expenses less total tax benefit 167 085 185 650 Source GAO 22