Child Dependent Tax Credit Income Limit For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married

Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit If you re a taxpayer who claims a child as a dependent you may qualify for the credit up to 2 000 per child In 2019 the average CTC benefit was about 2 380 ranging from 619 for

Child Dependent Tax Credit Income Limit

Child Dependent Tax Credit Income Limit

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

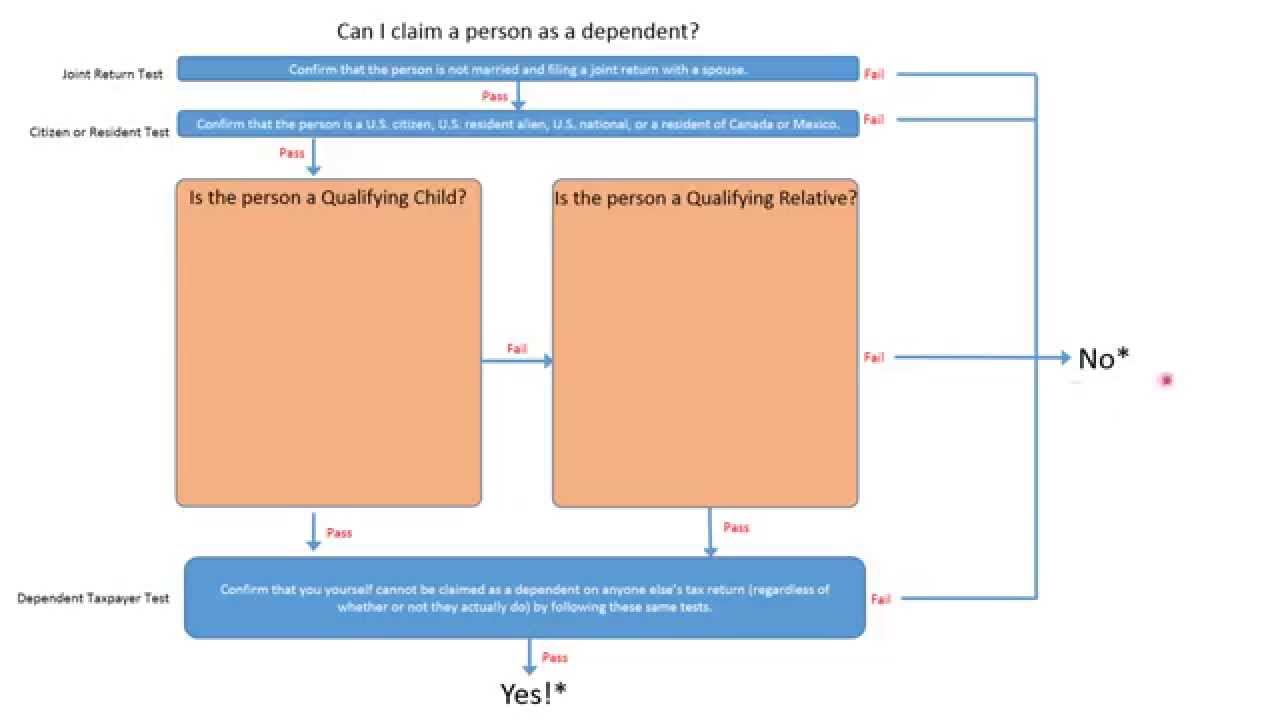

Who Can I Claim As A Dependent On My Tax Return A Flow Chart YouTube

https://i.ytimg.com/vi/pRuxkahKB8o/maxresdefault.jpg

Child Tax Credit income limit and phase out The Child Tax Credit amounts change as your modified adjusted gross income MAGI increases In fact once you reach a certain threshold the credit amount The 2024 Child Tax Credit can reduce your tax liability on your annual taxes Here s a breakdown of the CTC s income limits and rules

What are the child tax credit 2024 income limits As mentioned the child tax credit amount you can expect on your refund will depend on your modified adjusted Child Tax Credit income limit To get the maximum 2 000 Child Tax Credit your 2023 MAGI must be under 200 000 If you file taxes jointly with your spouse your

Download Child Dependent Tax Credit Income Limit

More picture related to Child Dependent Tax Credit Income Limit

FAQ WA Tax Credit

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

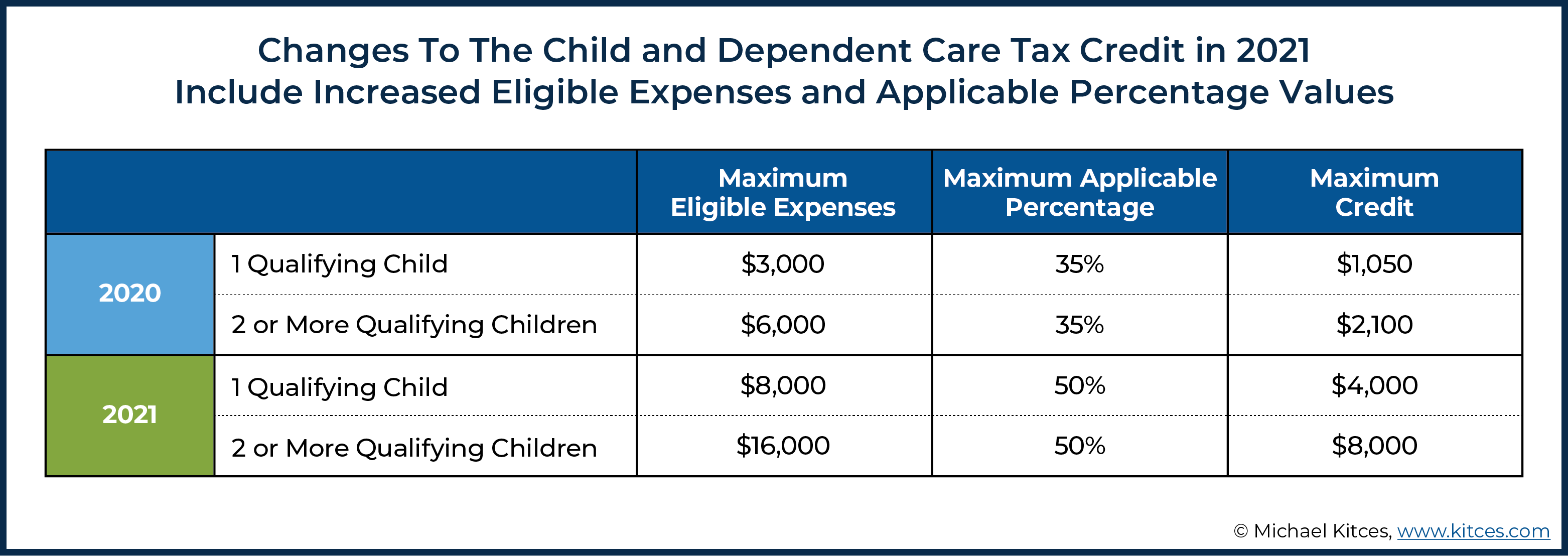

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/bGO8AFn9_9/1616431373979.png

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

Child Tax Credit and Additional Child Tax Credit The child tax credit is up to 2 000 per qualifying child under age 17 For 2021 the Child Tax Credit is 3 600 for each qualifying child under the age of 6 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

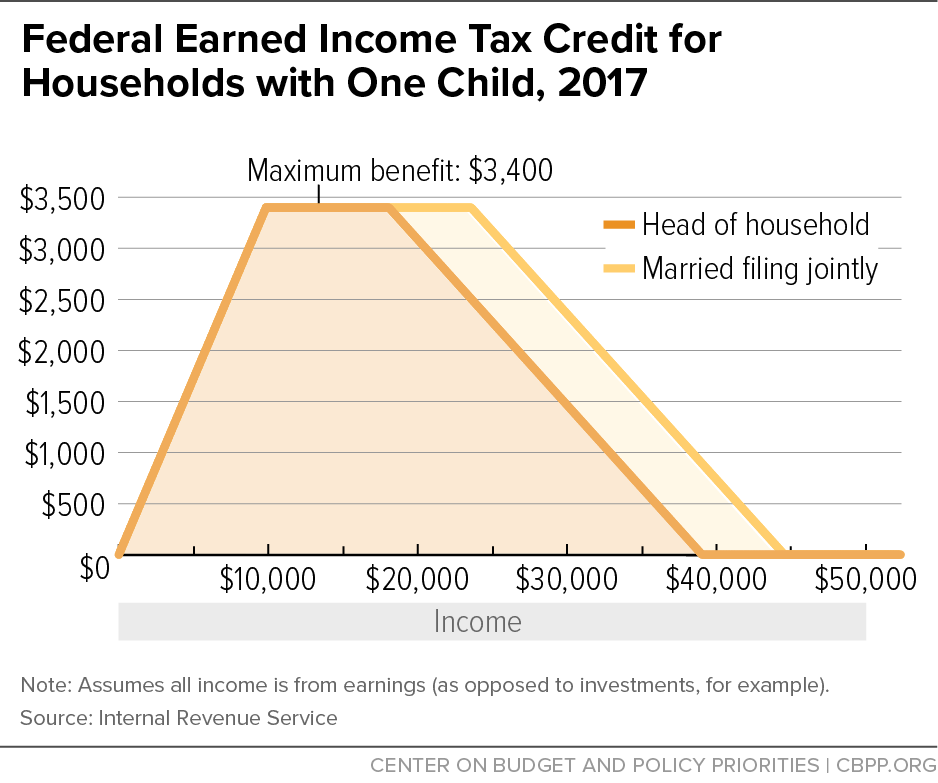

If you have one child and your adjusted gross income was 46 560 filing alone or 53 120 filing jointly with a spouse in 2023 you could claim up to 3 995 in a For the 2023 tax year you can get a maximum tax credit of 2 000 for each qualifying child under age 17 although there is an income limit of 400 000 for married

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

https://www.pgpf.org/sites/default/files/child-tax-credit-2021-chart.jpg

https://www.nerdwallet.com/article/tax…

For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married

https://www.irs.gov/instructions/i1040s8

Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit

Dependent Tax Credit Claim Eligibility And Exceptions FastnEasyTax

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Care Credit Printable Application Printable Word Searches

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

How Much Can You Earn For Child Tax Credits Credit Walls

Child Credit Tax Fill Online Printable Fillable Blank PdfFiller

Child Credit Tax Fill Online Printable Fillable Blank PdfFiller

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Child And Dependent Care Tax Credit WYPR

Child And Dependent Tax Credit Affordable Bookkeeping Payroll

Child Dependent Tax Credit Income Limit - The Child Tax Credit can reduce your taxes by up to 2 000 per qualifying child age 16 or younger If you do not owe taxes up to 1 600 of the Child Tax Credit